OpGen’s

Business

We are a precision medicine

company harnessing the power of molecular diagnostics and informatics to help combat infectious disease. We are developing molecular

information products and services for global healthcare settings, helping to guide clinicians with more rapid and actionable information

about life threatening infections, improve patient outcomes, and decrease the spread of infections caused by MDROs. Our proprietary

DNA tests and informatics address the rising threat of antibiotic resistance by helping physicians and other healthcare providers

optimize care decisions for patients with acute infections.

OpGen is developing high resolution

Acuitas AMR Gene Panel tests designed to determine pathogen levels in clinical specimens and the key drug resistance gene profiles

of Gram-negative organisms. Currently, the Acuitas AMR Gene Panel tests are available for sale for RUO. Following completion of

research and development efforts, and if OpGen is able to obtain the appropriate regulatory clearances, OpGen anticipates its

Acuitas AMR Gene Panel tests will be used in the clinical setting to provide pathogen and antibiotic resistance gene information

to aid in decision-making for patients at risk for cUTI, lower respiratory tract infections, blood stream infections, and for

testing of bacterial isolates. OpGen currently offers its Acuitas AMR Gene Panel (RUO) tests to CROs, pharmaceutical companies,

hospitals and other healthcare providers for RUO. OpGen offers its Acuitas Lighthouse Software to health care facilities and public

health facilities for research purposes, primarily in relation to infection control and surveillance.

Acuitas

AMR Gene Panel and Acuitas Lighthouse Software

The Acuitas AMR Gene Panel

is a development-stage, qualitative and semi-quantitative nucleic acid-based in vitro diagnostic test that is designed for simultaneous

detection and identification of multiple bacterial nucleic acids and select genetic determinants of antimicrobial resistance in

urine specimens or bacterial colonies isolated from urine and other body sites. The Acuitas AMR Gene Panel (Urine) is intended

as an aid in the diagnosis of specific agents of cUTIs for patients at risk of cUTI. The Acuitas AMR Gene Panel (Urine) employs

automated deoxyribonucleic acid, or DNA, extraction on the Qiagen® EZ1 Advanced XL and multiplex real-time PCR on the Applied

Biosystems™ QuantStudio 5 PCR System. The Acuitas AMR Gene Panel (Urine) test detects up to 47 gene targets which span 600

subtypes and convey resistance to nine classes of antibiotics directly from urine and isolated colonies, and is currently sold

as a RUO test. Gene families detected include: KPC, NDM, VIM, IMP, OXA, CTXM-1, CTXM-9, CMY, MCR, and resistance genes to fluoroquinolone

antibiotics. From urine specimens, the Acuitas AMR Gene Panel (Urine) will semi-quantitatively detect the most common bacterial

causes of cUTI (E. coli, K. pneumoniae, P. aeruginosa, P. mirabilis, E. faecalis). The Acuitas AMR Gene Panel (Urine) is

designed to provide test results in under three hours, compared with traditional microbiology methods, which can take two to three

days.

OpGen is also developing the

Acuitas AMR Gene Panel (Isolates) test for testing bacterial isolates. This test is currently available in the United States for

RUO and is being used in such capacity in connection with The New York State Infectious Disease Digital Health Initiative for

testing of bacterial isolates. The test is contributing to the initiative’s research mission by genotyping carbapenem resistant

isolates from three health systems in the New York City Metro Area. Results are subsequently analyzed by the Acuitas Lighthouse

Software (RUO) to support a series of infection control tracking capabilities that are of interest to The New York State Department

of Health and healthcare providers. On May 13, 2019, OpGen filed a 510(k) submission with the FDA for clearance for its Acuitas

AMR Gene Panel test for the detection of antimicrobial resistance genes in bacterial isolates. The FDA responded to our submission

with an AI Request in July 2018, to which we have 180 days to submit a complete response. In the meantime, our 510(k) submission

is on hold. If we are able to obtain FDA clearance of the Acuitas AMR Gene Panel (Isolates) test, we expect use of the test to

expand from current research uses to include the clinical diagnostic use of test information to support antibiotic decision making

in acute care patient management of patients with MDRO infections.

The Acuitas Lighthouse Software

(RUO) manages and evaluates data that identify the most common microbial causes of cUTI and key genetic determinants of antibiotic

drug resistance, based on the amplification data of gene targets extracted from urine specimens. Through analysis of this data,

the Acuitas Lighthouse Software can identify five bacterial species and predict resistance to up to fourteen different antibiotics

from across nine antibiotic classes including: Aminoglycosides, Carbapenems, Cephalosporins, Fluoroquinolones, Polymyxins, Penicillins,

Sulfonamides, Trimethoprim and Vancomycin. The Acuitas Lighthouse Software consists of the Acuitas Lighthouse Portal, a web application;

the Acuitas Lighthouse Prediction Engine, data analysis software; and draws from the Lighthouse Knowledgebase, a relational database

management system; and minor supporting software components. The Acuitas Lighthouse Software (RUO) was selected by The New York

State Department of Health Wadsworth Center for the genomic microbiology component of The New York State Infectious Disease Digital

Health Initiative. All components of the Acuitas Lighthouse Software are hosted in a cloud-based web application that is protected

by security measures. The input to Acuitas Lighthouse Software is a data file generated by processing the results from the Acuitas

AMR Gene Panel (Urine) test through the Acuitas AMR Gene Panel (Urine) Gene Analysis Software. This input file indicates which

gene targets were detected by the assay and is loaded into the Acuitas Lighthouse Software via an interface of the Acuitas Lighthouse

Portal, accessed by the user through a web browser. The Acuitas AMR Gene Panel (Urine) Gene Analysis Software results are retained

by the Acuitas Lighthouse Knowledgebase and are sent to the Acuitas Lighthouse Prediction Engine for analysis. The Acuitas Lighthouse

Prediction Engine contains software implementations of data models that were derived using a training panel of thousands of bacterial

isolates with detailed genotypic and phenotypic characterizations, all stored within the Acuitas Lighthouse Knowledgebase. These

models, each specific to one microbial species and antibiotic drug pairing, are used to make predictions of antibiotic resistance

by analyzing the loaded input data. The results from the Acuitas Lighthouse Prediction Engine indicate whether there is evidence

of resistance detected through the presence of specific genes, and if there is known intrinsic resistance to certain drugs. These

final results are reported to the user via a Prediction Report and the Resistance Dashboard interface in the Acuitas Lighthouse

Portal; both displays present the Acuitas Lighthouse Prediction Engine output in combination with selected input data and metadata,

as well as the semi-quantitative counts of gene copies / mL for urine specimens. Our development of the Acuitas Lighthouse Software

and the Acuitas AMR Gene Panel (Urine) test, thus far, has resulted from a comprehensive, multi-year effort, which remains ongoing,

to help address urgent clinical needs for improved rapid antibiotic decision-making capabilities.

The figure below describes

the workflow for the Acuitas AMR Gene Panel (Urine) test and the Acuitas Lighthouse Software.

In October 2018, OpGen entered

into a supply agreement with QIAGEN GmbH, or QIAGEN, to advance OpGen’s rapid diagnostics for antimicrobial resistance.

