As filed with the Securities and

Exchange Commission on October 8, 2019

Registration No. 333-233665

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment

No. 1

to

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

JAKKS

PACIFIC, INC.

(Exact name of registrant as specified in

its charter)

|

Delaware

(State or other jurisdiction of incorporation

or

organization)

|

95-4527222

(I.R.S. Employer Identification Number)

|

2951 28th Street

Santa Monica, California 90405

(424) 268-9444

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Stephen G. Berman

JAKKS Pacific, Inc.

2951 28th Street

Santa Monica, California 90405

(424) 268-9444

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

Copy to:

|

Van C. Durrer II, Esq.

P. Michelle Gasaway, Esq.

Skadden, Arps, Slate, Meagher &

Flom LLP

300 South Grand Avenue

Los Angeles, California 90071

(213) 687-5000

|

Irving Rothstein, Esq.

Feder Kaszovitz LLP

845 Third Avenue

New York, New York 10022-6601

(212) 888-8200

Fax: (212) 888-7776

|

From time to time after the effective

date of this Registration Statement.

(Approximate date of commencement of proposed

sale to the public)

If the only securities

being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box: ¨

If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities

Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. x

If this Form is

filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for

the same offering. ¨

If this Form is

a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is

a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is

a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ¨

Indicate by check mark

whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer x

|

|

Non-accelerated filer ¨

|

Smaller reporting company ¨

|

|

|

Emerging growth company ¨

|

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities

to be registered

|

|

Amount to be registered

|

|

Proposed

maximum

offering

price per

unit(2)

|

|

|

Proposed maximum

aggregate offering

price(2)

|

|

|

Amount of

registration fee(4)

|

|

|

Common Stock, par value $.001 per share

|

|

52,581,277 shares(1)

|

|

$

|

0.73

|

(3)

|

|

$

|

38,384,332.21

|

|

|

$

|

4,652.18

|

|

|

|

(1)

|

All common stock offered hereby is for the account of the selling security holders and pursuant to

Rule 416 under the Securities Act of 1933, as amended (“Securities Act”), includes such indeterminate number of shares

of common stock as may be issuable with respect to the common stock being registered hereunder as a result of stock splits, stock

dividends or similar transactions.

|

|

|

(2)

|

Estimated solely for the purpose

of computing the amount of the registration fee pursuant to Rule 457(c).

|

|

|

(3)

|

Pursuant to Rule 457(c), represents the average of the high and low sales prices of our common stock

for any of the five business preceding the date hereof.

|

|

|

(4)

|

JAKKS Pacific, Inc. previously paid $2,801.73 with respect to 9,185,250

shares of common stock previously registered and remaining unissued under the Registration Statement on Form

S-3 (333-221944), filed by JAKKS Pacific, Inc. on December 8, 2017. Pursuant to Rule 457(p), such

unutilized filing fees are being applied to the filing fee payable pursuant to this Registration Statement. The balance of

the filing fee was paid with the initial filing of this Registration Statement.

|

The registrant hereby amends this

registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a

further amendment which specifically states that this registration statement shall thereafter become effective in accordance with

section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as

the Commission acting pursuant to said section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. The selling security holders may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it

is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED October 8, 2019

PRELIMINARY PROSPECTUS

52,581,277 Shares

JAKKS

PACIFIC, INC.

Common Stock

This prospectus relates

to (i) 46,728,275 shares of the common stock, par value of $0.001 per share (our “common stock”), of JAKKS Pacific,

Inc. (the “Company”), underlying convertible notes owned by Oasis Investments II Master Fund Ltd (“Oasis”)

and (ii) 5,853,002 shares of our common stock owned by the other persons listed under the caption “Selling Stockholders”

on page 15 (the “Investor Parties,” and together with Oasis, the “selling stockholders”). The

shares may be sold from time to time by the selling stockholders. None of the shares registered herein will be sold for our account

and we will not receive any proceeds from the sale of the common stock. See “Use of Proceeds.”

Our common stock is

listed on The Nasdaq Stock Market LLC, or the Nasdaq, under the symbol “JAKK.” If any other securities offered by this

prospectus will be listed on a securities exchange, such listing will be described in the applicable prospectus supplement.

Investment in our

securities involves risks, including those described under “Risk Factors” beginning on page 7 of this prospectus.

You should carefully read and consider these risk factors and the risk factors included in the reports that we file under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), in any prospectus supplement relating to specific offerings

of securities and in other documents that we file with the Securities and Exchange Commission.

Neither the Securities

and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities

or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is .

TABLE OF CONTENTS

ABOUT

THIS PROSPECTUS

References in this

prospectus to “we,” “us,” “our” or the “Company” mean JAKKS Pacific, Inc. and its

consolidated subsidiaries, unless the context otherwise requires.

This prospectus is

part of a Registration Statement on Form S-3, or the Registration Statement, that we filed with the Securities and Exchange

Commission, or SEC, using the “shelf” registration process. Under this process, the selling stockholders may sell the

securities described in the prospectus in one or more offerings. A prospectus supplement may also add, update or change information

contained in this prospectus. You should read both this prospectus and any prospectus supplement together with additional information

described under the heading “Where You Can Find More Information.”

In connection with

this offering, no person is authorized to give any information or to make any representations not contained or incorporated by

reference in this prospectus. If information is given or representations are made, you may not rely on that information or representations

as having been authorized by us. This prospectus is neither an offer to sell nor a solicitation of an offer to buy any securities

other than those registered by this prospectus, nor is it an offer to sell or a solicitation of an offer to buy securities where

an offer or solicitation would be unlawful.

You should rely only

on the information contained in or incorporated by reference into this prospectus or any applicable prospectus supplement. Neither

we nor or the selling stockholders have authorized anyone to provide you with different information. If anyone provides you with

different or inconsistent information, you should not rely on it. The selling stockholders will not make an offer of the securities

in any jurisdiction where it is unlawful. You should assume that the information in this prospectus and any applicable prospectus

supplement, and any related free writing prospectus that we prepare, as well as the information in any document incorporated or

deemed to be incorporated into this prospectus and any applicable prospectus supplement, is accurate only as of the date on the

front cover of the documents containing the information.

WHERE

YOU CAN FIND MORE INFORMATION

We file annual, quarterly

and current reports, proxy statements and other information with the SEC, as required by the Exchange Act. You can review our electronically

filed reports, proxy and information statements, and other information regarding us on the SEC’s Internet site at http://www.sec.gov.

The information contained on the SEC’s website is expressly not incorporated by reference into this prospectus.

Our SEC filings are

also available on our website, www.jakks.com. The information on or accessible from this website is expressly not incorporated

by reference into, and does not constitute a part of, this prospectus.

