UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of The Securities Exchange Act of 1934

NOVINT

TECHNOLOGIES, INC.

(name of small business issuer in its charter)

|

|

|

|

|

Delaware

|

|

85-0461778

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

100 Merrick Road–Suite 400W

|

|

|

|

Rockville Centre, NY 11570

|

|

87114

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Issuer’s telephone number (866) 298-4420

Securities registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act: None

|

|

|

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value per share

|

|

None

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

Novint Technologies, Inc. is filing this General Form for Registration of Securities on Form 10, which we refer to as the Registration Statement, to register its common stock, par value $0.0001 per share, pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Unless otherwise mentioned or unless the context requires otherwise, when used in this Registration Statement, the terms “Item 9” “Company,” “we,” “us,” and “our” refer to Novint Technologies, Inc.

The Registration Statement, as amended, will become effective automatically by lapse of time 60 days from the date of the filing pursuant to Section 12(g)(1) of the Exchange Act, or earlier if accelerated at the request of the Company. As of the effective date we will be subject to the requirements of Regulation 13(a) under the Exchange Act and will be required to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and we will be required to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act.

This registration statement shall hereafter become effective in accordance with the provisions of section 8(a) of the Securities Act of 1933.

FORWARD LOOKING STATEMENTS

There are statements in this registration statement that are not historical facts. These “forward-looking statements” can be identified by use of terminology such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control. Although management believes that the assumptions underlying the forward-looking statements included in this Registration Statement are reasonable, they do not guarantee our future performance, and actual results could differ from those contemplated by these forward-looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data, and other information, and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. In light of these risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking statements contained in this Registration Statement will in fact transpire. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking statements.

TABLE OF CONTENTS

This registration statement shall hereafter become effective in accordance with the provisions of section 8(a) of the Securities Act of 1933.

Item 1. Business

Novint Timeline and Detailed Business Description

Novint Technologies

(OTCBB:NVNT) was initially incorporated in the State of New Mexico as Novint Technologies, Inc. in April 1999. On

February 26, 2002, the company changed its state of incorporation to Delaware by merging into Novint Technologies, Inc.,

a Delaware corporation (“Novint” or the “Company”). The Company went public in 2001 with the goal

of commercializing haptics technology licensed from Sandia National Labs and developing a revolutionary haptic game controller

for computer video gaming and other computer applications based on this technology. Haptics technologies allow people to use their

sense of touch to interact with computers. The company was based on Albuquerque, New Mexico, near Sandia National Labs.

During its first eight

years, the company derived revenue primarily from developing professional applications for our customers including contracts with

companies such as Aramco, Lockheed Martin, Chrysler, Chevron and Sandia National Laboratories. However, the Company’s intent

was to eventually generate most of its revenues from the sale of the revolutionary consumer Falcon product (described in

the sections below), the associated “grips,” or handles that are shaped to mirror the application that the product

is being used to simulate, e.g. a gun handle, a sword handle, or a steering wheel) and the sale or license of specially enabled

computer games designed to be used with the Falcon.

The Company’s

product that was commercially released in 2007, the Novint Falcon game controller, lets users experience video games and other

computer applications using a realistic and detailed sense of touch referred to as a “haptic” feel. Holding its handle,

users feel the shapes, textures, weight, dimension and force feedback effects in software games that have been enabled to work

with the Falcon. These “feelings” that are felt in the hand of the user that is holding the Falcon controller are

generated by tiny nano vibrations that create sensations that simulate the real life sensation of touch. As opposed to providing

simple vibrations and feedback like Rumble Strip based joysticks developed by Immersion Corporation (IMMR), the Falcon uses patented

nano-vibrations to create different “textures and “feels” while a person is holding onto the controller. For

example, a person can tell the difference between a piece of rubber or wool as they hold the handle of the Falcon and run over

the different materials on the screen. When firing a gun, the person gets a kickback and feeling based on the type of gun that

is being fired and when a person is hit onscreen they can feel what type of hit and from what direction the hit came from. Catching

a baseball in a glove actually feels like the ball landing in glove while you are gripping the controller. The feelings are almost

surreal and frightening at times. It is difficult to describe the experience without actually feeling it firsthand and this has

certainly been one of the issues that have prevented significant sales traction for the product. Using the Falon and its haptics

technology, games and applications have the crucial missing “third sense” to human computer interaction.

In late 2006, BusinessWeek wrote that “Novint’s haptic controller, the Falcon, looks set to revolutionize gaming.”

In 2007, the Company began shipping the Falcon to commercial retailers and distributors in the U.S. The product was

available through retailers, including Fry’s, Tiger Direct, and J&R Music Store. Additionally, in the fourth

quarter of 2007, Novint opened its online store for the sale of the Falcon and computer games integrated to work with the Falcon. Customers

could download games for use with the Falcon by going to the Company’s website and purchasing the haptics enabled games. The

company developed many of their own gaming titles. The Company also licensed a number of better known game titles and then had

the company’s programmers haptically enabled these titles to take advantage of the haptic feedback and sensations using

the Falcon controller. Novint’s programmers added these haptic parts to the play of the programming code of these

games using manual customization. Over the years, the company eventually commercialized over 45 titles available for use with

the Falcon controller.

Although the Company

sold thousands of units, sales of the Falcon controller struggled along without ever reaching a critical mass, continuing to this

day. The Company did release dozens of software titles that were optimized to work with the Falcon as described above, however,

the titles were not released fast enough and the cost of acquiring rights and haptically enabling the software was too large of

a challenge for a small company. Additionally, as noted above, the company was also not successful in finding a large company

to work with to help market the Falcon more effectively and assist with the huge software development efforts that were necessary.

Although the Company has not derived any revenue from the licensing of the Company’s technology for consumer console and PC interactive computer games, from time to time the Company has engaged in discussions with larger commercial partners. The Company has also performed R&D under contract for larger companies with the end goal of leading to commercial product development, but none of these efforts has led to commercial product deployments. Although the Company continues to make efforts in this area, there can be no assurances that the company will be able to find partners for its products. In addition, pursuant to the patent sale and licensing arrangement described below, there are certain extensive restrictions on the ability of the company to engage commercial partners on a go forward basis. The Company retained the right to enter into manufacturing arrangements to produce for others, or have manufacturer’s produce on behalf of Novint, the company’s existing Falcon products based on their current or developed designs only as well as the unreleased next generation designs of the company’s Xio products.

