Current Report Filing (8-k)

November 18 2019 - 4:27PM

Edgar (US Regulatory)

0000062996

false

0000062996

2019-11-14

2019-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

____________________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

____________________________________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

November 14, 2019

Masco Corporation

(Exact name of Registrant as Specified in

Charter)

|

Delaware

|

1-5794

|

38-1794485

|

|

(State or Other Jurisdiction

of

Incorporation or Organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

17450 College Parkway, Livonia, Michigan

|

|

48152

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(313) 274-7400

(Registrant’s telephone number, including

area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, $1.00 par value

|

MAS

|

New York Stock Exchange

|

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

|

|

☐

|

Emerging growth company

|

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On November 14, 2019, Masco Corporation,

a Delaware corporation (“Masco”), entered into a securities purchase agreement (the “Agreement”) with ACProducts,

Inc., a Delaware corporation (“ACPI”), pursuant to which Masco agreed to sell 100% of the equity interests of Masco

Cabinetry LLC, a Delaware limited liability company (“Cabinetry”), to ACPI. The purchase price for the transaction

is $1 billion, consisting of $850 million in cash and preferred stock issued by ACProducts Holdings, Inc., a Delaware corporation

and holding company of ACPI, with a liquidation preference of $150 million, subject to certain customary purchase price adjustments.

The transaction is subject to customary closing

conditions, including the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Act, but it is

not subject to a financing condition. The transaction is expected to close during the first quarter of 2020.

The Agreement contains representations, warranties

and covenants of the parties that are customary for transactions of this type. Masco has also agreed to provide certain customary

transition services to ACPI in relation to the Cabinetry business for a specified post-closing period.

The Agreement contains certain customary

termination rights for Masco and ACPI, including if the closing does not occur on or before May 14, 2020.

The foregoing summary of the Agreement and

the transactions contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety by, the

full text of the Agreement, which is filed as Exhibit 2.1 hereto and incorporated herein by reference. The representations, warranties

and covenants contained in the Agreement are solely for the benefit of the parties to the Agreement. Investors and security holders

are not third-party beneficiaries under the Agreement and should not rely on the representations, warranties, covenants or agreements,

or any descriptions thereof as characterizations of the actual state of facts or condition of any party to the Agreement. Moreover,

information concerning the subject matter of the Agreement may change after the date thereof and such subsequent information may

or may not be fully reflected in Masco’s public disclosures.

Item 9.01. Financial Statements and Exhibits.

Exhibit No. Description

|

|

104

|

Cover Page Interactive Data File (embedded within the

Inline XBRL document).

|

FORWARD-LOOKING STATEMENTS

Statements in this Current Report on Form 8-K that are not

strictly historical may be “forward-looking” statements under the Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by words such as “outlook,” “believe,” “anticipate,”

“appear,” “may,” “will,” “should,” “intend,” “plan,” “estimate,”

“expect,” “assume,” “seek,” “forecast,” and similar references to future periods.

Our views about future performance involve risks and uncertainties that are difficult to predict and, accordingly, our actual results

may differ materially from the results discussed in our forward-looking statements. We caution you against relying on any of these

forward-looking statements.

Our future performance may be affected by the levels of residential

repair and remodel activity and new home construction, our ability to maintain our strong brands and reputation and to develop

new products, our ability to maintain our competitive position in our industries, our reliance on key customers, the cost and availability

of raw materials and increasing tariffs, our dependence on third-party suppliers, risks associated with international operations

and global strategies, our ability to achieve the anticipated benefits of our strategic initiatives, including the divestiture

of our Cabinetry business, our ability to successfully execute our acquisition strategy and integrate businesses that we have and

may acquire, our ability to attract, develop and retain talented personnel, risks associated with our reliance on information systems

and technology, and our ability to achieve the anticipated benefits from our investments in new technology. These and other factors

are discussed in detail in Item 1A, “Risk Factors” in our most recent Annual Report on Form 10-K, as well as in our

Quarterly Reports on Form 10-Q and in other filings we make with the Securities and Exchange Commission. Any forward-looking statement

made by us speaks only as of the date on which it was made. Factors or events that could cause our actual results to differ may

emerge from time to time, and it is not possible for us to predict all of them. Unless required by law, we undertake no obligation

to update publicly any forward-looking statements as a result of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

|

|

|

|

|

|

|

|

MASCO CORPORATION

|

|

|

|

|

|

|

|

|

By:

|

/s/ John G. Sznewajs

|

|

|

Name:

|

John G. Sznewajs

|

|

|

Title:

|

Vice President, Chief Financial Officer

|

|

|

|

November 18, 2019

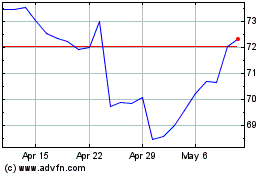

Masco (NYSE:MAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

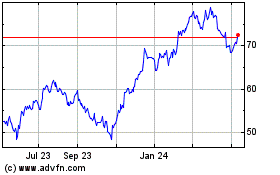

Masco (NYSE:MAS)

Historical Stock Chart

From Apr 2023 to Apr 2024