This prospectus contains

summaries of provisions contained in some of the documents discussed in this prospectus, but reference is made to the actual documents

for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents

referred to in this prospectus have been filed or will be filed or incorporated by reference as exhibits to the registration statement

of which this prospectus is a part. If any contract, agreement or other document is filed or incorporated by reference as an exhibit

to the registration statement, you should read the exhibit for a more complete understanding of the document or matter involved.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to

“incorporate by reference” into this prospectus information we file with the SEC in other documents. This means that

we can disclose important information to you by referring to another document we filed with the SEC. The information relating to

us contained in this prospectus should be read together with the information in the documents incorporated by reference.

We incorporate by reference

the documents listed below that we have previously filed with the SEC (other than any document or portion of any document furnished

or deemed furnished and not filed in accordance with SEC rules, including Items 2.02 and 7.01 of Form 8-K and Item 9.01 related

thereto):

|

|

(a)

|

our Annual Report on Form 10-K for the year ended December 31, 2018, filed with the SEC on March

18, 2019;

|

|

|

(b)

|

our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2019 and June 30, 2019, filed

with the SEC on May 9, 2019 and August 9, 2019, respectively;

|

|

|

(c)

|

our Current Reports on Form

8-K filed with the SEC on January

11, 2019, April

4, 2019, June

28, 2019, July

5, 2019, August

9, 2019, August

16, 2019 and September

23, 2019 and our Current Report on Form 8-K/A filed with the SEC on April

8, 2019; and

|

|

|

(d)

|

the description of our common stock contained in our Registration Statement on Form 8-A (File No.

0-28104), filed on March 29, 1996, including any amendments or reports filed for the purpose of updating that description, and

as incorporated therein by reference to our Registration Statement on Form SB-2 (Reg. No. 333-2048-LA).

|

We are also incorporating

by reference all additional documents filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act

of 1934, as amended, after the date of this prospectus and prior to the termination of the offering, other than any document or

portion of any document furnished or deemed furnished and not filed in accordance with SEC rules, including Items 2.02 and 7.01

on Form 8-K and Item 9.01 related thereto.

The information incorporated

by reference is considered to be part of this prospectus, and information that we file later with the SEC and incorporate by reference

in this prospectus will automatically update and supersede this previously filed information, as applicable, including information

in previously filed documents or reports that have been incorporated by reference into this prospectus. Any statement so modified

or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. You should not

assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front

cover of this prospectus (or any earlier date specified with respect to such information) or that any information we have incorporated

by reference is correct on any date subsequent to the date of the document incorporated by reference (or any earlier date specified

with respect to such information).

We will provide to

each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the reports or documents

that have been incorporated by reference into this prospectus but not delivered herewith. We will provide such reports or documents

upon written or oral request, at no cost to the requestor. Requests for incorporated reports or documents must be made to:

JAKKS Pacific, Inc.

2951 28th Street

Santa Monica, California 90405

Attention: Brent T. Novak

Telephone: (424) 268-9444

FORWARD

LOOKING STATEMENTS

This prospectus

includes or incorporates by reference, and any prospectus supplement will include or incorporate by reference, “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, (the “Securities Act”) and Section

21E of the Securities Exchange Act of 1934 (the “Securities Act”). For example, statements included in this prospectus,

any prospectus supplement and the documents incorporated by reference herein and therein regarding our financial position, business

strategy and other plans and objectives for future operations, and assumptions and predictions about future product demand, supply,

manufacturing, costs, marketing and pricing factors are all forward-looking statements. When we use words like “intend,”

“anticipate,” “believe,” “estimate,” “plan,” “will” or “expect,”

we are making forward-looking statements. We believe that the assumptions and expectations reflected in such forward-looking statements

are reasonable, based on information available to us on the date hereof, but we cannot assure you that these assumptions and expectations

will prove to have been correct or that we will take any action that we may presently be planning. We have disclosed certain important

factors that could cause our actual results to differ materially from our current expectations elsewhere in our incorporated filings.

You should understand that forward-looking statements made in this prospectus, any accompanying prospectus supplement and the

documents incorporated herein and therein, are necessarily qualified by these factors. We are not undertaking to publicly update

or revise any forward-looking statement if we obtain information or upon the occurrence of future events or otherwise.

The

Company

Company Overview

We are a leading multi-line,

multi-brand toy company that designs, produces, markets and distributes toys and related products, consumables and related products,

electronics and related products, kids indoor and outdoor furniture, and other consumer products. We focus our business on acquiring

or licensing well-recognized trademarks and brand names, most with long product histories (“evergreen brands”). We

seek to acquire these evergreen brands because we believe they are less subject to market fads or trends. We also develop proprietary

products marketed under our own trademarks and brand names, and have historically acquired complementary businesses to further

grow our portfolio. For accounting purposes, our products have been divided into three segments: (i) U.S. and Canada, (ii) International

and (iii) Halloween. Segment information with respect to revenues, assets and profits or losses attributable to each segment is

contained in Note 3 to the audited consolidated financial statements incorporated by reference into this prospectus. Our products

include:

Traditional Toys and

Electronics

|

|

·

|

Action figures and accessories, including licensed characters based on the Harry Potter®,

Incredibles 2, and Nintendo® franchises;

|

|

|

·

|

Toy vehicles, including Max Tow®, Road Champs®, Fly Wheels® and

MXS® toy vehicles and accessories;

|

|

|

·

|

Dolls and accessories, including small dolls, large dolls, fashion dolls and baby dolls based on

licenses, including Disney Frozen, Disney Princess, Fancy Nancy, Minnie Mouse Fashion Dolls; and infant

and pre-school products based on PBS’s Daniel Tiger’s Neighborhood®;

|

|

|

·

|

Private label products as “exclusives” for certain retail customers in various product

categories; and

|

|

|

·

|

Foot-to-floor ride-on products, including those based on Fisher Price®, Nickelodeon,

and Entertainment One licenses and inflatable environments, tents and wagons;

|

Role Play, Novelty

and Seasonal Toys

|

|

·

|

Role play, dress-up, pretend play and novelty products for boys and girls based on well-known brands

and entertainment properties such as Disney Frozen, Black & Decker®, Disney Princess, and Fancy

Nancy, as well as those based on our own proprietary brands;

|

|

|

·

|

Indoor and outdoor kids’ furniture, activity trays and tables and room décor; kiddie

pools, seasonal and outdoor products, including those based on Disney characters, Nickelodeon, and Entertainment

One licenses, and Funnoodle® pool floats;

|

|

|

·

|

Halloween and everyday costumes for all ages based on licensed and proprietary non-licensed brands,

including Super Mario Bros.®, Microsoft’s Halo®, Lego® Movie, Toy Story, Sesame

Street®, Power Rangers®¸Hasbro® brands and Disney Frozen, Disney Princess and

related Halloween accessories; and

|

|

|

·

|

Outdoor activity toys including MORFBoard®, an action sports eco-system that begins

with one board that transforms into different modules for skate, scoot, balance, and bounce activities. Junior sports toys including