Forcetek Transaction

In April 2011 Novint merged with Forcetek Technologies. Forcetek was a company started by serial entrepreneur Shannon Vissman that developed a full arm controller with forced feedback that could be used for gaming. Novint and Forcetek initially met at a gaming conference where the companies recognized the potential of being able to merge their complementary technologies into a single unified gaming controller that had much of the haptic feedback of the Falcon but in portable controller that fits on a user’s arm. After the merger with Novint, Shannon Vissman and Ryan Christoff joined the Board of Novint replacing Brian Long and Jan Richardson. In October 24, 2011 Tom Anderson resigned as CEO and Shannon Vissman of Forcetek became CEO. In connection with the merger, all debt of the Company was either paid off or converted to equity. Mr. Vissman, and to a lesser extent Mr. Christoff, provided equity funding of approximately $3 million at a fixed price per share for the combined company which continued to be known as Novint. This funding was used to merge R&D teams and to create a next generation game controller with the combined technologies, called the Xio, while continuing to support the company’s limited sales of the Falcon controller and related accessories and software. The integration work for the Xio was never completed though various prototypes were developed. During this time, Novint also did some custom haptic projects, including work for the US army related to Xio prototypes, but it never amounted to a large business and the company was unsuccessful in obtaining any commercial production contracts as a result of this work.

In August

2013 Brian Long, Jan Richardson, Tom Anderson and Shannon Vissman resigned from the board leaving Ryan Christoff as the sole

board member. Ryan appointed Orin Hirschman and Martin Chopp to the serve on the board alongside him. The Company then raised

$55,180 in senior secured debt in order to continue operations. Since that time, Novint has worked to preserve cash and

reduce expenses while continuing to sell small amounts of Falcons along with related accessories and software titles, with a

goal of allowing the Company to maximize its resources. At that time, the Company also initiated a process to explore ways to

further realize value from Novint’s patent portfolio, the Falcon hardware and related software, and the

company’s next generation Xio product.

In June 2015, after an extensive process, Novint sold 5 patents and sublicensed 5 patents to undisclosed technology company for $750,000 upfront, and a potential second payment of $750,000 upon waiver of assignment from the DOE to Sandia. The second payment was paid in July 2016. Net of broker fees, legal expenses and payments to Sandia to release their rights to the IP, Novint received a total of $699,714 in the transaction. Novint retained a non-transferable license that allows it to continue selling Falcons and next generation devices such as the Xio that are based on the company’s existing and anticipated designs.

Since that time, Novint has continued selling small amounts of Falcons and related software and accessories while engaging in discussions with potential partners on Falcon and Xio and studying other ways to realize value from these products. Novint was clearly much too early in trying to pioneer the market for a consumer haptic controller. One of the major disadvantages of the original Falcon design that has been highlighted by customers and potential commercial partners was its size and weight and the need for the controller to be sitting on a desktop. The next generation product that Novint has developed but not completed, the Xio, addresses this issue by being lightweight and strapping onto the hand and forearm, however, as previously noted, the product has not been completed for commercial release and there can be no assurances that the product will be completed or commercially released in the future.

Principal Products – Falcon

The Novint Falcon is an extensible, grounded (e.g., desktop), three-dimensional (3D) haptic interaction device. It is a compact robotic device with characteristics optimized for real-time force-feedback and tactile interaction. The Falcon was specifically developed for consumer applications with an emphasis on interactive gaming. The performance characteristics of the device, however, are such that it has seen some wider application in fields such as education, medicine, scientific visualization, robotics and tele-robotics.

The current consumer version of the Falcon consists of the Main Unit, a Stand and a “Grip” or end effector. The Main Unit is capable of generating high-fidelity, high-bandwidth, 3D forces and accurately sensing 3D position in real-time within its working envelope. The Main Unit has on-board computational capabilities and is programmed by and communicates with a host computer or system via a bi-directional USB communication interface. It is typically powered using an external DC power supply.

The Main Unit has a modular, quick connect/disconnect, electromechanical interface (i.e., the Grip Interface) that allows various Grips to be mounted to it. This interface allows a Grip to be mechanically connected to the Main Unit and provides electrical power and communication with the Grip. When the Falcon is utilized as a haptic interaction device, it is the Grip that the end-user actually grasps and uses to interact with the device.

The Grips themselves can have arbitrary shape and function. A Grip simply has to adhere to the mechanical and electrical constraints of the Grip Interface. Grips typically use on-board computational elements to report their state to the Main Unit via the serial communication channel of the Grip Interface. Two typical consumer Grips are a general purpose spherical interface and a pistol shaped Grip typically used for game play and interaction. These Grips have various buttons and communicate their identity as well as button state via the Grip Interface to the Main Unit. TheMain Unit is modularly mounted on a Stand. Consumer units are typically shipped with a “U” stand. The Falcon Main Unit can be mounted, however, on any stand or object that provides the appropriate mechanical interface and fasteners.

The Falcon communicates with a host computer or system via a bi-directional USB communication interface at a 1 KHz data rate. Drivers and APIs/SDKs on the host side allow haptic interaction to be incorporated or added to various applications across various markets.

Subsequent to the introduction of the current consumer Falcon haptic interface device, there have been a variety of improvements, features and options to the design of the device that have been implemented on a limited number of units for specific customers. Other significant changes have been designed for the device as product improvements or model variations. These changes to the device design have not yet made it to the shipping consumer version of the device but could do so given the appropriate timing and markets. For example, the current capstan cable drive mechanism for the Falcon utilizes a single spring tensioner. Under high speed motions, this approach results in unequal cable tension between the cable on one side of the capstan and the other. This can lead to some slippage of the cable relative to the capstan when motor direction is abruptly reversed after a high speed run. A drive system that helps guarantee balanced cable tension is one of the pre-planned product improvements for the Falcon. Another example would be the potential to decrease the electronics cost. The current consumer Falcon utilizes a Digital Signal Processor (DSP), along with other electronics elements, to implement the Falcon’s processing and communication system. Significant effort has been undertaken in designs where an ASIC is used for a major portion of these processing and communication requirements. This design will allow much more economical production of the Falcon for larger volume production runs.

