LCNB Corp. ("LCNB") (NASDAQ: LCNB) today announced net income of

$4,727,000 (total basic and diluted earnings per share of $0.36)

and $14,082,000 (total basic and diluted earnings per share of

$1.07) for the three and nine months ended September 30, 2019,

respectively. This compares to net income of $4,201,000 (total

basic and diluted earnings per share of $0.32) and $9,652,000

(total basic and diluted earnings per share of $0.84) for the same

three and nine month periods in 2018.

Commenting on the financial results, LCNB Chief Executive

Officer Eric Meilstrup said, "We are pleased to report strong

earnings for the three and nine months ended September 30, 2019.

Net income for the first nine months of 2019 was $4,430,000 greater

than the first nine months of 2018, fueled by a $5,900,000 increase

in net interest income that resulted primarily from a $63.4

million, or 5.5%, increase in our net loan portfolio, from $1.158

billion at September 30, 2018 to $1.222 billion at September 30,

2019. Part of the increase in net interest income was also due to a

full nine months of net earnings on loans, deposits, and borrowings

obtained through our merger with Columbus First Bancorp ("CFB") on

May 31, 2018. Our return on average assets for the first nine

months of 2019 was 1.15% and our return on average equity was

8.42%. Additionally, positive earnings growth allowed for increased

shareholder dividends, from $0.48 per share for the first nine

months of 2018 to $0.51 per share for the same period in 2019. LCNB

remains committed to enhancing shareholder value. In addition to

increased earnings and dividends, LCNB commenced a new share

repurchase program during the second quarter 2019 that authorizes

the repurchase of up to 500,000 shares of our outstanding common

stock. Under this new program, we repurchased 400,000 shares during

the second and third quarters."

Net interest income for the three and nine months ended

September 30, 2019 was, respectively, $475,000 and $5,900,000

greater than the comparable periods in 2018, due to growth in the

average balance of LCNB's loan portfolio and to an increase in the

average rate earned on that portfolio, partially offset by a

decrease in average investment securities and increases in average

deposits and long-term borrowings and increases in the average

rates paid for the deposits and borrowings. Loans, deposits, and

long-term borrowings obtained through the merger with CFB were

considerable components of the growth in the average balance of

LCNB's loan portfolio and the increases in the average balances of

deposits and long-term borrowings.

The provision for loan losses for the three and nine months

ended September 30, 2019 was, respectively, $395,000 and $749,000

less than the comparable periods in 2018. Non-accrual loans and

loans past due 90 days or more and still accruing interest

increased $423,000, from $3,100,000 or 0.26% of total loans at

December 31, 2018 to $3,523,000 or 0.29% of total loans at

September 30, 2019. The increase in non-accrual loans is due to a

loan with a carrying value of approximately $1.0 million that was

newly classified as non-accrual during the third quarter 2019, This

increase was partially offset by a net decrease in other loans

classified as non-accrual or past due 90 days or more and still

accruing interest.

Non-interest income for the three and nine months ended

September 30, 2019 was, respectively, $435,000 and $778,000 greater

than the comparable periods in 2018, primarily due to increases in

fiduciary income, service charges and fees on deposit accounts, and

bank owned life insurance income. Also contributing to the increase

were market-driven increases in the fair value of equity security

investments, which were recorded in other operating income in the

consolidated condensed statements of income.

Non-interest expense for the three and nine months ended

September 30, 2019 was, respectively, $665,000 and $1,938,000

greater than the comparable periods in 2018, primarily due to

increases in salaries and employee benefits, state financial

institutions tax, marketing, and contracted services expenses.

Salaries and employee benefits increased primarily due to salary

and wage increases and newly hired employees, including CFB

employees retained. An increase in health insurance costs also

contributed to the increase in salaries and employee benefits.

State financial institutions tax expense increased due to a larger

capital base (Ohio financial institutions tax is based on capital,

not income), largely caused by stock issued to CFB stockholders as

merger consideration. Marketing expense increased primarily due to

promotion costs for new checking products introduced in 2018,

increased marketing activities in the Columbus area, and expanded

use of broadcast and digital media. A decrease in merger related

expenses and the absence of an impairment charge recognized on one

of LCNB's office buildings during the second quarter 2018 partially

offset these increases.