Under the agreement, OpGen will work to commercialize QIAGEN’s EZ1 Advanced XL automated nucleic acid purification instrumentation

(EZ1) and reagent kits in the United States to be used with the Acuitas AMR Gene Panel products for research purposes. Under the

terms of the agreement, OpGen will purchase EZ1 instruments and reagent kits from QIAGEN and sell or place them with customers

in the United States for use with the Acuitas AMR Gene Panel products for RUO and, if the necessary 510(k) clearances are obtained,

as diagnostic products. The EZ1 is a Class II Medical Device listed with the FDA that provides full automation with sample preparation

throughput of up to 14 samples per one-hour run. QIAGEN is the global leader for nucleic acid sample preparation with a full line

of instruments and reagents. There are thousands of EZ1 instruments currently used in laboratories worldwide.

In September 2018, OpGen announced

a collaboration with The New York State DOH and ILÚM to develop a state-of-the-art research program to detect, track, and

manage antimicrobial-resistant infections at healthcare institutions in New York State. The collaboration is called The New York

State Infectious Disease Digital Health Initiative. The first stage of the collaboration is the completion of a demonstration

project, which commenced in February 2019 and is expected to last until March 2020. We believe a successful demonstration project

will lead to a statewide program. Under the demonstration project, OpGen will work with DOH’s Wadsworth Center and ILÚM

to develop an infectious disease digital health and precision medicine platform that connects healthcare institutions to DOH and

uses genomic microbiology for statewide surveillance and control of antimicrobial resistance. The DOH, ILÚM and OpGen will

work collaboratively to build a sustainable, flexible infectious diseases reporting, tracking and surveillance tool for antimicrobial

resistance that can be applied across New York State. The goal of this research project is to improve patient outcomes and save

healthcare dollars by integrating real-time epidemiologic surveillance with rapid delivery of resistance results to care-givers

via web-based and mobile platforms. ILÚM is leading the project with the implementation of its technology platform. OpGen

is providing its Acuitas AMR Gene Panel (RUO) for rapid detection of multidrug-resistant bacterial pathogens along with its Acuitas

Lighthouse Software (RUO) for high resolution pathogen tracking. Under the agreement, OpGen will receive approximately $1.6 million

for the 12-month demonstration portion of the project, with the potential for full implementation during the next four years,

should certain milestones be achieved.

In June 2017, OpGen

entered into a supply agreement to use Thermo Fisher Scientific’s technology in the United States and Europe to support

the commercialization of its rapid molecular products for RUO. Under the terms of the agreement, OpGen provides customer

access to Thermo Fisher Scientific’s products to support the commercialization of our Acuitas QuickFISH Rapid Test and

Acuitas Lighthouse Software to combat MDROs. In January 2018, the Company entered into a second supply agreement to

incorporate Thermo Fisher Scientific’s real-time PCR technology in the Company’s Acuitas AMR Gene Panel tests.

Specific products covered under these agreements include the QuantStudio 5 Real-Time PCR System, TaqMan® Fast Advanced

Master Mix and TaqMan® MGB Probes for quick, multiplexed gene detection.

OpGen’s relationship

with Merck & Co., Inc. includes investment from Merck Global Health Innovation Fund, or MGHIF, and a research agreement with

Merck Sharp & Dohme, or MSD, to provide access to MSD’s 250,000 clinical isolate SMART bacterial surveillance archive.

In December 2017, we entered into a subcontractor agreement with ILÚM, whereby ILÚM provided services to the Company

in the performance of the Company’s CDC contract to deploy ILÚM’s commercially-available cloud- and mobile-based

software platform for infectious disease management in three medical sites in Colombia with the aim of improving antibiotic use

in resource-limited settings.

OpGen’s FDA cleared

and CE marked QuickFISH and PNA FISH products are powered by PNA technology and provide rapid pathogen identification, typically

in less than 30 minutes from a positive blood culture result.

Intellectual Property

As of December 31, 2018, we had total ownership rights

to 22 U.S. patents and applications, including six pending U.S. non-provisional patent applications, and 16 issued U.S. patents.

More specifically, as of December 31, 2018, related to our FISH products, we had ownership rights to 11 U.S. patents and patent

applications, including three pending U.S. non-provisional patent applications, and eight issued U.S. patents. These issued patents

begin to expire in November 2024 and will be fully expired by March 2032. As of December 31, 2018, related to our Acuitas products,

we had ownership rights to three pending U.S. non-provisional patent applications and no issued U.S. patents. As of December 31,

2018, related to our other products, we had ownership rights to eight issued U.S. patents. These issued patents begin to expire

in June 2026 and will be fully expired by January 2032. A majority of our issued and exclusively licensed FISH patents from Dako

Denmark A/S expired over the last six years. The remaining 17 exclusively licensed U.S. FISH patents expire between 2019 and 2024.

Curetis’

Business

Current

Diagnostic Tests and Informatics

Curetis’

automated sample-to-answer product offerings are based on the Unyvero A50 platform that has been CE-IVD-marked since 2012 and

was FDA cleared through the de novo process for the FDA cleared Unyvero LRT test. The Unyvero LRT test is designed to facilitate

diagnoses in connection with the 500,000 to 750,000 complicated pneumonia cases each year in the United States, as estimated by

pneumonia facts published by the American Thoracic Society in 2018. The test detects 19 microorganism targets and 10 antibiotic

resistance markers from endotracheal aspirates of adult hospitalized patients with suspected lower respiratory tract infections.

The Unyvero LRT test will also be available for testing bronchoalveolar lavage, or BAL, specimens of U.S. patients with lower

respiratory tract infections if our 510(k) submission, the receipt of which was acknowledged by the FDA on July 23, 2019, is cleared

for marketing in the United States. In Europe and other international markets, Curetis offers five CE-marked application cartridges

for hospitalized pneumonia, intra-abdominal infections, UTI, implant and tissue infections and blood stream infections. Curetis’

portfolio of these tests is highlighted in the figure below.

The

Unyvero Platform is a highly automated cartridge-based sample-to-answer molecular diagnostics platform based on multiplexed end-point

PCR with an array-based detection process. It integrates fully automated sample preparation, analysis and identification of disease

relevant pathogens and antibiotic resistance markers to provide timely high-quality information to its end-users. The scalable

system is designed to be either placed in laboratory settings or directly in hospital wards or intensive care units. Time-to-result

is four to five hours for the different application cartridges. The Unyvero Platform’s intuitive workflow with only minimal

hands-on time enables hospital staff to perform molecular tests at the point of need, such as in the ICU setting. Unyvero and

System Components are highlighted in the figure below. As of June 30, 2019, there were 170 Unyvero Analyzer placements globally.

Curetis’ ARESdb informatics

are currently commercialized through partnerships and an NGS service lab in Vienna, Austria. Curetis is accessing the AMR research

market through its exclusive bioinformatics collaboration with QIAGEN. Curetis has development agreements with Sandoz to reposition

antibiotics and recently introduced a specialized service laboratory offering of next-generation molecular AMR testing services

with an initial focus on infection control, AMR epidemiology and surveillance, clinical research and pharmaceutical anti-infectives

R&D. All services are based on NGS performed in Vienna, Austria and the ARESdb software.