There are other areas of potential improvement to the Falcon. The current consumer Falcon is relatively compact compared to other arm mechanisms. The radial twist employed in the “arm” design decreases the radial cross section of the device. Physical layout of the electronics is also optimized to decrease size. In addition, the U-shaped base helps to decrease the apparent size of the device. Nonetheless, further decreasing the apparent and real volume of the device is desirable for increased consumer acceptance. Ideally, this decrease would also reduce the cost of goods sold for the Falcon. Novint has outlined a fundamental approach where most of the encasing plastic for the Falcon Main Unit will be removed and the underlying plastic frame for the Falcon will be modified to be the exterior of the device as well as supporting the device mechanisms and electronics. This will significantly decrease the apparent size and volume of the Falcon. It also provides significant additional shape, color and opacity options to the look of the Falcon Main Unit including clear plastic options where the internal mechanisms and electronics are visible.

A significant amount of effort has been taken in the design of potential consumer Grips. One major class of effort has revolved around variations in general purpose Grips for ergonomic and functional improvements. A significant number of custom variations of the Falcon have been designed and built over time. Typically, these developments have been for customers in the “professional” sectors (e.g., medicine, telerobotics, and scientific visualization). These variations have been based on the current consumer Falcon design and can easily be incorporated into the standard shipping Falcon line when appropriate.

Novint has made several custom variations to the Falcon for specific customers and use cases. As part of its custom efforts, Novint developed improved control algorithms for the Falcon Main Unit that allow higher peak forces to be generated or lower forces to be maintained for longer periods of time. These developments were embodied in custom units referred to as “Super Falcons”. Fundamentally, these improvements involved changes the timing and pulse-width modulation motor control used in the control algorithms run on the Falcon Main Unit’s DSP. No changes to Falcon hardware are required. This allows a “Super Falcon” to be sold to consumers when appropriate. In addition, several fundamentally new Grip designs for the Falcon have been developed for custom customer applications. Consumer versions of these designs are possible.

As previously discussed, the Novint Falcon was designed, primarily, with consumer gaming applications in mind. The Novint Falcon was designed to be used for both PC and console gaming. All that is required to interface to the device is some form of serial interface (wired or wireless). Novint has also created in-lab prototypes of the Falcon that would be directly connected to gaming consoles.

In addition to the Falcon device, Novint has been selling software and demonstrations for all gaming genres including Action, Adventure, Fighting, Racing, Simulation, Sport, Strategy, Parlor, Massively Multiplayer Online (MMO) and Miscellaneous (e.g., board games, pinball). Novint has also created a number of haptically enabled software applications across that would allow the Falcon to be utilized for many non-gaming uses. For example, Novint has developed medical simulation software for various injection procedures including: Epidural injections, Synvisc™ injection, Depo-Medrol™ injection and other injections. Novint has also developed software applications that allow a user to feel as well as see medical data. For example, CT Scan data can be probed using the Falcon and the difference between soft tissue and bone can be felt. Novint’s medical applications have typically been used both for medical marketing and procedure familiarization or training. In addition, Novint has developed specific software that works with the Falcon for marketing purposes. For example, Novint modified a game for Anheuser-Busch to use during its on-site marketing campaigns. Novint has also developed software applications where a Falcon’s motion is controlled via software or in real time using another (remote) Falcon.

Other Haptic Companies and Competition

Recent developments over the last several years create the potential for more consumer interest in haptic devices and controllers. In 2016, Facebook released the Oculus Rift Virtual Reality (VR) headset which a consumer can wear on their head and experience virtual reality at a sub $1,000 price point. HTC started selling a similar headset and both companies also sell companion hand controllers. These controllers are small and lightweight, but offer limited haptic feedback compared to the Falcon.

Over the last few years, and in particular in very recent periods, there have been a number of start up companies working on new haptic controllers including handheld devices that are similar to those controllers sold by Facebook and HTC, as well as more elaborate wearable haptic controllers including gloves. These devices are more similar to Novint’s next generation Xio design and are much more elaborate than the handheld controllers that are currently on the market. The sudden surge in development in this area would suggest that the field is beginning to gain much more interest following the commercial releases of the Oculus Rift and HTC products as well as similar headsets that are being introduced by other companies. In addition, there are many companies producing virtual reality and haptic devices that are competitive or may be competitive in the future with the Falcon and Xio. Some of the the products and companies that may be competitive include:

Immersion Corporation (NASDAQ:IMMR) is primarily a 1D or 2D haptics (a Haptic computer interaction in which forces are mechanically displayed to a user in 1 or 2 directions of movement; examples are force feedback joysticks and force feedback mice) hardware company. Immersion is a public company, which has acquired other haptics device companies. They have acquired Cybernet, Haptech and Virtual Technologies.

VRgluv from VRgluv in Atlanta is a new product that is a glove for controlling virtual reality systems such as the Occulus Rift and HTC Vive. The glove has sensors throughout as well as force feedback and appears to be provide a very robust user experience. The company’s product appears be directly competitive with Novint’s Xio product.

Microsoft has several haptic devices that simply vibrate and rumble, such as the control pads for their Xbox systems. Microsoft may be working on various haptic controllers to complement the company’s Hololens Virtual Reality headset that it has begun selling. Logitech sells haptics mice, wheels, and joysticks that they licensed from Immersion and that are primarily used for gaming. Logitech’s haptics products are two-dimensional and do not offer as many features as our products will. Microsoft has several haptic devices that simply vibrate and rumble, such as the control pads for their Xbox systems. Microsoft may be working on various haptic controllers to complement the company’s Hololens Virtual Reality headset that it has begun selling.

