UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

COMPAÑÍA CERVECERÍAS UNIDAS S.A.

(Exact name of Registrant as specified in its charter)

UNITED BREWERIES COMPANY, INC.

(Translation of Registrant’s name into English)

Republic of Chile

(Jurisdiction of incorporation or organization)

Vitacura 2670, 23rd floor, Santiago, Chile

(Address of principal executive offices)

_________________________________________

Securities registered or to be registered pursuant to section 12(b) of the Act.

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F X Form 40-F ___

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ___ No X

CCU REPORTS CONSOLIDATED THIRD QUARTER 2019 RESULTS1,2

Santiago, Chile, November 6, 2019 – CCU announced today its consolidated financial and operating results for the third quarter 2019, which ended September 30, 2019:

· Consolidated Volumes increased 6.0%. Volume variation per Operating segment was as follows:

o Chile 6.5%

o International Business 6.2%. Excluding Bolivia, volumes rose 3.9%3

o Wine 4.8%

· Net sales increased 0.5%

· EBITDA reached CLP 63,757 million, a 6.8% decrease. Variation per Operating segment was as follows:

o Chile 8.1%

o International Business (100.0)%

o Wine 29.0%

· Net income reached CLP 8,626 million, a drop of 55.5%, when excluding the effects of the CCU Argentina and Anheuser-Busch InBev S.A./N.V. (ABI) transaction, which took place in the 2Q18 (the “Transaction”)4

· Earnings per share reached CLP 23.3 per share

|

|

|

|

|

|

|

|

|

|

|

Key figures

|

|

3Q19

|

3Q18

|

Total

change %

|

|

YTD19

|

YTD18

|

Total

change %

|

|

(In ThHL or CLP million unless stated otherwise)

|

|

|

Volumes

|

|

6,857

|

6,467

|

6.0

|

|

20,855

|

19,882

|

4.9

|

|

Net sales

|

|

390,249

|

388,349

|

0.5

|

|

1,244,469

|

1,232,682

|

1.0

|

|

Gross profit

|

|

189,392

|

191,286

|

(1.0)

|

|

612,622

|

641,308

|

(4.5)

|

|

EBIT

|

|

37,895

|

45,017

|

(15.8)

|

|

138,520

|

172,537

|

(19.7)

|

|

EBITDA

|

|

63,757

|

68,404

|

(6.8)

|

|

216,064

|

238,464

|

(9.4)

|

|

Net income

|

|

8,626

|

19,390

|

(55.5)

|

|

75,183

|

88,565

|

(15.1)

|

|

Earnings per share (CLP)

|

|

23.3

|

52.5

|

(55.5)

|

|

203.5

|

239.7

|

(15.1)

|

|

|

|

|

|

|

|

|

|

|

|

Including the effect of the Transaction:

|

|

|

|

|

|

|

|

|

|

EBIT

|

|

37,895

|

45,017

|

(15.8)

|

|

138,520

|

381,472

|

(63.7)

|

|

EBITDA

|

|

63,757

|

68,404

|

(6.8)

|

|

216,064

|

447,399

|

(51.7)

|

|

Net income

|

|

8,626

|

21,521

|

(59.9)

|

|

75,183

|

244,192

|

(69.2)

|

1 For an explanation of the terms used in this report, please refer to the Glossary in Additional Information and Exhibits. Figures in tables and exhibits have been rounded and may not add up exactly to the total shown.

2 All growth or variation references in this Earnings Release refer to 3Q19 compared to 3Q18, unless otherwise stated.

3 CCU began to consolidate Bolivia by August 9, 2018.

4 For further information about the Transaction see the Note 1- letter C, of our Consolidated Financial Statements.

In the third quarter of 2019, in spite of a less dynamic economic scenario, CCU’s consolidated volumes performed positively by growing 6.0%, supported by all Operating segments. Despite higher volumes, EBITDA was down 6.8%, to CLP 63,757 million and EBITDA margin decreased 128 bps to 16.3%. The weaker financial results were mainly explained by: (i) the depreciation of the CLP and ARS against the USD, which depreciated 6.5%1 and 41.4%2, respectively, increasing our USD-denominated costs, and (ii) the application of Hyperinflation Accounting in Argentina, mainly affecting the consolidation of our Argentine results, due to the 28.7%6 devaluation of the ARS against the CLP. These external effects, mostly concentrated in Argentina, were too significant to be compensated in the short run with efficiencies and pricing, aspects which we are particularly concentrated on. Consequently, the International Operating segment EBITDA dropped by CLP 10,433 million, more than explaining the consolidated EBITDA contraction of CLP 4,647 million. In fact, the Chile and Wine Operating segments delivered positive EBITDA growth, even excluding a non-recurrent operating gain of CLP 3,149 million in the Chile Operating segment. This gain was fully offset, at Net income level, by a non-recurrent non-operating loss. In all, Net income decreased by 55.5% to CLP 8,626 million.

In the Chile Operating segment, our top-line rose 5.6%, with volumes expanding 6.5%, accelerating with respect to the first half of the year. Average prices were down 0.9%, explained by promotional activities partially compensated with revenue management efforts. Gross margin dropped by 94 bps, mostly due to the higher USD-denominated costs from the weaker CLP against the USD. MSD&A expenses as a percentage of Net sales worsened by 35 bps, due to the anticipation of marketing expenses partially compensated by efficiency gains in distribution. In all, EBITDA reached CLP 54,936 million, an expansion of 8.1%, and EBITDA margin jumped 48 bps, from 20.2% to 20.7%. Excluding a non-recurrent operating gain of CLP 3,149 million from the sale of a real estate asset, EBITDA would have expanded 1.9%, and EBITDA margin would have reached 19.5%.