Unyvero

A30 RQ Instrument

The Curetis Unyvero A30

RQ is a new device candidate designed to address the low to mid-plex testing market for 5-30 DNA targets. The device provides

results in 45 to 90 minutes with 2 to 5 minutes of hands on time. The Unyvero A30 RQ has a small laboratory footprint and

has an attractive cost of goods profile. Fully functional instrument system prototypes have been available since the fourth quarter

of 2018 and the first multiplex real-time PCR assays have been successfully transferred onto the Unyvero A30 RQ cartridges

and successfully benchmarked against their performance on standard PCR instruments. Curetis is aiming to have the Unyvero A30

RQ platform ready for partnering in 2020. The compact Unyvero A30 instrument and test cartridges are illustrated below.

We believe that the Unyvero A30 platform would also lend itself for the future development and regulatory approvals of certain

panels from the Acuitas and/or Unyvero side of Newco onto this novel platform.

|

|

Current

Commercial Agreements

Curetis has entered into a

number of distribution and collaboration agreements in the past few years, including:

|

|

·

|

In September 2019, Ares Genetics signed a technology evaluation agreement with an undisclosed global IVD corporation.

This collaboration follows the successful completion of a feasibility study in which Ares Genetics correctly identified 100% of

the pathogen species and successfully predicted antibiotic resistance for over 50 drug/pathogen combinations in line with FDA requirements.

In the first phase of the collaboration, expected to take about 10 months, Ares Genetics expects to further enrich ARESdb with

a focus on certain pathogens relevant in a first, undisclosed infectious disease indication. Additional clinical isolates of such

pathogens will be sequenced by Ares Genetics at its recently established NGS laboratory in Vienna, Austria. Based on this enlarged

and enriched dataset, Ares Genetics expects to further optimize the algorithms for predictive antibiotic resistance testing for

drug/pathogen combinations particularly relevant in the targeted indication to enable NGS-based infectious disease diagnostics.

Under the agreement, the collaborator will fully fund Ares Genetics’ research and development activities for the genotypic

and phenotypic characterization of additional bacterial strains to augment ARESdb and the development of optimized algorithms for

predicting antibiotic resistance. Furthermore, in return for an up-front option fee, the collaborator obtained a right of first

negotiation for an exclusive, worldwide, human clinical diagnostic use license to ARESdb and the ARES Technology Platform for the

term of the technology evaluation agreement plus three months. The collaborator has the right to terminate the technology evaluation

agreement by providing limited notice to Ares Genetics.

|

|

|

·

|

In

March 2019, Curetis signed a distribution agreement with A. Menarini Diagnostics covering

the Unyvero A50 product line. Menarini is an established global healthcare company with

total revenues in 2018 of €3.6 billion, with over 1,000 employees in clinical diagnostics

and an installed base of 10,000 instruments in Europe. The collaboration initially includes

11 European countries with the option to expand into the Middle East and Africa. Including

the Menarini relationship, we anticipate that Newco will have 18 partners covering 43

countries in Europe, the Middle East, South America and Asia.

|

|

|

·

|

In

February 2019 Ares Genetics and QIAGEN GmbH

entered into a global strategic licensing agreement for ARESdb and AREStools in the area

of AMR research that aims to create a community platform for antimicrobial resistance

research. Under the terms of the agreement, QIAGEN obtained a restricted license to exclusively

develop and commercialize general bioinformatics offerings and services for AMR research

based on Ares Genetics’ database on the genetics of antimicrobial resistance. On

the signing of the agreement, Ares Genetics received a technology access fee and will

be entitled to a milestone payment at product launch, as well as industry-standard royalty

rates on net sales of products and services based on ARESdb and AREStools. Ares Genetics

retains the full rights to use ARESdb and AREStools for AMR research, customized bioinformatics

services, and the development of specific AMR assays and applications for the Curetis

Group including Ares Genetics, as well as third parties, including other diagnostics

companies or partners in the pharmaceutical industry. The license to QIAGEN excludes

any human diagnostic uses of ARESdb and/or AREStools. Under a separate agreement QIAGEN

has also provided the bulk of laboratory automation and equipment at favorable reagent

rental conditions to Ares Genetics.

|

|

|

·

|

In

September 2015, Curetis entered into an eight-year China distribution agreement with

Beijing Clear Biotech, which includes a minimum purchase commitment of Unyvero A50 systems.

The agreement also requires a minimum number of cartridge purchases. Following completion

of clinical trials, Beijing Clear Biotech Co. Ltd. has recently filed for regulatory approval

of the Unyvero A50 LRT test with the Chinese National Medical Products Administration

(NMPA; formerly Chinese Food and Drug Administration). Following a recent expert panel

hearing with the NMPA, approval is expected in 2020 with commercial launch also anticipated

in 2020.

|

Newco’s Strategy

We believe that by combining the Curetis and OpGen product

offerings and products in development, we can build and commercialize a comprehensive precision medicine solution for combatting

infectious disease with a focus on developing diagnostic tests for rapid pathogen identification and genetic profiling, antibiotic

resistance analysis and advanced informatics to store and analyze MDRO and other infectious disease data for hospitals, out-patient

settings and other healthcare providers. We believe that Newco will establish a market leadership position and will be able to

capitalize on global opportunities in infectious disease and AMR detection. Key elements of Newco’s anticipated strategy

are to:

|

|

·

|

continue to gain regulatory approvals and establish a market position for proprietary molecular

diagnostic tests and platforms;

|

|

|

·

|

capitalize on unique AMR bioinformatics solutions based on the Acuitas Lighthouse Software and

ARESdb to help differentiate Newco’s molecular diagnostic offerings and establish stand-alone product offerings directly

or through strategic partners;

|

|

|

·

|

leverage global commercial channel capabilities and partners to help accelerate growth and establish

a global footprint for Newco’s tests and informatics;

|

|

|

·

|

pursue partner relationships to help fund product development and to support commercialization

of products and services; and

|

|

|

·

|

capitalize on the financial leverage, operational and research synergies to help improve return

on capital and achieve future profitability.

|

The two core components of Newco’s strategy are the

development and commercialization of rapid diagnostic tests and leveraging AMR information services into new markets and channels.

We believe that antimicrobial resistance is an urgent

global healthcare issue. MDROs have been prioritized as an urgent national and global threat by the CDC, the executive branch

of the federal government and the World Health Organization. In March 2015, The White House issued a National Strategy for Combating

Antibiotic-Resistant Bacteria. This strategy calls for the strengthening of surveillance efforts to combat resistance, the development

and use of innovative diagnostic tests for identification and characterization of resistant bacteria and antibiotic stewardship

and development.

The CDC estimates that in the United States more than two

million people are sickened every year with antibiotic-resistant infections, with at least 23,000 dying as a result. Antibiotic-resistant

infections add considerable but often avoidable costs to the U.S. healthcare system. In most cases, these infections require prolonged

and/or costlier treatments, extended hospital stays, additional doctor visits and healthcare facilities use, and result in greater

disability and death compared with infections that are treatable with antibiotics. Estimates for the total economic cost to the

U.S. economy are difficult to calculate but the CDC has estimated such costs to be as high as $20 billion in excess direct healthcare

costs annually. As described in a December 2014 report issued by the Review on Antimicrobial Resistance commissioned by the U.K.