Item 1A. Risk Factors.

Not required to be provided by smaller reporting companies.

Item 2. Financial Information.

The discussion of our financial condition and operating results should be read together with our accompanying audited consolidated financial statements included in this Registration Statement.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward Looking Statements

You should read the following discussion of our financial condition and results of operations together with our audited consolidated financial statements and interim unaudited condensed consolidated financial statements and notes to such financial statements included elsewhere in this Form 10. The following discussion contains forward-looking statements that involve risks and uncertainties. The forward-looking statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about our industry, business and future financial results. Our actual results could differ materially from the results contemplated by these forward-looking statements due to a number of factors, including other sections in this Form 10.

Overview

Novint Technologies, Inc. (the “Company” or “Novint”) was originally incorporated in the State of New Mexico in April 1999. On February 26, 2002, the Company changed its state of incorporation to Delaware by merging with Novint Technologies, Inc., a Delaware corporation. This merger was accounted for as a reorganization of the Company.

On December 22, 2011, the Company received a notice of termination of registration of its common stock with the Securities and Exchange Commission (“SEC”) for failure to file timely quarterly and annual reports under Sections 13 and 15(d) of the Exchange Act of 1934.

Nature of Business

The Company currently is engaged in the development and sale of 3D haptics products and equipment. Haptics refers to one’s sense of touch. The Company’s focus is in the consumer interactive computer gaming market, but the Company also does project work in other areas. The Company’s operations are based in New Mexico with sales of its haptics products primarily to consumers through retail outlets.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Use of Estimates and Assumptions

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The most significant estimates and assumptions made in the preparation of the financial statements relate to accrued royalties and contingent consideration. Actual results could differ from those estimates.

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with maturities of three months or less to be cash equivalents. The Company maintains cash balances at financial institutions that are insured by the Federal Deposit Insurance Corporation (“FDIC”) up to federally insured limits. At times balances may exceed FDIC insured limits. The Company has not experienced any losses in such accounts.

Revenue and Cost Recognition

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers (Topic 606), and has since issued amendments thereto (collectively referred to as “ASC 606”). The core principle of ASC 606 is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services, and the guidance defines a five-step process to achieve this core principle. The five-step process to achieve this principle is as follows: (i) identify the contract(s) with a customer, (ii) identify the performance obligations in the contract(s), (iii) determine the transaction price, (iv) allocate the transaction price to the performance obligations in the contract(s), and (v) recognize revenue when, or as, the entity satisfies a performance obligation. ASC 606 also mandates additional disclosure about the nature, amount, timing and uncertainty of revenues and cash flows arising from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to obtain or fulfill a contract.

Results for the reporting periods beginning after January 1, 2018 are presented under ASC 606, while prior period results are not adjusted and continue to be reported in accordance with historic accounting under ASC Topic 605.

Revenue from product sales relates to the sale of the Falcon haptics interface, which is a human-computer user interface (the “Falcon”) and related accessories. The Falcon allows the user to experience the sense of touch when using a computer, while holding its interchangeable handle. The Falcons are manufactured by an unrelated party. Revenue from product sales is recognized when the products are shipped to the customer and the Company has earned the right to receive and retain reasonable assured payments for the products sold and delivered. Consequently, if all these revenue from product sales requirements are not met, such sales will be recorded as deferred revenue until such time as all revenue recognition requirements are met.

Accounts Receivable

Accounts receivable are stated at the amounts management expects to collect. An allowance for doubtful accounts is recorded based on a combination of historical experience, aging analysis and information on specific accounts. Account balances are written off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. Management has determined that $0 allowance is required at December 31, 2018 and 2017.

Income Taxes

The Company accounts for its income taxes under the provisions of ASC Topic 740, “Income Taxes”. The method of accounting for income taxes under ASC 740 is an asset and liability method which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and liabilities are based on the differences between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance to the extent management concludes it is more likely than not that the assets will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the Statements of Operations in the period that includes the enactment date.

Fair Value of Financial Instruments

The Company follows the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) for disclosures about fair value of its financial instruments and to measure the fair value of its financial instruments. The FASB ASC establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three broad levels. The three levels of fair value hierarchy are described below:

|

Level 1

|

Quoted market prices available in active markets for identical assets or liabilities as of the reporting date.

|

|

|

|

|

Level 2

|

Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date.

|

|

|

|

|

Level 3

|

Pricing inputs that are generally observable inputs and not corroborated by market data.

|

Financial assets are considered Level 3 when their fair values are determined using pricing models, discounted cash flow methodologies or similar techniques and at least one significant model assumption or input is unobservable.

The carrying amounts of the Company’s financial assets and liabilities, including cash, inventory, prepaid expenses, accounts payable, accrued expenses, payroll and related liabilities, and advances approximate their fair values because of the short maturity of these instruments.

RESULTS OF OPERATIONS

Year Ended December 31, 2018 Compared to the Year Ended December 31, 2017

REVENUES. During the year ended December 31, 2018 and the year ended December 31, 2017, there were no revenues.

SELLING,

GENERAL AND ADMINISTRATIVE EXPENSES. Selling, general and administrative expenses and professional fees for the year ended December

31, 2018 and 2017, respectively, were $115,689 and $118,633, a decrease of $2,944. The decrease was primarily due to a decrease

in legal and accounting fees of $4,014 partial offset by an increase in administrative expenses of $1,070 due to an increase in

insurance costs.

OTHER EXPENSES. Other

expenses for the year ended December 31, 2018 and 2017, respectively, were $174 and $25,669, a decrease of $25,495. The decrease

was primarily due to a loss on settlement of debt of $25,291 in 2017.

NET LOSS. Net losses for the year ended December 31, 2018 and 2017, respectively, were $115,938 and $144,377, a decrease of $28,439.

Six Months Ended June 30, 2019 Compared to the Six Months Ended June 30, 2018

REVENUES. During the six months ended June 30, 2019 and the six months ended June 30, 2018, there were no revenues.