The International Business Operating segment, which includes Argentina, Bolivia, Paraguay and Uruguay, posted a 6.2% increase in volumes (3.9% when excluding Bolivia3) mostly driven by a good commercial dynamism in Argentina, demonstrating the strength of our beer portfolio. However, Net sales declined 16.4% and Gross margin contracted from 47.1% to 41.2%, explained by lower average prices in CLP, mostly due to the negative impact of the sharp depreciation of the ARS against the CLP during the quarter, and price adjustments that have not yet been enough to offset the effect of inflation and the devaluation of currencies in our costs and expenses. It is important to mention that it takes time to compensate for an impact of such magnitude and we expect to gradually do so by implementing revenue management initiatives. Accordingly, we increased prices by 25% by the end of September in Argentina. In all, EBITDA was marginally positive during the quarter.

The Wine Operating segment posted a 3.3% increase in revenue, explained by 4.8% higher volumes, partially offset by a 1.4% drop in average prices in CLP. The lower prices in CLP were mainly explained by negative mix effects in exports and in the domestic Argentine market, due to the incorporation of volumes from the recently acquired brands in Argentina, more than offsetting a positive effect from a stronger USD on export revenues. The Operating segment’s gross margin continued to recover this quarter, with an improvement of 428 bps, from 37.6% to 41.9%, primarily associated with lower cost of wine against last year. Altogether, EBITDA reached CLP 12,074 million, an expansion of 29.0%, and EBITDA margin improved by 418 bps, from 16.8% to 21.0%.

In Colombia, where we have a joint venture with Postobón, we continue to post a positive performance in volumes and in positioning Andina, our local mainstream beer. In addition, we are successfully developing our strategy and are about to produce our premium beer portfolio locally. In the malt category, our recently launched brand Natumalta has evolved positively. During the third quarter we continued on an upward commercial trend by almost tripling our volumes. This allowed us to more than double our accumulated volumes. We will continue focusing on developing brand equity and commercial execution, through a strategy that involves new consumer experiences, quality and innovation.

In the third quarter, CCU was able to deliver a solid performance in volumes in a highly competitive environment and challenging economic and social context to partially offset significant external effects, mainly related to the devaluation of the currencies. We expect to continue focusing on delivering profitable and sustainable growth by implementing additional revenue management initiatives together with our constant efforts in efficiencies, sales execution and service quality to our clients and consumers.

1 The CLP currency variation against the USD considers average of period (aop) compared to aop.

2 The ARS currency variation against the CLP or the USD considers 2019 end of period (eop) compared to 2018 eop

Page 2 of 12

|

CONSOLIDATED INCOME STATEMENT HIGHLIGHTS – THIRD QUARTER (Exhibit 1 & 3)

|

|

|

Variations against last year and 3Q18 ratios exclude the effects of the CCU Argentina and Anheuser-Busch InBev S.A./N.V. (ABI) transaction, which took place in the 2Q18.

|

|

·

|

Net sales increased 0.5%, explained by a 6.0% growth in consolidated volumes partially compensated by a contraction of 5.2% on average prices in CLP. Volume growth was driven by all Operating segments, while the fall in average prices in CLP was primarily explained by: (i) the application of Hyperinflation Accounting in Argentina, affecting the consolidation of our Argentine results, due to the 28.7%6 depreciation of the ARS against the CLP, (ii) lower average prices in the Chile Operating segment related to promotional activities partially compensated by revenue management efforts, and (iii) a contraction in the Wine Operating segment, due to unfavorable mix effects that more than counterbalance a stronger USD on export revenues.

|

|

·

|

Cost of sales increased 1.9%, explained by the 6.0% expansion in volumes and the 3.9% drop in Cost of sales per hectoliter. The Chile Operating segment reported a 1.1% growth in Cost of sales per hectoliter, explained by the increase in USD-linked costs from the 6.5%5 depreciation of the CLP against the USD, partially compensated by lower costs of aluminum and PET. In the International Business Operating segment, the Cost of sales per hectoliter in CLP decreased 12.5%, primarily due to a currency translation effect, given that in local currency Cost of sales per hectoliter increased as a result of higher USD-linked costs explained by the 41.4%6 depreciation of the ARS against the USD, as well as the effects of inflation in Argentina (53.5% y/y as of September). In the Wine Operating segment, the Cost of sales per hectoliter decreased by 8.2%, due to a lower cost of wine that more than offset the effect of the depreciation of the CLP against the USD on our materials linked to this currency.

|

|

·

|

Gross profit reached CLP 189,392 million, a decrease of 1.0%, resulting in a drop of 73 bps in our Gross margin, from 49.3% to 48.5%, as a consequence of the effects described above.

|

|

·

|

MSD&A expenses grew by 5.2%, and MSD&A as a percentage of Net sales increased by 179 bps. In the Chile Operating segment, MSD&A as a percentage of Net sales worsened by 35 bps, mainly explained by the anticipation of marketing expenses partially compensated by efficiency gains in distribution. In the International Business Operating segment, MSD&A as a percentage of Net sales deteriorated by 545 bps, concentrated in Argentina, due to the negative impact of inflation and the contraction in Net sales. In the Wine Operating segment, MSD&A as a percentage of Net sales rose 110 bps, from 24.7% to 25.8%.

|

|

·

|

EBIT reached CLP 37,895 million, a decrease of 15.8%. This result was mainly explained by: (i) the depreciation of the CLP and ARS against the USD, increasing our USD-denominated costs, and (ii) the application of Hyperinflation Accounting in Argentina, mainly affecting the consolidation of our Argentine results. These external effects, mostly concentrated in Argentina, were too significant to be compensated in the short run with efficiencies and pricing.

|

|

·

|

EBITDA reached CLP 63,757 million, a decrease of 6.8%. Consequently, EBITDA margin dropped 128 bps, from 17.6% to 16.3%. The lower EBITDA was more than explained by the International Business Operating segment, which reported a contraction of CLP 10,433 million, associated with the same impacts described in EBIT, while the Chile Operating segment and the Wine Operating segment, posted an increase of CLP 4,122 million and CLP 2,715 million, respectively. Additionally, in the Chile Operating segment we registered a non-recurrent gain of CLP 3,149 million from the sale of a real estate asset.

