Autolus Therapeutics plc (Nasdaq: AUTL), a clinical-stage

biopharmaceutical company developing next-generation programmed T

cell therapies, today announced its operational and financial

results for the third quarter ended September 30, 2019.

“We are excited about the opportunity to share

data updates at ASH on AUTO1 in ALL in three oral presentations, as

well as an oral presentation on AUTO3 in DLBCL. We are also looking

forward to presenting data on our other hematological clinical

programs at ASH, and non-clinical data on our lead solid tumor

program AUTO6NG at SITC,” stated Dr. Christian Itin, chairman and

chief executive officer of Autolus. “This quarter we have

made significant operational progress, delivering cell products

from our new manufacturing operations at the Cell and Gene Therapy

Catapult and further strengthening our management team.

Supported by a strong balance sheet, our key focus is on moving

AUTO1 into our first pivotal clinical program in adult patients

with ALL.”

Pipeline Updates:

- On November 5, the United States

Food and Drug Administration granted orphan drug designation for

AUTO1 for the treatment of acute lymphoblastic leukemia

(ALL).

- SITC Meeting PresentationSolid

tumors (AUTO6NG) - AUTO6NG: Next generation GD2-targeting CAR

T-cell therapy with improved persistence and insensitivity to TGFb

and checkpoint inhibition for relapsed/refractory neuroblastoma

(Saturday November 9, poster presentation)

- ASH Meeting PresentationsAdult ALL

(AUTO1) - AUTO1, a novel fast off CD19 CAR delivers durable

remissions and prolonged CAR T cell persistence with low CRS or

neurotoxicity in adult ALL (Saturday December 7, oral

presentation)Pediatric ALL (AUTO1) - Therapy of pediatric B-ALL

with a lower affinity CD19 CAR leads to enhanced expansion and

prolonged CAR T cell persistence in patients with low bone marrow

tumor burden, and is associated with a favorable toxicity profile

(Saturday December 7, oral presentation)Integration Site Analysis

(AUTO1) - Clonal dynamics of early responder and long-term

persisting CAR-T cells in humans (Saturday December 7, oral

presentation)DLBCL (AUTO3) - Phase 1/2 study of AUTO3 the first

bicistronic chimeric antigen receptor (CAR) targeting CD19 and CD22

followed by an anti-PD1 in patients with relapsed/refractory (r/r)

Diffuse Large B Cell Lymphoma (DLBCL): Results of Cohort 1 and 2 of

the ALEXANDER study (Saturday December 7, oral

presentation)Multiple Myeloma (AUTO2) - Phase 1 First-in-Human

study of AUTO2, the first chimeric antigen receptor (CAR) T cell

targeting APRIL for patients with relapsed/refractory Multiple

Myeloma (RRMM) (Sunday December 8, poster presentation)Pediatric

ALL (AUTO3) - Phase 1 Study of AUTO3, a Bicistronic Chimeric

Antigen Receptor (CAR) T-cell Therapy Targeting of CD19 and CD22,

in Pediatric Patients with Relapsed/Refractory B-cell Acute

Lymphoblastic Leukemia (r/r B-ALL): AMELIA Study (Sunday December

8, poster presentation)

Operational and Corporate

Highlights:

- Manufacturing updateThe Cell and

Gene Therapy Catapult site is fully operational and is delivering

clinical products for patients in both Europe and the US

- Significant change in shareholder

baseIn September, PPF Group announced that they had acquired,

mainly from Woodford Investment Management, an approximate 19%

holding of Autolus. Control of all the remaining shares of Autolus

held by Woodford Investment Management are in the process of being

transferred to Schroder UK Public Private Trust plc.

- Nature Medicine publication of

AUTO1 CARPALL study in pediatric ALLIn September, Autolus announced

that the journal Nature Medicine has published both pre-clinical

results and clinical data from the ongoing Phase 1 CARPALL trial of

AUTO1, demonstrating the potential of the company’s novel CAR T

therapy targeting CD19 in development for the treatment of

pediatric acute lymphoblastic leukemia (ALL).

- Executive Leadership Team

ChangesDavid Brochu has been named Senior Vice President, Head of

Product Delivery to lead the transition of the company’s

manufacturing organization to deliver products for late-stage

clinical studies and commercial sale. In addition, Vishal Mehta has

been named Vice President, Head of Clinical Operations.

Key Upcoming Clinical

Milestones:

- Initiation of the pivotal program

of AUTO1 in adult ALL on track – dosing of first patients in the

first half of 2020

- Go/no go decision on Phase 2

initiation of AUTO3 in DLBCL expected in mid-2020

- Interim Phase 1 data in T cell

lymphoma with AUTO4 in the second half of 2020

Financial results for third quarter

2019

Cash and equivalents at September 30, 2019

totaled $229.4 million, compared with $247.1 million at September

30, 2018.