SELLING,

GENERAL AND ADMINISTRATIVE EXPENSES. Selling, general and administrative expenses and professional fees for the six months ended

June 30, 2019 and 2018, respectively, were $67,010 and $63,300, an increase of $3,710. The increase was primarily due to an increase

in administrative expenses of $5,000 due to an increase in insurance costs partial offset by a decrease in legal and accounting

fees of $1,290.

OTHER EXPENSES. Other expenses for the six months ended June 30, 2019 and 2018, respectively, were $163 and $117, an increase of $46.

NET LOSS. Net losses for the six months ended June 30, 2019 and 2018, respectively, were $67,173 and $63,417, an increase of $3,756.

LIQUIDITY AND CAPITAL RESOURCES

As of June 30, 2019, we had a total cash balance of $474,248. Our cash flow from operating activities for the six months ended June 30, 2019 resulted in a deficit of $34,299 compared with a deficit of $38,424 in the same period of the prior year. We did not have any cash flow from investing activities or financing activities for the six months ended June 30, 2019 and 2018.

The financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

Contractual Obligations

We do not currently have fixed contractual obligations or commitments that include future estimated payments.

Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures, or capital resources that is material to our investors.

Item 3. Properties.

At this time, the Company does not lease or own any real property.

Item 4. Security Ownership of Certain Beneficial Owners and Management.

The following tables set forth, as of November 11, 2019, certain information concerning the beneficial ownership of our capital stock by:

|

|

●

|

each stockholder known by us to own beneficially 5% or more of any class of our outstanding stock;

|

|

|

●

|

each director;

|

|

|

●

|

each named executive officer;

|

|

|

●

|

all of our executive officers and directors as a group; and

|

|

|

●

|

each person, or group of affiliated persons, who is known by us to beneficially own more than 5% of any class of our outstanding stock.

|

As of

November 11, 2019, the Company had authorized 500,000,000 shares of common stock, par value $0.0001, of which there were

202,308,728 shares of common stock outstanding.

Beneficial ownership

is determined in accordance with the rules and regulations of the SEC and includes voting or investment power with respect to

our common stock. Shares of our common stock subject to options that are currently exercisable or exercisable within 60 days of

November 11, 2019 are considered outstanding and beneficially owned by the person holding the options for the purpose of calculating

the percentage ownership of that person but not for the purpose of calculating the percentage ownership of any other person. Except

as otherwise noted, we believe the persons and entities in this table have sole voting and investing power with respect to all

of the shares of our common stock beneficially owned by them, subject to community property laws, where applicable.

Security Ownership of Certain Beneficial Owners & Management

|

Name and Address of Beneficial Owner

|

|

Shares Owned (6)

|

|

|

Fully Diluted

Ownership

Percentage (1)

|

|

|

AIGH Investment Partners, LLC (2)

|

|

|

8,662,500

|

|

|

|

4.28

|

%

|

|

6006 Berkeley Avenue

|

|

|

|

|

|

|

|

|

|

Baltimore, MD 21209

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Congregation Ahavas Tzdokah Vchesed Inc.

|

|

|

61,722,996

|

|

|

|

30.51

|

%

|

|

1655 E 24th St

|

|

|

|

|

|

|

|

|

|

Brooklyn, NY 11229

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ellis International (3)

|

|

|

9,396,328

|

|

|

|

4.64

|

%

|

|

100 Merrick Road–Suite 400W

|

|

|

|

|

|

|

|

|

|

Rockville Centre, NY 11570

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alpha Capital Anstalt

|

|

|

10,736,961

|

|

|

|

5.31

|

%

|

|

510 Madison Avenue, 14th Floor

|

|

|

|

|

|

|

|

|

|

New York, NY 10022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Globis Capital related entities (4)

|

|

|

13,410,546

|

|

|

|

6.63

|

%

|

|

805 Third Avenue, 15th floor

|

|

|

|

|

|

|

|

|

|

New York, New York 10022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ryan Christoff

|

|

|

11,142,857

|

|

|

|

5.51

|

%

|

|

c/o Novint Technologies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Officers and Directors

|

|

|

18,058,828

|

|

|

|

8.93

|

%

|

|

as a Group (5)

|

|

|

|

|

|

|

|

|

(1)

Calculated on the basis of 202,308,728 shares of Common Stock outstanding

(2)

Mr. Hirschman a Director of the Company has sole voting and dispositive power over shares held by AIGH Investment Partners LLC

(3)

Mr. Chopp a Director of the Company shares voting and dispositive power over shares held by Ellis International

(4)

Mr. Packer has sole voting and dispositive power over 687,068 common shares held by Mr. Packer personally. Mr. Packer shares voting

and dispositive power over 12,723,478 common shares held by Globis Capital Partners and by Globis Overseas Fund Ltd.

(5) Mr.

Christoff, Mr. Chopp and Mr. Hirschman are serving as directors of the Company. Mr. Hirschman is serving as President

on an interim part-time basis.

(6)

Applicable percentage of ownership is based on 202,308,728 shares of common stock outstanding on November 11, 2019. Percentage

ownership is determined based on shares owned together with securities exercisable or convertible into shares of common stock

within 60 days of November 11, 2019, for each stockholder. Beneficial ownership is determined in accordance with the rules of

the SEC and generally includes voting or investment power with respect to securities. Shares of common stock subject to securities

exercisable or convertible into shares of common stock that are currently exercisable or exercisable within 60 days of November

11, 2019, are deemed to be beneficially owned by the person holding such securities for the purpose of computing the percentage

of ownership of such person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other

person. Our common stock is our only issued and outstanding class of securities eligible to vote. Unless otherwise stated, all

shareholders can be reached at mailing address 100 Merrick Road–Suite 400W, Rockville Centre, NY 11570.

Item 5. Directors and Executive Officers.

The following table sets forth certain information regarding our current executive officers and directors as of November 11, 2019.