|

|

·

|

Non-operating result totalized a loss of CLP 19,990 million, an increase of 68.3% when compared with a loss of CLP 11,874 million last year, primarily due to: (i) higher Net financial expenses by CLP 2,500 million, mostly caused by an increase in debt and financial costs in Argentina, (ii) higher loss in Foreign currency exchange by CLP 2,430 million, mostly concentrated in Argentina, (iii) a decrease of CLP 2,383 million in Results as per adjustment units, largely explained by the application of Hyperinflation accounting in Argentina and (iv) a lower result in Equity and income of JVs and associated by CLP 1,556 million, caused by a lower financial result in Colombia.

|

|

·

|

Income taxes reached CLP 6,886 million, an improvement of CLP 4,110 million from last year, mostly explained by a lower taxable income.

|

|

·

|

Net income reached CLP 8,626 million, a contraction of 55.5%. This result was mainly explained by the same effects mentioned above. It is important to highlight that the non-recurring operating gain in the Chile Operating segment was fully offset by a non-recurrent non-operating loss.

|

Page 3 of 12

|

CONSOLIDATED INCOME STATEMENT HIGHLIGHTS – NINE MONTHS (Exhibit 2 & 4)

|

|

|

Variations against last year and 3Q18 ratios exclude the effects of the CCU Argentina and Anheuser-Busch InBev S.A./N.V. (ABI) transaction, which took place in the 2Q18.

|

|

·

|

Net sales increased 1.0%, driven by 4.9% volume growth, which was partially offset by a 3.8% decline in average prices in CLP. Consolidated volume growth was mostly driven by a 7.1% and 4.6% increase in volumes in the International Business and Chile Operating segments, respectively, while the Wine Operating segment grew 0.9%. The 3.8% lower average prices in CLP was mostly due to the 14.4% drop in the International Business Operating segment, mainly explained by the depreciation of the ARS against the CLP and price adjustments that have not yet been enough to offset inflation and currencies fluctuation. The Chile Operating segment average prices were down 0.3%, associated with promotional activities. In the Wine Operating segment, the average prices expanded 2.4%, due to the favorable impact of the stronger USD on export revenues that more than offset negative mix effects in exports and in the domestic Argentine market, due to the incorporation of volumes from the recently acquired brands.

|

|

·

|

Cost of sales increased 6.8%, explained by the 4.9% expansion in volumes and the 1.9% rise in Cost of sales per hectoliter. The Chile Operating segment reported a 3.2% growth in Cost of sales per hectoliter, explained by the increase in USD-linked costs from the 9.0%5 depreciation of the CLP against the USD, partially compensated by lower costs of aluminum, PET and sugar. In the International Business Operating segment, the Cost of sales per hectoliter in CLP increased 4.0%, primarily due to the impact of the 41.4%6 depreciation of the ARS against the USD on USD-linked costs, as well as the effects of inflation in Argentina. In the Wine Operating segment, the Cost of sales per hectoliter decreased by 2.7%, associated with a lower cost of wine.

|

|

·

|

Gross profit reached CLP 612,622 million, a decrease of 4.5%, resulting in 280 bps fall in our Gross margin, as a consequence of the effects described above.

|

|

·

|

MSD&A expenses increased 3.3% and, as a percentage of Net sales, rose by 90 bps from 38.5% to 39.4%. In the Chile Operating segment, MSD&A as a percentage of Net sales remained flat while in the International Business Operating segment increased by 379 bps, due to the negative impact of inflation and the contraction in Net sales. In the Wine Operating segment, MSD&A as a percentage of Net sales increased 131 bps.

|

|

·

|

EBIT reached CLP 138,520 million, a decrease of 19.7%, associated with the abovementioned effects.

|

|

·

|

EBITDA reached CLP 216,064 million, a decrease of 9.4%, largely explained by the International Business Operating segment, and in a lesser extent, by the Chile Operating segment, which reported a decline of 62.0% and 0.3%, respectively, partially compensated by the 24.1% increase in the Wine Operating segment. Accordingly, our consolidated EBITDA margin contracted by 198 bps, from 19.3% to 17.4%. This result was explained by the same drivers described above.

|

|

·

|

Non-operating result totalized a loss of CLP 32,180 million a 6.3% increase when compared with a loss of CLP 30,277 million, primarily as a result of: (i) a higher loss of CLP 6,347 million in Results as per adjustment units, largely explained by the application of Hyperinflation accounting in Argentina, and (ii) a lower result in Equity and income of JVs and associated by CLP 4,738 million, explained by a lower financial result in Colombia. These effects were partially compensated by a better result in Foreign currency exchange by CLP 4,176 million, and a lower Net financial expenses by CLP 3,604 million, due to higher Cash and cash equivalents maintained during the first part of the year for Tax and dividend payments, mainly related to the results from both ongoing operations and the Transaction4.

|

|

·

|

Income taxes reached CLP 21,830 million, 50.5% less than last year, mainly explained by a lower consolidated taxable income and a tax asset revaluation in Argentina with a positive non-recurrent impact in the 2Q19.

|

|

·

|

Net income reached CLP 75,183 million, a decrease of 15.1%.

|

Page 4 of 12

|

HIGHLIGHTS OPERATING SEGMENTS THIRD QUARTER

|

|

1. CHILE OPERATING SEGMENT

|

In the Chile Operating segment, our top-line rose 5.6%, with volumes expanding 6.5%, accelerating with respect to the first half of the year. Average prices were down 0.9%, explained by promotional activities partially compensated with revenue management efforts. Gross margin dropped by 94 bps, mostly due to the higher USD-denominated costs from the weaker CLP against the USD. MSD&A expenses as a percentage of Net sales worsened by 35 bps, due to the anticipation of marketing expenses partially compensated by efficiency gains in distribution. In all, EBITDA reached CLP 54,936 million, an expansion of 8.1%, and EBITDA margin jumped 48 bps, from 20.2% to 20.7%. Excluding a non-recurrent operating gain of CLP 3,149 million from the sale of a real estate asset, EBITDA would have expanded 1.9%, and EBITDA margin would have reached 19.5%.

