First BanCorp. to Acquire Banco Santander Puerto Rico

October 21 2019 - 4:17PM

Business Wire

First BanCorp. (the “Company”) (NYSE: FBP), the bank holding

company of FirstBank Puerto Rico (“FirstBank”), announced today the

signing of a stock purchase agreement for FirstBank to acquire

Banco Santander Puerto Rico (“BSPR”) for a $63 million premium to

BSPR’s core tangible common equity in an all cash transaction. The

transaction is subject to receipt of all necessary regulatory

approvals.

As of June 30, 2019, BSPR had $6.2 billion of assets, $3.1

billion of loans and $5.0 billion of deposits. On a pro forma basis

based on June 30, 2019 data, including purchase accounting

adjustments, after the transaction FirstBank will have

approximately $17.6 billion in assets, a $12.0 billion loan

portfolio, and $14.2 billion of deposits.

Aurelio Alemán, President and Chief Executive Officer of First

BanCorp., commented: “We are very excited to announce this

transformational transaction for our Company. After completing

comprehensive due diligence, we have signed an agreement to acquire

Banco Santander Puerto Rico. This acquisition will significantly

improve our scale and competitiveness in Puerto Rico, while

enhancing our funding and risk profile. The transaction is

financially compelling and generates 35% accretion to fully

phased-in 2020 consensus earnings per share (EPS) with a tangible

book value per share earnback period of 2.6 years.”

“While continuing to grow and invest in our franchise, we have

been preparing for a strategic transaction of this magnitude. The

Banco Santander Puerto Rico team expands our talent bench in

retail, commercial and business banking. First BanCorp will become

a stronger competitor in Puerto Rico with the scale and breadth to

better serve retail and commercial customers, and increase our

financial investments in innovation and talent development. We are

greatly appreciative of expanding our client base and we will work

hard to continue enhancing our portfolio of products, services and

channels to meet their needs and exceed their expectations.”

“Our combined institution will be well-positioned to continue

growth initiatives and further support the economic recovery and

redevelopment in Puerto Rico,” added Alemán.

Transaction Highlights

The transaction is structured as an acquisition of the BSPR’s

holding company, immediately followed by the merger of BSPR and its

holding company into FirstBank. The transaction represents an

efficient deployment of capital with a compelling financial impact

for the Company:

- 100% cash transaction

- $425 million base purchase price, or 117.5% of BSPR’s core

tangible common equity, comprised of a $63 million premium on $362

million of core tangible common equity as of June 30, 2019; plus

$638 million of BSPR’s excess capital as of June 30, 2019 paid at

par; purchase price is subject to adjustment based on BSPR’s

balance sheet as of the closing date

- The transaction is expected to be 35% accretive to 2020

consensus EPS of $0.81 (assuming fully phased-in BSPR earnings,

cost savings and transaction adjustments)

- Tangible book value per share is expected to be diluted by

approximately 7% at close, with an expected earnback period of

approximately 2.6 years based on the crossover method

- Transaction is expected to deliver an internal rate of return

of approximately 20%

- Pre-tax annual cost savings of $48 million expected to be fully

achieved in 2021, representing approximately 35% of BSPR’s

non-interest expenses over the last-twelve-months, excluding OREO

expense

- One-time restructuring charges of approximately $76 million

expected to be phased-in 50% at close with the remainder to be

incurred in 2021

- FirstBank will not assume any of BSPR’s non-performing assets

(“NPAs”) under the agreement. Pro forma NPA/Asset Ratio of

approximately 2.2% as of June 30, 2019

- Enhanced funding and liquidity profile, with a pro forma

loan-to-deposit ratio of 84%

- All pro forma capital ratios at closing expected to remain

significantly above the “well capitalized” threshold, with a

closing pro forma Total Risk-Based Capital Ratio of 18.0%, a

closing pro forma Tier 1 Capital Ratio of 15.6%, a closing pro

forma Common Equity Tier 1 Ratio of 15.3% and a closing pro forma

Tier 1 Leverage Ratio of 11.2%

Timing and Approvals

The transaction has been unanimously approved by the Company’s

and FirstBank’s Board of Directors. The transaction is subject to

the satisfaction of customary closing conditions, including receipt

of all required regulatory approvals, and is expected to close in

the middle of 2020.