Martin Chopp – Director 69

Mr. Chopp has served as a Director of Novint Technologies since August 2013. Mr. Chopp’s extensive capital markets experience includes management roles in numerous investment funds and public companies. Mr. Chopp is the President of SDC Capital LLC and President, Chief Financial Officer and Secretary of Sons Capital, LLC, positions which he has held for more than five years. Additionally, Mr. Chopp is the General Partner of Ellis International as well as The Hewlett Fund, LP. Mr. Chopp served as the Chief Executive Officer, President and Director of Datatrend Services, Inc. (formerly Babystar, Inc.) until 1997. Mr. Chopp was President of Sun Capital Company from 1995 to February 2007 and a Director of Glen Rose Petroleum Corp. from April 2010 to March 2011. The Board feels Mr. Chopp is an appropriate director due to his capital markets experience.

Ryan Christoff - Director 49

Mr. Christoff has served as a Director of Novint Technologies since April of 2011. Prior to that, Mr. Christoff was the President of ForceTek, which merged with Novint just prior to April 2011. Mr. Christoff provided operational expertise and helped design the biomechanics of XIO, the full arm controller that provided force feedback for gaming and other applications, produced by ForceTek. Mr. Christoff has been the President and owner of The Physical Therapy Institute (PTI) since 2008. PTI has operations in central and western Pennsylvania and Eastern Indiana. Mr. Christoff holds a Doctorate degree in Orthopedic Physical Therapy, a Master’s Degree in physical therapy from Chatham University, and a B.S. degree in sports medicine from the University of Pittsburgh. The Board feels Mr. Christoff is an appropriate director due to his gaming industry experience.

Orin Hirschman – President, Treasurer and Director 51

Mr. Hirschman has served as a Director of Novint Technologies since August 2013. Mr. Hirschman has over 25 years of experience in money management, leveraged buyouts, restructuring and venture capital. Mr. Hirschman has been the manager of AIGH Investment Partners, LP since 2011. From 1994 until 2001 Mr. Hirschman served as a co-manager of two private investment funds, Adam Smith Investment Partnerships and Adam Smith Investment Partners, Ltd (the “Adam Smith Funds”). In addition to Mr. Hirschman’s private placement investments over the last fifteen years, the Adam Smith Funds, and AIGH Investment Partners, LP, his experience in the securities industry includes tenures with Wesray Capital, the investment firm founded by former U.S. Secretary of the Treasury William E. Simon, and Randall Rose & Company, a $100 million money management firm based in New York. Mr. Hirschman has been actively involved in the financing and structuring of over 70 companies, including many high technology companies. Mr. Hirschman’s educational background includes an M.B.A. in Finance from New York University Graduate School of Business and a degree in Biology and Finance from Touro College where he graduated Summa Cum Laude. The Board feels Mr. Hirschman is an appropriate director due to his capital markets experience.

Item 6. Executive Compensation.

Compensation of Officers Summary Compensation Table

The following tables set forth certain information about compensation paid, earned or accrued for services by our executive officers in the fiscal years ended December 31, 2018 and December 31, 2017.

A

summary of cash and other compensation paid in accordance with management consulting contracts for our executives and directors

for the most recent two years is as follows:

|

Name

and

Principal

|

|

|

|

|

|

|

|

|

|

Stock

Awards

|

|

Option

Awards

|

|

Non-Equity

Incentive Plan Compensation

|

|

Nonqualified

Deferred

Compensation

Earnings

|

|

All

other

compensation

|

|

Total

|

|

Position

|

|

Title

|

|

Year

|

|

Salary

($)

|

|

Bonus

($)

|

|

($)

|

|

($)

|

|

($)

|

|

($)

|

|

($)

|

|

($)

|

|

(a)

|

|

|

|

(b)

|

|

(c)

|

|

(d)

|

|

(e)

|

|

(f)(9)

|

|

(g)

|

|

(h)

|

|

(i)

|

|

(j)

|

|

Orin

Hirschman

|

|

President

|

|

|

2018

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2017

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

Consulting Agreements, Employment Agreements and Other Arrangements

The Company has no agreement that provides for payment to executive officers at, following, or in connection with the resignation, retirement or other termination, or a change in control of Company or a change in any executive officer’s responsibilities following a change in control. Mr. Hirschman, the Company’s Interim President and sole employee, serves on an unpaid basis.

Outstanding Equity Awards at Fiscal Year-End

The table below summarizes the outstanding equity awards to our executive officers and directors as of June 30, 2019.

|

OPTION AWARDS

|

|

Name

|

|

Number of Common Shares Underlying Unexercised Options

(#)

Exercisable

|

|

|

Number of Common Shares Underlying Unexercised Options

(#)

Unexercisable

|

|

|

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#)

|

|

|

Option Exercise Price

($)

|

|

|

Option Expiration Date

|

|

|

None.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock Option Plan and other Employee Benefits Plans

None.

Compensation of Directors

As of December 31, 2018, there is no cash compensation paid to directors for their service on our board of directors.

Code of Ethics

Our Board of Directors adopted a Code of Conduct and Ethics (the “Code”) in March 2006, which applies to our officers, directors and employees. The purpose of the Code is to deter wrongdoing and to promote:

|

|

●

|

honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

|

|

|

|

|

|

|

●

|

full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with, or submits to, the Securities and Exchange Commission (“SEC”) or NASDAQ, and in other public communications made by the Company;

|

|

|

|

|

|

|

●

|

compliance with applicable laws and governmental rules and regulations;

|

|

|

|

|

|

|

●

|

the prompt internal reporting of violations of the Code to an appropriate person or persons identified in the Code; and

|

|

|

|

|

|

|

●

|

accountability for adherence to the Code.

|

A copy of the Code is filed herewith as Exhibit 14.1 and is incorporated herein by reference.

Item 7. Certain Relationships and Related Transactions, and Director Independence.

Director Independence

For purposes of determining director independence, we have applied the definitions set out in NASDAQ Rule 5605(a)(2). The OTCBB on which shares of common stock are quoted does not have any director independence requirements. The NASDAQ definition of “Independent Director” means a person other than an Executive Officer or employee of the Company or any other individual having a relationship which, in the opinion of the Company’s Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

According to the NASDAQ

definition, Orin Hirshman is not an independent director because he is also an executive officer of the Company. According to the

NASDAQ definition, Martin Chopp and Ryan Chrisoff are independent directors. All current directors are or may become in the future

shareholders of the Company.