Prime Minister, titled “Antimicrobial Resistance: Tackling a Crisis for the Health and Wealth of Nations,” there are

estimated to be 700,000 deaths each year from antimicrobial resistance, including 50,000 deaths annually in the United States and

Europe.

|

|

·

|

Rapid

diagnostics – The two lead products for Newco’s rapid diagnostics

business are for lower respiratory infection and urinary tract infection. The LRT test

is based on the Unyvero A50 and was FDA cleared in 2018 for use with tracheal aspirates

as a sample type. In July 2019, Curetis filed for the 510(k) clearance of an LRT application

cartridge optimized for use with BAL as an additional sample type. BAL is another common

sample type for the diagnosis of lower respiratory tract infections. In response to its

July 2019 510(k) submission, Curetis received an AI request from the FDA in September

2019, effectively placing the 510(k) submission on hold until the FDA determines that

the deficiencies identified in the AI request have been resolved. Curetis has started

the response process in an interactive review format. Curetis anticipates it will be

able to respond to all information requests by the end of 2019. Curetis believes that

receipt of FDA clearance of an Unyvero LRT Application Cartridge for this additional

sample type would significantly increase the total addressable market for Unyvero in

the United States. Newco plans to continue to expand the commercial opportunity for the

Unyvero products by developing new tests, running additional clinical trials, pursuing

expanded regulatory approvals and through sales and marketing activities intended to

help increase commercial adoption and test usage. OpGen is developing OpGen-branded Acuitas

AMR Gene Panel tests for use on the Thermo Fisher Scientific Applied Biosystems™

QuantStudio™ 5 Real-Time PCR System. The first of these new tests will be for antibiotic

resistance testing of bacterial isolates. The second indication for the Acuitas AMR Gene

Panel is for management of patients with cUTI.

|

|

|

·

|

ARESdb

and Acuitas Lighthouse informatics and services – Newco plans to pursue commercial

opportunities to provide the Acuitas Lighthouse informatics and companion genomic testing

to pharmaceutical companies, CROs, health systems, third party in vitro diagnostic

companies, and government agencies. Through OpGen’s participation in The New York

State Infectious Disease Digital Health Initiative, we anticipate deploying the Acuitas

Lighthouse Software throughout the State of New York to help identify and track patients

with Superbug infections. The focus in the health system segment is on helping guide

antibiotic decision-making and supporting patient safety initiatives. Newco intends to

actively pursue government funding for development and deployment of the Acuitas Lighthouse

informatics in the United States and internationally.

|

In support of its strategy,

we anticipate that Newco will focus on:

|

|

·

|

obtaining

FDA clearance to market the Unyvero A50 LRT test for BAL specimens and expand the base

of commercial customers;

|

|

|

·

|

entering

into strategic partnering and licensing agreements to provide funding and support further

development of the Unyvero A30 platform;

|

|

|

·

|

completing

development and clinical evaluations, obtaining necessary regulatory approvals, and successfully

commercializing the Acuitas AMR Gene Panel (Urine) for cUTIs, with a goal of achieving

three-hour antibiotic resistance analysis from the time of specimen collection;

|

|

|

·

|

commercializing

the Acuitas AMR Gene Panel tests for RUO, which started in January 2018 and for which

on May 13, 2019, we filed a 510(k) submission with the FDA for clearance for the detection

of antimicrobial resistance genes in bacterial isolates;

|

|

|

·

|

making

additional FDA 510(k) submissions for the Acuitas AMR Gene Panel (Urine) test anticipated

in the first quarter of 2020, and the Acuitas Lighthouse Software (AMR Gene Panel Prediction)

anticipated in the first half of 2020;

|

|

|

·

|

successfully

completing the demonstration project of The New York State Digital Health Initiative

to support Statewide deployment in subsequent years;

|

|

|

·

|

obtaining

third-party funding to expand the ARESdb offerings in conjunction with established in

vitro diagnostic companies;

|

|

|

·

|

expanding

our business collaborations with Merck, Sandoz and other pharmaceutical companies;

|

|

|

·

|

capitalizing

on opportunities to deploy the Acuitas Lighthouse informatics and genomic testing for

pharmaceutical/CRO services;

|

|

|

·

|

growing

the ARESdb and Acuitas Lighthouse data warehouse offerings for resistance and susceptibility

data in hospital, hospital system, or broader community applications;

|

|

|

·

|

seeking

government funding to advance programs focused on identification and treatment of MDROs;

and

|

|

|

·

|

continuing

development of the Acuitas Lighthouse Software and work to install Acuitas Lighthouse

Software to customer sites in the United States and globally.

|

Risk

Factors

Our business is subject to

numerous risks and uncertainties, including those highlighted in the section entitled “Risk Factors” immediately following

this prospectus summary. These risks include, but are not limited to, the following:

|

|

·

|

we

have a history of losses and expect to incur losses for the next several years;

|

|

|

·

|

we

have not yet consummated the Newco transaction with Curetis, and need to raise additional

funds to support our business and the operations of Curetis prior to the closing under

the Implementation Agreement, and to support Newco’s business after the closing;

|

|

|

·

|

the

transactions contemplated by the Implementation Agreement may not close because of failure

to meet one of the conditions to closing;

|

|

|

·

|

many

of the material terms of the short-term, subordinated credit facility with Curetis required

by the Implementation Agreement, or the Interim Facility, including the interest rate,

term and committed amount, have not yet been negotiated, and we may be unable to negotiate

favorable terms;

|

|

|

·

|

we

may need to pursue an additional financing to fund Newco’s operations after the

closing;

|

|

|

·

|

the

process of obtaining FDA clearance and/or approval is time-consuming and expensive, and

we may not be successful in obtaining such clearances or approvals in a timely manner

or at all;

|

|

|

·

|

our

products may never achieve significant commercial market acceptance;

|

|

|

·

|

our

contracts with government agencies could be subject to uncertain future funding;

|

|

|

·

|

our

sales cycle is lengthy and variable; and

|

|

|

·

|

we

may not be able to compete successfully with the products and services sold by other

companies in our industry, who are better capitalized than we are.

|

Nasdaq

Listing Requirements and Reverse Stock Split

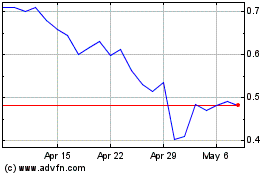

On May 6, 2019,

the Listing Qualifications Staff of the Nasdaq Capital Market notified us that the closing bid price of our common stock had,

for 30 consecutive business days preceding the date of such notice, been below the $1.00 per share minimum required for continued

listing on the Nasdaq Capital Market pursuant to Nasdaq Marketplace Rule 5550(a)(2), or the Minimum Bid Price Rule. In accordance

with Nasdaq Marketplace Rule 5810(c)(3)(A), we were provided 180 calendar days, or until November 4, 2019, to regain compliance.

If at any time before November 4, 2019, the closing bid price of our common stock is at least $1.00 for a minimum of ten consecutive

trading days, we will regain compliance.