Skyball® hyper-charged balls, sport sets and Wave Hoops® toy hoops marketed under our Maui® brand.

|

We continually review

the marketplace to identify and evaluate popular and evergreen brands and product categories that we believe have the potential

for growth. We endeavor to generate growth within these lines by:

|

|

·

|

creating innovative products under our established licenses and brand names;

|

|

|

·

|

adding new items to the branded product lines that we expect will enjoy greater popularity;

|

|

|

·

|

infusing innovation and technology when appropriate to make them more appealing to today’s

kids; and

|

|

|

·

|

focusing our marketing efforts to enhance consumer recognition and retailer interest.

|

Our Business Strategy

In addition to developing

our own proprietary brands and marks, licensing popular trademarks enables us to use these high-profile marks at a lower cost than

we would incur if we purchased these marks or developed comparable marks on our own. By licensing trademarks, we have access to

a far greater range of marks than would be available for purchase. We also license technology developed by unaffiliated inventors

and product developers to enhance the design and functionality of our products.

We sell our products

through our in-house sales staff and independent sales representatives to toy and mass-market retail chain stores, department stores,

office supply stores, drug and grocery store chains, club stores, toy specialty stores and wholesalers. Our two largest customers

are Wal-Mart and Target, which accounted for approximately 25.3% and 21.5%, respectively, of our net sales in 2018. No other customer

accounted for more than 10% of our net sales in 2018.

Our Growth Strategy

Key elements of our

growth strategy include:

|

|

·

|

Expand Core Products. We manage our existing and new brands through strategic product development

initiatives, including introducing new products, modifying existing products and extending existing product lines to maximize their

longevity. Our marketing teams and product designers strive to develop new products or product lines to offer added technological,

aesthetic and functional improvements to our extensive portfolio.

|

|

|

·

|

Enter New Product Categories. We use our extensive experience in the toy and other consumer

product industries to evaluate products and licenses in new product categories and to develop additional product lines. We began

marketing licensed classic video games for simple plug-in use with television sets and expanded into several related categories

by infusing additional technologies such as motion gaming and through the licensing of this category from our current licensors,

such as Disney and Viacom which owns Nickelodeon.

|

|

|

·

|

Pursue Strategic Acquisitions. We supplement our internal growth with selected strategic

acquisitions. In October 2016, we acquired the operating assets of the C’est Moi™ performance makeup and youth

skincare product lines whose distribution was limited primarily to Asia. We launched a full line of makeup and skincare products

branded under the C’est Moi name in the U.S. to a limited number of retail customers in 2018. Sales of our C’est Moi

products were not material in 2018 and we expect to grow the brand and sales over time. We will continue focusing our acquisition

strategy on businesses or brands that we believe have compatible product lines and/or offer valuable trademarks or brands.

|

|

|

·

|

Acquire Additional Character and Product Licenses. We have acquired the rights to use many

familiar brand and character names and logos from third parties that we use with our primary trademarks and brands. Currently,

among others, we have license agreements with Nickelodeon®, Disney and Warner Bros.®, as well as with the licensors of

the many popular licensed children’s characters previously mentioned, among others. We intend to continue to pursue new licenses

from these entertainment and media companies and other licensors. We also intend to continue to purchase additional inventions

and product concepts through our existing network of inventors and product developers.

|

|

|

·

|

Expand International Sales. We believe that foreign markets, especially Europe, Australia,

Canada, Latin America and Asia, offer us significant growth opportunities. In 2018, our sales generated outside the United States

were approximately $127.8 million, or 22.5% of total net sales. We intend to expand our international sales and further expand

distribution agreements in Europe to capitalize on our experience and our relationships with foreign distributors and retailers.

We expect these initiatives to contribute to our international growth in 2019.

|

|

|

·

|

Capitalize On Our Operating Efficiencies. We believe that our current infrastructure and

operating model can accommodate growth without a proportionate increase in our operating and administrative expenses, thereby increasing

our operating margins.

|

The execution of our

growth strategy, however, is subject to several risks and uncertainties and we cannot assure you that we will continue to experience

growth in, or maintain our present level of net sales. For example, our growth strategy will place additional demands upon our

management, operational capacity and financial resources and systems. The increased demand upon management may necessitate our

recruitment and retention of additional qualified management personnel. We cannot assure you that we will be able to recruit and

retain qualified personnel or expand and manage our operations effectively and profitably. To effectively manage future growth,

we must continue to expand our operational, financial and management information systems and to train, motivate and manage our

work force. While we believe that our operational, financial and management information systems will be adequate to support our

future growth, no assurance can be given they will be adequate without significant investment in our infrastructure. Failure to

expand our operational, financial and management information systems or to train, motivate or manage employees could have a material

adverse effect on our business, financial condition and results of operations.

Moreover, implementation

of our growth strategy is subject to risks beyond our control, including competition, market acceptance of new products, changes

in economic conditions, our ability to obtain or renew licenses on commercially reasonable terms and our ability to finance increased

levels of accounts receivable and inventory necessary to support our sales growth, if any.

Furthermore, we cannot

assure you that we can identify attractive acquisition candidates or negotiate acceptable acquisition terms, and our failure to

do so may adversely affect our results of operations and our ability to sustain growth.

Finally, our acquisition

strategy involves a number of risks, each of which could adversely affect our operating results, including difficulties in integrating

acquired businesses or product lines, assimilating new facilities and personnel and harmonizing diverse business strategies and

methods of operation; diversion of management attention from operation of our existing business; loss of key personnel from acquired

companies; and failure of an acquired business to achieve targeted financial results.

Corporate Information

We were formed as a

Delaware corporation in 1995. Our principal executive offices are located at 2951 28th Street, Santa Monica, California 90405.

Our telephone number is (424) 268-9444. Our Internet website address is www.jakks.com. The information on or accessible from this

website is expressly not incorporated by reference into, and does not constitute a part of, this prospectus.

RISK

FACTORS

Investing in our securities

involves a high degree of risk that may result in a loss of all or part of your investment. Before making an investment decision,

you should carefully review the following factors as well as the risk factors contained under the heading “Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31, 2018, and any risk factors that we may describe in our other

filings with the SEC, including our subsequent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K, as well as other information we include or incorporate by reference in this prospectus and any accompanying prospectus

supplement. If any such risks occur, our business, financial condition or results of operations could be materially harmed, the

market price of our securities could decline and you could lose all or part of your investment.

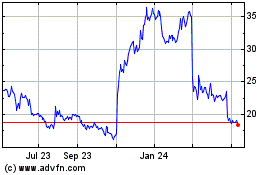

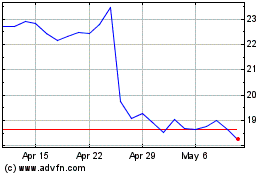

The price of the

common stock may fluctuate significantly, and you could lose all or part of your investment.