Net total operating expenses for the three

months ended September 30, 2019 were $35.6 million, net of grant

income of $0.3 million, as compared to net operating expenses of

$17.1 million, net of grant income of $0.3 million, for the same

period in 2018. The increase was due, in general, to the increase

in development activity, increased headcount primarily in our

development and manufacturing functions, and the cost of being a

public company.

Research and development expenses increased to

$27.3 million for the three months ended September 30, 2019 from

$10.1 million for the three months ended September 30, 2018. Cash

costs, which exclude depreciation as well as share-based

compensation, increased to $21.6 million from $9.0 million. The

increase in research and development cash costs of

$12.6 million consisted primarily of an increase of

compensation-related costs of $5.2 million primarily due to an

increase in employee headcount to support the advancement of our

product candidates in clinical development, an increase of $3.6

million in research and development program expenses related to the

activities necessary to prepare, activate, and monitor clinical

trial programs, including the manufacturing technical transfer

activities required for AUTO1 to enable the commencement at the end

of 2019 of a registration study in Adult Acute Lymphoblastic

Leukemia, an increase of $2.6 million in facilities costs

supporting the expansion of our research and translational science

capability and investment in manufacturing facilities and

equipment, an increase of $0.7 million in telecom and software

costs, and an increase of $0.5 million in other costs.

General and administrative expenses increased to

$8.6 million for the three months ended September 30, 2019

from $7.3 million for the three months ended September 30,

2018. Cash costs, which exclude depreciation expense as well as

share-based expense compensation decreased to $5.6 million from

$5.7 million. Compensation related expenses decreased by $0.6

million and IT, telecommunication, and general office expense costs

decreased by $0.7 million which were offset by an increase in legal

and professional fees of $0.9 million and an increase of $0.3

million in commercial costs.

Net loss attributable to ordinary shareholders

was $27.2 million for the three months ended September 30, 2019,

compared to $12.9 million for the same period in 2018.

The basic and diluted net loss per ordinary

share for the three months ended September 30, 2019 totaled $(0.61)

compared to a basic and diluted net loss per ordinary share of

$(0.33) for the three months ended September 30, 2018.

Autolus anticipates that cash on hand provides a

runway into the second half of 2021.

Conference Call and Presentation

Information

Autolus management will host a conference call

today, November 7, at 8:30 a.m. EST/ 1:30pm GMT, to discuss the

company’s financial results and operational update.

To listen to the webcast and view the

accompanying slide presentation, please go to:

https://www.autolus.com/investor-relations/news-events/events.

The call may also be accessed by dialing (866) 679-5407 for U.S.

and Canada callers or (409) 217-8320 for international callers.

Please reference conference ID 5075598. After the conference call,

a replay will be available for one week. To access the replay,

please dial (855) 859-2056 for U.S. and Canada callers or (404)

537-3406 for international callers. Please reference conference ID

5075598.

About Autolus Therapeutics

plc

Autolus is a clinical-stage biopharmaceutical

company developing next-generation, programmed T cell therapies for

the treatment of cancer. Using a broad suite of proprietary and

modular T cell programming technologies, the company is engineering

precisely targeted, controlled and highly active T cell therapies

that are designed to better recognize cancer cells, break down

their defense mechanisms and eliminate these cells. Autolus has a

pipeline of product candidates in development for the treatment of

hematological malignancies and solid tumors. For more information

please visit www.autolus.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the "safe harbor" provisions of

the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are statements that are not historical

facts, and in some cases can be identified by terms such as "may,"

"will," "could," "expects," "plans," "anticipates," and "believes."

These statements include, but are not limited to, statements

regarding Autolus’ financial condition and results of operations,

as well as statements regarding the anticipated development of

Autolus’ product candidates, including its intentions regarding the

timing for providing further updates on the development of its

product candidates, and the sufficiency of its cash resources. Any

forward-looking statements are based on management's current views

and assumptions and involve risks and uncertainties that could

cause actual results, performance or events to differ materially

from those expressed or implied in such statements. For a

discussion of other risks and uncertainties, and other important

factors, any of which could cause our actual results to differ from

those contained in the forward-looking statements, see the section

titled "Risk Factors" in Autolus' Annual Report on Form 20-F filed

on November 23, 2018 as well as discussions of potential risks,

uncertainties, and other important factors in Autolus' future

filings with the Securities and Exchange Commission from time to

time. All information in this press release is as of the date of

the release, and the company undertakes no obligation to publicly

update any forward-looking statement, whether as a result of new

information, future events, or otherwise, except as required by

law.