In terms of innovation, during the quarter CCU introduced a new online sales platform in Chile, named “La Barra” bringing a new experience to our customers through home delivery, special discounts and a multi-category offer. Additionally, regarding brands, we launched Cristal Summer Lager with a positive acceptance from the consumers. This new beer contains hops that bring citrus notes and an aroma that leaves a refreshing feel ideal for summer.

Regarding sustainability, for the second consecutive year CCU stood out for its actions in economic, social and environmental matters, being listed in Chile's Dow Jones Sustainability Index and, for the first time, entering the MILA Pacific Alliance index (Latin American Integrated Markets) positioning us among the best evaluated companies in the region. We are aware that environmental care is a concern that transcends industries, generations and countries. In this regard we have taken a number of initiatives to promote a cross-disciplinary education in order to facilitate the tasks of collection and recycling. Along the same line, CCU joined the Chilean Plastics Pact, committing to the challenge of rethinking the future of this material in Chile, moving towards a circular economy.

|

2. INTERNATIONAL BUSINESS OPERATING SEGMENT

|

The International Business Operating segment, which includes Argentina, Bolivia, Paraguay and Uruguay, posted a 6.2% increase in volumes (3.9% when excluding Bolivia3) mostly driven by a good commercial dynamism in Argentina, demonstrating the strength of our beer portfolio. However, Net sales declined 16.4% and Gross margin contracted from 47.1% to 41.2%, explained by lower average prices in CLP, mostly due to the negative impact of the sharp depreciation of the ARS against the CLP during the quarter, and price adjustments that have not yet been enough to offset the effect of inflation and the devaluation of currencies in our costs and expenses. It is important to mention that it takes time to compensate for an impact of such magnitude and we expect to gradually do so by implementing revenue management initiatives. Accordingly, we increased prices by 25% by the end of September in Argentina. In all, EBITDA was marginally positive during the quarter.

This quarter in Argentina, our premium beer brand Imperial added a new variety, an American Pale Ale (APA). The APA style is characterized as being an easy drinking beer, with low bitterness and citrus notes, ideal for consumers looking for something between a pale ale beer and an India Pale Ale (IPA).

Regarding our beer brand Schneider, we introduced new varieties adding a black and red ale in its iconic can. In addition, Schneider signed a strategic agreement with the Argentine Football Association, to become the new official sponsor of the National Teams for the next three years, which allows us to continue strengthening the relationship with the most popular sport in the country.

|

3. WINE OPERATING SEGMENT

|

The Wine Operating segment posted a 3.3% increase in revenue, explained by 4.8% higher volumes, partially offset by a 1.4% drop in average prices in CLP. The lower prices in CLP were mainly explained by negative mix effects in exports and in the domestic Argentine market, due to the incorporation of volumes from the recently acquired brands in Argentina, more than offsetting a positive effect from a stronger USD on export revenues. The Operating segment’s gross margin continued to recover this quarter, with an improvement of 428 bps, from 37.6% to 41.9%, primarily associated with lower cost of wine against last year. Altogether, EBITDA reached CLP 12,074 million, an expansion of 29.0%, and EBITDA margin improved by 418 bps, from 16.8% to 21.0%.

During the quarter, and considering CCU's joint contribution to Chile's first waste management program VSPT Wine Group was the first winery to participate in a pilot plan of the Extended Producer Responsibility Law (Ley REP), encouraging our country to raise standards, manage waste in a sustainable manner and open up to a true circular economy view.

Page 5 of 12

|

ADDITIONAL INFORMATION AND EXHIBITS

|

ABOUT CCU

CCU is a multi-category beverage company with operations in Chile, Argentina, Bolivia, Colombia, Paraguay and Uruguay. CCU is one of the largest players in each one of the beverage categories in which it participates in Chile, including beer, soft drinks, mineral and bottled water, nectar, wine and pisco, among others. CCU is the second-largest brewer in Argentina and also participates in the cider, spirits and wine industries. In Uruguay and Paraguay, the Company is present in the beer, mineral and bottled water, soft drinks and nectar categories. In Bolivia, CCU participates in the beer, water, soft drinks and malt beverage categories. In Colombia, the Company participates in the beer and in the malt industry. The Company’s principal licensing, distribution and / or joint venture agreements include Heineken Brouwerijen B.V., PepsiCo Inc., Seven-up International, Schweppes Holdings Limited, Société des Produits Nestlé S.A., Pernod Ricard Chile S.A., Promarca S.A. (Watt’s) and Coors Brewing Company.

CORPORATE HEADQUARTERS

Vitacura 2670, 26th floor

Santiago

Chile

STOCK TICKER

Bolsa de Comercio de Santiago: CCU

NYSE: CCU

CAUTIONARY STATEMENT

Statements made in this press release that relate to CCU’s future performance or financial results are forward-looking statements, which involve known and unknown risks and uncertainties that could cause actual performance or results to materially differ. We undertake no obligation to update any of these statements. Persons reading this press release are cautioned not to place undue reliance on these forward-looking statements. These statements should be taken in conjunction with the additional information about risk and uncertainties set forth in CCU’s annual report on Form 20-F filed with the US Securities and Exchange Commission and in the annual report submitted to the CMF (Chilean Market Regulator) and available on our web page.

