Table of Contents

Filed pursuant to Rule 424(b)(3)

Registration No. 333-233584

PROSPECTUS

Up to 8,125,946 Shares of Common Stock

This prospectus covers the offer and sale

of up to 8,125,946 shares of our common stock, $0.0001 par value, by Lincoln Park Capital Fund, LLC (“Lincoln Park”

or the “Selling Stockholder”).

The shares of common stock being offered

to the Selling Stockholder have been or may be issued pursuant to the purchase agreement dated August 7, 2019 that we entered

into with Lincoln Park (as amended on August 20, 2019, the “Purchase Agreement”). See “The Lincoln

Park Transaction” for a description of the Purchase Agreement and “Selling Stockholder” for additional information

regarding Lincoln Park. The prices at which Lincoln Park may sell the Shares will be determined by the prevailing market price

for the Shares or in negotiated transactions.

We are not selling any securities under

this prospectus and will not receive any of the proceeds from the sale of the Shares by the Selling Stockholder.

The Selling Stockholder may sell the shares

of common stock described in this prospectus in a number of different ways and at varying prices. See “Plan of Distribution”

for more information about how the Selling Stockholder may sell the shares of common stock being registered pursuant to this prospectus.

The Selling Stockholder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as

amended (the “Securities Act”).

We will pay the expenses relating to the

registration under the Securities Act of the offer and sale by Lincoln Park of the shares covered by this prospectus, including

legal and accounting fees.

Our common stock is currently quoted

on the Nasdaq Capital Market under the symbol “PHIO”. The closing price of our common stock on October 1, 2019, as

reported by Nasdaq, was $0.29 per share.

Investing in our securities involves

a high degree of risk. In reviewing this prospectus, you should consider carefully the risks and uncertainties in the section

entitled “Risk Factors” beginning on page 4 of this prospectus.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense. The securities are not being offered in any

jurisdiction where the offer is not permitted.

The date of this prospectus is

October 1, 2019

TABLE OF CONTENTS

We have not authorized

anyone to provide you with information other than that contained or incorporated by reference in this prospectus or in any free

writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for and can provide

no assurance as to the reliability of, any other information that others may give to you. We are not offering to sell, and the

Selling Stockholder is not offering to sell, securities in any jurisdictions where offers and sales are not permitted. The information

contained or incorporated by reference in this prospectus or any free writing prospectus is accurate only as of its date, regardless

of its time of delivery or any sale of our securities. Our business, financial condition, results of operations, and prospects

may have changed since that date.

We urge you to

carefully read this prospectus and any prospectus supplement, together with the information incorporated herein by reference

as described under the heading “Where You Can Find More Information” and “Incorporation of

Certain Information by Reference.”

No action is being

taken in any jurisdiction outside the United States to permit an offering of our securities or possession or distribution of this

prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States

are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus

applicable to that jurisdiction.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified

by words such as “intends,” “believes,” “anticipates,” “indicates,” “plans,”

“expects,” “suggests,” “may,” “should,” “potential,” “designed

to,” “will” and similar references, although not all forward-looking statements contain these words. Forward-looking

statements are neither historical facts nor assurances of future performance. These statements are based only on our current beliefs,

expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events

and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject

to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our

control. Risks that could cause actual results to vary from expected results expressed in our forward-looking statements include,

but are not limited to:

|

|

·

|

our ability to obtain sufficient financing to develop our product candidates;

|

|

|

·

|

expected ongoing significant research and development expenses without a current source of revenue, which may lead to uncertainty as to our ability to continue as a going concern;

|

|

|

·

|

dilution that could be caused by future financing transactions or future issuances of capital stock in strategic transactions;

|

|

|

·

|

our strategic focus on immuno-oncology;

|

|

|

·

|

the novel and unproven approach associated with our RNAi technology;

|

|

|

·

|

our limited experience as a company in immuno-oncology;

|

|

|

·

|

identifying and developing product candidates, including whether we are able to commence clinical trials in humans or obtain approval for our product candidates;

|

|

|

·

|

our dependence on the success of our product candidates, which may not receive regulatory approval or be successfully commercialized;

|

|

|

·

|

factors could prevent us from obtaining regulatory approval or commercializing our product candidates on a timely basis, or at all;

|

|

|

·

|

FDA regulation of our therapeutics;

|

|

|

·

|

our reliance on in-licensed technologies and the potential need for additional intellectual property rights in the future;

|

|

|

·

|

our ability to protect our intellectual property rights and the adequacy of our intellectual

property rights;

|

|

|

·

|

competitive risks, including the risks associated with competing against companies in the immuno-oncology space with significantly greater resources;

|

|

|

·

|

our reliance on third parties for the manufacture of our clinical product candidates;

|

|

|

·

|

potential product liability claims;

|

|

|

·

|

pricing regulations, third-party reimbursement practices or healthcare reform initiatives;

|

|

|

·

|

our ability to attract, hire and retain qualified personnel;

|

|

|

·

|

effectiveness of our internal control over financial reporting; and

|

|

|

·

|

volatility of our common stock.

|

Our actual results and financial condition

may differ materially from those indicated in the forward-looking statements as a result of the foregoing factors, as well as those

identified in this prospectus under the heading “Risk Factors” and in other filings the Company periodically makes

with the Securities and Exchange Commission. Therefore, you should not rely unduly on any of these forward-looking statements.

Forward-looking statements contained in this prospectus speak as of the date hereof and the Company does not undertake to update

any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of

this report.

Prospectus

Summary

The following

summary highlights certain information contained elsewhere in this prospectus and the documents incorporated by reference

herein. This summary provides an overview of selected information and does not contain all of the information you should

consider in making your investment decision. Therefore, you should read the entire prospectus and the documents incorporated

by reference herein carefully before investing in our securities. Investors should carefully consider the information set

forth under “Risk Factors” beginning on page 4 of this prospectus and the financial statements and other

information incorporated by reference in this prospectus. In this prospectus, unless otherwise noted, (1) the term

“Phio” refers to Phio Pharmaceuticals Corp. and our subsidiary, MirImmune, LLC and (2) the terms

“Company,” “we,” “us,” and “our” refer to the ongoing business operations of

Phio and MirImmune, LLC, whether conducted through Phio or MirImmune, LLC.

Overview

Phio Pharmaceuticals

Corp. is a biotechnology company developing the next generation of immuno-oncology therapeutics based on our self-delivering RNAi

(“sd-rxRNA®”) therapeutic platform. The Company's efforts are focused on silencing tumor-induced

suppression of the immune system through our proprietary sd-rxRNA platform with utility in immune cells and/or the tumor micro-environment.