On August 22,

2019, at the annual meeting of stockholders, our stockholders approved an amendment to our Amended and Restated Certificate of

Incorporation, authorizing a reverse stock split of the issued and outstanding shares of our common stock, at a ratio within a

range of not less than five-to-one and not more than twenty-five-to-one, such ratio and the implementation and timing of such

reverse stock split to be determined in the discretion of our Board of Directors. On August 22, 2019, our Board of Directors

approved a reverse stock split of one share for every twenty outstanding shares, or the 2019 Reverse Stock Split. On August 28,

2019, we filed an amendment to our Amended and Restated Certificate of Incorporation to effect the 2019 Reverse Stock Split. All

of the Company’s historic share and share prices in this prospectus have been adjusted to reflect the 2019 Reverse Stock

Split.

In implementing

the 2019 Reverse Stock Split, the number of shares of our common stock held by each stockholder was reduced by dividing the number

of shares held immediately before the 2019 Reverse Stock Split by twenty and then rounding down to the nearest whole share. We

are paying cash to each stockholder in lieu of issuing any fractional shares. The 2019 Reverse Stock Split did not affect any

stockholder’s percentage ownership interest in our Company or proportionate voting power, except to the extent that interests

in fractional shares were paid in cash.

In addition, we

have adjusted all outstanding shares of any restricted stock units, stock options and warrants entitling the holders to purchase

shares of our common stock as a result of the 2019 Reverse Stock Split, as required by the terms of these securities. In particular,

we have reduced the conversion ratio for each security, and increased the exercise price in accordance with the terms of each

security based on 2019 Reverse Stock Split ratio (i.e., the number of shares issuable under such securities has been divided by

twenty, and the exercise price per share has been multiplied by twenty). Also, we proportionately reduced the number of

shares reserved for issuance under our existing 2015 Equity Incentive Plan, or the 2015 Plan, based on the 2019 Reverse Stock

Split ratio. The 2019 Reverse Stock Split did not otherwise affect any of the rights currently accruing to holders of our common

stock, or options or warrants exercisable for our common stock.

We have regained

compliance with the Minimum Bid Price Rule as of September 13, 2019, as a result of the 2019 Reverse Stock Split. Although we

expect that the 2019 Reverse Stock Split will result in a sustained increase in the market price of our common stock, the 2019

Reverse Stock Split may not result in a permanent increase in the market price of our common stock, which is dependent on many

factors, including general economic, market and industry conditions and other factors detailed from time to time in the reports

we file with the SEC.

On August 19, 2019, OpGen, received

a written notification from The Nasdaq Stock Market LLC, or Nasdaq, notifying the Company that it has failed to comply with Nasdaq

Marketplace Rule 5550(b)(1) because the Company’s stockholders’ equity as of June 30, 2019 fell below the required

minimum of $2,500,000, and as of June 30, 2019, the Company did not meet the alternative compliance standards of market value

of listed securities or net income from continuing operations for continued listing. In accordance with Nasdaq’s listing

requirements, the Company had 45 calendar days to submit a plan to regain compliance. If the plan is accepted, Nasdaq can grant

the Company an extension of up to 180 calendar days from the date it received the notification to evidence compliance. The Company

submitted a plan to Nasdaq to regain compliance with the Nasdaq minimum stockholders’ equity standard on October 3, 2019,

which plan includes information regarding this offering. The Company believes that if this offering is successful, we will regain

compliance with the minimum stockholders’ equity standard for continued listing. However, there can be no assurance that

the Company’s plan will be accepted or that if it is, that the Company will be able to regain compliance.

THE OFFERING

|

Units

offered by us in this offering:

|

1,526,717

units, each consisting of one share of our common stock and one common warrant to purchase one share of our common stock.

|

|

Pre-funded units

offered by us in this offering:

|

We are also offering

to each purchaser whose purchase of units in this offering would otherwise result in the purchaser, together with its affiliates

and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our

outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if the purchaser

so chooses, pre-funded units (each pre-funded unit consisting of one pre-funded warrant to purchase one share of our common

stock and one common warrant to purchase one share of our common stock) in lieu of units that would otherwise result in the

purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding

common stock. The purchase price of each pre-funded unit will equal the price at which the units are being sold to the public in

this offering, minus $0.01, and the exercise price of each pre-funded warrant included in each pre-funded unit will be $0.01

per share. This offering also relates to the shares of common stock issuable upon exercise of any pre-funded warrants underlying

the pre-funded units sold in this offering. For each pre-funded unit we sell, the number of units we are offering will be

decreased on a one-for-one basis. Because we will issue a common warrant as part of each unit or pre-funded unit, the number

of common warrants sold in this offering will not change as a result of a change in the mix of the units and pre-funded units

sold.

|

|

Common warrants

offered by us in the offering

|

Common warrants

to purchase an aggregate of 1,526,717 shares of our common stock. Each unit and each pre-funded unit includes a common warrant

to purchase one share of our common stock. Each common warrant will have an exercise price of $ per

share, will be immediately separable from the common stock or pre-funded warrant, as the case may be, will be immediately

exercisable and will expire on the fifth anniversary of the original issuance date. This prospectus also relates to the offering

of the shares of common stock issuable upon exercise of the common warrants.

|

|

Option to purchase additional securities:

|

The underwriter has a 30-day option to purchase up to 229,007 additional shares of our common stock and/or

warrants to purchase up to an additional 229,007 shares of our common stock from us at the public offering price, less underwriting

discounts and commissions.

|

|

Common stock outstanding prior to this offering:

|

882,268 shares of

common stock.

|

|

Common stock outstanding

after this offering:

|

2,408,985 shares

(or 2,637,992 shares if the underwriter exercises its option to purchase additional shares in full), in each case assuming

no sale of pre-funded units and no exercise of the common warrants issued in this offering.

|

|

Use of Proceeds:

|

We

currently intend to use the net proceeds of this offering for the following purposes: prior to the closing of the transactions

contemplated by the Implementation Agreement to (1) complete the business combination with Curetis; (2) provide short-term

funding to Curetis under the Interim Facility to fund the Curetis Group’s current operations; and (3) support research

and development and regulatory activities for the Company’s anticipated FDA 510(k) submissions for the Acuitas AMR Gene

Panel test and the Acuitas Lighthouse Software; and, if any proceeds remain following the closing of the transactions under

the Implementation Agreement, to: (4) commercialize Newco’s products, with a focus on the Unyvero platform and diagnostic

tests, and the Acuitas AMR Gene Panel tests; (5) support further development and commercialization of the Ares Genetics database

and Acuitas Lighthouse Software; (6) fund directed efforts to the customers and collaborators of each company to introduce

the products and services of Newco; (7) invest in manufacturing and operations infrastructure to support sales of products;

and (8) the balance, if any, for general corporate purposes. If the transactions under the Implementation Agreement do not

close, to the extent any proceeds remain, we plan to use any remaining proceeds to support OpGen’s operations as far

as possible into 2020. Many of the material terms of the Interim Facility, including the interest rate, term and committed

amount, have not yet been negotiated, and we may be unable to negotiate favorable terms. See “Use of Proceeds”

on page 64 of this prospectus and “Risk Factors” beginning on page 34 of this prospectus.

|

|

Risk Factors:

|

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 34 of this prospectus and the other information included or incorporated by reference in this prospectus.

|

|

Nasdaq Capital

Market symbol:

|

“OPGN.”

