Additional Proxy Soliciting Materials (definitive) (defa14a)

October 21 2019 - 5:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant x

|

|

|

|

Filed by a Party other than the Registrant o

|

|

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

o

|

Soliciting Material under §240.14a-12

|

|

|

|

Ashford Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

NEWS RELEASE

|

Contact:

|

Deric Eubanks

|

Jordan Jennings

|

Joseph Calabrese

|

|

|

Chief Financial Officer

|

Investor Relations

|

Financial Relations Board

|

|

|

(972) 490-9600

|

(972) 778-9487

|

(212) 827-3772

|

ASHFORD TRUST ANNOUNCES DISTRIBUTION OF

REMAINING SHARES OF ASHFORD INC.

Sets Record Date and Distribution Date for Distribution

DALLAS, October 21, 2019 — Ashford Hospitality Trust, Inc. (NYSE: AHT) (“Ashford Trust” or the “Company”) announced today that its Board of Directors has formally declared the distribution of its remaining 205,086 shares of common stock of Ashford Inc. (NYSE American: AINC). Both common stockholders and unitholders of Ashford Trust will receive their pro-rata share of Ashford Inc. common stock.

The distribution to Ashford Trust common stockholders will be completed through a pro-rata, taxable dividend of Ashford Inc. common stock on November 5, 2019 (the “Distribution Date”) to stockholders of record (“Ashford Trust Record Holders”) as of the close of business of the New York Stock Exchange (“NYSE”) on October 29, 2019 (the “Record Date”). On the Distribution Date, each Ashford Trust stockholder will receive approximately 0.0017 share of Ashford Inc. common stock for every share of Ashford Trust common stock held by such stockholder on the Record Date. The distribution is not contingent upon Ashford Inc.’s planned acquisition of Remington Holdings, L.P.’s hotel management business. After the distribution, Ashford Trust will not have any ownership interest in Ashford Inc. The distribution of Ashford Inc. common stock will be made in book-entry form, which means that no physical share certificates will be issued.

No fractional shares of Ashford Inc. common stock will be issued. Fractional shares of Ashford Inc. common stock to which Ashford Trust Record Holders would otherwise be entitled will be aggregated and, after the distribution, sold in the open market by the distribution agent. The aggregate net proceeds of the sales will be distributed in a pro-rata manner as cash payments to the Ashford Trust Record Holders who would otherwise have received fractional shares of Ashford

Inc. common stock. Ashford Trust stockholders should consult their tax advisors with respect to U.S. federal, state, local and foreign tax consequences of the dividend of Ashford Inc. common stock.

Ashford Hospitality Trust is a real estate investment trust (REIT) focused on investing opportunistically in the hospitality industry in upper upscale, full-service hotels.

Ashford has created an Ashford App for the hospitality REIT investor community. The Ashford App is available for free download at Apple’s App Store and the Google Play Store by searching “Ashford.”

Additional Information and Where to Find It

In connection with Ashford Inc.’s planned acquisition of Remington Holdings, L.P.’s hotel management business, Ashford Nevada Holding Corp. (a subsidiary of Ashford Inc., to be renamed Ashford Inc. at the closing of the transaction) has filed a Registration Statement on Form S-4 (Registration No. 333-232736), which includes a preliminary joint proxy statement/prospectus, which was mailed to Ashford Inc. stockholders on or about September 23, 2019. Additionally, Ashford Inc. files annual, quarterly and current reports, proxy and information statements and other information with the Securities and Exchange Commission. INVESTORS AND SECURITY HOLDERS OF ASHFORD INC. ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT ASHFORD INC. WILL FILE WITH THE SECURITIES AND EXCHANGE COMMISSION WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ASHFORD INC. AND THE TRANSACTION. The proxy/prospectus and other relevant materials in connection with the transaction (when they become available), and any other documents filed by Ashford Inc. with the Securities and Exchange Commission, may be obtained free of charge at the Securities and Exchange Commission’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the Securities and Exchange Commission at the Ashford Inc.’s website, www.ashfordinc.com, under the “Investors” link, or by requesting them in writing or by telephone from us at 14185 Dallas Parkway, Suite 1100, Dallas, Texas 75254, Attn: Investor Relations or (972) 490-9600.

Ashford Inc. and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders of Ashford Inc. in favor of the proposed merger. Information about the directors and executive officers of Ashford Inc. and their ownership of Ashford Inc. capital stock is set forth in its definitive proxy statement on Schedule 14A for its 2019 special meeting of stockholders, as filed with the SEC on September 23, 2019. Additional information regarding the participants in the solicitation of proxies and a description of their direct and indirect interests, by security holdings or otherwise, with respect to the proposed merger is included in the preliminary proxy statement filed by Ashford Inc. with the SEC and will be included in the definitive proxy statement to be filed by Ashford Inc. with the SEC, when it becomes available.

Safe Harbor for Forward-Looking Statements

Certain statements and assumptions in this press release contain or are based upon “forward-looking” information and are being made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties. When we use the words “will likely result,” “may,” “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” or similar expressions, we intend to identify forward-looking statements. Such statements are subject to numerous assumptions and uncertainties, many of which are outside Ashford Trust’s control.

These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated, including, without limitation: general volatility of the capital markets and the market price of our common stock and preferred stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel to our advisor; changes in our industry and the market in which we operate, interest rates or the local economic conditions; the degree and nature of our competition; actual and potential conflicts of interest with Ashford Trust, Ashford Inc., Remington Lodging, our executive officers and our non-independent directors; changes in governmental regulations, accounting rules, tax rates and similar matters; legislative and regulatory changes, including changes to the Internal Revenue Code of 1986, as amended (the “Code”), and related rules, regulations and interpretations governing the taxation of REITs; limitations imposed on our business and our ability to satisfy complex rules in order for us to qualify as a REIT

for federal income tax purposes; and risks related to Ashford Inc.’s ability to complete the acquisition of Remington’s hotel management business on the proposed terms. These and other risk factors are more fully discussed in Ashford Trust’s filings with the Securities and Exchange Commission.

The forward-looking statements included in this press release are only made as of the date of this press release. Investors should not place undue reliance on these forward-looking statements. We are not obligated to publicly update or revise any forward-looking statements, whether as a result of new information, future events or circumstances, changes in expectations or otherwise.

-END-

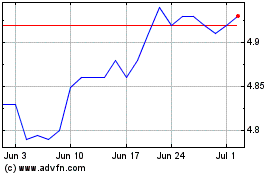

Ashford (AMEX:AINC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ashford (AMEX:AINC)

Historical Stock Chart

From Apr 2023 to Apr 2024