UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2019

Commission File Number: 001-38353

PagSeguro Digital Ltd.

(Name of Registrant)

Av.

Brigadeiro Faria Lima, 1384, 4º andar, parte A

São Paulo, SP, 01451-001, Brazil

+55 11 3038 8127

(Address of Principal Executive Office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐

No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted

by Regulation S-T Rule 101(b)(7):

Yes ☐

No ☒

Unaudited Condensed Consolidated

Interim Financial Statements

PagSeguro Digital Ltd.

At September 30, 2019 and for the three and nine-month periods ended

September 30, 2019 and 2018

PagSeguro Digital Ltd.

Unaudited condensed consolidated interim financial statements

At September 30, 2019 and for the three and nine-month periods ended September 30, 2019 and 2018

Contents

PagSeguro Digital Ltd.

Unaudited condensed consolidated interim balance sheet

At September 30, 2019 and December 31, 2018

(All amounts in thousands of reais)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note

|

|

|

September 30,

2019

|

|

|

December 31,

2018

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

5

|

|

|

|

314,082

|

|

|

|

2,763,050

|

|

|

Financial investments

|

|

|

6

|

|

|

|

1,779,566

|

|

|

|

—

|

|

|

Accounts receivable

|

|

|

7

|

|

|

|

9,873,987

|

|

|

|

8,104,679

|

|

|

Inventories

|

|

|

|

|

|

|

59,085

|

|

|

|

88,551

|

|

|

Taxes recoverable

|

|

|

|

|

|

|

120,677

|

|

|

|

65,653

|

|

|

Other receivables

|

|

|

|

|

|

|

38,974

|

|

|

|

20,148

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

|

|

|

|

12,186,371

|

|

|

|

11,042,081

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Judicial deposits

|

|

|

|

|

|

|

4,380

|

|

|

|

1,511

|

|

|

Accounts receivable

|

|

|

7

|

|

|

|

21,941

|

|

|

|

—

|

|

|

Prepaid expenses

|

|

|

|

|

|

|

4,948

|

|

|

|

968

|

|

|

Investment

|

|

|

|

|

|

|

1,500

|

|

|

|

—

|

|

|

Property and equipment

|

|

|

10

|

|

|

|

253,171

|

|

|

|

67,104

|

|

|

Intangible assets

|

|

|

11

|

|

|

|

512,575

|

|

|

|

305,614

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current assets

|

|

|

|

|

|

|

798,515

|

|

|

|

375,197

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

|

|

|

|

12,984,886

|

|

|

|

11,417,278

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note

|

|

|

September

30, 2019

|

|

|

December

31, 2018

|

|

|

Liabilities and equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payables to third parties

|

|

|

12

|

|

|

|

4,408,326

|

|

|

|

4,324,198

|

|

|

Trade payables

|

|

|

|

|

|

|

185,667

|

|

|

|

165,246

|

|

|

Payables to related parties

|

|

|

8

|

|

|

|

34,875

|

|

|

|

30,797

|

|

|

Salaries and social charges

|

|

|

13

|

|

|

|

116,163

|

|

|

|

73,936

|

|

|

Taxes and contributions

|

|

|

14

|

|

|

|

129,629

|

|

|

|

80,093

|

|

|

Provision for contingencies

|

|

|

15

|

|

|

|

8,327

|

|

|

|

7,004

|

|

|

Other payables

|

|

|

|

|

|

|

5,241

|

|

|

|

29,501

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

|

|

|

|

4,888,228

|

|

|

|

4,710,775

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deferred income tax and social contribution

|

|

|

16

|

|

|

|

474,481

|

|

|

|

132,125

|

|

|

Other payables

|

|

|

|

|

|

|

17,263

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current liabilities

|

|

|

|

|

|

|

491,744

|

|

|

|

132,125

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

|

|

|

|

5,379,972

|

|

|

|

4,842,900

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share capital

|

|

|

17

|

|

|

|

26

|

|

|

|

26

|

|

|

Capital reserve

|

|

|

17

|

|

|

|

5,760,233

|

|

|

|

5,688,134

|

|

|

Equity valuation adjustments

|

|

|

17

|

|

|

|

(22,637

|

)

|

|

|

(7,325

|

)

|

|

Profit retention reserve

|

|

|

17

|

|

|

|

1,883,223

|

|

|

|

909,267

|

|

|

Treasury shares

|

|

|

17

|

|

|

|

(39,532

|

)

|

|

|

(39,532

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,581,313

|

|

|

|

6,550,570

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interests

|

|

|

|

|

|

|

23,601

|

|

|

|

23,806

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total equity

|

|

|

|

|

|

|

7,604,914

|

|

|

|

6,574,376

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity

|

|

|

|

|

|

|

12,984,886

|

|

|

|

11,417,278

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements.

2

PagSeguro Digital Ltd.

