Current Report Filing (8-k)

October 21 2019 - 5:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 16, 2019

ESPORTS ENTERTAINMENT GROUP, INC.

(Exact name of registrant as specified in its

charter)

|

Nevada

|

|

000-51872

|

|

26-3062752

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

170 Pater House, Psaila Street

Birkirkara, Malta, BKR 9077

(Address of principal executive offices)

356 2757 7000

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

None

|

|

None

|

|

None

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry Into a Material Definitive Agreement.

On October 16, 2019, Esports Entertainment

Group, Inc. (the “Company”) consummated the third closing (“Third Closing”) of a private placement offering

(the “Offering”) whereby the Company entered into that certain securities purchase agreement (the “Purchase Agreement”)

with an accredited investor (the “Investor”). Pursuant to the Purchase Agreement, the Company issued to the Investor

a convertible promissory note (the “Note”) in the aggregate principal amount of $137,500 (including a 10% original

issue discount) and Warrants to purchase 229,167 shares of the Company’s common stock, par value $0.001 per share (“Common

Stock”) for aggregate gross proceeds of $125,000.

The Note accrues interest at a rate of 5% per

annum and is initially convertible into shares of the Company’s common stock at a conversion price of $0.60 per share, subject

to adjustment (the “Conversion Price”). The Note contains a mandatory conversion mechanism whereby unpaid principal

and accrued interest on the Note, upon the closing of a Qualified Offering (as defined therein) converts into shares of the Company’s

Common Stock at the lower of (i) the Conversion Price and (ii) 80% of the offering price in the Qualified Offering. The Note contains

customary events of default (each an “Event of Default”) and matures on August 29, 2020. If an Event of Default occurs,

the outstanding principal amount of the Note, plus accrued but unpaid interest, liquidated damages and other amounts owing with

respect to the Note will become, at the Investor’s election, immediately due and payable in cash at the “Mandatory

Default Amount”. The Mandatory Default Amount means the sum of 130% of the outstanding principal amount of the Note plus

accrued and unpaid interest, including default interest of 18% per year, and all other amounts, costs, expenses and liquidated

damages due in respect of the Note.

Pursuant to the Purchase Agreement, the Investor

is entitled to 100% Warrant coverage, such that the Investor received the same number of Warrants to purchase shares of Common

Stock as is the number of shares of Common Stock initially issuable upon conversion of the Note as of the date of issuance. The

Warrants are exercisable at a price of $0.75 per share, subject to adjustment from the date of issuance through August 29, 2022.

Joseph Gunnar & Co., LLC (the “Placement

Agent”) has acted as placement agent for the Offering but did not receive compensation in connection with the Third Closing.

The current aggregate Offering cash proceeds

to the Company is approximately $600,000.

The foregoing descriptions of the Purchase

Agreement, Note, and Warrants , do not purport to be complete and are qualified in their entirety by their full text, the forms

of which have been previously filed and are incorporated herein by reference.

Item 2.03. Creation of a Direct

Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of the Registrant.

Item 1.01 is hereby incorporated by reference.

Item 3.02. Unregistered

Sales of Equity Securities.

Item 1.01 is hereby incorporated by reference.

The securities issued pursuant to the Offering

were not registered under the Securities Act, but qualified for exemption under Section 4(a)(2) and/or Regulation D of the Securities

Act. The securities were exempt from registration under Section 4(a)(2) of the Securities Act because the issuance of such securities

by the Company did not involve a “public offering,” as defined in Section 4(a)(2) of the Securities Act, due to the

insubstantial number of persons involved in the transaction, size of the offering, manner of the offering and number of securities

offered. The Company did not undertake an offering in which it sold a high number of securities to a high number of investors.

In addition, the Investors had the necessary investment intent as required by Section 4(a)(2) of the Securities Act since the Investors

agreed to, and received, the securities bearing a legend stating that such securities are restricted pursuant to Rule 144 of the

Securities Act. This restriction ensures that these securities would not be immediately redistributed into the market and therefore

not be part of a “public offering.” Based on an analysis of the above factors, the Company has met the requirements

to qualify for exemption under Section 4(a)(2) of the Securities Act.

Item 9.01. Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ESPORTS ENTERTAINMENT GROUP, INC.

|

|

|

|

|

|

Dated: October 21, 2019

|

By:

|

/s/ Grant Johnson

|

|

|

|

Grant Johnson

Chief Executive Officer

|

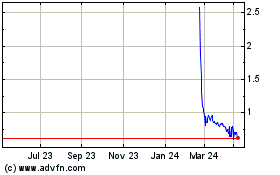

Esports Entertainment (QB) (USOTC:GMBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

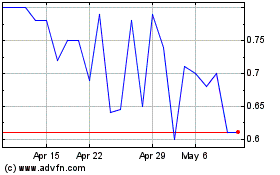

Esports Entertainment (QB) (USOTC:GMBL)

Historical Stock Chart

From Apr 2023 to Apr 2024