There is no established trading market for the common warrants or the pre-funded warrants, and we do not expect a trading

market to develop. We do not intend to list the common warrants or the pre-funded warrants on Nasdaq, any national securities

exchange or any other nationally-recognized trading system. Without an active trading market, the liquidity of the common

warrants and pre-funded warrants will be limited.

|

The number of shares of common stock to be outstanding immediately after this offering is based on 882,268 shares of our common

stock outstanding as of June 30, 2019, and excludes:

|

|

·

|

10,542 shares of common stock issuable

upon the exercise of outstanding options granted as of June 30, 2019, under our equity incentive plans at a weighted average exercise

price of $410.31 per share;

|

|

|

·

|

175,982

shares of common stock issuable upon the

exercise of outstanding warrants issued as of June 30, 2019, at a weighted average exercise

price of $288.25 per share;

|

|

|

·

|

15,663 shares of common stock issuable upon vesting of outstanding restricted stock units granted

as of June 30, 2019; and

|

|

|

·

|

4,221 shares of common stock available for future issuance under our equity incentive plans as

of June 30, 2019;

|

|

|

·

|

76,335 shares

of common stock, or 87,786 shares of common stock if the underwriter exercises its option

to purchase additional securities in full, issuable upon exercise of warrants to be issued

to the underwriter at an exercise price of 130% of the public offering price as described

in “Underwriting,”

|

|

|

·

|

1,526,717

shares of common stock issuable upon the exercise of the common warrants to be issued

to purchasers in this offering at an exercise price of $ per

share; and

|

|

|

·

|

up to 2,662,564 shares of common stock issuable pursuant to the terms of the Implementation Agreement.

|

The number of outstanding options,

restricted stock units and shares of common stock available for future issuances under our equity incentive plans does not reflect

grants of 1,500 shares of common stock issuable upon vesting of restricted stock units, the expiration of stock options to purchase

499 shares of our common stock, forfeitures of stock options to purchase 107 shares of our common stock or forfeitures of 500

shares of our common stock issuable upon vesting of restricted stock units since June 30, 2019.

Unless otherwise indicated, all information

contained in this prospectus assumes (i) that the underwriter has not exercised its option to purchase additional securities, (ii) no sale of pre-funded units in this offering, which, if sold, would reduce the number of units that we are offering

on a one-for-one basis, and (iii) no exercise of options issued under our equity incentive plans or of warrants, including the

common warrants offered in this offering and the underwriter’s warrants to be issued to the underwriter in connection with

this offering.

Company and Other Information

OpGen, Inc. was incorporated in Delaware in 2001. On July

14, 2015, the Company acquired AdvanDx, Inc., a Delaware corporation, as a wholly-owned subsidiary in a merger transaction, or

the AdvanDx Merger. On September 3, 2019, we formed Crystal GmbH, a private limited liability company organized under the laws

of the Federal Republic of Germany for the sole purpose of acquiring the Transferred Shares and transferred assets and liabilities

of the Curetis business. Our principal executive office is located at 708 Quince Orchard Road, Gaithersburg, Maryland, 20878,

and our telephone number is (240) 813-1260. The Company also has operations in Copenhagen, Denmark and Bogota, Colombia. Our website

address is www.opgen.com. We do not incorporate the information on or accessible through our website into this prospectus, and

you should not consider any information on, or that can be accessed through, our website as part of this prospectus.

Implications

of Being an Emerging Growth Company

As a company with less than

$1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the

Jumpstart Our Business Startups Act, or the JOBS Act, enacted in April 2012. An “emerging growth company” may take

advantage of exemptions from some of the reporting requirements that are otherwise applicable to public companies. These exceptions

include:

|

|

·

|

being

permitted to present only two years of audited financial statements and only two years

of related Management’s Discussion and Analysis of Financial Condition and Results

of Operations in this prospectus;

|

|

|

·

|

not

being required to comply with the auditor attestation requirements of Section 404 of

the Sarbanes-Oxley Act of 2002, as amended;

|

|

|

·

|

reduced

disclosure obligations regarding executive compensation in our periodic reports, proxy

statements and registration statements; and

|

|

|

·

|

exemptions

from the requirements of holding a nonbinding advisory vote on executive compensation

and stockholder approval of any golden parachute payments not previously approved.

|

We may take advantage of these

provisions until the last day of our fiscal year following the fifth anniversary of the closing of our initial public offering

in May 2015. However, if certain events occur prior to the end of such five-year period, including if we become a “large

accelerated filer,” our annual gross revenue exceeds $1.07 billion or we issue more than $1.0 billion of non-convertible

debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage

of certain of the reduced disclosure obligations in this prospectus and may elect to take advantage of other reduced reporting

requirements in future filings. As a result, the information that we provide to our stockholders may be different than you might

receive from other public reporting companies in which you hold equity interests.

In addition, the JOBS Act

provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised

accounting standards. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject

to the same new or revised accounting standards as other public companies that are not emerging growth companies.

OPGEN

SUMMARY FINANCIAL DATA

The following summary financial

data should be read together with our financial statements and related notes, and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” included in our latest Annual Report on Form 10-K and Quarterly Reports

on Form 10-Q and incorporated by reference into this prospectus. The summary statements of operations data for the years ended

December 31, 2018 and 2017 and the six months ended June 30, 2019 and 2018, and the balance sheet data as of June 30, 2019 have

been derived from our audited financial statements and unaudited interim condensed financial statements incorporated by reference

into this prospectus. Historical results are not necessarily indicative of the results that may be expected in the future.

|

|

|

Year

Ended

December

31,

|

|

Six

Months Ended

June 30,

|

|

|

|

2018

|

|

2017

|

|

2019

|

|

2018

|

|

|

|

(In thousands,

except per share data)

|

|

|

|

|

|

|

|

(Unaudited)

|

|

Statements of Operation Data:

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

2,946

|

|

|

$

|

3,211

|

|

|

|

2,030

|

|

|

|

1,635

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products sold

|

|

|

1,223

|

|

|

|

1,613

|

|

|

|

419

|

|

|

|

646

|

|

|

Cost of services(1)

|

|

|

626

|

|

|

|

520

|

|

|

|

396

|

|

|

|

348

|

|

|

Research and development(1)

|

|

|

5,677

|

|

|

|

6,883

|

|

|

|

2,930

|

|

|

|

2,535

|

|

|

General and administrative(1)

|

|

|

7,069

|

|

|

|

6,693

|

|

|

|

3,340

|

|

|

|

3,622

|

|

|

Sales and marketing(1)

|

|

|

1,532

|

|

|

|

2,768

|

|

|

|

766

|

|

|

|

756

|

|

|

Impairment of right-of-use

asset

|

|

|

—

|

|

|

|

—

|

|

|

|

521

|

|

|

|

—

|

|

|

Total operating expenses(1)

|

|

|

16,127

|

|

|

|

18,477

|

|

|

|

8,372

|

|

|

|

7,907

|

|

|

Operating loss

|

|

|

(13,181

|

)

|

|

|

(15,266

|

)

|

|

|

(6,342

|

)

|

|

|

(6,272

|

)

|

|

Interest and other (expense) income

|

|

|

5

|

|

|

|

(87

|

)

|

|

|

(9

|

)

|

|

|

5

|

|

|

Interest expense

|

|

|

(191

|

)