Unaudited condensed consolidated interim statement of income

For the three and nine-month periods ended September 30, 2019 and 2018

(All amounts in thousands of reais unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three-month period

|

|

|

Nine-month period

|

|

|

|

|

Note

|

|

September

30, 2019

|

|

|

September

30, 2018

|

|

|

September

30, 2019

|

|

|

September

30, 2018

|

|

|

Net revenue from transaction activities and other services

|

|

19

|

|

|

879,355

|

|

|

|

598,932

|

|

|

|

2,391,299

|

|

|

|

1,557,028

|

|

|

Net revenue from sales

|

|

19

|

|

|

14,939

|

|

|

|

94,641

|

|

|

|

145,982

|

|

|

|

278,036

|

|

|

Financial income

|

|

19

|

|

|

537,832

|

|

|

|

387,264

|

|

|

|

1,465,503

|

|

|

|

994,697

|

|

|

Other financial income

|

|

19

|

|

|

30,833

|

|

|

|

56,504

|

|

|

|

101,257

|

|

|

|

237,395

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue and income

|

|

|

|

|

1,462,959

|

|

|

|

1,137,341

|

|

|

|

4,104,041

|

|

|

|

3,067,156

|

|

|

Cost of sales and services

|

|

20

|

|

|

(684,262

|

)

|

|

|

(550,641

|

)

|

|

|

(1,986,434

|

)

|

|

|

(1,478,156

|

)

|

|

Selling expenses

|

|

20

|

|

|

(164,556

|

)

|

|

|

(90,299

|

)

|

|

|

(378,613

|

)

|

|

|

(268,316

|

)

|

|

Administrative expenses

|

|

20

|

|

|

(134,585

|

)

|

|

|

(164,491

|

)

|

|

|

(336,822

|

)

|

|

|

(492,690

|

)

|

|

Financial expenses

|

|

20

|

|

|

(6,510

|

)

|

|

|

(7,226

|

)

|

|

|

(14,553

|

)

|

|

|

(26,553

|

)

|

|

Other expenses, net

|

|

20

|

|

|

(4,910

|

)

|

|

|

(4,150

|

)

|

|

|

(8,983

|

)

|

|

|

(5,160

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit before income taxes

|

|

|

|

|

468,136

|

|

|

|

320,534

|

|

|

|

1,378,636

|

|

|

|

796,281

|

|

|

Current income tax and social contribution

|

|

16

|

|

|

12,515

|

|

|

|

(40,067

|

)

|

|

|

(38,974

|

)

|

|

|

(160,260

|

)

|

|

Deferred income tax and social contribution

|

|

16

|

|

|

(138,054

|

)

|

|

|

(48,908

|

)

|

|

|

(364,574

|

)

|

|

|

(28,400

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax and social contribution

|

|

|

|

|

(125,539

|

)

|

|

|

(88,975

|

)

|

|

|

(403,548

|

)

|

|

|

(188,660

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income for the period

|

|

|

|

|

342,597

|

|

|

|

231,559

|

|

|

|

975,088

|

|

|

|

607,621

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable to

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the Company

|

|

|

|

|

342,243

|

|

|

|

231,286

|

|

|

|

973,955

|

|

|

|

606,831

|

|

|

Non-controlling interests

|

|

|

|

|

354

|

|

|

|

273

|

|

|

|

1,133

|

|

|

|

790

|

|

|

Basic earnings per common share - R$

|

|

18

|

|

|

1,0685

|

|

|

|

0,7385

|

|

|

|

3,0409

|

|

|

|

1,9375

|

|

|

Diluted earnings per common share - R$

|

|

18

|

|

|

1,0352

|

|

|

|

0,7370

|

|

|

|

2,9460

|

|

|

|

1,9337

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these

unaudited condensed consolidated interim financial statements.

3

PagSeguro Digital Ltd.

Unaudited condensed consolidated interim statement of comprehensive income

For the three and nine-month periods ended September 30, 2019 and 2018

(All amounts in thousands of reais unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three-month period

|

|

|

Nine-month period

|

|

|

|

|

September 30,

2019

|

|

|

September 30,

2018

|

|

|

September 30,

2019

|

|

|

September 30,

2018

|

|

|

Net income for the period

|

|

|

342,597

|

|

|

|

231,559

|

|

|

|

975,088

|

|

|

|

607,621

|

|

|

Currency translation adjustment

|

|

|

135

|

|

|

|

292

|

|

|

|

(471

|

)

|

|

|

648

|

|

|

Fair value of financial investments through OCI

|

|

|

12

|

|

|

|

—

|

|

|

|

(57

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income for the period

|

|

|

342,744

|

|

|

|

231,851

|

|

|

|

974,561

|

|

|

|

608,269

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable to

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the Company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income for the period

|

|

|

342,390

|

|

|

|

231,578

|

|

|

|

973,428

|

|

|

|

607,479

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interests

|

|

|

354

|

|

|

|

273

|

|

|

|

1,133

|

|

|

|

790

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income for the period

|

|

|

342,744

|

|

|

|

231,851

|

|

|

|

974,561

|

|

|

|

608,269

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements.