Advisors

Goldman Sachs & Co. LLC served as financial advisor and

Skadden, Arps, Slate, Meagher & Flom LLP served as legal

counsel to the Company. Moelis & Company LLC and Simpson

Thacher & Bartlett LLP advised the Board of Directors of the

Company.

Accompanying Presentation and Conference Call Details

First BanCorp’s senior management will host a conference call

and live webcast on Tuesday, October 22, 2019, immediately

following the 10:00 a.m. (Eastern Time) earnings call and webcast.

The presentation will be made available on the Corporation’s

website, www.1firstbank.com. The call may be accessed via a live

Internet webcast through the investor relations section of the

Corporation’s web site: www.1firstbank.com or through a dial-in

telephone number at (877) 506-6537 or (412) 380–2001 for

international callers. The Corporation recommends that listeners go

to the web site at least 15 minutes prior to the call to download

and install any necessary software. Following the webcast

presentation, a question and answer session will be made available

to research analysts and institutional investors. A replay of the

webcast will be archived in the investor relations section of First

BanCorp’s web site, www.1firstbank.com, until October 22, 2020. A

telephone replay will be available one hour after the end of the

conference call through November 22, 2019 at (877) 344-7529 or

(412) 317-0088 for international callers. The replay access code is

10135120.

About First BanCorp.

First BanCorp. is the parent corporation of FirstBank Puerto

Rico, a state-chartered commercial bank with operations in Puerto

Rico, the U.S. and British Virgin Islands and Florida, and of

FirstBank Insurance Agency, LLC. Among the subsidiaries of

FirstBank Puerto Rico are First Federal Finance Limited Liability

Company and First Express, Inc., both small loan companies. First

BanCorp’s shares of common stock trade on the New York Stock

Exchange under the symbol “FBP.”

Safe Harbor

This press release may contain “forward-looking statements”

concerning the Company. The words or phrases “expect,”

“anticipate,” “intend,” “look forward,” “should,” “would,”

“believes” and similar expressions are meant to identify

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, and are subject to the

safe harbor created by such sections. Such forward-looking

statements include, but are not limited to, statements regarding

the Company’s ability to declare dividends on the Company’s

Preferred Stock in any future periods. Such statements are subject

to known and unknown risks, uncertainties and contingencies that

may cause actual results to differ materially from the

expectations, intentions, beliefs, plans, estimates or predictions

of the future expressed or implied by such forward-looking

statements. These risks, uncertainties and contingencies include,

but are not limited to the factors described in the Company’s

Annual Report on Form 10-K, in its Quarterly Reports on Form 10-Q

and in other filings with the SEC. The Company does not undertake,

and specifically disclaims any obligation, to update any

“forward-looking statements” to reflect occurrences or

unanticipated events or circumstances after the date of such

statements, except as required by the federal securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191021005811/en/

First BanCorp. John B. Pelling III Investor Relations

Officer 787-729-8003 john.pelling@firstbankpr.com

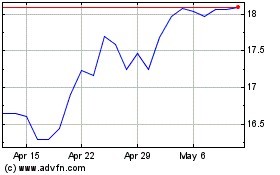

First Bancorp (NYSE:FBP)

Historical Stock Chart

From Mar 2024 to Apr 2024

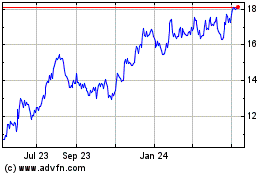

First Bancorp (NYSE:FBP)

Historical Stock Chart

From Apr 2023 to Apr 2024