Current Report Filing (8-k)

November 21 2019 - 6:35AM

Edgar (US Regulatory)

ANNALY CAPITAL MANAGEMENT INC false 0001043219 0001043219 2019-11-20 2019-11-20 0001043219 us-gaap:CommonStockMember 2019-11-20 2019-11-20 0001043219 nly:A7.50SeriesDCumulativeRedeemablePreferredStockMember 2019-11-20 2019-11-20 0001043219 nly:A6.95SeriesFFixedtoFloatingRateCumulativeRedeemablePreferredStockMember 2019-11-20 2019-11-20 0001043219 nly:A6.50SeriesGFixedtoFloatingRateCumulativeRedeemablePreferredStockMember 2019-11-20 2019-11-20 0001043219 nly:A6.75SeriesIFixedtoFloatingRateCumulativeRedeemablePreferredStockMember 2019-11-20 2019-11-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 20, 2019

Annaly Capital Management, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Maryland

|

|

1-13447

|

|

22-3479661

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

1211 Avenue of the Americas

New York, New York

|

|

10036

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (212) 696-0100

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading

Symbol(s)

|

|

Name of Each Exchange

on Which Registered

|

|

Common Stock, par value $0.01 per share

|

|

NLY

|

|

New York Stock Exchange

|

|

7.50% Series D Cumulative Redeemable Preferred Stock

|

|

NLY.D

|

|

New York Stock Exchange

|

|

6.95% Series F Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

|

|

NLY.F

|

|

New York Stock Exchange

|

|

6.50% Series G Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

|

|

NLY.G

|

|

New York Stock Exchange

|

|

6.75% Series I Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

|

|

NLY.I

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Departure of Kevin G. Keyes as Chairman, Chief Executive Officer and President

On November 21, 2019, Annaly Capital Management, Inc. (the “Company”) announced the departure of Kevin G. Keyes from his roles as Chairman, Chief Executive Officer and President of the Company and member of the Board of Directors (the “Board”). The Board and Mr. Keyes have mutually agreed that his departure will be effective as of November 21, 2019. Mr. Keyes is retiring from the Company’s external manager, Annaly Management Company LLC (the “Manager”) and its affiliates. Mr. Keyes will be available for consultation to ensure a smooth transition.

On the same date, the Company and Mr. Keyes entered into a Separation and Release Agreement in full satisfaction of all obligations owed to Mr. Keyes by the Company under the terms of the Severance and Noncompetition Agreement between the Company and Mr. Keyes, dated August 1, 2018.

Appointment of Chief Financial Officer Glenn A. Votek as Interim Chief Executive Officer and President and Election as a Member of the Board

On November 20, 2019, the Board appointed Glenn A. Votek, 61, who has served as the Company’s Chief Financial Officer since 2013, as Chief Executive Officer and President, on an interim basis, effective as of November 21, 2019. It is expected that Mr. Votek will serve in such roles until the appointment by the Board of a permanent chief executive officer and president. The Board has also elected Mr. Votek as a member of the Board, effective immediately. The Board has formed a search committee for a permanent chief executive officer. Mr. Votek will serve as a member of such committee. Mr. Votek will continue to serve as the Company’s Chief Financial Officer. Biographical and other information concerning Mr. Votek is included in the Company’s proxy statement for the 2019 Annual Meeting of Stockholders, filed with the SEC on April 9, 2019 and is incorporated by reference herein.

Board Leadership Changes

Board of Directors determined to separate the roles of Chief Executive Officer and Chair of the Board. On November 20, 2019, Director Thomas Hamilton was appointed as an independent Chair of the Board, and Directors Wellington J. Denahan and Jonathan D. Green were appointed as Vice Chairs of the Board, effective as of November 21, 2019. In connection with these changes, the Board will not maintain a separate Lead Independent Director and accordingly Mr. Green will no longer serve in such position. Biographical and other information concerning Mr. Hamilton, Ms. Denahan and Mr. Green is included in the Company’s proxy statement for the 2019 Annual Meeting of Stockholders, filed with the SEC on April 9, 2019 and is incorporated by reference herein.

|

Item 7.01.

|

Regulation FD Disclosure.

|

A copy of the Company’s press release (the “Press Release”) announcing the matters described under Item 5.02 above is attached hereto and furnished as Exhibit 99.1.

This Press Release is being furnished pursuant to Item 7.01, and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

|

Item 9.01.

|

Financial Statements and Exhibits

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNALY CAPITAL MANAGEMENT, INC.

|

|

|

|

|

|

(REGISTRANT)

|

|

|

|

|

|

|

|

|

|

Date: November 21, 2019

|

|

|

|

By:

|

|

/s/ Anthony C. Green

|

|

|

|

|

|

Name:

|

|

Anthony C. Green

|

|

|

|

|

|

Title:

|

|

Chief Corporate Officer and Chief Legal Officer

|

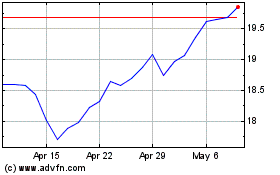

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

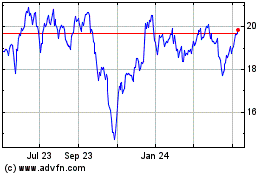

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024