4

PagSeguro Digital Ltd.

Unaudited condensed consolidated interim statement of changes in equity

For the nine-month periods ended September 30, 2019 and 2018

(All amounts in thousands of reais)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital reserve

|

|

|

Profit reserve

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note

|

|

|

Share

capital

|

|

|

Treasury

shares

|

|

|

Capital

reserve

|

|

|

Share-based

long-term

incentive

plan (LTIP)

|

|

|

Legal

reserve

|

|

|

Profit

retention

reserve

|

|

|

Retained

earnings

|

|

|

Equity

valuation

adjustments

|

|

|

Total

|

|

|

Non-controlling

interests

|

|

|

Total

equity

|

|

|

At December 31, 2017

|

|

|

|

|

|

|

524,577

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

30,216

|

|

|

|

312,047

|

|

|

|

—

|

|

|

|

55

|

|

|

|

866,895

|

|

|

|

3,496

|

|

|

|

870,391

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Conversion of profit reserve to common shares

|

|

|

17

|

|

|

|

(524,556

|

)

|

|

|

—

|

|

|

|

866,819

|

|

|

|

—

|

|

|

|

(30,216

|

)

|

|

|

(312,047

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Net income for the period

|

|

|

17

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

606,831

|

|

|

|

—

|

|

|

|

606,831

|

|

|

|

790

|

|

|

|

607,621

|

|

|

Currency translation adjustment

|

|

|

17

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

648

|

|

|

|

648

|

|

|

|

—

|

|

|

|

648

|

|

|

Non-controlling acquisition

|

|

|

17

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(7,588

|

)

|

|

|

(7,588

|

)

|

|

|

19,568

|

|

|

|

11,980

|

|

|

Issuance of common shares in initial public offering, net of offering costs

|

|

|

17

|

|

|

|

5

|

|

|

|

—

|

|

|

|

4,522,278

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

4,522,283

|

|

|

|

—

|

|

|

|

4,522,283

|

|

|

Shares issued—Stock options plan

|

|

|

17

|

|

|

|

—

|

|

|

|

—

|

|

|

|

256,860

|

|

|

|

(256,860

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Shares based long term incentive plan (LTIP)

|

|

|

17

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

268,606

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

268,606

|

|

|

|

—

|

|

|

|

268,606

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At September 30, 2018

|

|

|

|

|

|

|

26

|

|

|

|

—

|

|

|

|

5,645,957

|

|

|

|

11,746

|

|

|

|

—

|

|

|

|

—

|

|

|

|

606,831

|

|

|

|

(6,885

|

)

|

|

|

6,257,675

|

|

|

|

23,854

|

|

|

|

6,281,529

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income for the period

|

|

|

17

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

302,436

|

|

|

|

—

|

|

|

|

302,436

|

|

|

|

351

|

|

|

|

302,787

|

|

|

Currency translation adjustment

|

|

|

17

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(440

|

)

|

|

|

(440

|

)

|

|

|

—

|

|

|

|

(440

|

)

|

|

Non-controlling acquisition

|

|

|

17

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(399

|

)

|

|

|

(399

|

)

|

|

Shares issued—stock option plan

|

|

|

17

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,306

|

|

|

|

(1,306

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Share based long term incentive plan (LTIP)

|

|

|

17

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

30,431

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

30,431

|

|

|

|

—

|

|

|

|

30,431

|

|

|

Acquisition of treasury shares

|

|

|

17

|

|

|

|

—

|

|

|

|

(39,532

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(39,532

|

)

|

|

|

—

|

|

|

|

(39,532

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At December 31, 2018

|

|

|

|

|

|

|

26

|

|

|

|

(39,532

|

)

|

|

|

5,647,263

|

|

|

|

40,871

|

|

|

|

—

|

|

|

|

—

|

|

|

|

909,267

|

|

|

|

(7,325

|

)

|

|

|

6,550,570

|

|

|

|

23,806

|

|

|

|

6,574,376

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income for the period

|

|

|

17

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

973,956

|

|

|

|

—

|

|

|

|

973,956

|

|

|

|

1,133

|

|

|

|

975,089

|

|

|

Currency translation adjustment

|

|

|

17

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(471

|

)

|

|

|

(471

|

)

|

|

|

—

|

|

|

|

(471

|

)

|

|

Loss on financial assets through other comprehensive income

|

|

|

17

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(57

|

)

|

|

|

(57

|

)

|

|

|

—

|

|

|

|

(57

|

)

|

|

Non-controlling acquisition

|

|

|

17

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(14,784

|

)

|

|

|

(14,784

|

)

|

|

|

(1,338

|

)

|

|

|

(16,123

|

)

|

|

Shares issued—stock option plan

|

|

|

17

|

|

|

|

—

|

|

|

|

—

|

|

|

|

36,231

|

|

|

|

(36,231

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Share based long term incentive plan (LTIP)

|

|

|

17

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

72,099

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

72,099

|

|

|

|

—

|

|

|

|

72,099

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At September 30, 2019

|

|

|

|

|

|

|

26

|

|

|

|

(39,532

|

)

|

|

|

5,683,494

|

|

|

|

76,739

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,883,223

|

|

|

|

(22,637

|

)

|

|

|

7,581,313

|

|

|

|

23,601

|

|

|

|

7,604,914

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements.