Our goal is to maximize the power of our sd-rxRNA therapeutic compounds by weaponizing immune effector cells to overcome tumor

immune escape providing patients a powerful new treatment option that goes beyond current treatment modalities.

Our development efforts are based on our

broadly patented sd-rxRNA technology platform. Our sd-rxRNA compounds do not require a delivery vehicle to penetrate into tissues

and cells and are designed to “silence” or down-regulate, the expression of a specific gene which is over-expressed

in cancer. We believe that our sd-rxRNA platform uniquely positions the Company in the field of immuno-oncology because of this

and the following reasons:

|

|

·

|

Efficient uptake of sd-rxRNA to immune cells obviating the need for facilitated delivery (mechanical or formulation);

|

|

|

·

|

Can target multiple genes (i.e. multiple immunosuppression pathways) in a single therapeutic entity;

|

|

|

·

|

Gene silencing by sd-rxRNA has been shown to have a sustained, or long-term, effect in vivo;

|

|

|

·

|

Favorable clinical safety profile of sd-rxRNA with local administration; and

|

|

|

·

|

Can be readily manufactured under current good manufacturing practices.

|

The self-delivering

nature of our compounds makes sd-rxRNA ideally suited for use with adoptive cell transfer (“ACT”) treatments

and direct therapeutic use. ACT consists of the infusion of immune cells with antitumor properties. These cells can be derived

from unmodified (i.e. naturally occurring) immune cells, immune cells isolated from resected tumors, or genetically engineered

immune cells recognizing tumor neoantigens/neoepitopes cells.

Currently, ACT

therapies for the treatment of solid tumors face several hurdles. Multiple inhibitory mechanisms restrain immune cells used in

ACT from effectively eradicating tumors, including immune checkpoints, reduced cell fitness and cell persistence. Furthermore,

the immunosuppressive tumor micro-environment (the “TME”) can pose a formidable barrier to immune cell infiltration

and function.

Phio has developed

a platform based on our sd-rxRNA technology that allows easy, precise, rapid, and selective non-genetically modified programming

of ACT cells (ex-vivo, during manufacturing) and of the TME (in vivo, by local application), resulting in improved

cell-based immunotherapy.

For additional information

about the Company, please refer to other documents we have filed with the Securities and Exchange Commission and that are incorporated

by reference into this prospectus, as listed under the heading “Incorporation of Certain Information by Reference.”

Corporate Information

We were incorporated

in the state of Delaware in 2011 as RXi Pharmaceuticals Corporation. On November 19, 2018, the Company changed its name to Phio

Pharmaceuticals Corp., to reflect its transition from a platform company to one that is fully committed to developing groundbreaking

immuno-oncology therapeutics. Our executive offices are located at 257 Simarano Drive, Suite 101, Marlborough, MA 01752, and our

telephone number is (508) 767-3861. The Company’s website is www.phiopharma.com. Our website and the information

contained on that site, or connected to that site, is not part of or incorporated by reference into this prospectus.

Our certificate

of incorporation provides that the Court of Chancery of the State of Delaware is the exclusive forum for the following types of

actions or proceedings: any derivative action or proceeding brought on behalf of the Company, any action asserting a claim of

breach of a fiduciary duty owed by any director, officer or other employee of the Company to the Company or the Company’s

stockholders, any action asserting a claim against the Company arising pursuant to any provision of the Delaware General Corporation

Law or the Company’s certificate of incorporation or bylaws, or any action asserting a claim against the Company governed

by the internal affairs doctrine. Despite the fact that our certificate of incorporation provides for this exclusive forum provision

to be applicable to the fullest extent permitted by applicable law, Section 27 of the Securities and Exchange Act of 1934, as

amended (the “Exchange Act”), creates exclusive federal jurisdiction over all suits brought to enforce any

duty or liability created by the Exchange Act or the rules and regulations thereunder and Section 22 of the Securities Act of

1933, as amended (the “Securities Act”), creates concurrent jurisdiction for federal and state courts over

all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. As a

result, this provision of our certificate of incorporation would not apply to claims brought to enforce a duty or liability created

by the Securities Act, Exchange Act, or any other claim for which the federal courts have exclusive jurisdiction.

THE OFFERING

|

Common stock to be offered

|

|

8,125,946 shares consisting of:

|

|

by the Selling Stockholder

|

|

|

|

|

|

· 500,000

Commitment Shares issued to Lincoln Park upon the execution of the Purchase Agreement; and

|

|

|

|

|

|

|

|

·

7,625,946 shares we may sell to Lincoln Park under the Purchase Agreement from time to time after the date of this

prospectus, subject to the Exchange Cap and Beneficial Ownership Cap, as defined below under “Lincoln Park

Transaction”

|

|

|

|

|

|

Common stock outstanding prior to this offering

|

|

25,091,197 shares, as of August 6, 2019

|

|

|

|

|

Common stock to be outstanding after this offering

|

|

33,217,143 shares, which gives effect to the issuance of a total of 8,125,946 shares under

the Purchase Agreement.

|

|

|

|

|

|

Use of Proceeds

|

|

We will receive no proceeds from the sale of shares of common stock by Lincoln Park in this

offering. We may receive up to $10,000,000 in aggregate gross proceeds under the Purchase Agreement from any sales we make to

Lincoln Park pursuant to the Purchase Agreement after the date of this prospectus. Any proceeds that we receive from sales to

Lincoln Park under the Purchase Agreement will be used for working capital and general corporate purposes. See “Use of

Proceeds.”

|

|

|

|

|

|

Risk factors

|

|

This investment involves a high degree of risk. See “Risk

Factors” for a discussion of factors you should consider carefully before making an investment decision.

|

|

Trading Market

|

|

Our common stock is listed on The Nasdaq Capital Market under the symbol “PHIO.”

|

RISK FACTORS

Investing in our securities involves a high degree of risk.

Before investing in our securities, you should carefully consider the risks, uncertainties and assumptions described below and

discussed under the heading “Risk Factors” included in our most recent Annual Report on Form 10-K for the year ended

December 31, 2018, as revised or supplemented by subsequent filings, which are on file with the Securities and Exchange Commission

and are incorporated herein by reference, and which may be amended, supplemented or superseded from time to time by other reports

we file with the Securities and Exchange Commission in the future.