LCNB Corp. is a financial holding company headquartered in

Lebanon, Ohio. Through its subsidiary, LCNB National Bank (the

“Bank”), it serves customers and communities in Southwest and South

Central Ohio. A financial institution with a long tradition for

building strong relationships with customers and communities, the

Bank offers convenient banking locations in Butler, Clermont,

Clinton, Fayette, Franklin, Hamilton, Montgomery, Preble, Ross, and

Warren Counties, Ohio. The Bank continually strives to exceed

customer expectations and provides an array of services for all

personal and business banking needs including checking, savings,

online banking, personal lending, business lending, agricultural

lending, business support, deposit and treasury, investment

services, trust and IRAs and stock purchases. LCNB Corp. common

shares are traded on the NASDAQ Capital Market Exchange® under the

symbol “LCNB.” Learn more about LCNB Corp. at www.lcnb.com.

Certain statements made in this news release regarding LCNB’s

financial condition, results of operations, plans, objectives,

future performance and business, are “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, Section 21E of the Securities Exchange Act of 1934, as

amended, and the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are identified by the fact they

are not historical facts and include words such as “anticipate”,

“could”, “may”, “feel”, “expect”, “believe”, “plan”, and similar

expressions. Please refer to LCNB’s Annual Report on Form 10-K for

the year ended December 31, 2018, as well as its other filings with

the SEC, for a more detailed discussion of risks, uncertainties and

factors that could cause actual results to differ from those

discussed in the forward-looking statements.

These forward-looking statements reflect management's current

expectations based on all information available to management and

its knowledge of LCNB’s business and operations. Additionally,

LCNB’s financial condition, results of operations, plans,

objectives, future performance and business are subject to risks

and uncertainties that may cause actual results to differ

materially. These factors include, but are not limited to:

- the success, impact, and timing of the implementation of LCNB’s

business strategies;

- LCNB’s ability to integrate recent and any future acquisitions

may be unsuccessful, or may be more difficult, time-consuming or

costly than expected;

- LCNB may incur increased charge-offs in the future;

- LCNB may face competitive loss of customers;

- changes in the interest rate environment may have results on

LCNB’s operations materially different from those anticipated by

LCNB’s market risk management functions;

- changes in general economic conditions and increased

competition could adversely affect LCNB’s operating results;

- changes in other regulations and government policies affecting

bank holding companies and their subsidiaries, including changes in

monetary policies, could negatively impact LCNB’s operating

results;

- LCNB may experience difficulties growing loan and deposit

balances;

- United States trade relations with foreign countries could

negatively impact the financial condition of LCNB's customers,

which could adversely affect LCNB's operating results and financial

condition;

- deterioration in the financial condition of the U.S. banking

system may impact the valuations of investments LCNB has made in

the securities of other financial institutions resulting in either

actual losses or other than temporary impairments on such

investments;

- difficulties with technology or data security breaches,

including cyberattacks, that could negatively affect LCNB's ability

to conduct business and its relationships with customers, vendors,

and others; and

- government intervention in the U.S. financial system, including

the effects of legislative, tax, accounting and regulatory actions

and reforms, including the Dodd-Frank Wall Street Reform and

Consumer Protection Act, the Jumpstart Our Business Startups Act,

the Consumer Financial Protection Bureau, the capital ratios of

Basel III as adopted by the federal banking authorities, and the

Tax Cuts and Jobs Act.

Forward-looking statements made herein reflect management's

expectations as of the date such statements are made. Such

information is provided to assist shareholders and potential

investors in understanding current and anticipated financial

operations of LCNB and is included pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

LCNB undertakes no obligation to update any forward-looking

statement to reflect events or circumstances that arise after the

date such statements are made.

LCNB Corp. and

Subsidiaries

Financial Highlights

(Dollars in thousands, except per

share amounts)

(Unaudited)

Three Months Ended

Nine Months Ended

9/30/2019

6/30/2019

3/31/2019

12/31/2018

9/30/2018

9/30/2019

9/30/2018

Condensed Income

Statement

Interest income

$

16,329

16,328

16,113

15,844

15,070

48,770

38,750

Interest expense

2,751

2,738

2,722

2,334

1,967

8,211

4,091

Net interest income

13,578

13,590

13,391

13,510

13,103

40,559

34,659

Provision (credit) for loan losses

264

54

(105

)

(39

)

