Report of Foreign Issuer (6-k)

October 08 2019 - 4:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2019

Commission File Number: 001-34476

BANCO SANTANDER (BRASIL) S.A.

(Exact name of registrant as specified in its charter)

Avenida Presidente Juscelino Kubitschek, 2041 and 2235

Bloco A – Vila Olimpia

São Paulo, SP 04543-011

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ___X___ Form 40-F _______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

BANCO SANTANDER (BRASIL) S.A.

Public-Held Company with Authorized Capital

Corporate Taxpayer’s Registry No 90.400.888/0001-42

Company Registry (NIRE) No 35.300.332.067

MATERIAL FACT

BANCO SANTANDER (BRASIL) S.A., pursuant to Rulings Nos. 358/02 and 480/09 of the Brazilian Securities Exchange Commission (Comissão de Valores Mobiliários – CVM), and in accordance with the best corporate governance practices, hereby informs its shareholders and the market in general that, on this date, it announced projections to some of its indicators for the year of 2022, based on reasonable premises of the management, which, however, are subject to significant uncertainties, and many of which are not and shall not be under control of the Company management:

|

|

|

|

|

Loan portfolio (average growth)

|

R$ 317,625MM

|

>10%

|

|

ROE

|

21.3%

|

~21%

|

|

C/I (end of term)

|

39.4%

|

~38%

|

|

Active customers (average growth)

|

25.5MM

|

>7%

|

|

Prospera customers

|

368 thousand

|

>1MM

|

BR GAAP data.

The abovementioned indicators will be included in the Company Reference Form, according to the applicable regulation.

Any changes in perception or in the criteria considered for the projections above may cause the results to differ from the indicators.

São Paulo, October 08, 2019.

Angel Santodomingo

Investor Relations Officer

Banco Santander (Brasil) S.A.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: October 8, 2019

|

Banco Santander (Brasil) S.A.

|

|

|

|

|

|

By:

|

/S/ Amancio Acurcio Gouveia

|

|

|

|

Amancio Acurcio Gouveia

Officer Without Specific Designation

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/S/ Angel Santodomingo Martell

|

|

|

|

Angel Santodomingo Martell

Vice - President Executive Officer

|

|

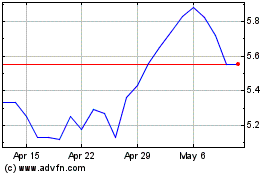

Banco Santander Brasil (NYSE:BSBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

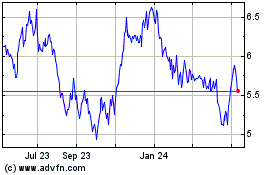

Banco Santander Brasil (NYSE:BSBR)

Historical Stock Chart

From Apr 2023 to Apr 2024