Our business, financial condition, results of operations

and future growth prospects could be materially and adversely affected by any of these risks. In these circumstances, the market

price of our common stock could decline, and you may lose all or part of your investment. The risks and uncertainties incorporated

by reference into this prospectus are not the only ones we face. Additional risks and uncertainties not presently known or which

we consider immaterial as of the date hereof may also have an adverse effect on our business.

Risks Related to This Offering

The sale or issuance of our common stock to Lincoln Park

may cause dilution and the sale of the shares of common stock acquired by Lincoln Park, or the perception that such sales may occur,

could cause the price of our common stock to fall.

On August 7, 2019, we entered into

the Purchase Agreement with Lincoln Park, pursuant to which Lincoln Park has committed to purchase up to $10,000,000 of

our common stock. Upon the execution of the Purchase Agreement, we issued 500,000 Commitment Shares to Lincoln Park as a fee

for its commitment to purchase shares of our common stock under the Purchase Agreement. The remaining shares of our common

stock that may be issued under the Purchase Agreement may be sold by us to Lincoln Park at our discretion from time to time

over a 30-month period commencing after the satisfaction of certain conditions set forth in the Purchase Agreement, including

that the SEC has declared effective the registration statement that includes this prospectus, and subject to applicable

Nasdaq limits on the number of shares that we can sell to Lincoln Park, absent stockholder approval. The purchase price for the

shares that we may sell to Lincoln Park under the Purchase Agreement will fluctuate based on the price of our common stock.

Depending on market liquidity at the time, sales of such shares may cause the trading price of our common stock to fall.

We generally have the right to control the

timing and amount of any future sales of our shares to Lincoln Park. Additional sales of our common stock, if any, to Lincoln Park

will depend upon market conditions and other factors to be determined by us. We may ultimately decide to sell to Lincoln Park all,

some, or none of the additional shares of our common stock that may be available for us to sell pursuant to the Purchase Agreement.

If and when we do sell shares to Lincoln Park, after Lincoln Park has acquired the shares, Lincoln Park may resell all, some or

none of those shares at any time or from time to time in its discretion. Therefore, sales to Lincoln Park by us could result in

substantial dilution to the interests of other holders of our common stock. Additionally, the sale of a substantial number of shares

of our common stock to Lincoln Park, or the anticipation of such sales, could make it more difficult for us to sell equity or equity-related

securities in the future at a time and at a price that we might otherwise wish to effect sales.

We may require additional financing to sustain our operations

and without it we may not be able to continue operations.

The Company believes that its existing

cash, and the potential proceeds available under the Purchase Agreement with Lincoln Park (assuming the Company is able to

access the full amount), should be sufficient to fund the Company’s operations for at least the next twelve months. We have

generated significant losses to date and expect to continue to incur significant operating losses as we advance our product

candidates through drug development and the regulatory process. In the future, we will be dependent on obtaining funding from

third parties, such as proceeds from the issuance of debt, sale of equity, funded research and development programs and

payments under partnership and collaborative agreements, in order to maintain our operations and meet our obligations to

licensors. There is no guarantee that debt, additional equity or other funding will be available to us on acceptable terms,

or at all.

The extent we rely on Lincoln Park as a

source of funding will depend on a number of factors including, the prevailing market price of our common stock and the extent

to which we are able to secure working capital from other sources. If obtaining sufficient funding from Lincoln Park were to prove

unavailable or prohibitively dilutive, we will need to secure another source of funding in order to satisfy our working capital

needs. Even if we sell all $10,000,000 under the Purchase Agreement to Lincoln Park, we may still need additional capital to fully

implement our business, operating and development plans. Should the financing we require to sustain our working capital needs be

unavailable or prohibitively expensive when we require it, the consequences could be a material adverse effect on our business,

operating results, financial condition and prospects.

USE OF PROCEEDS

This prospectus relates to shares of our

common stock that may be offered and sold from time to time by Lincoln Park. We will receive no proceeds from the sale of shares

of common stock by Lincoln Park in this offering. We may receive up to $10,000,000 in aggregate gross proceeds from any sales of

our common stock to Lincoln Park under the Purchase Agreement after the date of this prospectus. We will pay the expenses relating

to the registration under the Securities Act of the offer and sale by Lincoln Park of the shares covered by this prospectus, including

legal and accounting fees.

DIVIDEND

POLICY

We have never paid any cash dividends and

do not anticipate paying any cash dividends on our common stock in the foreseeable future. We expect to retain future earnings,

if any, for use in our development activities and the operation of our business. The payment of any future dividends will be subject

to the discretion of our Board of Directors and will depend, among other things, upon our results of operations, financial condition,

cash requirements, prospects and other factors that our Board of Directors may deem relevant.

lincoln

park Transaction

General

On August 7, 2019, we entered into a

purchase agreement with Lincoln Park, which, as amended on August 20, 2019, we refer to in this prospectus as the

“Purchase Agreement,” pursuant to which Lincoln Park has agreed to purchase from us up to an aggregate of

$10,000,000 of our common stock (subject to certain limitations) from time to time over the term of the Purchase Agreement.

Also on August 7, 2019, we entered into a registration rights agreement with Lincoln Park, which we refer to in this

prospectus as the “Registration Rights Agreement,” pursuant to which we have filed with the SEC the registration

statement that includes this prospectus to register for resale under the Securities Act of 1933, as amended, or the

“Securities Act,” the shares of common stock that have been or may be issued to Lincoln Park under the Purchase

Agreement.

Following the execution of the Purchase

Agreement, we issued 500,000 shares of common stock to Lincoln Park as consideration for its commitment to purchase shares of our

common stock under the Purchase Agreement, which we refer to in this prospectus as the “Commitment Shares.” We do not

have the right to commence any sales of our common stock to Lincoln Park under the Purchase Agreement until certain conditions

set forth in the Purchase Agreement, all of which are outside of Lincoln Park’s control, have been satisfied, including that

the registration statement of which this prospectus is a part is declared effective by the Securities and Exchange Commission.

Thereafter, under

the terms and subject to the conditions of the Purchase Agreement, we have the right to sell to Lincoln Park, and Lincoln Park

is obligated to purchase, up to $10,000,000 of shares of our common stock, subject to certain limitations set forth in the Purchase

Agreement, from time to time, over a 30-month period.