Volatility in the market

price of the common stock may prevent you from being able to sell your shares at or above the price you paid for your shares. The

market price could fluctuate significantly for various reasons, which include:

|

|

·

|

the potential issuance of additional shares of common stock, including pursuant to convertible

securities or other contractual rights to purchase or receive shares of common stock;

|

|

|

·

|

our quarterly or annual earnings or earnings of other companies in our industry;

|

|

|

·

|

the public’s reaction to our press releases, our other public announcements and our filings

with the SEC;

|

|

|

·

|

the actions of the Company’s customers and competitors (including new product line announcements

and introductions);

|

|

|

·

|

changes in earnings estimates or recommendations by research analysts who track the common stock

or the stocks of other companies in our industry;

|

|

|

·

|

new laws or regulations or new interpretations of laws or regulations applicable to our business,

including regulations affecting foreign manufacturing;

|

|

|

·

|

changes in accounting standards, policies, guidance, interpretations or principles;

|

|

|

·

|

changes in general conditions in the United States and global economies or financial markets, including

those resulting from war, incidents of terrorism or responses to such events;

|

|

|

·

|

litigation involving us or investigations or audits with respect to our operations;

|

|

|

·

|

our compliance with listing standards of Nasdaq or any other securities exchange on which the common

stock or any of our other securities may be listed or traded;

|

|

|

·

|

sales of common stock by our directors, executive officers and significant stockholders; and

|

|

|

·

|

other factors described in our filings with the SEC.

|

In addition, in recent

years, the stock market has experienced extreme price and volume fluctuations. This volatility has had a significant impact on

the market price of securities issued by many companies, including us and other companies in our industry. The changes frequently

appear to occur without regard to the operating performance of these companies. The price of the common stock could fluctuate based

upon factors that have little or nothing to do with us, and these fluctuations could materially reduce our stock price.

If we are unable to maintain the listing

of our common stock on Nasdaq or any other securities exchange, it may be more difficult for you to sell your securities.

Our common stock is currently

traded on Nasdaq. On June 24, 2019, we received written notice from Nasdaq notifying us that our common stock had closed below

the $1.00 per share minimum bid price required by the Nasdaq listing rules for 30 consecutive business days. On August 14, 2019,

we received an additional written notice from Nasdaq notifying us that we are not in compliance with the Nasdaq listing requirement

that we maintain a minimum of $10,000,000 in stockholders’ equity. The company is in the process of reviewing potential actions

and responses to each of these notices.

There can be no assurance

that we will be able to regain compliance with the Nasdaq listing rules or comply with Nasdaq’s other listing standards in

the future. If we fail to regain compliance with the Nasdaq listing rules, our common stock will be delisted by Nasdaq. A delisting

of our common stock could negatively impact the Company by further reducing the liquidity and market price of our common stock

and the number of investors willing to hold or acquire our common stock, which could negatively impact our ability to raise equity

financing. This delisting could also impair the value of your investment.

The delisting of

our common stock from Nasdaq may constitute a “fundamental change” under the New Oasis Notes (as defined below) and/or

the Company’s 4.875% convertible senior notes due 2020 (the “2020 Notes”) if our common stock is not listed

on another U.S. national securities exchange or quoted or traded on an established over-the-counter (and, in the case of the 2020

Notes, automated) trading market or system in the U.S., which would require us to repurchase all or any portion of such notes

at the option of the noteholders. The delisting of our common stock from Nasdaq may also result in an event of default under our

ABL and term loan credit agreements.

The concentration

of our stock ownership may limit your ability to influence the outcome of director elections and other matters requiring stockholder

approval.

In connection with

the Transaction Agreement, dated as of August 7, 2019 (the “Transaction Agreement”), by and among the Company, certain

of the Company’s affiliates and subsidiaries, the Investor Parties and Oasis, on August 9, 2019 (the “Closing Date”),

we entered into voting agreements with certain of our stockholders (each, a “Voting Agreement” and collectively, the

“Voting Agreements”). The common stock beneficially owned by the stockholders subject to the Voting Agreements constituted

approximately 53% of the total issued and outstanding common stock entitled to vote as of the Closing Date (after giving effect

to the issuance of shares of common stock to the Investor Parties).

Stockholders party

to the Voting Agreements that vote their shares of common stock in accordance with the terms of the Voting Agreements may control

the outcome of certain matters requiring stockholder approval. Pursuant to the terms of the Voting Agreements, each stockholder

party to a Voting Agreement has agreed to, among other things, vote such stockholder’s shares of common stock as follows:

(i) in favor of a proposal to amend the Company’s Amended and Restated Certificate of Incorporation (our “charter”)

to classify the Company’s board of directors (the “Board”) into three classes with staggered three-year terms

(the “Classified Board Proposal”); and (ii) to cause the election to the Board of any New Independent Common Director

(as defined in the Company’s Second Amended and Restated By-laws (our “bylaws”)) nominee selected by the Nominating

and Corporate Governance Committee of the Board in accordance with the Amended and Restated Nominating and Corporate Governance

Committee Charter. In addition, certain of the Voting Agreements contain restrictions on such stockholders’ ability to enter

into voting agreements, trusts and proxies and, with certain exceptions, require transferees of such stockholders’ shares

of common stock to enter into a substantially identical voting agreement with the Company.

A classified board

of directors may discourage some takeover bids, including some that would otherwise allow stockholders the opportunity to realize

a premium over the market price of their stock or that a majority of our stockholders otherwise believes may be in their best interests

to accept or where the reason for the desired change is inadequate performance of our directors or management. Because of the additional

time required to change control of the Board, a classified board may also make it more difficult and more expensive for a potential

acquirer to gain control of the Board and the Company. Until the Classified Board Proposal is approved, a change in control of

the Board can be made by stockholders holding a plurality of the votes cast at a single annual meeting where there is a contested

director election. If the Classified Board Proposal is approved, it will take at least two annual meetings following the annual

meeting at which the classified board structure becomes effective for a potential acquirer to effect a change in control of the

Board, even if the potential acquirer were to acquire a majority of our outstanding common stock.