5

PagSeguro Digital Ltd.

Unaudited condensed consolidated interim statement of cash flows

For the nine-month periods ended September 30, 2019 and 2018

(All amounts in thousands of reais)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2019

|

|

|

September 30,

2018

|

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

|

|

Profit before income taxes

|

|

|

1,378,637

|

|

|

|

796,281

|

|

|

Expenses (revenues) not affecting cash

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

82,208

|

|

|

|

62,474

|

|

|

Chargebacks

|

|

|

136,741

|

|

|

|

50,397

|

|

|

Accrual of provision for contingencies

|

|

|

846

|

|

|

|

2,658

|

|

|

Share based long term incentive plan (LTIP)

|

|

|

72,099

|

|

|

|

245,066

|

|

|

Inventory provisions

|

|

|

(30,031

|

)

|

|

|

4,111

|

|

|

Other financial cost, net

|

|

|

(51,552

|

)

|

|

|

(700

|

)

|

|

Changes in operating assets and liabilities

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(2,322,955

|

)

|

|

|

(4,281,849

|

)

|

|

Inventories

|

|

|

59,497

|

|

|

|

(15,089

|

)

|

|

Taxes recoverable

|

|

|

(18,763

|

)

|

|

|

(21,681

|

)

|

|

Other receivables

|

|

|

(21,617

|

)

|

|

|

4,546

|

|

|

Other payables

|

|

|

(5,767

|

)

|

|

|

515

|

|

|

Payables to third parties

|

|

|

84,128

|

|

|

|

622,149

|

|

|

Trade payables

|

|

|

19,758

|

|

|

|

59,224

|

|

|

Receivables from (payables to) related parties

|

|

|

4,078

|

|

|

|

117,730

|

|

|

Salaries and social charges

|

|

|

42,226

|

|

|

|

39,228

|

|

|

Taxes and contributions

|

|

|

13,917

|

|

|

|

34,261

|

|

|

Provision for contingencies

|

|

|

—

|

|

|

|

(1,317

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(556,550

|

)

|

|

|

(2,281,996

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Income tax and social contribution paid

|

|

|

(65,735

|

)

|

|

|

(186,554

|

)

|

|

Interest income received

|

|

|

394,966

|

|

|

|

263,952

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities

|

|

|

(227,319

|

)

|

|

|

(2,204,598

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

|

|

|

|

|

Amount paid on acquisitions, net of cash acquired

|

|

|

(18,047

|

)

|

|

|

—

|

|

|

Purchases of property and equipment

|

|

|

(206,961

|

)

|

|

|

(29,054

|

)

|

|

Purchases and development of intangible assets

|

|

|

(256,741

|

)

|

|

|

(117,445

|

)

|

|

Acquisition of financial investments

|

|

|

(1,724,877

|

)

|

|

|

—

|

|

|

Redemption of financial investments

|

|

|

—

|

|

|

|

211,116

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) investing activities

|

|

|

(2,206,626

|

)

|

|

|

64,617

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities

|

|

|

|

|

|

|

|

|

|

Proceeds from offering of shares

|

|

|

—

|

|

|

|

4,717,874

|

|

|

Transactional costs

|

|

|

—

|

|

|

|

(189,852

|

)

|

|

Transaction with non-controlling interest

|

|

|

(15,992

|

)

|

|

|

(5,389

|

)

|

|

Capital increase by non-controlling

shareholders

|

|

|

969

|

|

|

|

20,639

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) financing activities

|

|

|

(15,023

|

)

|

|

|

4,543,273

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents

|

|

|

(2,448,968

|

)

|

|

|

2,403,292

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the beginning of the period

|

|

|

2,763,050

|

|

|

|

66,767

|

|

|

Cash and cash equivalents at the end of the period

|

|

|

314,082

|

|

|

|

2,470,059

|

|

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements.

6

PagSeguro Digital Ltd.

Notes to the unaudited condensed consolidated interim financial statements

At September 30, 2019 and for the three and nine-month periods ended September 30, 2019

(All amounts in thousands of reais unless otherwise stated)

PagSeguro Digital Ltd. (“PagSeguro Digital” or the “Company”) is a holding company, subsidiary of Universo Online S.A.

(“UOL”), referred to together with its subsidiaries as the “PagSeguro Group”, was incorporated on July 19, 2017. 99.99% of the shares of PagSeguro Internet S.A. (“PagSeguro Brazil”) were contributed to PagSeguro

Digital on January 4, 2018 and, PagSeguro Digital maintains control of PagSeguro Brazil.

