BankFinancial Corporation Reports Financial Results for the Third Quarter 2019 and Will Host Conference Call and Webcast on W...

October 21 2019 - 5:12PM

BankFinancial Corporation (Nasdaq - BFIN) (the “Company” or

"BankFinancial") announced today that its net income for the three

months ended September 30, 2019 was $3.9 million, or $0.26 per

common share, compared to net income of $3.7 million, or $0.22 per

common share, for the three months ended September 30,

2018. BankFinancial also reported net income of $8.3 million,

or $0.53 per common share, for the nine months ended

September 30, 2019, compared to net income of $11.9 million,

or $0.68 per common share, for the nine months ended

September 30, 2018.

Net interest income before provision (recovery)

of allowance for loan losses for the quarter ended

September 30, 2019 was stable compared to the previous quarter

at $13.2 million. Noninterest expense was $9.5 million, as

increases in loan advertising and in cybersecurity prevention

expenses offset continued improvements in operating efficiency.

The average yield on the loan and lease

portfolio for the quarter ended September 30, 2019 was 4.92%,

compared to an average loan and lease portfolio yield of 4.76% for

the quarter ended June 30, 2019. The average cost of

retail and commercial deposits stabilized at 1.13% for the quarter

ended September 30, 2019. The average cost of wholesale

deposits and borrowings increased to 2.48% for the quarter ended

September 30, 2019, compared to an average cost of 2.39% for

the quarter ended June 30, 2019. Net interest margin

increased to 3.67% for the quarter ended September 30, 2019,

compared to 3.60% for the quarter ended June 30, 2019.

Total loans declined due to substantially increased prepayments

within the multifamily real estate loan portfolio and the scheduled

amortization of investment grade leases in the commercial equipment

lease portfolio, partially offset by increases in commercial

lending. Multifamily real estate loans decreased by $42.2

million (6.8%) as we received $49.4 million in total loan payments

due to project sales and cash-out refinances by other

lenders. Commercial leases decreased by $13.3 million (4.6%),

primarily due to the scheduled amortization of lower-yielding

investment grade leases in excess of investment grade lease

originations. Commercial loans increased by $10.1 million

(6.6%) compared to June 30, 2019 due to new borrower originations

and modestly increased line utilization. Residential and

nonresidential real estate loan balances declined due to scheduled

portfolio amortization and prepayments.

Asset quality remained favorable. The

ratio of nonperforming loans to total loans was 0.12% and the ratio

of nonperforming assets to total assets was 0.11% at September 30,

2019.

Total deposits declined by $41.4 million (3.1%)

from June 30, 2019 to September 30, 2019 due in part to

seasonal factors with respect to retail and commercial checking

accounts. The Bank reduced its marketing for retail

certificates of deposit due to its higher liquidity and to better

manage our cost of funds. Retail money market deposit

accounts declined by $9.9 million (4.0%), primarily due to seasonal

fluctuations in public funds accounts and internal transfers to

other deposit or trust products. Total wholesale deposits and

borrowings declined by $13.4 million (15.0%) during the third

quarter of 2019 as we utilized excess liquidity to pay off maturing

wholesale deposits and borrowings.

The capital position remained strong with a Tier

1 leverage ratio of 11.43%. During 2019, we repurchased

1,107,550 common shares, which represented 6.7% of the common

shares outstanding at December 31, 2018.

BankFinancial’s Quarterly Financial and Statistical Supplement

will be available today on BankFinancial's

website, www.bankfinancial.com on the “Investor Relations”

page, and through the EDGAR database on the SEC's website,

www.sec.gov. The Quarterly Financial and Statistical Supplement

includes comparative GAAP and non-GAAP performance data and

financial measures for the most recent five quarters.

BankFinancial's management will review third quarter 2019 results

in a conference call and webcast for stockholders and analysts on

Wednesday, October 23, 2019 at 9:30 a.m. Chicago, Illinois

Time. The conference call may be accessed by calling (844)

413-1780 using participant passcode 4729609. The conference

call will be simultaneously webcast at www.bankfinancial.com,

“Investor Relations” page. For those unable to participate in

the conference call, the webcast will be archived through

Wednesday, November 6, 2019 on our website.

BankFinancial Corporation is the holding company

for BankFinancial, NA, a national bank providing financial services

to individuals, families and businesses through 19 full-service

banking offices, located in Cook, DuPage, Lake and Will Counties,

Illinois and to selected commercial loan and deposit customers on a

regional or national basis. BankFinancial Corporation's common

stock trades on the Nasdaq Global Select Market under the symbol

BFIN. Additional information may be found at the company's website,

www.bankfinancial.com.

This release includes “forward-looking

statements” as defined in the Private Securities Litigation Reform

Act of 1995. A variety of factors could cause BankFinancial’s

actual results to differ from those expected at the time of this

release. For a discussion of some of the factors that may cause

actual results to differ from expectations, please refer to

BankFinancial’s most recent Annual Report on Form 10-K as filed

with the SEC, as supplemented by subsequent filings with the

SEC. Investors are urged to review all information contained

in these reports, including the risk factors discussed

therein. Copies of these filings are available at no cost on

the SEC's web site at www.sec.gov or on BankFinancial’s web

site at www.bankfinancial.com. Forward looking statements

speak only as of the date they are made, and we do not undertake to

update them to reflect changes.

|

For Further Information Contact: |

|

|

Shareholder, Analyst and Investor Inquiries: |

Media Inquiries: |

|

Elizabeth A. DoolanSenior Vice President – FinanceBankFinancial

CorporationTelephone: 630-242-7151 |

Gregg T. AdamsPresident – Marketing & SalesBankFinancial,

NATelephone: 630-242-7234 |

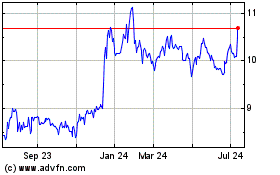

BankFinancial (NASDAQ:BFIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

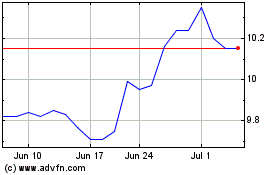

BankFinancial (NASDAQ:BFIN)

Historical Stock Chart

From Apr 2023 to Apr 2024