In connection with

the consummation of the transactions contemplated by the Transaction Agreement, we issued an aggregate of 200,000 shares of Series

A Senior Preferred Stock, par value $0.001 (“Series A Senior Preferred Stock”), to the Investor Parties. The Certificate

of Designations of the Series A Senior Preferred Stock (the “Certificate of Designations”) provides, among other things,

that, for so long as at least 50,000 shares of Series A Senior Preferred Stock remain outstanding, (i) the holders of a majority

of the outstanding shares of Series A Senior Preferred Stock have the sole right to nominate candidates to serve as the Series

A Preferred Directors (as defined in our bylaws) and (ii) the holders of shares of Series A Senior Preferred Stock, voting as a

separate class, have the right to elect two individuals to serve as the Series A Preferred Directors. From and after (i) the first

annual meeting of stockholders occurring after less than 50,000 shares of Series A Senior Preferred Stock remain outstanding, the

holders of Series A Senior Preferred Stock will only have the right to nominate and elect one Series A Preferred Director, and

(ii) the time no shares of Series A Senior Preferred Stock remain outstanding, the holders of Series A Senior Preferred Stock will

no longer have the right to nominate or elect any Series A Preferred Directors. The Series A Preferred Directors will serve for

terms ending at the annual meeting of stockholders in 2023 and for successive three-year terms thereafter (until no shares of Series

A Senior Preferred Stock remain outstanding), and as of such time as the Classified Board Proposal is approved, the Series A Preferred

Directors shall be deemed to serve in the longest initial class.

Also, some or all of

our significant stockholders, if they were to act together, would be able to control our management and affairs and matters requiring

stockholder approval, including the election of directors and the approval of significant corporate transactions, such as mergers,

consolidations or the sale of substantially all of our assets. Consequently, this concentration of ownership may have the effect

of delaying or preventing a change of control, including a merger, consolidation or other business combination involving us, or

discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control, even if that change of

control would benefit our other stockholders and may prevent our stockholders from realizing a premium over the current market

price for their shares of common stock. Furthermore, our significant stockholders may also have interests that differ from yours

and may vote their shares of common stock in a way with which you disagree and which may be adverse to your interests.

Sales or issuances

of substantial amounts of our common stock in the public market, or the perception that these sales or issuances may occur, or

the conversion of our convertible notes could cause the market price of our common stock to decline.

Sales or issuances

of substantial amounts of our common stock in the public market, including pursuant to this offering, or the perception that these

sales or issuances may occur, or the conversion of our convertible notes could cause the market price of our common stock to decline.

This could also impair our ability to raise additional capital through the sale of our equity securities. Future sales or issuances

of our common stock or other equity-related securities could be dilutive to holders of our common stock, including purchasers of

our common stock in this offering.

Our common stock

will rank junior to the Series A Senior Preferred Stock with respect to dividends and amounts payable in the event of our liquidation.

Our common stock will

rank junior to the Series A Senior Preferred Stock with respect to the payment of dividends and distributions and in the liquidation,

dissolution or winding up, and upon any distribution of the assets of, the Company. This means that, unless accumulated dividends

have been paid or set aside for payment on all outstanding Series A Senior Preferred Stock for all past completed dividend periods,

no dividends may be declared or paid on our common stock. Likewise, in the event of our voluntary or involuntary liquidation, dissolution

or winding-up, no distribution of our assets may be made to holders of our common stock until we have paid to holders of the Series

A Senior Preferred Stock the Liquidation Preference (as defined below).

USE

OF PROCEEDS

None of the shares

to be sold pursuant to this prospectus will be sold by us or for our account, and we will not receive any proceeds from the sale

thereof.

DESCRIPTION

OF CAPITAL stock

We have summarized

below general terms and conditions of the common stock that we may offer and sell pursuant to this prospectus. The following summary

description of our common stock is based on the provisions of the General Corporation Law of the State of Delaware, or DGCL, our

certificate of incorporation, as amended (our “charter”), and our bylaws, as amended (our “bylaws”). This

description does not purport to be complete and is qualified in its entirety by reference to the full text of the DGCL, as it may

be amended from time to time, and to the terms of our charter and bylaws, as each may be amended from time to time, which are incorporated

by reference as exhibits to the registration statement of which this prospectus is a part.

General

Our charter authorizes

us to issue 100,000,000 shares of common stock, par value $0.001 per share, and 5,000,000 shares of preferred stock, par value

of $0.001 per share. As of September 4, 2019, we had 38,323,211 shares of common stock and 200,000 shares of Series A Senior Preferred

Stock issued and outstanding. No other class or series of shares of beneficial interest has been established.

The number of authorized

shares of any class may be increased or decreased by an amendment to our charter approved by a majority of the entire Board, by

the holders of a majority of our outstanding shares of common stock entitled to vote thereon and by the holders of a majority of

our outstanding shares of Series A Senior Preferred Stock. The Board may authorize the issuance from time to time of shares of

stock of any class or series, whether now or hereafter authorized, or securities or rights convertible into shares of its stock

of any class or series, for such consideration as the Board may deem advisable (or without consideration in the case of a stock

split or stock dividend), subject to such restrictions or limitations, if any, as may be set forth in the charter or the bylaws.

The rights, preferences and privileges of our common stock and common stockholders are subject to, and may be adversely affected

by, the rights of the holders of shares of any new class or series, whether common or preferred, that the Board may create, designate

or issue in the future.

Under Delaware law,

our stockholders generally are not liable for our debts or obligations.

Common stock

Voting

rights

Holders of common stock

are entitled to one vote for each share held on all matters submitted to a vote of stockholders except for the election of the

Series A Preferred Directors (as defined in our bylaws), in which case, only the holders of the Series A Preferred Stock have the

right to vote in such election. Generally, our bylaws provide that all matters to be voted on by our common stockholders must be

approved by a majority of the votes cast at a meeting at which a quorum is present unless more than a majority of the votes cast

is required by statute or our bylaws; provided, however, that if the number of nominees for Common Director (as defined in our

bylaws) exceeds the number of Common Directors to be elected, the Common Directors shall be elected by the vote of a plurality

of the shares represented in person or by proxy at any such meeting and entitled to vote on the election of Common Directors.

Dividends

Holders of common stock

will be entitled to receive ratably such dividends, if any, as may be declared from time to time by the Board out of funds legally

available therefor, and will be entitled to receive, pro rata, all assets of the Company available for distribution to such holders

upon liquidation.

No preemptive or similar rights

Holders of common stock

have no preemptive, subscription or redemption rights. All outstanding shares of common stock are, and the common stock offered

hereby, upon issuance and sale, will be, fully paid and nonassessable.

Preferred stock

Pursuant to our charter,

the Company is authorized to issue “blank check” preferred stock, which may be issued from time to time in one or more

series upon authorization by the Board. The Board, without further approval of the stockholders, is authorized to fix the designations,

powers, preferences and rights of the shares of each such class or series of preferred stock and the qualifications, limitations

and restrictions thereof. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions

and other corporate purposes, could, among other things, adversely affect the voting power of the holders of the common stock and,

under certain circumstances, make it more difficult for a third party to gain control of the Company, discourage bids for the Company’s

common stock at a premium or otherwise adversely affect the market price of the common stock.