Under the Purchase Agreement, on any business

day selected by the Company, the Company may direct Lincoln Park to purchase shares of our common stock in amounts up to 200,000

shares (or up to $50,000 in shares of common stock, whichever is greater) in a “regular purchase,” which amounts may

be increased to up to 500,000 shares provided the market price of our common stock at the time of sale exceeds is not below certain

threshold prices, as set forth in the Purchase Agreement, subject in each case to $1,000,000 in total purchase proceeds per purchase

date. In addition to regular purchases, the Company may also direct Lincoln Park to purchase additional amounts as accelerated

purchases or as additional purchases if the Company has utilized the Regular Purchase Amount in full and if the closing sale price

of the Common Stock exceeds certain threshold prices, as set forth in the Purchase Agreement. The purchase price of the shares

that may be sold to Lincoln Park under the Purchase Agreement will be based on the market price of our common stock preceding the

time of sale as computed under the Purchase Agreement.

In accordance with applicable rules of The

Nasdaq Capital Market, the Purchase Agreement also limits the Company’s issuance of shares of Common Stock to Lincoln Park

thereunder to 5,015,730 shares of Common Stock, representing 19.99% of the shares of Common Stock outstanding on the date of the

Purchase Agreement (the “Exchange Cap”) unless (a) stockholder approval is obtained to issue more than such amount

or (b) the average price of all applicable sales of our common stock to Lincoln Park under the Purchase Agreement equals or exceeds

the lower of (i) the closing price of our common stock on the Nasdaq Capital Market immediately preceding August 7, 2019 plus an

incremental amount or (ii) the average of the closing price of our common stock on the Nasdaq Capital Market for the five Business

Days immediately preceding August 7, 2019 plus an incremental amount, such that issuances and sales of our common stock to Lincoln

Park under the Purchase Agreement would be exempt from the Exchange Cap limitation under applicable Nasdaq rules.

The Purchase Agreement also prohibits us

from directing Lincoln Park to purchase any shares of common stock if those shares, when aggregated with all other shares of our

common stock then beneficially owned by Lincoln Park and its affiliates, would result in Lincoln Park and its affiliates having

beneficial ownership, at any single point in time, of more than 9.99% of the then total outstanding shares of our common stock,

as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, or the “Exchange Act,”

and Rule 13d-3 thereunder, which limitation we refer to as the “Beneficial Ownership Cap”.

There are no trading volume requirements

or restrictions under the Purchase Agreement, and we will control the timing and amount of any sales of our common stock to Lincoln

Park. We may at any time in our sole discretion terminate the Purchase Agreement without fee, penalty or cost upon one business

days’ notice. There are no restrictions on future financings, rights of first refusal, participation rights, penalties or

liquidated damages in the Purchase Agreement or Registration Rights Agreement, other than a prohibition on entering into any “Variable

Rate Transaction,” as defined in the Purchase Agreement. Lincoln Park may not assign or transfer its rights and obligations

under the Purchase Agreement.

A total of 8,125,946 shares of our common

stock are being offered under this prospectus, which may be less than the amount of shares issuable under the Purchase Agreement.

As of August 23, 2019, there were 25,591,197 shares of our common stock outstanding, of which 25,124,081 shares were held by non-affiliates.

If all of the 8,125,946 shares offered by Lincoln Park under this prospectus were issued and outstanding as of August 23, 2019,

such shares would represent 24% of the total number of shares of our common stock outstanding and 25% of the total number of outstanding

shares held by non-affiliates, in each case as of the date hereof; however, these percentages do not give effect to the prohibition

contained in the Purchase Agreement that prevents us from selling and issuing to Lincoln Park shares of our common stock that would

cause us to exceed the Exchange Cap or that would cause Lincoln Park and its affiliates to exceed the Beneficial Ownership Cap.

If we elect to issue and sell more than

the 8,125,946 shares offered under this prospectus to Lincoln Park, which we have the right, but not the obligation, to do, we

must first register for resale under the Securities Act any such additional shares, which could cause additional substantial dilution

to our stockholders. The number of shares ultimately offered for resale by Lincoln Park is dependent upon the number of shares

we sell to Lincoln Park under the Purchase Agreement.

Issuances of our common

stock in this offering will not affect the rights or privileges of our existing stockholders, except that the economic and voting

interests of each of our existing stockholders will be diluted as a result of any such issuance. Although the number of shares

of common stock that our existing stockholders own will not decrease, the shares owned by our existing stockholders will represent

a smaller percentage of our total outstanding shares after any such issuance to Lincoln Park.

Purchase of Shares Under the Purchase Agreement

Under the Purchase Agreement, on any business

day selected by us, we may direct Lincoln Park to purchase up to 200,000 shares of our common stock on any such business day, which

we refer to as a “Regular Purchase,” provided, however, that (i) the Regular Purchase may be increased to up to 300,000

shares, provided that the closing sale price is not below $0.60 on the purchase date, (ii) the Regular Purchase may be increased

to up to 400,000 shares, provided that the closing sale price is not below $0.80 on the purchase date, and (iii) the Regular Purchase

may be increased to up to 500,000 shares, provided that the closing sale price is not below $1.00 on the purchase date. In each

case, the maximum amount of any single Regular Purchase may not exceed $1,000,000 per purchase. The purchase price per share for

each such Regular Purchase will be equal to the lower of:

|

·

|

the lowest sale price for our common stock on the purchase date of such shares; or

|

|

|

|

|

·

|

the arithmetic average of the three lowest closing sale prices for our common stock during the 10 consecutive

business days ending on the business day immediately preceding the purchase date of such shares.

|

In addition to Regular Purchases described

above, we may also direct Lincoln Park, on any business day on which we have properly submitted a Regular Purchase for the full

amount of our common stock permitted on such business day, to purchase an additional amount of our common stock, which we refer

to as an “Accelerated Purchase,” not to exceed the lesser of:

|

·

|

30% of the aggregate shares of our common stock traded during normal trading hours on the purchase date;

and

|

|

|

|

|

·

|

3 times the number of purchase shares purchased pursuant to the corresponding Regular Purchase.

|

The purchase price per share for each such

Accelerated Purchase will be equal to the lower of:

|

·

|

95% of the volume weighted average price during (i) the entire trading day on the purchase date, if the

volume of shares of our common stock traded on the purchase date has not exceeded a volume maximum calculated in accordance with

the Purchase Agreement, (ii) the portion of the trading day of the purchase date (calculated starting at the beginning of normal

trading hours) until such time at which the volume of shares of our common stock traded has exceeded such volume maximum, or (iii)

the portion of the trading day on the purchase date (calculated starting at the beginning of normal trading hours) until such time

at which the sales price of our common stock has fallen below the minimum price threshold set forth in the notice for the Accelerated