PagSeguro Brazil is a privately held

corporation established on January 20, 2006, headquartered in the city of São Paulo, Brazil, and engaged in providing financial technology solutions and services and corresponding related activities, focused principally on

micro-merchants and small and medium-sized businesses (“SMEs”).

PagSeguro Brazil

subsidiaries are Net+Phone Telecomunicações Ltda. (“Net+Phone”), Boa Compra Ltda. (“Boa Compra”), BCPS Online Services LDA. (“BCPS”), R2TECH Informática S.A. (“R2TECH”), BIVACO Holding

S.A. (“BIVA”), Fundo de Investimento em Direitos Creditórios—PagSeguro (“FIDC”), Tilix Digital S.A. (“TILIX”) and YAMÍ Software & Inovação Ltda. (“YAMÍ”).

In addition to our operations carried out by PagSeguro Brazil, on January 4, 2019, PagSeguro Digital acquired 100% of BBN Banco

Brasileiro de Negócios S.A. (renamed BancoSeguro S.A. “BancoSeguro” in February 2019), through BS Holding Financeira Ltd. (“BS Holding”), a holding company incorporated under PagSeguro Digital.

On March 15, 2019, PagSeguro Group acquired 10% of the share capital of Netpos Serviços de Informática S.A.

(“NETPOS”). Total consideration paid amounted to R$1,500 which was settled in cash. PagSeguro Group acquired 10% of shares and does not have control of NETPOS operation, based on IFRS 3. NETPOS was not consolidated in these interim

financial statements.

These unaudited condensed consolidated interim financial statements include BS Holding and its subsidiary

BancoSeguro and PagSeguro Brazil and its subsidiaries Net+Phone, Boa Compra, BCPS, R2TECH, BIVA, FIDC, TILIX and YAMÍ.

|

|

1.1.

|

Initial Public Offering (“IPO”)

|

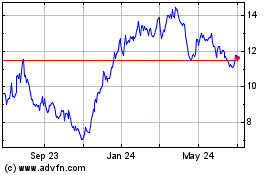

On January 26, 2018, PagSeguro Digital completed its Initial Public Offering (“IPO”). 50,925,642 new shares were offered by

PagSeguro Digital and 70,267,746 shares were offered by the controlling shareholder UOL.

The initial offering price was US$21,50 per

common share, for gross proceeds of US$1,095.2 million (or R$3,444.2 million). The Company received net proceeds of US$1,046.0 million (or R$3,289.8 million), after deducting US$43.8 million (or R$137.8 million) in underwriting

discounts and commissions and US$5.2 million (or R$16.7 million) of other offering expenses.

7

PagSeguro Digital Ltd.

Notes to the unaudited condensed consolidated interim financial statements (Continued)

At September 30, 2019 and for the three and nine-month periods ended September 30, 2019

(All amounts in thousands of reais unless otherwise stated)

|

1.

|

General information (Continued)

|

|

|

1.1.

|

Initial Public Offering (“IPO”) (Continued)

|

The shares offered and sold in the IPO were registered under the Securities Act of 1933, as amended, pursuant to the Company’s

Registration Statement on Form F-1 (Registration No. 333-222292) which was declared effective by the Securities and Exchange Commission on January 26, 2018.

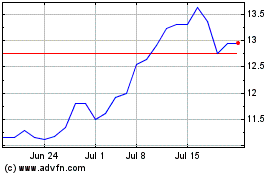

The common stock has been traded on the New York Stock Exchange (NYSE) since January 26, 2018, under the symbol “PAGS”.

|

|

1.2.

|

Follow-on public offering

|

On June 26, 2018, PagSeguro Digital completed its follow-on public offering. A number of

11,550,000 new shares were offered by PagSeguro Digital and 26,400,000 shares were offered by the controlling shareholder UOL.

The

initial offering price was US$29,25 per common share, for gross proceeds of US$337.8 million (or R$1,274.4 million). The Company received net proceeds of US$326.8 million (or R$1,232.6 million), after deducting US$7.9 million (or

R$29.9 million) in underwriting discounts and commissions and US$3.1 million (or R$11.9 million) of other offering expenses.

|

|

1.3.

|

Long-Term Incentive Plan (“LTIP”)

|

Members of management participate in a Long-Term Incentive Plan, or LTIP, which was established by UOL for its group companies on July 29,

2015 and has been adopted by PagSeguro Digital. Beneficiaries under the LTIP are selected by UOL’s LTIP Committee, which consists of the Chairman and two officers of UOL and are submitted to our Board of Directors for adoption.

The policy for recognizing and measuring share-based payments in the interim period is described in Note 17.

|

2.

|

Presentation and preparation of the unaudited condensed consolidated interim financial statements and

significant accounting policies

|

These unaudited condensed consolidated interim financial statements do not include

all of the information required for a complete set of financial statements prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standard Board. However, selected

explanatory notes are included to explain events and transactions that are significant to an understanding of the changes in the Company’s financial position and performance since the last annual financial statements.