Series A Senior Preferred

Stock

Pursuant to the

Certificate of Designations of Series A Senior Preferred Stock filed with the Secretary of State of the State of Delaware on August

9, 2019, as amended and as it may be further amended from time to time (the “Certificate of Designations”), the Company

issued 200,000 shares of Series A Senior Preferred Stock, par value $0.001 per share, to the Investor Parties.

Dividends, redemptions

and other payments

The Series A Senior

Preferred Stock has the right to receive dividends on a quarterly basis equal to 6.0% per annum, payable in cash or, if not paid

in cash, by an automatic accretion of the Series A Preferred Stock. The Series A Senior Preferred Stock has no stated maturity

and will remain outstanding indefinitely unless and until redeemed or repurchased in accordance with the terms of the Certificate

of Designations. The Company has the right to redeem all or a portion of the Series A Senior Preferred Stock at its Liquidation

Preference at any time after payment in full of the New Term Loan (as defined below). In addition, upon the occurrence of certain

change of control type events, holders of the Series A Senior Preferred Stock are entitled to receive an amount (the “Liquidation

Preference”), prior to and in preference to holders of common stock or other junior stock, equal to (i) 20% of the Accreted

Amount (as defined in the Certificate of Designations) in the case of a certain specified transaction, or (ii) otherwise, 150%

of the Accreted Amount, in either case plus any accrued and unpaid dividends.

The Certificate of

Designations also includes restrictions on the ability of the Company to pay dividends on or make distributions with respect to,

or redeem or repurchase, shares of Common Stock or other junior stock.

Voting and approval

rights

The Series A Senior

Preferred Stock does not have any voting rights, except (i) to the extent required by the DGCL, (ii) for the exclusive right to

elect the Series A Preferred Directors and (iii) for certain approval rights over certain transactions. These approval rights require

the prior consent of specified percentages of holders (or in certain cases, all holders) of the Series A Senior Preferred Stock

in order for the Company to take certain actions, including the issuance of additional shares of Series A Senior Preferred Stock

or parity stock, the issuance of senior stock, amendments to our charter, the Certificate of Designations, our bylaws and the charter

of the Nominating and Corporate Governance Committee of our Board, material changes in the Company’s line of business and

certain change of control type transactions. In addition, the Certificate of Designations provides that the approval of at least

six directors is required for any related person transaction within the meaning of Item 404 of Regulation S-K under the Act, including,

without limitation, the adoption of, or any amendment, modification or waiver of, any agreement or arrangement related to any such

transaction.

Preemptive rights

In addition, holders

of the Series A Senior Preferred Stock have preemptive rights regarding future issuance of Series A Senior Preferred Stock or parity

stock.

Board representation

rights

In addition, the Certificate

of Designations provides the holders of Series A Senior Preferred Stock certain board representation rights. The Certificate of

Designations provides, among other things, that, for so long as at least 50,000 shares of Series A Senior Preferred Stock remain

outstanding, (i) the holders of a majority of the outstanding shares of Series A Senior Preferred Stock have the sole right to

nominate candidates to serve as the Series A Preferred Directors and (ii) the holders of shares of Series A Senior Preferred Stock,

voting as a separate class, have the right to elect two individuals to serve as the Series A Preferred Directors. From and after

(i) the first annual meeting of stockholders occurring after less than 50,000 shares of Series A Senior Preferred Stock remain

outstanding, the holders of Series A Senior Preferred Stock will only have the right to nominate and elect one Series A Preferred

Director, and (ii) the time no shares of Series A Senior Preferred Stock remain outstanding, the holders of Series A Senior Preferred

Stock will no longer have the right to nominate or elect any Series A Preferred Directors. The Series A Preferred Directors will

serve for terms ending at the annual meeting of stockholders in 2023 and for successive three-year terms thereafter (until no shares

of Series A Senior Preferred Stock remain outstanding), and as of such time as the Classified Board Proposal is approved, the Series

A Preferred Directors shall be deemed to serve in Class III. The number of Common Directors and Series A Preferred Directors is

fixed and cannot be amended without the approval of holders of a majority of the outstanding Common Stock and holders of at least

80% of the outstanding shares of Series A Senior Preferred Stock, each voting as a separate class.

Anti-Takeover Effects

of Delaware Law, Certificate of Incorporation and By-laws

The following provisions

may make a change in control of our business more difficult and could delay, defer or prevent a tender offer or other takeover

attempt that a stockholder might consider to be in its best interest, including takeover attempts that might result in the payment

of a premium to our stockholders over the market price for their shares. These provisions also may promote the continuity of our

management by making it more difficult for a person to remove or change the incumbent members of our Board.

Delaware

Law

We

are subject to the provisions of Section 203 of the DGCL regulating corporate takeovers. In general, the statute prohibits a publicly-held

Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period

of three years after the date that the person became an interested stockholder, subject to exceptions, unless the business combination

is approved by our Board in a prescribed manner or the transaction in which the person became an interested stockholder is approved

by our Board and disinterested stockholders in a prescribed manner. Generally, a “business combination” includes a

merger, asset or stock sale, or other transaction resulting in a financial benefit to the stockholder. Generally, an “interested

stockholder” is a person who, together with affiliates and associates, owns, or within three years prior, did own, 15% or

more of the corporation’s voting stock. These provisions may have the effect of delaying, deferring or preventing a change

in control of our business without further action by the stockholders.

Authorized

but unissued capital stock

The DGCL generally

does not require stockholder approval for any issuance of shares of our authorized by unissued capital stock. However, the listing

requirements of Nasdaq, which apply to our common stock, require stockholder approval of certain issuances of capital stock equal

to or exceeding 20.0% of the then outstanding number of shares of common stock or voting power.

In addition, the existence

of unissued and unreserved common stock or preferred stock may enable our Board to issue shares to persons friendly to current

management, which issuance could render more difficult or discourage an attempt to obtain control of our company by means of a

merger, tender offer, proxy contest or otherwise, and thereby protect the continuity of our management and possibly deprive the

stockholders of opportunities to sell their shares at prices higher than prevailing market prices.

“Blank check”

preferred stock

Pursuant to our charter,

we are authorized to issue “blank check” preferred stock, which may be issued from time to time in one or more series

upon authorization by the Board. The Board, without further approval of the stockholders, is authorized to fix the designations,

powers, preferences and rights of the shares of each such class or series of preferred stock and the qualifications, limitations

and restrictions thereof. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions

and other corporate purposes, could, among other things, adversely affect the voting power of the holders of the common stock and,

under certain circumstances, make it more difficult for a third party to gain control of the Company, discourage bids for our common

stock at a premium or otherwise adversely affect the market price of the common stock.

Special meetings of

stockholders

Our bylaws provide

that special meetings of stockholders may be called only by the directors or by any officer instructed by the directors to call

such meeting.

