Current Report Filing (8-k)

October 23 2019 - 4:30PM

Edgar (US Regulatory)

0001717307

false

0001717307

2019-10-20

2019-10-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

October 21, 2019

INDUSTRIAL LOGISTICS PROPERTIES TRUST

(Exact Name of Registrant as Specified in

Its Charter)

Maryland

(State or Other Jurisdiction of Incorporation)

|

001-38342

|

|

82-2809631

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

Two Newton Place

255 Washington Street, Suite 300,

Newton, Massachusetts

|

|

02458-1634

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

617-219-1460

(Registrant’s Telephone Number, Including

Area Code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities Registered Pursuant

to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol

|

|

Name

of each Exchange on which Registered

|

|

Common Shares of Beneficial Interest

|

|

ILPT

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

In this Current Report on Form 8-K,

the terms “we,” “us” and “our” refer to Industrial Logistics Properties Trust and certain of

its subsidiaries, unless the context indicates otherwise.

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On October 21, 2019, certain of our subsidiaries,

or the borrowers, entered into a non-amortizing loan agreement with Morgan Stanley Bank, N.A., UBS AG and Bank of America, N.A.,

or collectively, the lenders, pursuant to which we obtained a $350.0 million mortgage loan, or the loan, secured by 11 of our mainland

properties containing an aggregate of approximately 8.0 million rentable square feet located in eight states. The loan matures

on November 7, 2029 and requires monthly payments of interest at a fixed rate of 3.33% per annum. We expect to use the net proceeds

from the loan to reduce outstanding borrowings under our $750.0 million unsecured revolving credit facility.

Principal payments on the loan are not required

prior to the end of the initial term of the loan, subject to certain conditions set forth in the loan agreement. We have the option

to prepay the loan in full at any time after October 21, 2022 (or, if earlier, the second anniversary of the securitization of

the loan, if it is securitized), subject to a premium, and to prepay the loan at par with no premium on or after May 7, 2029. In

addition, at any time after October 21, 2022 (or, if earlier, the second anniversary of the securitization of the loan, if it is

securitized) and prior to May 7, 2029, the loan may be defeased in full upon meeting certain conditions.

The loan agreement contains customary covenants

and provides for acceleration of payment of all amounts due thereunder upon the occurrence and continuation of certain events of

default. In addition, pursuant to the loan agreement and related documents, we are required to maintain a minimum consolidated

net worth of at least $250.0 million and liquidity of at least $15.0 million. The loan is generally non-recourse to us except with

respect to certain carveouts set forth in the loan agreement and to our obligation to indemnify the lenders for certain environmental

losses relating to hazardous materials and violations of environmental law.

The lenders and/or certain of their affiliates

are parties to our unsecured revolving credit facility, and have engaged in, and may in the future engage in, investment banking,

commercial banking, advisory and other commercial dealings in the ordinary course of business with us. They have received, and

may in the future receive, customary fees and commissions for these engagements.

The foregoing description of the loan agreement

is not complete and is subject to and qualified in its entirety by reference to the loan agreement, a copy of which is attached

as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information contained in Item 1.01 of

this Current Report on Form 8-K regarding the loan agreement is incorporated into this Item 2.03 by reference.

Warning Concerning Forward-Looking Statements

This Current Report on Form 8-K contains

statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995 and other securities laws. Also, whenever we use words such as “believe”, “expect”, “anticipate”,

“intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives

of these or similar expressions, we are making forward-looking statements. These forward-looking statements are based upon our

present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual

results may differ materially from those contained in or implied by our forward-looking statements as a result of various

factors. For example, this Current Report on Form 8-K states that we expect to use the net proceeds from the loan to reduce outstanding

borrowings under our $750.0 million unsecured revolving credit facility. However, we may use the net proceeds from the loan for

other purposes.

The information contained in our filings

with the Securities and Exchange Commission, or SEC, including under the caption “Risk Factors” in our periodic

reports, or incorporated therein, identifies other important factors that could cause differences from our forward-looking

statements. Our filings with the SEC are available on the SEC’s website at www.sec.gov.

You should not place undue reliance upon

our forward-looking statements.

Except as required by law, we do not intend

to update or change any forward-looking statements as a result of new information, future events or otherwise.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

INDUSTRIAL LOGISTICS PROPERTIES TRUST

|

|

|

|

|

|

|

By:

|

/s/ Richard W. Siedel, Jr.

|

|

|

Name:

|

Richard W. Siedel, Jr.

|

|

|

Title:

|

Chief Financial Officer and Treasurer

|

Dated: October 23, 2019

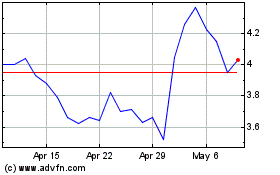

Industrial Logistics Pro... (NASDAQ:ILPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

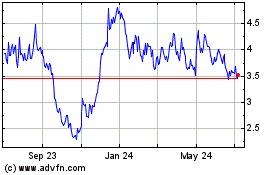

Industrial Logistics Pro... (NASDAQ:ILPT)

Historical Stock Chart

From Apr 2023 to Apr 2024