Current Report Filing (8-k)

October 16 2019 - 5:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 10,

2019

Amyris, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-34885

|

55-0856151

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

5885 Hollis Street, Suite 100, Emeryville, CA

|

94608

|

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

(510) 450-0761

|

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

|

|

(Former name or former address, if changed since last report.)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2 below):

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value per share

|

AMRS

|

The Nasdaq Stock Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

|

Entry into a Material Definitive Agreement.

|

As previously reported, Amyris, Inc.

(the “Company”) and certain of the Company’s subsidiaries (the

“Subsidiary Guarantors”) are party to a Loan and Security Agreement, dated June 29, 2018, as

subsequently amended on August 24, 2018, November 14, 2018, December 14, 2018, April 4, 2019 and August 14, 2019 (as amended,

the “LSA”), by and among the Company, the Subsidiary Guarantors and Foris Ventures, LLC

(“Foris”), an entity affiliated with director John Doerr of Kleiner Perkins Caufield & Byers, a

current stockholder, and an owner of greater than five percent of the Company’s outstanding common stock, par value

$0.0001 per share (the “Common Stock”), as successor-in-interest to GACP

Finance Co., LLC, as administrative agent and lender. The provisions of the LSA and related matters were

previously reported in a Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission

(the “SEC”) on July

2, 2018 and in Note 5, “Debt” and Note 16, “Subsequent Events” in Part II,

Item 8 of Amendment No. 1

on Form 10-K/A to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018, filed with

the SEC on October 4, 2019, and all of such disclosure is incorporated herein by reference.

On October 10, 2019, the Company, the Subsidiary Guarantors and

Foris entered into Amendment No 6 to the LSA (the “LSA Amendment”), pursuant to which the maximum loan

commitment of Foris under the LSA was increased by $10.0 million.

|

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

In connection with the entry into the LSA

Amendment described in Item 1.01 above, on October 11, 2019, the Company borrowed an additional $10.0 million from Foris under

the LSA (the “LSA Loan”), which loan is subject to the terms and provisions of the LSA, including the

lien on substantially all of the assets of the Company and the Subsidiary Guarantors. After giving effect to the LSA Loan, there

is $81.0 million aggregate principal amount of loans outstanding under the LSA.

|

Item 3.02

|

|

Unregistered Sales of Equity Securities.

|

In connection with the LSA Loan described in Item 2.03 above, on

October 11, 2019 the Company issued to Foris a warrant to purchase up to 2,000,000 shares of Common Stock, at an exercise price

of $2.87 per share, with an exercise term of two years from issuance (the “Foris Warrant”). Pursuant

to the terms of the Foris Warrant, Foris may not exercise the Foris Warrant to the extent that, after giving effect to such exercise,

Foris, together with its affiliates, would beneficially own in excess of 19.99% of the number of shares of Common Stock outstanding

after giving effect to such exercise, unless the Company has obtained stockholder approval to exceed such limit. The Foris Warrant

was issued in a private placement pursuant to the exemption from registration under Section 4(a)(2) of the Securities Act of 1933,

as amended (the “Securities Act”), and Regulation D promulgated under the Securities Act.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

AMYRIS, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: October 16, 2019

|

By:

|

/s/ Kathleen Valiasek

|

|

|

|

|

Kathleen Valiasek

|

|

|

|

|

Chief Business Officer

|

Amyris (NASDAQ:AMRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

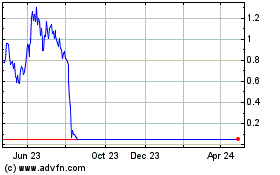

Amyris (NASDAQ:AMRS)

Historical Stock Chart

From Apr 2023 to Apr 2024