Notice

for stockholder meetings

Our

bylaws establish an advance notice procedure for business to be

brought before an annual or special meeting of our stockholders. The advance notice provision provides that a copy of the notice

of any meeting shall be given, personally or by mail, to the stockholders not less than 10 days nor more than 60 days before the

date of the meeting. This provision may discourage or deter a potential acquirer from conducting a solicitation of proxies to elect

the acquirer’s own slate of directors or otherwise attempting to obtain control of the Company.

Board vacancies

Any vacancy occurring

on our Board and any newly created directorship may be filled only by a majority of the directors remaining in office (even if

less than a quorum), except that (i) any vacancy of a New Independent Common Directors (as defined in our bylaws) may be filled

only by a majority of the directors remaining in office (even if less than a quorum) in accordance with the nominating committee

of the Board, with an individual selected by the Nominating Committee from the Preapproved List (as defined in our bylaws) and

(ii) any vacancy of a Series A Preferred Director (as defined in our bylaws) may be filled only by a majority of the directors

remaining in office (even if less than a quorum) solely with an individual selected by the Required Preferred Holders.

Appraisal rights

Under Delaware law,

holders of shares of our common stock are generally entitled to exercise any rights of an objecting stockholder available under

the DGCL.

Listing

Our common stock

is listed on the Nasdaq under the symbol “JAKK.” On October 7, 2019, the last reported sale price for our common stock

on the Nasdaq was $0.75.

Transfer Agent

The transfer agent and

registrar for our common stock is Computershare Trust Company, N.A.

SELLING

STOCKHOLDERS

This prospectus is

being filed pursuant to the terms of the Amended and Restated Registration Rights Agreement, dated as of August 9, 2019 (the “Oasis

Registration Rights Agreement”), by and between the Company and Oasis and the Registration Rights Agreement, dated as of

September 6, 2019 (together with the Oasis Registration Rights Agreement, the “Registration Rights Agreements”), by

and among the Company and the Investor Parties. The shares of common stock being offered by Oasis are those issuable to Oasis pursuant

to the terms of the convertible notes (the “New Oasis Notes”) issued to Oasis pursuant to the Transaction Agreement.

For additional information regarding the issuance of those New Oasis Notes, see the Company’s Current Report on Form 8-K

filed August 9, 2019, incorporated herein by reference. We are registering the shares of common stock in order to permit Oasis

to offer the shares for resale from time to time. Except for: (i) the ownership of the New Oasis Notes issued pursuant to the Transaction

Agreement, (ii) the Voting Agreements, (iii) the ownership of the convertible note issued pursuant to the Exchange Agreement, by

and between the Company and Oasis, dated as of July 25, 2018, which was exchanged for a New Oasis Note, (iv) the ownership of the

convertible note issued pursuant to the Exchange Agreement, by and between the Company and Oasis, dated as of November 7, 2017,

which was exchanged for a New Oasis Note, and (v) Alex Shoghi, an employee of an affiliate of Oasis, serving on the Board,

Oasis has not had any material relationship with us within the past three years.

The shares of common

stock being offered by the Investor Parties are those issued to the Investor Parties pursuant to the Transaction Agreement. We

are registering the shares of common stock in order to permit the Investor Parties to offer the shares for resale from time to

time. Except for: (i) the ownership of common stock, Series A Senior Preferred Stock and certain other securities of the Company,

(ii) the Voting Agreements, (iii) certain designees of the Investor Parties serving on the Board, and (iv) the Investor Parties

or their affiliates being lenders to the Company under the First Lien Term Loan Facility Credit Agreement, dated as of August 9,

2019, by and among the Company, Disguise, Inc., JAKKS Sales LLC, Maui, Inc., Moose Mountain Marketing, Inc. and Kids Only, Inc.,

as borrowers, the Company, as borrower representative, the guarantors party thereto from time to time, the lenders party thereto

from time to time and Cortland Capital Market Services LLC, as agent (the “New Term Loan”), the Investor Parties have

not had any material relationship with us within the past three years.

The table below lists

the selling stockholders and other information regarding the beneficial ownership of the shares of common stock by each of the

selling stockholders. The second column lists the number of shares of common stock beneficially owned by each selling stockholder.

The third column lists

the shares of common stock being offered by this prospectus by the selling stockholders. In accordance with the terms of the Registration

Rights Agreements, this prospectus generally covers the resale of (i) at least 100% of the maximum number of shares of common stock

issued and issuable pursuant to the terms of the New Oasis Notes (including, without limitation, as payment of interest thereunder)

as of the trading day immediately preceding the date the registration statement is initially filed with the SEC and (ii) 100% of

the number of shares of common stock issued to the Investor Parties pursuant to the Transaction Agreement. Because the conversion

price of the New Oasis Notes may be adjusted, the number of shares that may actually be issued pursuant to the New Oasis Notes

may be more or less than the number of shares being offered by this prospectus.

The fourth column assumes

the sale of all of the shares offered by the selling stockholders pursuant to this prospectus.

Under the terms of

the New Oasis Notes, Oasis may not convert the New Oasis Notes to the extent such conversion would cause Oasis, together with its

affiliates, to beneficially own a number of shares of common stock which would exceed 4.99% of our then outstanding shares of common

stock following such conversion, excluding for purposes of such determination shares of common stock issuable upon conversion of

the New Oasis Notes which have not been converted. The number of shares in the second column does not reflect this limitation.

The selling stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

|

Name of Selling Stockholder

|

|

Number of Shares of

Common Stock Owned

Prior to Offering

|

|

|

Maximum Number of

Shares

of Common Stock to be Sold

Pursuant to this Prospectus

|

|

|

Number of Shares of

Common Stock Owned

After Offering

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oasis Investments II Master Fund Ltd. (1)

|

|

|

1,098,906

|

|

|

|

46,728,275

|

|

|

|

1,098,906

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Axar Master Fund Ltd (2)

|

|

|

1,038,598

|

|

|

|

1,038,598

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Star V Partners LLC (3)

|

|

|

102,637

|

|

|

|

102,637

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BSP Special Situations Master A L.P. (4)

|

|

|

1,119,648

|

|

|

|

1,119,648

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Moab Partners, L.P. (5)

|

|

|

1,750,745

|

|

|

|

1,750,745

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nineteen77 Global Multi- Strategy Alpha Master Limited (6)

|

|

|

1,198,838

|

|

|

|

1,198,838

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Citadel Equity Fund Ltd. (7)

|

|

|

209,712

|

|

|

|

197,270

|

|

|

|

12,442

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concise Short Term High Yield Master Fund, SPC (8)

|

|

|

106,075

|

|

|

|

106,075

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mercer QIF Fund PLC - Mercer Investment Fund 1 (9)

|

|

|

202,230

|

|

|

|

202,230

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Saratoga Advantage Trust - James Alpha Hedged High Income Portfolio (10)

|

|

|

18,994

|

|

|

|

18,994

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concise Short Term High Yield Fund (11)

|

|

|

102,862

|

|

|

|

102,862

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The BeeBee Foundation (12)

|

|

|

15,105

|

|

|

|

15,105

|

|

|

|

0

|

|

|

|

(1)

|

Oasis Management Company Ltd., the investment manager of Oasis Investments II Master Fund Ltd.