8

PagSeguro Digital Ltd.

Notes to the unaudited condensed consolidated interim financial statements (Continued)

At September 30, 2019 and for the three and nine-month periods ended September 30, 2019

(All amounts in thousands of reais unless otherwise stated)

|

2.

|

Presentation and preparation of the unaudited condensed consolidated interim financial statements and

significant accounting policies (Continued)

|

These unaudited condensed consolidated interim financial statements for

the nine-month period ended September 30, 2019 were authorized for issuance by the PagSeguro Digital’s Board of Directors on October 31, 2019.

|

|

2.1.

|

Basis of preparation of condensed consolidated interim financial information

|

These unaudited condensed consolidated interim financial statements for the nine-month period ended September 30, 2019 have been prepared

in accordance with International Accounting Standard 34, “Interim Financial Reporting” as issued by the International Accounting Standard Board.

These unaudited condensed consolidated interim financial statements do not include all the notes of the type normally included in an annual

consolidated financial statement. Accordingly, this report is to be read in conjunction with the annual consolidated financial statements for the year ended December 31, 2018 (the “Annual Financial Statements”).

The accounting policies and critical accounting estimates and judgments adopted are consistent with those of the previous financial year and

corresponding interim reporting period.

|

|

2.2.

|

New accounting pronouncements

|

Effective for periods beginning on or after January 1, 2019

The accounting policies adopted in the preparation of the unaudited condensed consolidated interim financial statements are consistent with

those followed in the preparation of the annual consolidated financial statements for the year ended December 31, 2018, except for the adoption of new standards effective as January 1st,

2019. The Company applies, for the first time, IFRS 16—Leases as well as other amendments and interpretations that apply for the first time in 2019. As required by IAS 34, the nature and effect of these changes are disclosed below. Those

changes, however, did not have material impacts on the unaudited condensed consolidated interim financial statements.

9

PagSeguro Digital Ltd.

Notes to the unaudited condensed consolidated interim financial statements (Continued)

At September 30, 2019 and for the three and nine-month periods ended September 30, 2019

(All amounts in thousands of reais unless otherwise stated)

|

2.

|

Presentation and preparation of the unaudited condensed consolidated interim financial statements and

significant accounting policies (Continued)

|

|

|

2.2.

|

New accounting pronouncements (Continued)

|

Effective for periods beginning on or after January 1, 2019 (Continued)

The following new standards have been issued by IASB and are effective for the nine-month ended September 30, 2019:

IFRS 16—Leases

This

new standard requires lessees to recognize the liability of the future payments and the right of use of the leased asset for virtually all lease contracts, including operating leases. Certain short-term and

low-value contracts may be out of the scope of this new standard. The criteria for recognition and measurement of leases in the financial statements of the lessors are substantially maintained. IFRS 16 is

effective for years beginning on or after January 1, 2019 and replaces IAS 17—“Leases” and related interpretations. Management has performed an assessment and did not identify any material impacts to date. Therefore, changes to

standards or new pronouncements applicable to the years presented in the consolidated financial statements were not relevant to the PagSeguro Group, for retrospective disclosure and disclosure of amounts.

IFRIC Interpretation 23 Uncertainty over Income Tax Treatment

The Interpretation addresses the accounting for income taxes when tax treatments involve uncertainty that affects the application of IAS 12

Income Taxes. The Interpretation specifically addresses the following:

|

|

•

|

|

Whether an entity considers uncertain tax treatments separately;

|

|

|

•

|

|

The assumptions an entity makes about the examination of tax treatments by taxation authorities;

|

|

|

•

|

|

How an entity determines taxable profit (tax loss), tax bases, unused tax losses, unused tax credits and tax

rates; and

|

|

|

•

|

|

How an entity considers changes in facts and circumstances

|

An entity has to determine whether to consider each uncertain tax treatment separately or together with one or more other uncertain tax

treatments. The approach that better predicts the resolution of the uncertainty needs to be followed. The interpretation did not have an impact on the unaudited condensed consolidated interim financial statements.

10

PagSeguro Digital Ltd.

Notes to the unaudited condensed consolidated interim financial statements (Continued)

At September 30, 2019 and for the three and nine-month periods ended September 30, 2019

(All amounts in thousands of reais unless otherwise stated)

|

2.

|

Presentation and preparation of the unaudited condensed consolidated interim financial statements and

significant accounting policies (Continued)

|

|

|

2.2.

|

New accounting pronouncements (Continued)

|

Effective for periods beginning on or after January 1, 2019 (Continued)

Annual Improvements 2015-2017 Cycle

IFRS 3—Business Combinations

The amendments clarify that, when an entity obtains control of a business that is a joint operation, it applies the requirements for a business

combination achieved in stages, including remeasuring previously held interests in the assets and liabilities of the joint operation at fair value. In doing so, the acquirer remeasures its entire previously held interest in the joint operation.