659

213

962

Net interest income after provision

13,314

13,536

13,496

13,549

12,444

40,346

33,697

Non-interest income

3,356

2,998

2,772

2,702

2,921

9,126

8,348

Non-interest expense

10,982

10,833

10,700

9,925

10,317

32,515

30,577

Income before income taxes

5,688

5,701

5,568

6,326

5,048

16,957

11,468

Provision for income taxes

961

973

941

1,133

847

2,875

1,816

Net income

$

4,727

4,728

4,627

5,193

4,201

14,082

9,652

Amort/Accret income on acquired loans

$

302

355

224

229

198

881

340

Amort/Accret expenses on acquired

interest-bearing liabilities

$

4

142

144

149

214

290

214

Tax-equivalent net interest income

$

13,679

13,700

13,536

13,680

13,279

40,915

35,203

Per Share

Data

Dividends per share

$

0.17

0.17

0.17

0.17

0.16

0.51

0.48

Basic earnings per common share

$

0.36

0.36

0.35

0.40

0.32

1.07

0.84

Diluted earnings per common share

$

0.36

0.36

0.35

0.40

0.32

1.07

0.84

Book value per share

$

17.44

17.18

16.83

16.47

16.05

17.44

16.05

Tangible book value per share

$

12.57

12.31

12.05

11.67

11.18

12.57

11.18

Weighted average common shares

outstanding:

Basic

12,932,950

13,192,691

13,283,634

13,285,386

13,285,203

13,135,134

11,480,390

Diluted

12,937,145

13,196,665

13,287,338

13,290,499

13,290,665

13,139,100

11,486,051

Shares outstanding at period end

12,927,463

12,978,554

13,314,148

13,295,276

13,304,976

12,927,463

13,304,976

Selected

Financial Ratios

Return on average assets

1.13

%

1.16

%

1.15

%

1.27

%

1.03

%

1.15

%

0.89

%

Return on average equity

8.33

%

8.46

%

8.47

%

9.55

%

7.76

%

8.42

%

7.23

%

Dividend payout ratio

47.22

%

47.22

%

48.57

%

42.50

%

50.00

%

47.66

%

57.14

%

Net interest margin (tax equivalent)

3.67

%

3.72

%

3.71

%

3.69

%

3.59

%

3.70

%

3.61

%

Efficiency ratio (tax equivalent)

64.47

%

64.87

%

65.61

%

60.58

%

63.68

%

64.98

%

70.21

%

Selected Balance

Sheet Items

Cash and cash equivalents

$

22,826

23,185

19,527

20,040

19,812

Debt and equity securities

239,730

246,701

264,559

282,813

299,786

Loans:

Commercial and industrial

$

71,576

79,513

79,725

77,740

78,002

Commercial, secured by real estate

797,842

793,863

764,424

740,647

704,987

Residential real estate

320,703

326,029

334,227

349,127

347,920

Consumer

23,918

19,649

17,409

17,283

17,505

Agricultural

11,525

10,843

10,900

13,297

13,280

Other, including deposit overdrafts

456

373

409

450

498

Deferred net origination costs (fees)

(128

)

(9

)

40

79

133

Loans, gross

1,225,892

1,230,261

1,207,134

1,198,623

1,162,325

Less allowance for loan losses

4,167

4,112

4,126

4,046

4,016

Loans, net

$

1,221,725

1,226,149

1,203,008

1,194,577

1,158,309

Total earning assets

$

1,470,074

1,482,913

1,476,862

1,483,166

1,465,787

Total assets

1,644,447

1,642,012

1,632,387

1,636,927

1,620,299

Total deposits

1,355,383

1,357,959

1,347,857

1,300,919

1,371,023

Three Months Ended

Nine Months Ended

9/30/2019

6/30/2019

3/31/2019

12/31/2018

9/30/2018

9/30/2019

9/30/2018

Selected Balance

Sheet Items, continued

Short-term borrowings

—

—

—

56,230

—

Long-term debt

41,990

41,986

42,982

47,032

23,079

Total shareholders’ equity

225,492

222,972

224,018

218,985

213,515

Equity to assets ratio

13.71

%

13.58

%

13.72

%

13.38

%

13.18

%

Loans to deposits ratio

90.45

%

90.60

%

89.56

%

92.14

%

84.78

%

Tangible common equity (TCE)

$

162,485

159,702

160,488

155,197

149,398

Tangible common assets (TCA)