Related Party Transactions

None of the directors or executive officers of the Company, nor any person who owned of record or was known to own beneficially more than 5% of the Company’s outstanding shares of its Common Stock, nor any associate or affiliate of such persons or companies, has any material interest, direct or indirect, in any transaction that has occurred during the past fiscal year, or in any proposed transaction, which has materially affected or will affect the Company.

With regard to any future related party transaction, we plan to fully disclose any and all related party transactions in the following manner:

|

|

●

|

Disclosing such transactions in reports where required;

|

|

|

●

|

Disclosing in any and all filings with the SEC, where required;

|

|

|

●

|

Obtaining disinterested directors consent; and

|

|

|

●

|

Obtaining shareholder consent where required.

|

Review, Approval or Ratification of Transactions with Related Persons

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Item 8. Legal Proceedings.

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are not presently a party to any material litigation, nor to the knowledge of management is any litigation threatened against us, which may materially affect us.

Item 9. Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters.

Market Information

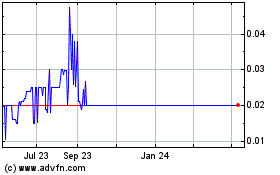

Our common stock is currently quoted on the OTC Pink Sheets under the symbol NVNT. On December 22, 2011 we filed a Form 15-12G and down listed to the OTC Pink sheets. Because we are quoted on the OTC Markets, our common stock may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained if it were listed on a national securities exchange.

Record Holders

As of November 11, 2019, there were 202,308,728 common shares issued and outstanding, which were held by 194 stockholders of record.

Dividends

We have never declared or paid any cash dividends on our common stock nor do we anticipate paying any in the foreseeable future. Furthermore, we expect to retain any future earnings to finance our operations and expansion. The payment of cash dividends in the future will be at the discretion of our Board of Directors and will depend upon our earnings levels, capital requirements, any restrictive loan covenants and other factors the Board considers relevant.

Securities Authorized for Issuance under Equity Compensation Plans

None.

Item 10. Recent Sales of Unregistered Securities.

None.

Item 11. Description of Registrant’s Securities to be Registered.

Common Stock

This Form 10 relates to our common stock, $0.0001 par value per share (the “Common Stock”). We are authorized to issue 500,000,000 shares of Common Stock. As of November 11, 2019, there were 202,308,728 shares of common stock issued and outstanding.

The holders of our Common Stock have equal ratable rights to dividends from funds legally available therefore, when, as and if declared by our board of directors. Holders of Common Stock are also entitled to share ratably in all of our assets available for distribution to holders of Common Stock upon liquidation, dissolution or winding up of the affairs.

The holders of shares of our Common Stock do not have cumulative voting rights, which means that the holders of more than 50% of such outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose and in such event, the holders of the remaining shares will not be able to elect any of our directors. The holders of 50% percent of the outstanding Common Stock constitute a quorum at any meeting of shareholders, and the vote by the holders of a majority of the outstanding shares or a majority of the shareholders at a meeting at which quorum exists are required to effect certain fundamental corporate changes, such as liquidation, merger or amendment of our articles of incorporation.

Holders of our Common Stock may resell their shares of Common Stock, pursuant to Rule 144 under the Securities Act (“Rule 144”), one year following the date of acquisition of such securities from the Company until such time that the Company becomes subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act. Holders of our Common Stock may resell their shares of Common Stock, pursuant to Rule 144 six months following the date of acquisition of such securities from the Company or an affiliate of the Company after the Company has been subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act, for a period of at least 90 days immediately before such sale, and has filed all required reports under the Exchange Act (other than reports on Form 8-K) during the preceding 12 months (or such shorter period as the Company was required to file such reports). If the condition set forth above relating to the Company having filed all required reports under the Exchange Act is not satisfied, holders of our Common Stock may resell their shares of Common Stock, pursuant to Rule 144, one year following the acquisition of such securities from the Company or an affiliate of the Company.

Shares of our Common Stock are registered at the office of the Company and are transferable at such office by the registered holder (or duly authorized attorney) upon surrender of the Common Stock certificate, properly endorsed. No transfer shall be registered unless the Company is satisfied that such transfer will not result in a violation of any applicable federal or state securities laws.

Dividends

We have not paid any cash dividends to our shareholders. The declaration of any future cash dividends is at the discretion of our Board of Directors and depends upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Stock Transfer Agent

Our transfer agent is IssuerDirect located in Raleigh, NC.

Item 12. Indemnification of Directors and Officers.

Our Bylaws provide that to the fullest extent permitted by Delaware law the Company shall indemnify our Directors and officers against expenses (including attorneys’ fees), judgments, fines, and amounts paid in settlement actually and reasonably incurred in connection with any threatened, pending or completed action, suit, or proceeding in which such person was or is a party or is threatened to be made a party by reason of the fact that such person is or was a director or officer of the corporation. In general, our officers and directors may be indemnified with respect to actions taken in good faith and in a manner that they reasonably believed to be in the best interest of the Company, and, in the case of a criminal proceeding, had no reasonable cause to believe his conduct was unlawful.

The indemnification provisions in our bylaws may discourage stockholders from bringing a lawsuit against directors for breach of their fiduciary duty. These provisions may also have the effect of reducing the likelihood of derivative litigation against directors and officers, even though such an action, if successful, might otherwise benefit us and our stockholders. In addition, your investment may be adversely affected to the extent we pay the costs of settlement and damage awards against directors and officers pursuant to these indemnification provisions. We believe that the indemnification provisions in our Certificate of Incorporation, as amended, are necessary to attract and retain qualified persons as Directors and officers.

The above-described provisions relating to the exclusion of liability and indemnification of directors and officers are sufficiently broad to permit the indemnification of such persons in certain circumstances against liabilities arising under the Securities Act.