Purchase; or

|

|

|

|

|

·

|

the closing sale price of our common stock on the accelerated purchase date.

|

We may also direct Lincoln Park,

not later than 1:00 p.m., Eastern time, on a business day on which an Accelerated Purchase has been completed and all of the shares

to be purchased thereunder have been delivered to Lincoln Park in accordance with the Purchase Agreement prior to such time on

such business day to purchase an additional amount of our common stock, which we refer to as an Additional Accelerated Purchase,

of up to the lesser of:

|

·

|

30% of the aggregate shares of our common stock traded during normal trading hours on the purchase date;

and

|

|

|

|

|

·

|

3 times the number of purchase shares purchased pursuant to the corresponding Regular Purchase.

|

The purchase price per share for each such

Additional Accelerated Purchase will be equal to the lower of:

|

·

|

95% of the volume weighted average price during (i) the entire trading day on the additional accelerated

purchase date, if the volume of shares of our common stock traded on the purchase date has not exceeded a volume maximum calculated

in accordance with the Purchase Agreement, (ii) the portion of the trading day of the purchase date (calculated starting at the

beginning of normal trading hours) until such time at which the volume of shares of our common stock traded has exceeded such volume

maximum, or (iii) the portion of the trading day on the purchase date (calculated starting at the beginning of normal trading hours)

until such time at which the sales price of our common stock has fallen below the minimum price threshold set forth in the notice

for the Additional Accelerated Purchase; or

|

|

|

|

|

·

|

the closing sale price of our common stock on the additional accelerated purchase date.

|

The Company has the right, in its sole

discretion, to set a minimum price threshold for each Accelerated Purchase and Additional Accelerated Purchase in the notice provided

with respect to such Accelerated Purchase and Additional Accelerated Purchase, and the Company may direct multiple Regular, Accelerated

and Additional Accelerated Purchases in a day provided that delivery of shares has been completed with respect to any prior Regular,

Accelerated and Additional Accelerated Purchases that Lincoln Park has purchased.

In the case of the Regular Purchases, Accelerated

Purchases and Additional Accelerated Purchases, the purchase price per share will be equitably adjusted for any reorganization,

recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction occurring during the business

days used to compute the purchase price.

Other than as described above, there are

no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any sales

of our common stock to Lincoln Park.

Events of Default

Events of default under the Purchase Agreement

include the following:

|

·

|

the effectiveness of the registration statement of which this prospectus forms a part lapses for any

reason (including, without limitation, the issuance of a stop order), or any required prospectus supplement and accompanying prospectus

are unavailable for the resale by Lincoln Park of our common stock offered hereby, and such lapse or unavailability continues for

a period of 10 consecutive business days or for more than an aggregate of 30 business days in any 365-day period;

|

|

|

|

|

·

|

suspension by our principal market of our common stock from trading for a period of one business day;

|

|

|

|

|

·

|

the de-listing of our common stock from The NASDAQ Capital Market, our principal market, provided our

common stock is not immediately thereafter trading on the New York Stock Exchange, the NASDAQ Global Market, the NASDAQ Global

Select Market, the NYSE Market, the OTC Bulletin Board or OTC Markets (or nationally recognized successor thereto);

|

|

|

|

|

·

|

the failure of our transfer agent to issue to Lincoln Park shares of our common stock within three business

days after the applicable date on which Lincoln Park is entitled to receive such shares;

|

|

|

|

|

·

|

any breach of the representations or warranties or covenants contained in the Purchase Agreement or Registration

Rights Agreement that has or could have a material adverse effect on us and, in the case of a breach of a covenant that is reasonably

curable, that is not cured within five business days;

|

|

|

|

|

·

|

if at any time the Exchange Cap is reached, to the extent applicable;

|

|

|

|

|

·

|

any voluntary or involuntary participation or threatened participation in insolvency or bankruptcy proceedings

by or against us; or

|

|

|

|

|

·

|

if at any time we are not eligible to transfer our common stock electronically.

|

Lincoln Park does not have the right to

terminate the Purchase Agreement upon any of the events of default set forth above. During an event of default, all of which are

outside of Lincoln Park’s control, we may not direct Lincoln Park to purchase any shares of our common stock under the Purchase

Agreement.

Our Termination Rights

We have the unconditional right, at any

time, for any reason and without any payment or liability to us, to give notice to Lincoln Park to terminate the Purchase Agreement.

In the event of bankruptcy proceedings by or against us, the Purchase Agreement will automatically terminate without action of

any party.

No Short-Selling or Hedging by Lincoln Park

Lincoln Park has agreed that neither it

nor any of its affiliates shall engage in any direct or indirect short-selling or hedging of our common stock during any time prior

to the termination of the Purchase Agreement.

Prohibitions on Variable Rate Transactions

There are no restrictions on future financings,

rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement or Registration Rights

Agreement other than a prohibition on entering into a “Variable Rate Transaction,” as defined in the Purchase Agreement.

Effect of Performance of the Purchase Agreement on Our Stockholders

All 8,125,946 shares registered in this

offering which have been or may be issued or sold by us to Lincoln Park under the Purchase Agreement are expected to be freely

tradable. It is anticipated that shares registered in this offering will be sold over a period of up to 30 months commencing on

the date that the registration statement including this prospectus becomes effective. The sale by Lincoln Park of a significant

amount of shares registered in this offering at any given time could cause the market price of our common stock to decline and

to be highly volatile. Sales of our common stock to Lincoln Park, if any, will depend upon market conditions and other factors

to be determined by us. We may ultimately decide to sell to Lincoln Park all, some or none of the additional shares of our common

stock that may be available for us to sell pursuant to the Purchase Agreement. If and when we do sell shares to Lincoln Park, after

Lincoln Park has acquired the shares, Lincoln Park may resell all, some or none of those shares at any time or from time to time

in its discretion. Therefore, sales to Lincoln Park by us under the Purchase Agreement may result in substantial dilution to the

interests of other holders of our common stock. In addition, if we sell a substantial number of shares to Lincoln Park under the

Purchase Agreement, or if investors expect that we will do so, the actual sales of shares or the mere existence of our arrangement

with Lincoln Park may make it more difficult for us to sell equity or equity-related securities in the future at a time and at

a price that we might otherwise wish to effect such sales. However, we have the right to control the timing and amount of any additional

sales of our shares to Lincoln Park and the Purchase Agreement may be terminated by us at any time at our discretion without any

cost to us.