GLOSSARY

Operating segments

The Operating segments are defined with respect to its revenues in the geographic areas of commercial activity:

· Chile: This segment commercializes Beer, Non Alcoholic Beverages and Spirits in the Chilean market, and also includes the results of Transportes CCU Limitada, Comercial CCU S.A., Creccu S.A. and Fábrica de Envases Plásticos S.A.

· International Business: This segment commercializes Beer, Cider, Non-Alcoholic Beverages and Spirits in the Argentina, Uruguay, Paraguay and Bolivia.

· Wine: This segment commercializes Wine, mainly in the export market reaching over 80 countries, as well as the Chilean and Argentine domestic market.

· Other/Eliminations: Considers the non-allocated corporate overhead expenses and eliminations of transactions between segments.

Page 6 of 12

ARS

Argentine peso.

CLP

Chilean peso.

Cost of sales

Formerly referred to as Cost of Goods Sold (COGS), includes direct costs and manufacturing costs.

Earnings per Share (EPS)

Net profit divided by the weighted average number of shares during the year.

EBIT

Earnings Before Interest and Taxes. For management purposes, EBIT is defined as Net income before other gains (losses), net financial expenses, equity and income of joint ventures, foreign currency exchange differences, results as per adjustment units and income taxes. EBIT is equivalent to Adjusted Operating Result used in the 20-F Form.

EBITDA

EBITDA represents EBIT plus depreciation and amortization. EBITDA is not an accounting measure under IFRS. When analyzing the operating performance, investors should use EBITDA in addition to, not as an alternative for Net income, as this item is defined by IFRS. Investors should also note that CCU’s presentation of EBITDA may not be comparable to similarly titled indicators used by other companies. EBITDA is equivalent to ORBDA (Adjusted Operating Result Before Depreciation and Amortization), used in the 20-F Form.

Exceptional Items (EI)

Formerly referred to as Non-recurring items (NRI), Exceptional Items are either income or expenses which do not occur regularly as part of the normal activities of the Company. They are presented separately because they are important for the understanding of the underlying sustainable performance of the Company due to their size or nature.

Gross profit

Gross profit represents the difference between Net sales and Cost of sales.

Gross margin

Gross profit as a percentage of Net sales.

Liquidity ratio

Total current assets / Total current liabilities

Marketing, Sales, Distribution and Administrative expenses (MSD&A)

MSD&A includes marketing, sales, distribution and administrative expenses.

Net Financial Debt

Total Financial Debt minus Cash & Cash Equivalents.

Net Financial Debt / EBITDA

The ratio is based on a twelve month rolling calculation for EBITDA.

Net income

Net income attributable to the equity holders of the parent.

UF

The UF is a monetary unit indexed to the Consumer Price Index variation in Chile.

USD

United States Dollar.

Page 7 of 12

|

Exhibit 1: Consolidated Income Statement (Third Quarter 2019)

|

|

|

|

|

Third Quarter

|

2019

|

2018

|

Total

|

|

|

(CLP million)

|

Change %

|

|

Net sales

|

390,249

|

388,349

|

0.5

|

|

Cost of sales

|

(200,857)

|

(197,063)

|

1.9

|

|

% of Net sales

|

51.5

|

50.7

|

|

|

Gross profit

|

189,392

|

191,286

|

(1.0)

|

|

MSD&A

|

(157,458)

|

(149,735)

|

5.2

|

|

% of Net sales

|

40.3

|

38.6

|

|

|

Other operating income/(expenses)

|

5,961

|

3,466

|

72.0

|

|

EBIT

|

37,895

|

45,017

|

(15.8)

|

|

EBIT margin %

|

9.7

|

11.6

|

|

|

Net financial expenses

|

(6,543)

|

(4,043)

|

61.8

|

|

Equity and income of JVs and associated

|

(5,346)

|

(3,790)

|

41.1

|

|

Foreign currency exchange differences

|

(6,471)

|

(4,041)

|

60.1

|

|

Results as per adjustment units

|

(1,914)

|

470

|

(507.3)

|

|

Other gains/(losses)

|

284

|

(470)

|

(160.4)

|

|

Non-operating result

|

(19,990)

|

(11,874)

|

68.3

|

|

Income/(loss) before taxes

|

17,905

|

33,143

|

(46.0)

|

|

Income taxes

|

(6,886)

|

(10,995)

|

(37.4)

|

|

Net income for the period

|

11,019

|

22,147

|

(50.2)

|

|

|

|

|

|

|

Net income attributable to:

|

|

|

|

|

The equity holders of the parent

|

8,626

|

19,390

|

(55.5)

|

|

Non-controlling interest

|

(2,393)

|

(2,757)

|

(13.2)

|

|

|

|

|

|

|

EBITDA

|

63,757

|

68,404

|

(6.8)

|

|

EBITDA margin %

|

16.3

|

17.6

|

|

|

|

|

|

|

|

Including the effect of the Transaction:

|

|

|

|

|

EBIT

|

37,895

|

45,017

|

(15.8)

|

|

EBIT margin %

|

9.7

|

11.6

|

|

|

EBITDA

|

63,757

|

68,404

|

(6.8)

|

|

EBITDA margin %

|

16.3

|

17.6

|

|

|

Net income (attributable to equity holders of the parent)

|

8,626

|

21,521

|

(59.9)

|

|

|

|

|

|

|

OTHER INFORMATION

|

|

|

|

|

Number of shares

|

369,502,872

|

369,502,872

|

|

|

Shares per ADR

|

2

|

2

|

|

|

|

|

|

|

|

Earnings per share (CLP)

|

23.3

|

52.5

|

(55.5)

|

|

Earnings per ADR (CLP)

|

46.7

|

105.0

|

(55.5)

|

|

|

|

|

|

|

Depreciation

|

25,862

|

23,387

|

10.6

|

|

Capital Expenditures

|

34,491

|

31,481

|

9.6

|

Page 8 of 12

|

Exhibit 2: Consolidated Income Statement (Nine months ended on September 30, 2019)