Regarding indemnification for liabilities arising under the Securities Act, which may be permitted to directors or officers under Delaware law, we are informed that, in the opinion of the SEC, such indemnification is against public policy, as expressed in the Securities Act and is, therefore, unenforceable.

We have not entered into any agreements with our directors and executive officers that require us to indemnify these persons against expenses, judgments, fines, settlements and other amounts actually and reasonably incurred (including expenses of a derivative action) in connection with any proceeding, whether actual or threatened, to which any such person may be made a party by reason of the fact that the person is or was a director or officer of our Company or any of our affiliated enterprises.

We do not maintain any policy of directors’ and officers’ liability insurance that insures its directors and officers against the cost of defense, settlement or payment of a judgment under any circumstances.

Item 13. Financial Statements and Supplementary Data.

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To

the Board of Directors and Shareholders of Novint Technologies, Inc.:

Opinion

on the Financial Statements

We

have audited the accompanying balance sheets of Novint Technologies, Inc. (“the Company”) as of December 31, 2018

and 2017, the related statements of operations, stockholders’ equity (deficit), and cash flows for each of the years in

the two-year period ended December 31, 2018 and the related notes (collectively referred to as the “financial statements”).

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of

the Company as of December 31, 2018 and 2017, and the results of its operations and its cash flows for each of the years in the

two-year period ended December 31, 2018, in conformity with accounting principles generally accepted in the United States of America.

Explanatory

Paragraph Regarding Going Concern

The

accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed

in Note 1 to the financial statements, the Company has suffered recurring losses from operations and has a negative cash flows

from operations that raise substantial doubt about its ability to continue as a going concern. Management's plans in regard to

these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the

outcome of this uncertainty.

Basis

for Opinion

These

financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on

the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company

Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company

in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission

and the PCAOB.

We

conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit

to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error

or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial

reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but

not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting.

Accordingly, we express no such opinion.

Our

audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to

error or fraud, and performing procedures that respond to those risks. Such procedures included examining on a test basis, evidence

regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles

used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that our audits provide a reasonable basis for our opinion.

/s/

Sadler, Gibb & Associates, LLC

We

have served as the Company’s auditor since 2017

Salt

Lake City, UT

July

25, 2019

|

office

|

801.783.2950

|

|

fax

|

801.783.2960

|

|

www.sadlergibb.com

|

Main:

2455 East Parleys Way Suite 320, Salt Lake City, UT 84109

|

Provo:

3507 N University Ave #100, Provo, UT 84604

|

Novint

Technologies, Inc.

BALANCE

SHEETS

AS

OF DECEMBER 31, 2018 AND 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

|

2017

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

508,547

|

|

|

$

|

575,083

|

|

|

Prepaid expenses and other current assets

|

|

|

4,113

|

|

|

|

3,745

|

|

|

Total Current Assets

|

|

|

512,660

|

|

|

|

578,828

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$

|

512,660

|

|

|

$

|

578,828

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$

|

585,094

|

|

|

$

|

535,324

|

|

|

Total Current Liabilities

|

|

|

585,094

|

|

|

|

535,324

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

|

|

585,094

|

|

|

|

535,324

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.0001 par value; 12,500,000 shares authorized, 0 shares issued and outstanding as of December 31, 2018 and 2017

|

|

|

—

|

|

|

|

—

|

|

|

Common stock, $0.0001 par value; 500,000,000 shares authorized, 202,308,728 shares issued and outstanding as of December 31, 2018 and 2017

|

|

|

20,231

|

|

|

|

20,231

|

|

|

Additional paid in capital

|

|

|

41,059,293

|

|

|

|

41,059,293

|

|

|

Accumulated deficit

|

|

|

(41,151,958

|

)

|

|

|

(41,036,020

|

)

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL STOCKHOLDERS’ EQUITY (DEFICIT)

|

|

|

(72,434

|

)

|

|

|

43,504

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT)

|

|

$

|

512,660

|

|

|

$

|

578,828

|

|

The accompanying notes are an integral part of these financial statements

Novint

Technologies, Inc.

STATEMENTS

OF OPERATIONS

FOR

THE YEARS ENDED DECEMBER 31, 2018 AND 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

|

2017

|

|

|

Selling, general and administrative:

|

|

|

|

|

|

|

|

|

|

Professional fees

|

|

$

|

34,963

|

|

|

$

|

38,977

|

|

|

General and administrative expenses

|

|

|

80,726

|

|

|

|

79,656

|

|

|

Total selling, general and administrative

|

|

|

115,689

|

|

|

|

118,633

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(115,689

|

)

|

|

|

(118,633

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Other expense:

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

(174

|

)

|

|

|

(378

|

)

|

|

Loss on settlement of debt

|

|

|

—

|

|

|

|

(25,291

|

)

|

|

Total other expense

|

|

|

(174

|

)

|

|

|

(25,669

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Loss before provision for income taxes

|

|

|

(115,863

|

)

|

|

|

(144,302

|

)

|

|

Provision for income taxes

|

|

|

(75

|

)

|

|

|

(75

|

)

|

|

Net loss

|

|

$

|

(115,938

|

)

|

|

$

|

(144,377

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share

|

|

|

|

|

|

|

|

|

|

Basic and Diluted

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding

|

|

|

|

|

|

|

|

|

|

Basic and Diluted

|

|

|

202,308,728

|

|

|

|

178,293,460

|

|

The accompanying notes are an integral part of these financial statements

Novint

Technologies, Inc.

STATEMENT

OF STOCKHOLDERS’ EQUITY (DEFICIT)

FOR

THE YEARS ENDED DECEMBER 31, 2018 AND 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

|

Paid-in

|

|

|

Accumulated

|

|

|

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Capital

|

|

|

(Deficit)

|

|

|

Total

|

|

|

Balances, December 31, 2016

|

|

|

173,569,145

|

|

|

$

|

17,357

|

|

|

$

|

40,981,696

|

|

|

$

|

(40,891,643

|

)

|

|

$

|

107,410

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of common stock for debt conversion

|

|

|

28,739,583

|

|

|

|

2,874

|

|

|

|

77,597

|

|

|