|

|

|

(233

|

)

|

|

|

(94

|

)

|

|

|

(112

|

)

|

|

Foreign currency transaction gains (losses)

|

|

|

(10

|

)

|

|

|

23

|

|

|

|

—

|

|

|

|

(10

|

)

|

|

Change in fair value of derivative financial instruments

|

|

|

8

|

|

|

|

144

|

|

|

|

—

|

|

|

|

8

|

|

|

Provision for income taxes

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Net loss

|

|

$

|

(13,369

|

)

|

|

$

|

(15,419

|

)

|

|

|

(6,445

|

)

|

|

|

(6,381

|

)

|

|

Net loss per common share, basic and diluted

|

|

$

|

(44.69

|

)

|

|

$

|

(195.95

|

)

|

|

|

(9.54

|

)

|

|

|

(25.78

|

)

|

|

Weighted average shares outstanding—basic and diluted

|

|

|

300

|

|

|

|

79

|

|

|

|

676

|

|

|

|

248

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Includes

stock-based compensation as follows:

|

|

|

|

Year Ended

December 31,

|

|

Six Months Ended

June 30,

|

|

|

|

2018

|

|

2017

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

(Unaudited)

|

|

Cost of services

|

|

$

|

1

|

|

|

$

|

14

|

|

|

$

|

1

|

|

|

$

|

4

|

|

|

Research and development

|

|

|

241

|

|

|

|

237

|

|

|

|

35

|

|

|

|

131

|

|

|

General and administrative

|

|

|

574

|

|

|

|

604

|

|

|

|

137

|

|

|

|

292

|

|

|

Sales and marketing

|

|

|

46

|

|

|

|

57

|

|

|

|

11

|

|

|

|

25

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stock-based compensation

|

|

$

|

862

|

|

|

$

|

912

|

|

|

$

|

184

|

|

|

$

|

452

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As

of June 30, 2019

|

|

|

|

Actual

|

|

As

Adjusted

|

|

|

|

(In thousands)

|

|

Balance Sheet Data:

|

|

(Unaudited)

|

|

Cash and cash equivalents

|

|

$

|

3,056

|

|

|

$

|

11,950

|

|

|

Working capital (deficiency)

|

|

|

(584

|

)

|

|

|

8,310

|

|

|

Total assets

|

|

|

8,933

|

|

|

|

17,826

|

|

|

Accumulated deficit

|

|

|

(168,525

|

)

|

|

|

(168,525

|

)

|

|

Total stockholders’ equity

|

|

|

1,827

|

|

|

|

10,721

|

|

The preceding table presents

a summary of our balance sheet data as of June 30, 2019:

|

|

·

|

on

an as adjusted basis to give effect to the receipt of the estimated net proceeds from

the sale of an aggregate of 1,526,717 units and no pre-funded units in this offering

at the assumed public offering price of $6.55 per unit and the issuance of 1,526,717

shares of common stock included in the units.

|

CURETIS

BUSINESS SUMMARY FINANCIAL DATA

For purposes of the Curetis Business combined financial

statements included in this prospectus, we refer to the business of Curetis N.V., principally operated by Curetis GmbH and its

subsidiaries, or the Curetis Group, as the Curetis Business. In the Curetis Business combined financial statements included in

the prospectus, the business of Curetis N.V. is presented, which comprises the Curetis Group as well as the Curetis Convertible

Notes that are assumed by OpGen pursuant to the Implementation Agreement and certain costs related to the Curetis Business, primarily

related to the compensation of certain members of senior management and its supervisory board that were historically incurred

by Curetis N.V. but not charged to the Curetis Group.

The following summary financial data

should be read together with the combined financial statements and related notes of the Curetis Business included in this prospectus.

The combined statements of operations and other comprehensive income for the years ended December 31, 2018 and 2017, have been

derived from the audited, combined financial statements of the Curetis Business for the years ended December 31, 2018 and 2017

included in the prospectus. All Curetis financial results and measures in this prospectus, other than the Curetis Business combined

financial statements, have been translated from Euros to U.S. dollars using the translation rates listed below or, otherwise,

of $1.13667 to €1.00 as of June 30, 2019, based on Oanda.com. These translation rates are provided for convenience only,

and OpGen makes no representation that the Euro amounts could have been, or could be, converted, realized or settled in U.S. dollars

at that rate on June 30, 2019, or at any other rate.

The unaudited combined interim financial

statements of the Curetis Business for the six months ended June 30, 2019 and 2018, and the combined statement of financial position

data as of June 30, 2019, have been derived from the unaudited interim condensed combined financial statements of the Curetis

Business as of and for the six months ended June 30, 2019. The combined financial statements as of and for the years ended December

31, 2018 and 2017 were prepared in accordance with IFRS as issued by the IASB. The unaudited interim condensed combined financial

statements of the Curetis Business were prepared in accordance with IFRS as issued by the IASB applicable for interim reporting

(IAS 34). Historical results are not necessarily indicative of the results that may be expected in the future.

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

|

|

Six Months Ended

|

|

|

|

December

31,

|

|

June

30,

|

|

|

|

2018

|

|

2017

|

|

2019

|

|

2018

|

|

Statements of Profits or Loss:

|

|

(In thousands

of USD (1))

|

|

Revenue

|

|

$

|

1,623

|

|

|

$

|

1,422

|

|

|

$

|

1,237

|

|

|

$

|

940

|

|

|

Cost of sales

|

|

|

(1,558

|

)

|

|

|

(1,582

|

)

|

|

|

(1,525

|

)

|

|

|

(1,275

|

)

|

|

Gross loss

|

|

|

65

|

|

|

|

(160

|

)

|

|

|

(288

|

)

|

|

|

(335

|

)

|

|

Distribution costs

|

|

|

(9,318

|

)

|

|

|

(8,632

|

)

|

|

|

(3,717

|

)

|

|

|

(4,903

|

)

|

|

Administrative expenses

|

|

|

(4,092

|

)

|

|

|

(3,815

|

)

|

|

|

(1,832

|

)

|

|

|

(2,175

|

)

|

|

Research & development expenses

|

|

|

(12,085

|

)

|

|

|

(8,786

|

)

|

|

|

(4,752

|

)

|

|

|

(5,451

|

)

|

|

Other income

|

|

|

715

|

|

|

|

206

|

|

|

|

130

|

|

|

|

220

|

|

|

Operating loss

|

|

|

(24,715

|

)

|

|

|

(21,187

|

)

|

|

|

(10,459

|

)

|

|

|

(12,644

|

)

|

|

Finance income

|

|

|

39

|

|

|

|

13

|

|

|

|

8

|

|

|

|

58

|

|

|

Finance costs

|

|

|

(1,374

|

)

|

|

|

(835

|

)

|

|

|

(846

|

)

|

|

|

(575

|

)

|

|

Finance result -- net

|

|

|

(1,335

|

)

|

|

|

(822

|

)

|

|

|

(838

|

)

|

|

|

(517

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes

|

|

|

(26,050

|

)

|

|

|

(22,009

|

)

|

|

|

(11,297

|

)

|

|

|

(13,161

|

)

|

|

Income tax expense

|

|

|

(41

|

)