|

|

|

|

YTD as of September

|

2019

|

2018

|

Total

|

|

|

(CLP million)

|

Change %

|

|

Net sales

|

1,244,469

|

1,232,682

|

1.0

|

|

Cost of sales

|

(631,847)

|

(591,374)

|

6.8

|

|

% of Net sales

|

50.8

|

48.0

|

|

|

Gross profit

|

612,622

|

641,308

|

(4.5)

|

|

MSD&A

|

(490,132)

|

(474,437)

|

3.3

|

|

% of Net sales

|

39.4

|

38.5

|

|

|

Other operating income/(expenses)

|

16,029

|

5,667

|

182.9

|

|

EBIT

|

138,520

|

172,537

|

(19.7)

|

|

EBIT margin %

|

11.1

|

14.0

|

|

|

Net financial expenses

|

(7,796)

|

(11,400)

|

(31.6)

|

|

Equity and income of JVs and associated

|

(15,668)

|

(10,930)

|

43.3

|

|

Foreign currency exchange differences

|

(5,196)

|

(9,372)

|

(44.6)

|

|

Results as per adjustment units

|

(6,415)

|

(69)

|

9,260.6

|

|

Other gains/(losses)

|

2,895

|

1,493

|

93.9

|

|

Non-operating result

|

(32,180)

|

(30,277)

|

6.3

|

|

Income/(loss) before taxes

|

106,339

|

142,260

|

(25.2)

|

|

Income taxes

|

(21,830)

|

(44,073)

|

(50.5)

|

|

Net income for the period

|

84,510

|

98,186

|

(13.9)

|

|

|

|

|

|

|

Net income attributable to:

|

|

|

|

|

The equity holders of the parent

|

75,183

|

88,565

|

(15.1)

|

|

Non-controlling interest

|

(9,327)

|

(9,621)

|

(3.1)

|

|

|

|

|

|

|

EBITDA

|

216,064

|

238,464

|

(9.4)

|

|

EBITDA margin %

|

17.4

|

19.3

|

|

|

|

|

|

|

|

Including the effect of the Transaction:

|

|

|

|

|

EBIT

|

138,520

|

381,472

|

(63.7)

|

|

EBIT margin %

|

11.1

|

30.9

|

|

|

EBITDA

|

216,064

|

447,399

|

(51.7)

|

|

EBITDA margin %

|

17.4

|

36.3

|

|

|

Net income (attributable to equity holders of the parent)

|

75,183

|

244,192

|

(69.2)

|

|

|

|

|

|

|

OTHER INFORMATION

|

|

|

|

|

Number of shares

|

369,502,872

|

369,502,872

|

|

|

Shares per ADR

|

2

|

2

|

|

|

|

|

|

|

|

Earnings per share (CLP)

|

203.5

|

239.7

|

(15.1)

|

|

Earnings per ADR (CLP)

|

406.9

|

479.4

|

(15.1)

|

|

|

|

|

|

|

Depreciation

|

77,544

|

65,927

|

17.6

|

|

Capital Expenditures

|

96,387

|

90,063

|

7.0

|

Page 9 of 12

|

Exhibit 3: Segment Information (Third Quarter 2019)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Chile Operating segment

|

|

2. International Business Operating segment

|

|

3. Wine Operating segment

|

|

Third Quarter

|

|

|

|

(In ThHL or CLP million unless stated otherwise)

|

2019

|

2018

|

YoY %

|

|

2019

|

2018

|

YoY %

|

|

2019

|

2018

|

YoY %

|

|

Volumes

|

4,442

|

4,170

|

6.5

|

|

2,039

|

1,920

|

6.2

|

|

395

|

377

|

4.8

|

|

Net sales

|

265,336

|

251,303

|

5.6

|

|

72,144

|

86,281

|

(16.4)

|

|

57,554

|

55,726

|

3.3

|

|

Net sales (CLP/HL)

|

59,729

|

60,264

|

(0.9)

|

|

35,378

|

44,938

|

(21.3)

|

|

145,702

|

147,778

|

(1.4)

|

|

Cost of sales

|

(126,837)

|

(117,764)

|

7.7

|

|

(42,405)

|

(45,636)

|

(7.1)

|

|

(33,428)

|

(34,753)

|

(3.8)

|

|

% of Net sales

|

47.8

|

46.9

|

|

|

58.8

|

52.9

|

|

|

58.1

|

62.4

|

|

|

Gross profit

|

138,499

|

133,539

|

3.7

|

|

29,740

|

40,645

|

(26.8)

|

|

24,126

|

20,973

|

15.0

|

|

% of Net sales

|

52.2

|

53.1

|

|

|

41.2

|

47.1

|

|

|

41.9

|

37.6

|

|

|

MSD&A

|

(104,626)

|

(98,216)

|

6.5

|

|

(36,380)

|

(38,805)

|

(6.2)

|

|

(14,863)

|

(13,777)

|

7.9

|

|

% of Net sales

|

39.4

|

39.1

|

|

|

50.4

|

45.0

|

|

|

25.8

|

24.7

|

|

|

Other operating income/(expenses)

|

3,702

|

69

|

|

|

1,492

|

3,212

|

|

|

228

|

119

|

|

|

EBIT

|

37,574

|

35,392

|

6.2

|

|

(5,149)

|

5,052

|

(201.9)

|

|

9,491

|

7,316

|

29.7

|

|

EBIT margin

|

14.2

|

14.1

|

|

|

(7.1)

|

5.9

|

|

|

16.5

|

13.1

|

|

|

EBITDA

|

54,936

|

50,814

|

8.1

|

|

2

|

10,435

|

(100.0)

|

|

12,074

|

9,360

|

29.0

|

|

EBITDA margin

|

20.7

|

20.2

|

|

|

0.0

|

12.1

|

|

|

21.0

|

16.8

|

|

|

Including the effect of the Transaction:

|

|

|

|

|

|

|

|

|

|

|

|

|

EBIT

|

37,574

|

35,392

|

6.2

|

|

(5,149)

|

5,052

|

(201.9)

|

|

9,491

|

7,316

|

29.7

|

|

EBITDA

|

54,936

|

50,814

|

8.1

|

|

2

|

10,435

|

(100.0)

|

|

12,074

|

9,360

|

29.0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. Other/eliminations

|

|

Total

|

|

|

|

|

|

Third Quarter

|

|

|

|

|

|

|

(In ThHL or CLP million unless stated otherwise)

|

2019

|

2018

|

YoY %

|

|

2019

|

2018

|

YoY %

|

|

|

|

|

|

Volumes

|

(20)

|

|

|

|

6,857

|

6,467

|

6.0

|

|

|

|

|

|

Net sales

|

(4,785)

|

(4,961)

|

(3.6)

|

|

390,249

|

388,349

|

0.5

|

|

|

|

|

|

Net sales (CLP/HL)

|

|

|

|

|

56,912

|

60,049

|

(5.2)

|

|

|

|

|

|

Cost of sales

|

1,813

|

1,090

|

66.4

|

|

(200,857)

|

(197,063)

|

1.9

|

|

|

|

|

|

% of Net sales

|

|

|

|

|

51.5

|

50.7

|

|

|

|

|

|

|

Gross profit

|

(2,972)

|

(3,871)

|

(23.2)

|

|

189,392

|

191,286

|

(1.0)

|

|

|

|

|

|

% of Net sales

|

|

|

|

|

48.5

|

49.3

|

|

|

|

|

|

|

MSD&A

|

(1,588)

|

1,062

|

(249.5)

|

|

(157,458)

|

(149,735)

|

5.2

|

|

|

|

|

|

% of Net sales

|

|

|

|

|

40.3

|

38.6

|

|

|

|

|

|

|

Other operating income/(expenses)

|

539

|

65

|

|

|

5,961

|

3,466

|

|

|

|

|

|

|

EBIT

|

(4,021)

|

(2,744)

|

46.5

|

|

37,895

|

45,017

|

(15.8)

|

|

|

|

|

|

EBIT margin

|

|

|

|

|

9.7

|

11.6

|

|

|

|

|

|

|

EBITDA

|

(3,256)

|

(2,205)

|

47.6

|

|

63,757

|

68,404

|

(6.8)

|

|

|

|

|

|

EBITDA margin

|

|

|

|

|

16.3

|

17.6

|

|

|

|

|

|

|

Including the effect of the Transaction:

|

|

|

|

|

|

|

|

|

|

|

|

|

EBIT

|

(4,021)

|

(2,744)

|

46.5

|

|

37,895

|

45,017

|

(15.8)

|

|

|

|

|

|

EBITDA

|

(3,256)

|

(2,205)

|

47.6

|

|

63,757

|

68,404

|

(6.8)

|

|

|

|

|

Page 10 of 12

|

Exhibit 4: Segment Information (Nine months ended on September 30, 2019)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Chile Operating segment

|

|

2. International Business Operating segment

|

|

3. Wine Operating segment

|

|

YTD as of September

|

|

|

|

(In ThHL or CLP million unless stated otherwise)

|

2019

|

2018

|

YoY %

|

|

2019

|

2018

|

YoY %

|

|

2019

|

2018

|

YoY %

|

|

Volumes

|

13,793

|

13,190

|

4.6

|

|

6,051

|

5,651

|

7.1

|

|

1,051

|

1,041

|

0.9

|

|

Net sales

|

814,916

|

781,973

|

4.2

|

|

285,901

|

312,042

|

(8.4)

|

|

156,426

|

151,302

|

3.4

|

|

Net sales (CLP/HL)

|

59,083

|

59,283

|

(0.3)

|

|

47,250

|

55,219

|

(14.4)

|

|

148,857

|

145,348

|

2.4

|

|

Cost of sales

|

(381,930)

|

(353,978)

|

7.9

|

|

(157,655)

|

(141,507)

|

11.4

|

|

(97,484)

|

(99,262)

|

(1.8)

|

|

% of Net sales

|

46.9

|

45.3

|

|

|

55.1

|

45.3

|

|

|

62.3

|

65.6

|

|

|

Gross profit

|

432,986

|

427,995

|

1.2

|

|

128,247

|

170,534

|

(24.8)

|

|

58,942

|

52,040

|

13.3

|

|

% of Net sales

|

53.1

|

54.7

|

|

|

44.9

|

54.7

|

|

|

37.7

|

34.4

|

|

|

MSD&A

|

(307,135)

|

(294,650)

|

4.2

|

|

(139,238)

|

(140,158)

|

(0.7)

|

|

(41,609)

|

(38,261)

|

8.8

|

|

% of Net sales

|

37.7

|

37.7

|

|

|

48.7

|

44.9

|

|

|

26.6

|

25.3

|

|

|

Other operating income/(expenses)

|

4,377

|

218

|

|

|

10,188

|

4,836

|

|

|

408

|

441

|

|

|

EBIT

|

130,228

|

133,563

|

(2.5)

|

|

(804)

|

35,213

|

(102.3)

|

|

17,740

|

14,221

|

24.8

|

|

EBIT margin

|

16.0

|

17.1

|

|

|

(0.3)

|

11.3

|

|

|

11.3

|

9.4

|

|

|

EBITDA

|

179,409

|

179,985

|

(0.3)

|

|

18,043

|

47,536

|

(62.0)

|

|

24,939

|

20,088

|

24.1

|

|

EBITDA margin

|

22.0

|

23.0

|

|

|

6.3

|

15.2

|

|

|

15.9

|

13.3

|

|

|

Including the effect of the Transaction:

|

|

|

|

|

|

|

|

|

|

|

|

|

EBIT

|

130,228

|

133,563

|

(2.5)