Pursuant to the terms of the Purchase Agreement,

we have the right, but not the obligation, to direct Lincoln Park to purchase up to $10,000,000 of our common stock, exclusive

of the 500,000 shares issued to Lincoln Park on such date as a commitment fee. Depending on the price per share at which we sell

our common stock to Lincoln Park pursuant to the Purchase Agreement, we may need to sell to Lincoln Park under the Purchase Agreement

more shares of our common stock than are offered under this prospectus in order to receive aggregate gross proceeds equal to the

$10,000,000 total commitment available to us under the Purchase Agreement. If we choose to do so, we must first register for resale

under the Securities Act such additional shares of our common stock, which could cause additional substantial dilution to our stockholders.

The number of shares ultimately offered for resale by Lincoln Park under this prospectus is dependent upon the number of shares

we direct Lincoln Park to purchase under the Purchase Agreement.

The Purchase Agreement prohibits us from

issuing or selling to Lincoln Park under the Purchase Agreement (i) any shares of our common stock if those shares, when aggregated

with all other shares of our common stock then beneficially owned by Lincoln Park and its affiliates, would exceed the Beneficial

Ownership Cap and (ii) shares of our common stock in excess of the Exchange Cap, unless we obtain stockholder approval to

issue shares in excess of the Exchange Cap or the average price of all applicable sales of our common stock to Lincoln Park under

the Purchase Agreement equals or exceeds the lower of (a) the closing price of our common stock on the Nasdaq Capital Market immediately

preceding August 7, 2019 plus an incremental amount or (b) the average of the closing price of our common stock on the Nasdaq Capital

Market for the five Business Days immediately preceding August 7, 2019 plus an incremental amount, such that the transactions contemplated

by the Purchase Agreement are exempt from the Exchange Cap limitation under applicable NASDAQ rules.

The following table sets forth the amount

of gross proceeds we would receive from Lincoln Park from our sale of shares to Lincoln Park under the Purchase Agreement at varying

purchase prices:

|

Assumed Average Purchase Price Per Share

|

|

|

Number of Registered Shares to be Issued if Full Purchase (1)

|

|

|

Percentage of Outstanding Shares After Giving Effect to the Issuance to Lincoln Park (2)

|

|

|

Proceeds from the Sale of Shares to Lincoln Park Under the $10M Purchase Agreement

|

|

|

$

|

0.29 (3)

|

|

|

|

5,015,730

|

|

|

|

16%

|

|

|

$

|

1,454,561

|

|

|

$

|

0.60

|

|

|

|

7,625,946

|

|

|

|

23%

|

|

|

$

|

4,575,568

|

|

|

$

|

0.80

|

|

|

|

7,625,946

|

|

|

|

23%

|

|

|

$

|

6,100,757

|

|

|

$

|

1.00

|

|

|

|

7,625,946

|

|

|

|

23%

|

|

|

$

|

7,625,946

|

|

____________________

|

|

(1)

|

Although the Purchase Agreement provides that we may sell up to $10,000,000 of our common stock to Lincoln Park, we are only

registering 8,125,946 shares under this prospectus which represents: (i) 500,000 shares that we already issued to Lincoln Park

as a commitment fee for making the commitment under the Purchase Agreement, and (ii) an additional 7,625,946 shares which may be

issued to Lincoln Park in the future under the Purchase Agreement, if and when we sell shares to Lincoln Park under the Purchase

Agreement, and which may or may not cover all the shares we ultimately sell to Lincoln Park under the Purchase Agreement, depending

on the purchase price per share. As a result, we have included in this column only those shares that we are registering in this

offering. If we seek to issue shares of our common stock, including shares from other transactions that may be aggregated with

the transactions contemplated by the Purchase Agreement under the applicable rules of The NASDAQ Capital Market, in excess of 5,015,730

shares, or 19.99% of the total common stock outstanding immediately prior to the execution of the Purchase Agreement, we may be

required to seek stockholder approval in order to be in compliance with the rules of The NASDAQ Capital Market.

|

|

|

(2)

|

The denominator is based on 25,591,197 shares outstanding as of August 23, 2019, which includes (i) 500,000 commitment

shares issued to Lincoln Park upon the execution of the Purchase

Agreement, and (ii) the number of shares set forth in the adjacent

column which we would have sold to Lincoln Park, assuming the purchase price in the adjacent column. The numerator is based

on the number of shares issuable under the Purchase Agreement at the corresponding assumed purchase price set forth in the

adjacent column.

|

|

|

(3)

|

The closing sale price of our common stock on October 1,

2019.

|

DETERMINATION OF OFFERING PRICE

The prices at which the Shares covered by

this prospectus may actually be sold will be determined by the prevailing public market price for shares of our common stock, by

negotiations between the Selling Stockholder and buyers of our Common Stock in private transactions or as otherwise described in

“Plan of Distribution.”

SELLING STOCKHOLDER

This prospectus relates to the possible

resale by the Selling Stockholder, Lincoln Park, of shares of our common stock that have been or may be issued to Lincoln Park

pursuant to the Purchase Agreement. We are filing the registration statement of which this prospectus forms a part pursuant to

the provisions of the Registration Rights Agreement, which we entered into with Lincoln Park on August 7, 2019 concurrently with

our execution of the Purchase Agreement, in which we agreed to provide certain registration rights with respect to sales by Lincoln

Park of the shares of our common stock that have been or may be issued to Lincoln Park under the Purchase Agreement.

Lincoln Park, as the Selling Stockholder,

may, from time to time, offer and sell pursuant to this prospectus any or all of the shares that we have issued or may issue to

Lincoln Park under the Purchase Agreement. The Selling Stockholder may sell some, all or none of its shares. We do not know how

long the Selling Stockholder will hold the shares before selling them, and we currently have no agreements, arrangements or understandings

with the Selling Stockholder regarding the sale of any of the shares.