|

|

|

65

|

|

|

|

(64

|

)

|

|

|

30

|

|

|

Loss for the period

|

|

$

|

(26,091

|

)

|

|

$

|

(21,944

|

)

|

|

$

|

(11,361

|

)

|

|

$

|

(13,131

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Convenience translation performed from Euros to U.S. Dollars

using the following exchange rate in effect as of each period end:

|

|

|

1.14379

|

|

|

|

1.19786

|

|

|

|

1.13667

|

|

|

|

1.16478

|

|

|

|

|

As

of June 30, 2019

|

|

Consolidated Statement of Financial Position

Data

|

|

|

(In

thousands of USD (1))

|

|

|

Cash and cash equivalents

|

|

|

5,432

|

|

|

Working capital

|

|

|

5,719

|

|

|

Total assets

|

|

|

26,478

|

|

|

Accumulated deficit

|

|

|

(193,632

|

)

|

|

Total equity

|

|

|

(3,347

|

)

|

|

|

|

|

|

|

|

(1) Convenience translation performed from Euros to U.S. Dollars

using the following exchange rate in effect as of June 30, 2019:

|

|

|

1.13667

|

|

UNAUDITED

PRO FORMA CONSOLIDATED COMBINED FINANCIAL INFORMATION

The following unaudited pro

forma condensed combined financial information was prepared using the acquisition method of accounting under U.S. GAAP.

For purposes of these unaudited pro forma condensed combined

financial information, we refer to the business of Curetis N.V., principally operated by Curetis GmbH and its subsidiaries as

the Curetis Business. In the Curetis Business combined financial statements included in the prospectus, the business of Curetis

N.V. is presented, which comprises the Curetis Group as well as the Curetis Convertible Notes that are assumed by OpGen pursuant

to the Implementation Agreement and certain costs related to the Curetis Business, primarily related to the compensation of certain

members of senior management and its supervisory board that were historically incurred by Curetis N.V. but not charged to the

Curetis Group.

If the business combination contemplated by the Implementation

Agreement was consummated prior to this offering, it would be accounted for as a reverse acquisition in accordance with U.S. GAAP.

Under this method of accounting, the Curetis Business would be deemed to be the accounting acquirer for financial reporting purposes.

This determination is primarily based on the facts that, immediately following the announcement of the business combination: (i)

if issued as of the date of this prospectus, Curetis N.V. would own a substantial majority of the voting rights of OpGen, (ii)

Curetis N.V. has the contractual right to designate a majority of the members of the initial board of directors of OpGen after

the closing; and (iii) the chief executive officer of the Curetis Business will be the Chief Executive Officer of OpGen after

the closing. Accordingly, if these facts remain, for accounting purposes, the business combination will be treated as the equivalent

of the Curetis Business issuing stock to acquire OpGen. As a result, as of the closing date of the business combination, the net

assets of OpGen would be recorded at their acquisition-date fair values in the financial statements of the Curetis Business and

the reported operating results prior to the business combination would be those of the Curetis Business. In addition, transaction

costs incurred by Curetis in connection with the business combination would be expensed as incurred.

We cannot assure you that the business combination will

be accounted for as a reverse acquisition. The final determination will be made after this offering is completed and once the

business combination is completed. In addition, the boards of Curetis and OpGen expect that the size of the post-closing Board

of OpGen will be up to seven members, with OpGen having input as to three of such members, and the current Chief Financial Officer

of OpGen will continue as the Chief Financial Officer of OpGen after the closing. Other than the change in Chief Executive Officer,

there is also no current intention to replace any existing executive officers of OpGen. OpGen and Curetis will re-assess the accounting

for the business combination after the consummation of this offering. However, we have assumed, for purposes of these unaudited

pro forma condensed combined financial statements, that Curetis N.V. will continue to hold a majority of the outstanding shares

of OpGen common stock at the closing, and that other indicia of control will lead to a determination that the business combination

should be accounted for as a reverse acquisition.

The unaudited pro forma condensed

combined balance sheet data assume that the business combination took place on June 30, 2019 and combines the historical

balance sheets of OpGen and the Curetis Business as of such date. The unaudited pro forma condensed combined balance sheet data

also assume the minimum capital raise, as required by the Implementation Agreement, was completed on June 30, 2019. The unaudited

pro forma condensed combined statement of operations data for the year ended December 31, 2018 and the six months ended June 30,

2019, assume that the business combination took place as of January 1, 2018, and combine the historical results of OpGen

and the Curetis Business for the year ended December 31, 2018 and the six months ended June 30, 2019, respectively.

The unaudited pro forma condensed combined financial information was prepared in accordance with the rules and regulations of

Article 11 of SEC Regulation S-X. The historical financial statements of OpGen and the Curetis Business have been adjusted

to give pro forma effect to events that are (i) directly attributable to the transaction, (ii) factually supportable,

and (iii) with respect to the unaudited pro forma condensed combined statements of operations, expected to have a continuing

impact on Newco’s results.

The combined financial statements

of the Curetis Business were prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the

International Accounting Standards Board, or IASB. The consolidated financial statements of OpGen were prepared in accordance

with U.S. GAAP. OpGen has performed a preliminary analysis and has not identified significant differences identified between IFRS

and U.S. GAAP for the purposes of presenting the unaudited pro forma condensed combined financial statements. In addition, the

unaudited condensed combined financial statements reflect reclassifications to conform the Curetis Business historical accounting

presentation to OpGen’s accounting presentation.

The consolidated financial

statements of OpGen are presented in US dollars, or USD, whereas, the financial statements of the Curetis Business are presented

in Euros. Therefore, the unaudited pro forma condensed combined financial information includes adjustments to convert the Curetis

Business’s financial information from Euros to USD.

OpGen's assets and liabilities

will be measured and recognized at their fair values as of the transaction date and combined with the assets, liabilities and

results of operations of the Curetis Business after the consummation of the business combination. The allocation of the purchase

price to acquired assets and assumed liabilities based on their underlying fair values requires the extensive use of significant

estimates and management’s judgment. The allocation of the purchase price is preliminary at this time, and will remain as

such until management completes valuations and other studies in order to finalize the valuation of the net assets acquired. These

provisional estimates will be adjusted upon the availability of further information regarding events or circumstances which exist

at the acquisition date and such adjustments may be significant. OpGen’s intangible assets have not yet been determined

and, therefore, the allocation of the purchase price in excess of OpGen’s net assets is shown entirely as goodwill.

The unaudited pro forma condensed

combined financial information is based on the assumptions and adjustments that are described in the accompanying notes. Accordingly,

the pro forma adjustments are preliminary, subject to further revision as additional information becomes available and additional

analyses are performed, including but not limited to the final assessment of the accounting acquirer, of the determination of

differences between IFRS and US GAAP, and of the application of purchase price adjustments, and have been made solely for the

purpose of providing unaudited pro forma condensed combined financial information. Differences between these preliminary estimates

and the final accounting, expected to be completed after the closing of the business combination, will occur and these differences

could have a material impact on the accompanying unaudited pro forma condensed combined financial information and the combined

company's future results of operations and financial position. In addition, depending on the number of shares issued in the interim

equity offering contemplated by this prospectus, the method for accounting of the business combination could change.

The unaudited pro forma condensed