1,581,440

1,578,742

1,568,857

1,573,139

1,556,182

TCE/TCA

10.27

%

10.12

%

10.23

%

9.87

%

9.60

%

Selected Average

Balance Sheet Items

Cash and cash equivalents

$

28,293

29,523

25,080

20,685

25,920

27,600

25,011

Debt and equity securities

243,553

249,954

266,081

291,433

304,112

253,113

308,020

Loans

$

1,227,806

1,217,726

1,208,809

1,177,061

1,155,846

1,218,183

991,350

Less allowance for loan losses

3,986

4,088

4,074

4,016

3,622

4,049

3,757

Net loans

$

1,223,820

1,213,638

1,204,735

1,173,045

1,152,224

1,214,134

987,593

Total earning assets

$

1,480,096

1,479,225

1,480,634

1,471,650

1,465,510

1,479,983

1,305,211

Total assets

1,654,034

1,637,645

1,635,416

1,626,029

1,623,016

1,642,186

1,442,896

Total deposits

1,365,702

1,352,449

1,333,529

1,333,673

1,367,950

1,350,678

1,232,599

Short-term borrowings

468

243

23,235

36,348

1,833

7,898

6,425

Long-term debt

41,988

42,567

44,676

25,536

25,757

43,067

13,841

Total shareholders’ equity

225,216

224,203

221,470

215,739

214,769

223,644

178,539

Equity to assets ratio

13.62

%

13.69

%

13.54

%

13.27

%

13.23

%

13.62

%

12.37

%

Loans to deposits ratio

89.90

%

90.04

%

90.65

%

88.26

%

84.49

%

90.19

%

80.43

%

Asset

Quality

Net charge-offs (recoveries)

$

209

68

(185

)

(68

)

245

92

348

Other real estate owned

197

197

244

244

35

197

35

Non-accrual loans

3,523

2,962

2,845

2,951

2,603

3,523

2,603

Loans past due 90 days or more and still

accruing

—

24

177

149

1

—

1

Total nonperforming loans

$

3,523

2,986

3,022

3,100

2,604

3,523

2,604

Net charge-offs (recoveries) to average

loans

0.07

%

0.02

%

(0.06

)%

(0.02

)%

0.08

%

0.01

%

0.05

%

Allowance for loan losses to total

loans

0.34

%

0.33

%

0.34

%

0.34

%

0.35

%

0.34

%

0.35

%

Nonperforming loans to total loans

0.29

%

0.24

%

0.25

%

0.26

%

0.22

%

0.29

%

0.22

%

Nonperforming assets to total assets

0.23

%

0.19

%

0.20

%

0.20

%

0.16

%

0.23

%

0.16

%

Assets Under

Management

LCNB Corp. total assets

$

1,644,447

1,642,012

1,632,387

1,636,927

1,620,299

Trust and investments (fair value)

411,724

382,462

367,649

337,549

386,582

Mortgage loans serviced

104,358

88,444

89,049

97,685

115,647

Cash management

117,530

71,973

55,981

48,906

36,502

Brokerage accounts (fair value)

262,038

260,202

245,758

233,751

247,175

Total assets managed

$

2,540,097

2,445,093

2,390,824

2,354,818

2,406,205

Non-GAAP

Financial Measures

Net income

$

4,727

4,728

4,627

5,193

4,201

14,082

9,652

Add: merger-related expenses, net of

tax

21

16

53

148

274

90

1,605

Adjusted net income

$

4,748

4,744

4,680

5,341

4,475

14,172

11,257

Basic adjusted earnings per share

0.37

0.36

0.36

0.41

0.34

1.08

0.98

Diluted adjusted earnings per share

0.37

0.36

0.36

0.41

0.34

1.08

0.98

Adjusted return on average assets

1.14

%

1.16

%

1.16

%

1.30

%

1.09

%

1.15

%

1.04

%

Adjusted return on average equity

8.36

%

8.49

%

8.57

%

9.82

%

8.27

%

8.47

%

8.43

%

LCNB CORP. AND

SUBSIDIARIES

CONSOLIDATED CONDENSED BALANCE

SHEETS

(Dollars in thousands)

September 30, 2019

(Unaudited)

December 31, 2018

ASSETS:

Cash and due from banks

$

18,374

18,310

Interest-bearing demand deposits

4,452

1,730

Total cash and cash equivalents

22,826

20,040

Interest-bearing time deposits

249

996

Investment securities:

Equity securities with a readily

determinable fair value, at fair value

2,266

2,078

Equity securities without a readily

determinable fair value, at cost

2,099

2,099

Debt securities, available-for-sale, at

fair value

191,230

238,421

Debt securities, held-to-maturity, at

cost

34,031

29,721

Federal Reserve Bank stock, at cost

4,652

4,653

Federal Home Loan Bank stock, at cost

5,203

4,845

Loans, net

1,221,725

1,194,577

Premises and equipment, net

34,045

32,627

Operating leases right of use asset

5,565

—

Goodwill

59,221

59,221

Core deposit and other intangibles

4,246

5,042

Bank owned life insurance

41,377

28,723

Other assets

15,712

13,884

TOTAL ASSETS

$

1,644,447

1,636,927

LIABILITIES:

Deposits:

Noninterest-bearing

$

335,989

322,571

Interest-bearing

1,019,394

978,348

Total deposits

1,355,383

1,300,919

Short-term borrowings

—

56,230

Long-term debt

41,990

47,032

Operating leases liability

5,531

—

Accrued interest and other liabilities

16,051

13,761

TOTAL LIABILITIES

1,418,955

1,417,942

COMMITMENTS AND CONTINGENT

LIABILITIES

—

—

SHAREHOLDERS' EQUITY:

Preferred shares – no par value,

authorized 1,000,000 shares, none outstanding

—

—

Common shares – no par value, authorized

19,000,000 shares at September 30, 2019 and December 31, 2018;

issued 14,102,490 and 14,070,303 shares at September 30, 2019 and

December 31, 2018, respectively

141,618

141,170

Retained earnings

101,929

94,547

Treasury shares at cost, 1,175,027 and

775,027 shares at September 30, 2019 and December 31, 2018

(18,847

)

(12,013

)

Accumulated other comprehensive income

(loss), net of taxes

792

(4,719

)

TOTAL SHAREHOLDERS' EQUITY

225,492

218,985

TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY

$

1,644,447

1,636,927

LCNB CORP. AND

SUBSIDIARIES

CONSOLIDATED CONDENSED

STATEMENTS OF INCOME

(Dollars in thousands, except per

share data)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2019

2018

2019

2018

INTEREST INCOME:

Interest and fees on loans

$

14,872

13,363

44,072

33,479

Dividends on equity securities with a

readily determinable fair value

15

17

47

48

Dividends on equity securities without a

readily determinable fair value

16

7

48

22

Interest on debt securities, taxable

918

901

2,720

2,766

Interest on debt securities,

non-taxable

379

661

1,340

2,045

Other short-term investments

129

121

543

390

TOTAL INTEREST INCOME

16,329

15,070

48,770

38,750

INTEREST EXPENSE:

Interest on deposits

2,475

1,810

7,225

3,777

Interest on short-term borrowings

3

12

224

88

Interest on long-term debt

273

145

762

226

TOTAL INTEREST EXPENSE

2,751

1,967

8,211

4,091

NET INTEREST INCOME

13,578

13,103

40,559

34,659

PROVISION FOR LOAN LOSSES

264

659

213

962

NET INTEREST INCOME AFTER PROVISION FOR

LOAN LOSSES

13,314

12,444

40,346

33,697

NON-INTEREST INCOME:

Fiduciary income

1,123

1,081

3,215

2,987

Service charges and fees on deposit

accounts

1,616

1,439

4,421

4,170

Net losses on sales of debt securities

(20

)

(7

)

(37

)

(8

)

Bank owned life insurance income

289

185

654

553

Gains from sales of loans

114

63

207

182

Other operating income

234

160

666

464

TOTAL NON-INTEREST INCOME

3,356

2,921

9,126

8,348

NON-INTEREST EXPENSE:

Salaries and employee benefits

6,403

5,686

18,808

15,791

Equipment expenses

322

276

866

797

Occupancy expense, net

751

734

2,258

2,119

State financial institutions tax

433

299

1,307

898

Marketing

410

382

1,009

798

Amortization of intangibles

263

286

780

659

FDIC insurance premiums (refunds), net

(13

)

91

225

289

Contracted services

455

387

1,394

1,093

Other real estate owned

1

1

52

4

Merger-related expenses

27

346

114

1,959

Other non-interest expense

1,930

1,829

5,702

6,170

TOTAL NON-INTEREST EXPENSE

10,982

10,317

32,515

30,577

INCOME BEFORE INCOME TAXES

5,688

5,048

16,957

11,468

PROVISION FOR INCOME TAXES

961

847

2,875

1,816

NET INCOME

$

4,727

4,201

14,082

9,652

Dividends declared per common share

$

0.17

0.16

0.51

0.48

Earnings per common share:

Basic

0.36

0.32

1.07

0.84

Diluted

0.36

0.32

1.07

0.84

Weighted average common shares

outstanding:

Basic

12,932,950

13,285,203

13,135,134

11,480,390

Diluted

12,937,145

13,290,665

13,139,100

11,486,051

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191021005845/en/

LCNB Corp. Eric J. Meilstrup, CEO and President, 800-344-BANK

Robert C. Haines II, Executive Vice President and CFO,

800-344-BANK

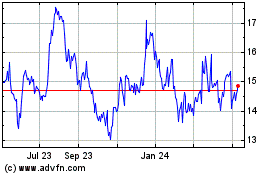

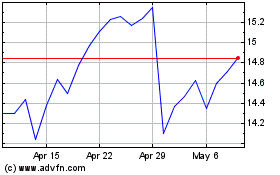

LCNB (NASDAQ:LCNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

LCNB (NASDAQ:LCNB)

Historical Stock Chart

From Apr 2023 to Apr 2024