The following table presents information

regarding the Selling Stockholder and the shares that it may offer and sell from time to time under this prospectus. The table

is prepared based on information supplied to us by the Selling Stockholder, and reflects its holdings as of August 7, 2019. Neither

Lincoln Park nor any of its affiliates has held a position or office, or had any other material relationship, with us or any of

our predecessors or affiliates. Beneficial ownership is determined in accordance with Section 13(d) of the Exchange Act and

Rule 13d-3 thereunder. The percentage of shares beneficially owned prior to the offering is based on 25,591,197 shares of

our common stock actually outstanding as of August 23, 2019.

|

Selling Stockholder

|

|

Shares Beneficially Owned Before this Offering

|

|

Percentage of Outstanding Shares Beneficially Owned Before this Offering

|

|

|

Shares to be Sold in this Offering

|

|

Percentage of Outstanding Shares Beneficially Owned After this Offering

|

|

Lincoln Park Capital Fund, LLC (1)

|

|

2,556,561(2)

|

|

|

9.99(3)

|

|

|

8,125,946(4)

|

|

9.99%(5)

|

____________________

|

|

(1)

|

Josh Scheinfeld and Jonathan Cope, the Managing Members of Lincoln Park Capital, LLC, are deemed to be beneficial owners of

all of the shares of common stock owned by Lincoln Park Capital Fund, LLC. Messrs. Cope and Scheinfeld have shared voting and investment

power over the shares being offered under the prospectus filed with the SEC in connection with the transactions contemplated under

the Purchase Agreement. Lincoln Park Capital, LLC is not a licensed broker dealer or an affiliate of a licensed broker dealer.

|

|

|

(2)

|

Represents (i) 500,000 Commitment Shares of our common stock issued to Lincoln Park upon our execution of the Purchase

Agreement as a fee for its commitment to purchase shares of our common stock under the Purchase Agreement, all of which

shares are covered by the registration statement that includes this prospectus; and (ii) an aggregate of 2,056,561 shares of

our common stock, representing the maximum aggregate number of

shares that may be issued to Lincoln Park as of the date of this

prospectus upon exercise of warrants to purchase our common stock, at certain fixed prices (that may be subject to

adjustment as provided in such warrants), which warrants were

acquired by Lincoln Park in connection with our public offerings of

securities in June 2015, December 2016, April 2018 and October 2018 (collectively, the “LPC Public Offering

Warrants”). We

have excluded

from the number of shares beneficially owned by Lincoln

Park prior to the offering: (a) an aggregate of

1,455,151 shares of our common stock underlying the LPC Public Offering Warrants, which, as of the date of this prospectus,

may not be issued to Lincoln Park under the express terms of such warrants prohibiting us from issuing shares upon exercise

of such warrants if such shares, when aggregated with all other shares of our common stock then beneficially owned by

Lincoln Park and its affiliates, would result in Lincoln Park

and its affiliates having beneficial ownership of more than

9.99% of

the then total outstanding shares of our common stock, as

calculated in accordance with the terms of such warrants; and (b)

all of the additional shares of common stock that Lincoln Park may be required to purchase pursuant to the Purchase

Agreement, because the issuance of such shares is solely at our discretion and is subject to certain conditions, the

satisfaction of all of which are outside of Lincoln Park’s control, including the registration statement of which this

prospectus is a part becoming and remaining effective. Furthermore, under the terms of the Purchase Agreement, issuances and

sales of shares of our common stock to Lincoln Park are subject to certain limitations on the amounts we may sell to Lincoln

Park at any time, including the Exchange Cap and the Beneficial Ownership Cap. See the description under the heading

“The Lincoln Park Transaction” for more information about the Purchase Agreement.

|

|

|

(3)

|

Based on 25,591,197 outstanding shares of our common stock as of August 23, 2019, which includes the 500,000 Commitment Shares

we issued to Lincoln Park on August 7, 2019.

|

|

|

(4)

|

Although the Purchase Agreement provides that we may sell up to $10,000,000 of our common stock to Lincoln Park, only 8,125,946

shares of our common stock are being offered under this prospectus, which represents: (i) 500,000 Commitment Shares issued to Lincoln

Park upon our execution of the Purchase Agreement as a fee for its commitment to purchase shares of our common stock under the

Purchase Agreement; and (ii) an aggregate of 7,625,946 shares of our common stock that may be sold by us to Lincoln Park at our

discretion from time to time over a 30-month period commencing after the satisfaction of certain conditions set forth in the Purchase

Agreement, including that the SEC has declared effective the registration statement that includes this prospectus. Depending on

the price per share at which we sell our common stock to Lincoln Park pursuant to the Purchase Agreement, we may need to sell to

Lincoln Park under the Purchase Agreement more shares of our common stock than are offered under this prospectus in order to receive

aggregate gross proceeds equal to the $10,000,000 total commitment available to us under the Purchase Agreement. If we choose to

do so, we must first register for resale under the Securities Act such additional shares. The number of shares ultimately offered

for resale by Lincoln Park is dependent upon the number of shares we sell to Lincoln Park under the Purchase Agreement.

|

|

|

(5)

|

Percentage represents the maximum aggregate number of shares issuable to Lincoln Park upon exercise of the LPC Public Offering

Warrants under the terms of such warrants, after giving effect to the resale by Lincoln Park of all shares of common stock that

have been or may be issued and sold by us pursuant to the Purchase Agreement and that are covered by this prospectus and referenced

in footnote (4) above.

|

PLAN OF DISTRIBUTION

The common stock offered by this prospectus

is being offered by the Selling Stockholder, Lincoln Park. The common stock may be sold or distributed from time to time by the

Selling Stockholder directly to one or more purchasers or through brokers, dealers, or underwriters who may act solely as agents

at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or at

fixed prices, which may be changed. The sale of the common stock offered by this prospectus could be effected in one or more of

the following methods:

|

·

|

ordinary brokers’ transactions;

|

|

|

|

|

·

|

transactions involving cross or block trades;

|

|

|

|

|

·

|

through brokers, dealers, or underwriters who may act solely as agents;

|

|

|

|

|

·

|

“at the market” into an existing market for the common stock;

|

|

|

|

|

·

|

in other ways not involving market makers or established business markets, including direct sales to

purchasers or sales effected through agents;

|

|

|

|

|

·

|

in privately negotiated transactions; or

|

|

|

|

|

·

|

any combination of the foregoing.

|

In order to comply with the securities

laws of certain states, if applicable, the shares may be sold only through registered or licensed brokers or dealers. In addition,

in certain states, the shares may not be sold unless they have been registered or qualified for sale in the state or an exemption

from the state’s registration or qualification requirement is available and complied with.

Lincoln Park is an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act.

Lincoln Park has informed us that it intends

to use an unaffiliated broker-dealer to effectuate all sales, if any, of the common stock that it may purchase from us pursuant

to the Purchase Agreement. Such sales will be made at prices and at terms then prevailing or at prices related to the then current

market price. Each such unaffiliated broker-dealer will be an underwriter within the meaning of Section 2(a)(11) of the Securities

Act. Lincoln Park has informed us that each such broker-dealer will receive commissions from Lincoln Park that will not exceed

customary brokerage commissions.