Investor and media contact: Silvia TaylorVice

President, Corporate Affairs and Communications

Autolus+1-240-801-3850s.taylor@autolus.com

UK:Julia Wilson+44 (0) 7818

430877 j.wilson@autolus.com

Autolus Therapeutics

PLCCondensed Consolidated Statements of Operations

and Comprehensive Loss (Unaudited)(In thousands,

except share and per share amounts)

| |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

|

Grant income |

$ |

297 |

|

$ |

307 |

|

$ |

2,599 |

|

$ |

1,176 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

(27,310) |

|

(10,096) |

|

(76,050) |

|

(30,586) |

|

|

General and administrative |

(8,605) |

|

(7,273) |

|

(29,531) |

|

(19,706) |

|

|

Total operating expenses, net |

(35,618) |

|

(17,062) |

|

(102,982) |

|

(49,116) |

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

Interest income |

509 |

|

796 |

|

2,124 |

|

1,351 |

|

|

Other income |

3,263 |

|

1,206 |

|

6,659 |

|

4,655 |

|

|

Total other income, net |

3,772 |

|

2,002 |

|

8,783 |

|

6,006 |

|

|

Net loss before income tax |

(31,846) |

|

(15,060) |

|

(94,199) |

|

(43,110) |

|

|

Income tax benefit |

4,598 |

|

2,200 |

|

11,294 |

|

5,883 |

|

|

Net loss attributable to ordinary

shareholders |

(27,248) |

|

(12,860) |

|

(82,905) |

|

(37,227) |

|

|

Other comprehensive loss: |

|

|

|

|

|

|

|

|

|

Foreign currency exchange translation adjustment |

(9,044) |

|

(973) |

|

(12,865) |

|

(7,215) |

|

|

Total comprehensive loss |

$ |

(36,292) |

|

$ |

(13,833) |

|

$ |

(95,770) |

|

$ |

(44,442) |

|

| |

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per ordinary share |

$ |

(0.61) |

|

$ |

(0.33) |

|

$ |

(1.95) |

|

$ |

(1.14) |

|

|

Weighted-average basic and diluted ordinary shares |

44,505,383 |

|

39,214,334 |

|

42,547,755 |

|

32,516,001 |

|

Autolus Therapeutics

PLCCondensed Consolidated Balance

Sheets(In thousands, except share and per share

amounts)

| |

September 30, 2019 |

|

December 31, 2018 |

|

Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash |

$ |

229,366 |

|

|

$ |

217,450 |

|

|

Restricted cash |

681 |

|

|

105 |

|

|

Prepaid expenses and other current assets |

30,136 |

|

|

15,411 |

|

|

Total current assets |

260,183 |

|

|

232,966 |

|

|

Non-current assets: |

|

|

|

|

Property and equipment, net |

28,413 |

|

|

19,968 |

|

|

Right of use asset, net |

24,133 |

|

|

— |

|

|

Long-term deposits |

1,912 |

|

|

1,276 |

|

|

Total assets |

$ |

314,641 |

|

|

$ |

254,210 |

|

|

Liabilities and shareholders' equity |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

2,733 |

|

|

2,022 |

|

|

Accrued expenses and other liabilities |

15,548 |

|

|

19,054 |

|

|

Lease liability |

2,282 |

|

|

— |

|

|

Total current liabilities |

20,563 |

|

|

21,076 |

|

|

Non-current liabilities: |

|

|

|

|

Lease liability |

24,407 |

|

|

— |

|

|

Long-term lease incentive obligation |

— |

|

|

207 |

|

|

Other long-term payables |

30 |

|

|

285 |

|

|

Total liabilities |

45,000 |

|

|

21,568 |

|

| |

|

|

|

|

Shareholders' equity: |

|

|

|

|

Ordinary shares, $0.000042 par value; 200,000,000 shares authorized

as of September 30, 2019 and December 31, 2018; 44,982,378 and

40,145,617, shares issued and outstanding at September 30, 2019 and

December 31, 2018, respectively |

2 |

|

|

2 |

|

|

Deferred shares, £0.00001 par value; 34,425 shares authorized,

issued and outstanding at September 30, 2019 and December 31,

2018 |

— |

|

|

— |

|

|

Deferred B shares, £0.00099 par value; 88,893,548 shares

authorized, issued and outstanding at September 30, 2019 and

December 31, 2018 |

118 |

|

|

118 |

|

|

Deferred C shares, £0.000001 par value; 1 share authorized, issued

and outstanding at September 30, 2019 and December 31, 2018 |

— |

|

|

— |

|

|

Additional paid-in capital |

494,080 |

|

|

361,311 |

|

|

Accumulated other comprehensive loss |

(28,353 |

) |

|

(15,488 |

) |

|

Accumulated deficit |

(196,206 |

) |

|

(113,301 |

) |

|

Total shareholders' equity |

269,641 |

|

|

232,642 |

|

|

Total liabilities and shareholders' equity |

$ |

314,641 |

|

|

$ |

254,210 |

|

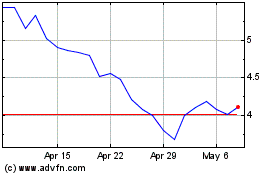

Autolus Therapeutics (NASDAQ:AUTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

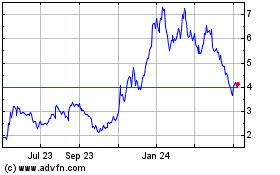

Autolus Therapeutics (NASDAQ:AUTL)

Historical Stock Chart

From Apr 2023 to Apr 2024