An entity applies those amendments to business combinations for which the acquisition date is on or after the beginning of the first annual

reporting period beginning on or after 1 January 2019. These amendments had no impact on the unaudited condensed consolidated interim financial statements as there is no transaction where a joint control is obtained.

IAS 12—Income Taxes

The amendments clarify that the income tax consequences of dividends are linked more directly to past transactions or events that generated

distributable profits than to distributions to owners. Therefore, an entity recognizes the income tax consequences of dividends in profit or loss, other comprehensive income or equity according to where it originally recognized those past

transactions or events.

An entity applies the amendments for annual reporting periods beginning on or after 1 January 2019. When the

entity first applies those amendments, it applies them to the income tax consequences of dividends recognized on or after the beginning of the earliest comparative period. The amendment did not have an impact on the unaudited condensed consolidated

interim financial statements.

11

PagSeguro Digital Ltd.

Notes to the unaudited condensed consolidated interim financial statements (Continued)

At September 30, 2019 and for the three and nine-month periods ended September 30, 2019

(All amounts in thousands of reais unless otherwise stated)

|

3.

|

Consolidation of subsidiaries

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At September 30, 2019

|

|

Company

|

|

Assets

|

|

|

Liabilities

|

|

|

Equity

|

|

|

Net income

(loss) for

the period

|

|

|

Ownership

– %

|

|

|

Level

|

|

Pagseguro Brazil

|

|

|

14,288,525

|

|

|

|

7,153,610

|

|

|

|

7,134,915

|

|

|

|

944,586

|

|

|

|

99.99

|

|

|

Direct

|

|

BS Holding

|

|

|

89,037

|

|

|

|

9

|

|

|

|

89,028

|

|

|

|

29,027

|

|

|

|

99.99

|

|

|

Direct

|

|

Net+Phone

|

|

|

231,496

|

|

|

|

65,098

|

|

|

|

166,398

|

|

|

|

37,450

|

|

|

|

99.99

|

|

|

Indirect

|

|

Boa Compra

|

|

|

93,679

|

|

|

|

54,868

|

|

|

|

38,811

|

|

|

|

12,261

|

|

|

|

99.99

|

|

|

Indirect

|

|

BCPS

|

|

|

1,807

|

|

|

|

395

|

|

|

|

1,412

|

|

|

|

(190

|

)

|

|

|

99.50

|

|

|

Indirect

|

|

R2TECH

|

|

|

10,389

|

|

|

|

2,373

|

|

|

|

8,016

|

|

|

|

4,148

|

|

|

|

100.00

|

|

|

Indirect

|

|

BIVA

|

|

|

17,770

|

|

|

|

5,172

|

|

|

|

12,598

|

|

|

|

66

|

|

|

|

100.00

|

|

|

Indirect

|

|

FIDC

|

|

|

1,910,966

|

|

|

|

374,009

|

|

|

|

1,536,957

|

|

|

|

1,004,881

|

|

|

|

100.00

|

|

|

Indirect

|

|

TILIX

|

|

|

6,621

|

|

|

|

8,832

|

|

|

|

(2,211

|

)

|

|

|

(3,847

|

)

|

|

|

100.00

|

|

|

Indirect

|

|

BancoSeguro

|

|

|

88,643

|

|

|

|

14,823

|

|

|

|

73,820

|

|

|

|

29,270

|

|

|

|

100.00

|

|

|

Indirect

|

|

YAMÍ

|

|

|

81

|

|

|

|

392

|

|

|

|

(311

|

)

|

|

|

—

|

|

|

|

100.00

|

|

|

Indirect

|

The operational context of the subsidiaries is to be read in conjunction with the annual financial statements

for the year ended December 31, 2018.

R2TECH

R2Tech, organized in Brazil, which manages our reconciliation product. PagSeguro Brazil acquired 51% of R2Tech in 2017 and the remaining 49% in

February 2019, obtained 100% of R2TECH. The total paid for the remaining purchase was R$13,992, which was settled in cash on that date.

BancoSeguro

On

January 4, 2019, BS Holding acquired 100% of BBN Banco Brasileiro de Negócios S.A. (renamed BancoSeguro S.A. in February 2019). BancoSeguro, organized in Brazil, through our fully owned direct subsidiary BS Holding. BancoSeguro holds a

license to provide financial services. We expect that this acquisition will allow us to expand our product and services offering.

BIVA

On April 1,

2019, PagSeguro Group acquired an additional interest of 22,65% of the issued shares of BIVA. Total consideration paid amount to R$2,000 which was settled in cash on the same date. This purchase increases PagSeguro Brazil’s interest to 100% of

BIVAs shares.

12

PagSeguro Digital Ltd.

Notes to the unaudited condensed consolidated interim financial statements (Continued)

At September 30, 2019 and for the three and nine-month periods ended September 30, 2019

(All amounts in thousands of reais unless otherwise stated)

|

3.

|

Consolidation of subsidiaries (Continued)

|

YAMÍ

On

August 9, 2019, PagSeguro Group acquired 100% of YAMÍ. Total consideration paid amount to R$3,000 which R$1,350 was settled in cash on the same date and the remaining portion will be paid in the next 6 years. YAMÍ provides a

back-office platform for e-commerce and marketplace and is a gateway specialized in split payment.