Brokers, dealers, underwriters or agents

participating in the distribution of the shares as agents may receive compensation in the form of commissions, discounts, or concessions

from the Selling Stockholder and/or purchasers of the common stock for whom the broker-dealers may act as agent. The compensation

paid to a particular broker-dealer may be less than or in excess of customary commissions. Neither we nor Lincoln Park can presently

estimate the amount of compensation that any agent will receive.

We know of no existing arrangements between

Lincoln Park or any other stockholder, broker, dealer, underwriter or agent relating to the sale or distribution of the shares

offered by this prospectus. At the time a particular offer of shares is made, a prospectus supplement, if required, will be distributed

that will set forth the names of any agents, underwriters or dealers and any compensation from the Selling Stockholder, and any

other required information.

We will pay the expenses incident to the

registration, offering, and sale of the shares to Lincoln Park. We have agreed to indemnify Lincoln Park and certain other persons

against certain liabilities in connection with the offering of shares of common stock offered hereby, including liabilities arising

under the Securities Act or, if such indemnity is unavailable, to contribute amounts required to be paid in respect of such liabilities.

Lincoln Park has agreed to indemnify us against liabilities under the Securities Act that may arise from certain written information

furnished to us by Lincoln Park specifically for use in this prospectus or, if such indemnity is unavailable, to contribute amounts

required to be paid in respect of such liabilities.

Lincoln Park has represented to us that

at no time prior to the Purchase Agreement has Lincoln Park or its agents, representatives or affiliates engaged in or effected,

in any manner whatsoever, directly or indirectly, any short sale (as such term is defined in Rule 200 of Regulation SHO of the

Exchange Act) of our common stock or any hedging transaction, which establishes a net short position with respect to our common

stock. Lincoln Park agreed that during the term of the Purchase Agreement, it, its agents, representatives or affiliates will not

enter into or effect, directly or indirectly, any of the foregoing transactions.

We have advised Lincoln Park that it is

required to comply with Regulation M promulgated under the Exchange Act. With certain exceptions, Regulation M precludes the selling

stockholder, any affiliated purchasers, and any broker-dealer or other person who participates in the distribution from bidding

for or purchasing, or attempting to induce any person to bid for or purchase any security which is the subject of the distribution

until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price

of a security in connection with the distribution of that security. All of the foregoing may affect the marketability of the securities

offered by this prospectus.

This offering will terminate on the date

that all shares offered by this prospectus have been sold by Lincoln Park.

Our common stock is quoted on The NASDAQ

Capital Market under the symbol “PHIO”.

Legal Matters

Certain legal matters

relating to the issuance of the securities offered by this prospectus will be passed upon for us by Gibson, Dunn & Crutcher

LLP, San Francisco, California.

Experts

The

consolidated financial statements as of December 31, 2018 and 2017 and for each of the two years in the period ended December 31,

2018 incorporated by reference in this prospectus have been so incorporated in reliance on the report of BDO USA, LLP, an independent

registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

Where You

Can Find More Information

We file annual, quarterly and current reports,

proxy statements and other information with the Securities and Exchange Commission (“SEC”). Our SEC filings are available

to the public over the Internet at the SEC’s website at http://www.sec.gov. Copies of certain information filed by us with

the SEC are also available on our website at www.phiopharma.com. Our website is not a part of this prospectus and is not incorporated

by reference in this prospectus, and you should not consider the contents of our website in making an investment decision with

respect to our common stock.

This prospectus is part of a registration

statement that we filed with the SEC. This prospectus omits some information contained in the registration statement in accordance

with SEC rules and regulations. You should review the information and exhibits in the registration statement for further information

about us and our subsidiaries and the securities we are offering. Statements in this prospectus concerning any document we filed

as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are

qualified by reference to these filings. You should review the complete document to evaluate these statements.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” the information we have filed with them, which means that we can disclose

important information to you by referring you to those documents. The information we incorporate by reference is an important part

of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. The

documents we are incorporating by reference are:

All

documents we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, except as to any portion of

any report or document that is not deemed filed under such provisions, (1) on or after the date of filing of the registration

statement containing this prospectus and prior to the effectiveness of the registration statement and (2) on or after the

date of this prospectus until the earlier of the date on which all of the securities registered hereunder have been sold or the

registration statement of which this prospectus is a part has been withdrawn, shall be deemed incorporated by reference in this

prospectus and to be a part of this prospectus from the date of filing of those documents and will be automatically updated and,

to the extent described above, supersede information contained or incorporated by reference in this prospectus and previously filed

documents that are incorporated by reference in this prospectus.

Nothing in this prospectus shall be deemed

to incorporate information furnished but not filed with the SEC pursuant to Item 2.02, 7.01 or 9.01 of Form 8-K.

Upon written or oral request, we will provide

without charge to each person, including any beneficial owner, to whom a copy of the prospectus is delivered a copy of any or all

of the reports or documents incorporated by reference herein (other than exhibits to such documents, unless such exhibits are specifically

incorporated by reference herein). You may request a copy of these filings, at no cost, by writing or telephoning us at the following

address: Phio Pharmaceuticals Corp., 257 Simarano Drive, Suite 101, Marlborough, Massachusetts 01752 Attention: Investor Relations,

telephone: (508) 767-3861. We maintain a website at www.phiopharma.com. You may access our definitive proxy

statements on Schedule 14A, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on

Form 8-K and periodic amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange

Act with the SEC free of charge at our website as soon as reasonably practicable after such material is electronically filed with,

or furnished to, the SEC. The information contained in, or that can be accessed through, our website is not incorporated by reference

in, and is not part of, this prospectus. We have not authorized any one to provide you with any information that differs from that

contained in this prospectus. Accordingly, you should not rely on any information that is not contained in this prospectus. You

should not assume that the information in this prospectus is accurate as of any date other than the date of the front cover of

this prospectus.

Phio Pharmaceuticals

Corp.

Up to 8,125,946 Shares

of Common Stock

PROSPECTUS

October 1,

2019

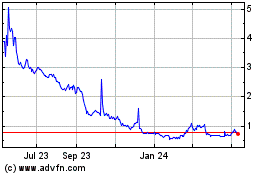

Phio Pharmaceuticals (NASDAQ:PHIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

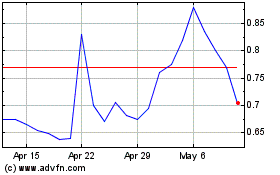

Phio Pharmaceuticals (NASDAQ:PHIO)

Historical Stock Chart

From Apr 2023 to Apr 2024