(“Oasis II Fund”), has voting and investment power over the securities held by Oasis II Fund. Seth Fischer is responsible

for the supervision and conduct of all investment activities of Oasis Management Company Ltd. Each of Oasis II Fund and Seth Fischer

disclaims beneficial ownership over these securities. The address of Oasis Management Company Ltd. is c/o Oasis Management (Hong

Kong), 21/F Man Yee Building, 68 Des Voeux Road, Central, Hong Kong. Possesses shared voting and dispositive power of such shares.

All the information presented in this Item with respect to this beneficial owner was extracted solely from the Schedule 13D/A filed

on August 9, 2019. The Company has the discretion to settle the conversion of the New Oasis Notes and to pay accrued interest

thereon in stock, in cash and/or in a combination thereof, provided that any payment of interest in stock is contingent upon the

satisfaction of certain equity conditions. Accordingly, the shares underlying the New Oasis Notes are not beneficially

owned by Oasis.

|

|

|

(2)

|

The address of Axar Master Fund

Ltd is c/o Axar Capital Management LP, 1330 Avenue of the Americas, 30th Floor, New York, NY 10019. Axar Capital Management LP

serves as the investment manager of Axar Master Fund Ltd. Axar GP LLC is the general partner of the investment manager. Andrew

Axelrod serves as the sole member of the general partner.

|

|

|

(3)

|

The address of Star V Partners

LLC is c/o Axar Capital Management LP, 1330 Avenue of the Americas, 30th Floor, New York, NY 10019. Axar Capital Management LP

serves as the investment manager of Star V Partners LLC. Axar GP LLC is the general partner of the investment manager. Andrew

Axelrod serves as the sole member of the general partner.

|

|

|

(4)

|

The address of BSP Special Situations

Master A L.P. is 9 West 57th Street, Suite 4920, New York, NY 10019.

|

|

|

(5)

|

The address of Moab Partners, L.P. is 152 West 57th Street, 9th Floor, New York, NY 10019.

|

|

|

(6)

|

The

address of Nineteen77 Global Multi-Strategy Alpha Master Limited (“GLEA”)

is 1 North Wacker Drive, 32nd Floor, Chicago IL 60606. UBS O’Connor LLC (“O’Connor”)

is the investment manager of GLEA and, accordingly, has voting control and investment

discretion over the securities described herein held by GLEA. Kevin Russell, the Chief

Investment Officer of O'Connor, also has voting control and investment discretion over

the securities described herein held by GLEA. As a result, each of O’Connor and

Mr. Russell may be deemed to have beneficial ownership (as determined under Section 13(d)

of the Securities Exchange Act of 1934, as amended) of the securities described herein

held by GLEA.

|

|

|

(7)

|

The

address of Citadel Equity Fund Ltd. (“CEFL”) is 131 South Dearborn Street,

Chicago, IL 60603. Pursuant to a portfolio management agreement, Citadel Advisors LLC,

a registered investment advisor (“CAL”), possesses voting and dispositive

power with respect to securities beneficially owned by CEFL. Citadel Advisors Holdings

LP (“CAH”) is the sole member of CAL. Citadel GP LLC is the general partner

of CAH. Kenneth Griffin (“Griffin”) is the President, Chief Executive Officer

and sole member of Citadel GP LLC. Citadel GP LLC and Griffin may be deemed to be the

beneficial owners of common stock of the issuer through their control of CAL and/or certain

other affiliates.

|

|

|

(8)

|

The address of Concise Capital

Management, LP, the investment manager of Concise Short Term High Yield Master Fund, SPC, is 1111 Brickell Avenue, Suite 1525,

Miami, FL 33131.

|

|

|

(9)

|

The address of Concise Capital

Management, LP, the investment manager of Mercer QIF Fund PLC – Mercer Investment Fund 1, is 1111 Brickell Avenue, Suite

1525, Miami, FL 33131.

|

|

|

(10)

|

The address of Concise Capital

Management, LP, the investment manager of The Saratoga Advantage Trust – James Alpha Hedged High Income Portfolio, is 1111

Brickell Avenue, Suite 1525, Miami, FL 33131.

|

|

|

(11)

|

The address of Concise Capital

Management, LP, the investment manager of Concise Short Term High Yield Fund, is 1111 Brickell Avenue, Suite 1525, Miami, FL 33131.

|

|

|

(12)

|

The address of Concise Capital

Management, LP, the investment manager of The BeeBee Foundation, is 1111 Brickell Avenue, Suite 1525, Miami, FL 33131.

|

PLAN

OF DISTRIBUTION

We are registering

the shares of common stock (i) issuable pursuant to the terms of the New Oasis Notes and (ii) issued to the Investor Parties pursuant

to the Transaction Agreement to permit the resale of these shares of common stock by the selling stockholders from time to time

after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling stockholders of the shares

of common stock. We will bear all fees and expenses incident to our obligation to register the shares of common stock.

The selling stockholders

may sell all or a portion of the shares of common stock beneficially owned by them and offered hereby from time to time directly

or through one or more underwriters, broker-dealers or agents. If the shares of common stock are sold through underwriters or broker-dealers,

the respective selling stockholder or selling stockholders will be responsible for underwriting discounts or commissions or agent’s

commissions. The shares of common stock may be sold in one or more transactions at fixed prices, at prevailing market prices at

the time of the sale, at varying prices determined at the time of sale, or at negotiated prices. These sales may be effected in

transactions, which may involve crosses or block transactions,

|

|

·

|

on any national securities exchange or quotation service on which the securities may be listed

or quoted at the time of sale;

|

|

|

·

|

in the over-the-counter market;

|

|

|

·

|

in transactions otherwise than on these exchanges or systems or in the over-the-counter market;

|

|

|

·

|

through the writing or settlement of options or other hedging transactions, whether such instruments

are listed on an options exchange or otherwise;

|

|

|

·

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

·

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position

and resell a portion of the block as principal to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

·

|

privately negotiated transactions;

|

|

|

·

|

sales pursuant to Rule 144;

|

|

|

·

|

broker-dealers may agree with the selling stockholders to sell a specified number of such shares

at a stipulated price per share;

|

|

|

·

|

a combination of any such methods of sale; and

|

|

|

·

|

any other method permitted pursuant to applicable law.

|

If the selling stockholders

effect such transactions by selling shares of common stock to or through underwriters, broker-dealers or agents, such underwriters,