Operating segments are reported consistently with the internal reporting provided to the chief operating decision-maker. The chief operating

decision-maker, responsible for allocating resources and assessing the performance of the operating segments, is the Board of Directors, which is also responsible for making the PagSeguro Group’s strategic decisions.

Considering that all decisions are based on consolidated reports, and that all decisions related to strategic and financial planning,

purchases, investments and the allocation of funds are made on a consolidated basis, the PagSeguro Group and its subsidiaries operate in a single segment, as payment arrangement agents.

The PagSeguro Group is domiciled in Brazil and has revenue arising from local customers and customers located abroad. The main revenue is

related to sales from the domestic market. Net revenues from the international market represent 1.2% and 0.85% for the nine-month periods ended September 30, 2019 and nine-month periods ended 2018, respectively.

|

5.

|

Cash and cash equivalents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2019

|

|

|

December 31,

2018

|

|

|

Short-term bank deposits

|

|

|

168,732

|

|

|

|

405,227

|

|

|

Short-term investment

|

|

|

145,350

|

|

|

|

2,357,823

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

314,082

|

|

|

|

2,763,050

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents are held for the purpose of meeting short-term cash needs and include cash on hand,

deposits with banks and other short-term highly liquid investments with original maturities of three-month or less, and with immaterial risk of change in value.

13

PagSeguro Digital Ltd.

Notes to the unaudited condensed consolidated interim financial statements (Continued)

At September 30, 2019 and for the three and nine-month periods ended September 30, 2019

(All amounts in thousands of reais unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2019

|

|

|

December 31,

2018

|

|

|

Short-term investment

|

|

|

1,779,566

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,779,566

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

Consists of investments in Brazilian Treasury Bonds (“LFTs”) with an average return of 100% of the

Basic Interest Rate (SELIC, currently at 5.5% per year), invested to comply with certain requirements for authorized payment institutions as set forth by Central Bank of Brazil regulation. This financial asset was classified at fair value through

other comprehensive income. The balance as of September 30, 2019 is related to excess cash and cash equivalents proceeds originated from the IPO and the follow-on offering mentioned in Notes 1.1 and 1.2,

respectively. Unrealized losses of LFTs as of September 30, 2019 totaled R$57.

14

PagSeguro Digital Ltd.

Notes to the unaudited condensed consolidated interim financial statements (Continued)

At September 30, 2019 and for the three and nine-month periods ended September 30, 2019

(All amounts in thousands of reais unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2019

|

|

|

December 31, 2018

|

|

|

|

|

Visa

|

|

|

Master

|

|

|

Hipercard

|

|

|

Elo

|

|

|

Total

|

|

|

Visa

|

|

|

Master

|

|

|

Hipercard

|

|

|

Total

|

|

|

Legal obligors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Itaú

|

|

|

662,093

|

|

|

|

2,292,191

|

|

|

|

571,023

|

|

|

|

—

|

|

|

|

3,525,308

|

|

|

|

570,463

|

|

|

|

1,979,994

|

|

|

|

514,627

|

|

|

|

3,065,084

|

|

|

Bradesco

|

|

|

885,863

|

|

|

|

167,771

|

|

|

|

—

|

|

|

|

201,735

|

|

|

|

1,255,369

|

|

|

|

735,784

|

|

|

|

170,497

|

|

|

|

—

|

|

|

|

906,281

|

|

|

Banco do Brasil

|

|

|

683,175

|

|

|

|

143,668

|

|

|

|

—

|

|

|

|

128,981

|

|

|

|

955,824

|

|

|

|

566,537

|

|

|

|

153,633

|

|

|

|

—

|

|

|

|

720,170

|

|

|

CEF

|

|

|

137,768

|

|

|

|

164,274

|

|

|

|

—

|

|

|

|

87,163

|

|

|

|

389,205

|

|

|

|

133,882

|

|

|

|

173,208

|

|

|

|

—

|

|

|

|

307,090

|

|

|

Santander

|

|

|

266,612

|

|

|

|

1,015,957

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,282,569

|

|

|

|

247,950

|

|

|

|

871,976

|

|

|

|

—

|

|

|

|

1,119,926

|

|

|

Other

|

|

|

545,911

|

|

|

|

1,444,709

|

|

|

|

—

|

|

|

|

62,892

|

|

|

|

2,053,512

|

|

|

|

386,808

|

|

|

|

1,069,323

|

|

|

|

—

|

|

|

|

1,456,131

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total card issuers (i)

|

|

|

3,181,422

|

|

|

|

5,228,570

|

|

|

|

571,023

|

|

|

|

480,771

|

|

|

|

9,461,786

|

|

|

|

2,641,424

|

|

|

|

4,418,631

|

|

|

|