|

|

(804)

|

246,441

|

(100.3)

|

|

17,740

|

14,221

|

24.8

|

|

EBITDA

|

179,409

|

179,985

|

(0.3)

|

|

18,043

|

258,765

|

(93.0)

|

|

24,939

|

20,088

|

24.1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. Other/eliminations

|

|

Total

|

|

|

|

|

|

YTD as of September

|

|

|

|

|

|

|

(In ThHL or CLP million unless stated otherwise)

|

2019

|

2018

|

YoY %

|

|

2019

|

2018

|

YoY %

|

|

|

|

|

|

Volumes

|

(40)

|

|

|

|

20,855

|

19,882

|

4.9

|

|

|

|

|

|

Net sales

|

(12,774)

|

(12,635)

|

1.1

|

|

1,244,469

|

1,232,682

|

1.0

|

|

|

|

|

|

Net sales (CLP/HL)

|

|

|

|

|

59,673

|

61,999

|

(3.8)

|

|

|

|

|

|

Cost of sales

|

5,222

|

3,373

|

54.8

|

|

(631,847)

|

(591,374)

|

6.8

|

|

|

|

|

|

% of Net sales

|

|

|

|

|

50.8

|

48.0

|

|

|

|

|

|

|

Gross profit

|

(7,552)

|

(9,262)

|

(18.5)

|

|

612,622

|

641,308

|

(4.5)

|

|

|

|

|

|

% of Net sales

|

|

|

|

|

49.2

|

52.0

|

|

|

|

|

|

|

MSD&A

|

(2,149)

|

(1,369)

|

57.0

|

|

(490,132)

|

(474,437)

|

3.3

|

|

|

|

|

|

% of Net sales

|

|

|

|

|

39.4

|

38.5

|

|

|

|

|

|

|

Other operating income/(expenses)

|

1,057

|

172

|

|

|

16,029

|

5,667

|

|

|

|

|

|

|

EBIT

|

(8,644)

|

(10,459)

|

(17.4)

|

|

138,520

|

172,537

|

(19.7)

|

|

|

|

|

|

EBIT margin

|

|

|

|

|

11.1

|

14.0

|

|

|

|

|

|

|

EBITDA

|

(6,328)

|

(9,145)

|

(30.8)

|

|

216,064

|

238,464

|

(9.4)

|

|

|

|

|

|

EBITDA margin

|

|

|

|

|

17.4

|

19.3

|

|

|

|

|

|

|

Including the effect of the Transaction:

|

|

|

|

|

|

|

|

|

|

|

|

|

EBIT

|

(8,644)

|

(12,754)

|

(32.2)

|

|

138,520

|

381,472

|

(63.7)

|

|

|

|

|

|

EBITDA

|

(6,328)

|

(11,439)

|

(44.7)

|

|

216,064

|

447,399

|

(51.7)

|

|

|

|

|

Page 11 of 12

|

Exhibit 5: Balance Sheet

|

|

|

|

|

September 30

|

December 31

|

|

|

2019

|

2018

|

|

|

(CLP million)

|

|

ASSETS

|

|

|

|

Cash and cash equivalents

|

150,562

|

319,014

|

|

Other current assets

|

555,018

|

621,993

|

|

Total current assets

|

705,580

|

941,007

|

|

|

|

|

|

PP&E (net)

|

1,059,644

|

1,021,267

|

|

Other non current assets

|

446,260

|

443,591

|

|

Total non current assets

|

1,505,904

|

1,464,858

|

|

Total assets

|

2,211,485

|

2,405,865

|

|

|

|

|

|

LIABILITIES

|

|

|

|

Short term financial debt

|

73,814

|

62,767

|

|

Other liabilities

|

345,805

|

582,957

|

|

Total current liabilities

|

419,619

|

645,724

|

|

|

|

|

|

Long term financial debt

|

251,556

|

228,185

|

|

Other liabilities

|

156,972

|

142,839

|

|

Total non current liabilities

|

408,529

|

371,025

|

|

Total Liabilities

|

828,148

|

1,016,749

|

|

|

|

|

|

EQUITY

|

|

|

|

Paid-in capital

|

562,693

|

562,693

|

|

Other reserves

|

(167,344)

|

(151,048)

|

|

Retained earnings

|

875,384

|

868,482

|

|

Total equity attributable to equity holders of the parent

|

1,270,734

|

1,280,127

|

|

Non - controlling interest

|

112,603

|

108,989

|

|

Total equity

|

1,383,337

|

1,389,116

|

|

Total equity and liabilities

|

2,211,485

|

2,405,865

|

|

|

|

|

|

OTHER FINANCIAL INFORMATION

|

|

|

|

|

|

|

|

Total Financial Debt

|

325,371

|

290,952

|

|

|

|

|

|

Net Financial Debt

|

174,808

|

(28,062)

|

|

|

|

|

|

Liquidity ratio

|

1.68

|

1.46

|

|

Total Financial Debt / Capitalization

|

0.19

|

0.17

|

|

Net Financial Debt / EBITDA

|

0.53

|

(0.05)

|

Page 12 of 12

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Compañía Cervecerías Unidas S.A.

(United Breweries Company, Inc.)

|

|

|

|

|

/s/ Felipe Dubernet

|

|

|

Chief Financial Officer

|

|

|

|

Date: November 6, 2019

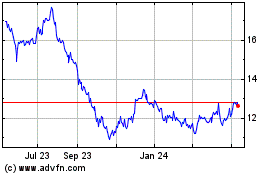

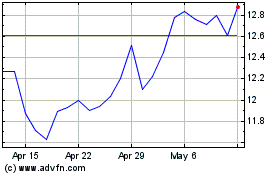

Compania Cervecerias Uni... (NYSE:CCU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Compania Cervecerias Uni... (NYSE:CCU)

Historical Stock Chart

From Apr 2023 to Apr 2024