Amended Current Report Filing (8-k/a)

October 07 2019 - 6:25AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report: August 22, 2019

(Date of earliest event reported)

Arcadia Biosciences, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-37383

|

|

81-0571538

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

202 Cousteau Place, Suite 105

Davis, CA 95618

(Address of principal executive offices, including zip code)

(530) 756-7077

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common

|

RKDA

|

NASDAQ CAPITAL MARKET

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Explanatory Note

On August 28, 2019, Arcadia Biosciences, Inc. (the “Company”) filed a Current Report on Form 8-K (“Original Form 8-K”) to report, among other things, the appointment of Matthew T. Plavan as the Company’s chief executive officer and Pam Haley as the Company’s chief financial officer, effective September 1, 2019 (“Effective Date”). The Company is filing this Form 8-K/A to amend the Original Form 8-K to disclose new compensation information for Mr. Plavan and Ms. Haley in connection with their appointments.

|

Item 5.02.

|

Departure of Directors or Certain Officers: Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On October 1, 2019, the Company and Mr. Plavan entered into an employment terms letter (the “Plavan Employment Letter”) that establishes his base salary as of the Effective Date as $370,000 per annum and his 2019 target bonus opportunity as 50% of his base salary for the portion of 2019 he served as the Company’s chief financial officer and 55% of his base salary for the portion of 2019 that he serves as the Company’s chief executive officer. As set forth in the Plavan Employment Letter, and consistent with the Company’s other named executive officers, Mr. Plavan’s employment is “at-will.” Mr. Plavan has entered into a severance and change in control agreement with the Company (the “Plavan CIC Agreement”), which by its terms will expire on the third anniversary of the Effective Date. Pursuant to the Plavan CIC Agreement, if the Company terminates Mr. Plavan’s employment for a reason other than cause or Mr. Plavan’s death or disability at any time other than during the twelve-month period immediately following a change of control, then Mr. Plavan will receive the following severance benefits from the Company: (i) severance in the form of base salary continuation for a period of six months; (ii) reimbursement for premiums paid for coverage pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended, or COBRA, for the executive and the executive’s eligible dependents for up to six months; and (iii) a pro-rated portion of the annual cash bonus he would have been entitled to receive for the year of termination if he had remained employed by the Company through the end of such year.

If during the twelve-month period immediately following a change of control, (x) the Company terminates Mr. Plavan’s employment for a reason other than cause or Mr. Plavan’s death or disability, or (y) Mr. Plavan resigns from employment for good reason, then, in lieu of the above described severance benefits, Mr. Plavan shall receive the following severance benefits from the Company: (i) severance in the form of base salary continuation for a period of twelve months; (ii) reimbursement for premiums paid for coverage pursuant to COBRA, for Mr. Plavan and his eligible dependents for up to twelve months; (iii) a pro-rated portion of the annual cash bonus he would have been entitled to receive for the year of termination if he had remained employed by the Company through the end of such year; and (iv) vesting shall accelerate as to 100% of all of Mr. Plavan’s outstanding equity awards.

Mr. Plavan’s receipt of severance payments or benefits pursuant to the Plavan CIC Agreement is subject to his signing a release of claims in the Company’s favor and complying with certain restrictive covenants set forth in that agreement. The Plavan CIC Agreement contains a “better after-tax” provision, which provides that if any of the payments to Mr. Plavan constitutes a parachute payment under Section 280G of the Code, the payments will either be (i) reduced or (ii) provided in full to Mr. Plavan, whichever results in him receiving the greater amount after taking into consideration the payment of all taxes, including the excise tax under Section 4999 of the Code, in each case based upon the highest marginal rate for the applicable tax.

On October 1, 2019, the Company and Ms. Haley entered into an employment terms letter (the “Haley Employment Letter”, and together with the Plavan Employment Letter, the “Employment Letters”) that establishes her base salary as of the Effective Date as $240,000 per annum and her 2019 target bonus opportunity as 25% of her base salary for the portion of 2019 she served as the Company’s controller and 35% of her base salary for the portion of 2019 that she serves as the Company’s chief financial officer. As set forth in the Employment Letter, and consistent with the Company’s other named executive officers, Ms. Haley’s employment is “at-will.” Ms. Haley has entered into a severance and change in control agreement with the Company (the “Haley CIC Agreement”, and together with the Plavan CIC Agreement, the “CIC Agreements”), which by its terms will expire on the third anniversary of the Effective Date. Pursuant to the Haley CIC Agreement, if the Company terminates Ms. Haley’s employment for a reason other than cause or Ms. Haley’s death or disability at any time other than during the twelve-month period immediately following a change of control, then Ms. Haley will receive the following severance benefits from the Company: (i) severance in the form of base salary continuation for a period of six months; (ii) reimbursement for premiums paid for coverage pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended, or COBRA, for the executive and the executive’s eligible dependents for up to six months; and (iii) a pro-rated portion of the annual cash bonus she would have been entitled to receive for the year of termination if she had remained employed by the Company through the end of such year.

If during the twelve-month period immediately following a change of control, (x) the Company terminates Ms. Haley’s employment for a reason other than cause or Ms. Haley’s death or disability, or (y) Ms. Haley resigns from employment for good reason, then, in lieu of the above described severance benefits, Ms. Haley shall receive the following severance benefits from the Company: (i) severance in the form of base salary continuation for a period of twelve months; (ii) reimbursement for premiums paid for coverage pursuant to COBRA, for Ms. Haley and her eligible dependents for up to twelve months; (iii) a pro-rated portion of the annual cash bonus she would have been entitled to receive for the year of termination if she had remained employed by the Company through the end of such year; and (iv) vesting shall accelerate as to 100% of all of Ms. Haley’s outstanding equity awards.

Ms. Haley’s receipt of severance payments or benefits pursuant to the Haley CIC Agreement is subject to her signing a release of claims in the Company’s favor and complying with certain restrictive covenants set forth in that agreement. The Haley CIC Agreement contains a “better after-tax” provision, which provides that if any of the payments to Ms. Haley constitutes a parachute payment under Section 280G of the Code, the payments will either be (i) reduced or (ii) provided in full to Ms. Haley, whichever results in her receiving the greater amount after taking into consideration the payment of all taxes, including the excise tax under Section 4999 of the Code, in each case based upon the highest marginal rate for the applicable tax.

The foregoing descriptions of the Employment Letters and CIC Agreements are a summary and are qualified in their entirety by reference to the Employment Letters and appended forms of CIC Agreements, which are attached hereto as Exhibits 10.1 and 10.2 and incorporated by reference herein.

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

|

|

|

Exhibit Number

|

|

Description

|

.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

ARCADIA BIOSCIENCES, INC.

|

|

|

|

|

|

|

|

Date: October 4, 2019

|

|

By:

|

|

/s/ PAMELA HALEY

|

|

|

|

Name:

|

|

Pamela Haley

|

|

|

|

Title:

|

|

Chief Financial Officer

|

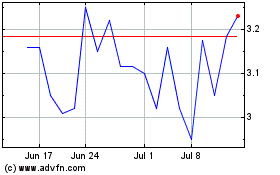

Arcadia Biosciences (NASDAQ:RKDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

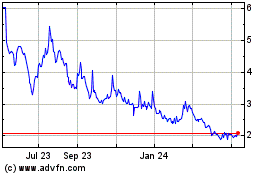

Arcadia Biosciences (NASDAQ:RKDA)

Historical Stock Chart

From Apr 2023 to Apr 2024