Quarterly Report (10-q)

October 02 2019 - 11:19AM

Edgar (US Regulatory)

October 2, 2019

Quarterly Report Under Section 13 or 15(d) of

The Securities Exchange Act of 1934

Commission File Number 333-65069

EXACT NAME as this appears in our Charter: Access-Power, Inc.

YEAR: 1996

STATE OF INC: FLORIDA

QUARTERLY REPORT PERIOD ENDING: Sept 30, 2019

I.R.S. Employer Identification No. 59-3420985

17164 Dune View Dr # 106 Grand Haven, MI 49417

(Address of principal executive office) (Zip Code)

Issuer's telephone number, including area code: (616) 312-5390

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

/X/ Quarterly Report Under Section 13 or 15(d) of

The Securities Exchange Act of 1934

For the Quarterly Period Ended September 30, 2019

/_/ Transition Report Under Section 13 or 15(d) of The Exchange Act

Commission File Number 333-65069

Access-Power, Inc.

(Exact Name of Small Business Issuer as Specified in its Charter)

Florida 59-3420985

(State or other jurisdiction of

(State or other jurisdiction of

|

Corporation or organization) (I.R.S. Employer Identification No.)

17164 Dune View Drive Apt 106, Grand Haven MI 49417

(Address of principal executive office) (Zip Code)

Issuer's telephone number, including area code: (616)312-5390

Transitional Small Business Disclosure Format (check one): Yes __ No X

SMALL

Smaller Reporting Company: Yes X NO ___

Emerging Growth Company: Yes X NO ___

|

Indicate whether registrant is a shell company: Yes ___ NO X

MOST RECENT CLOSING PRICE $.0001 PER SHARE. There is no bid for our

common stock while ACCR is traded on the grey sheets.

AS OF THE CLOSE OF BUSINESS OCTOBER 2, 2019, THE AGGREGATE MARKET

CAPITALIZATION ON A FULLY DILUTED BASIS IS $244,144.12, BASED ON A

CLOSING PRICE OF $.0001 PER SHARE.

****CURRENT UPDATE****

pjensen@myaccess-power.com

http://www.myaccess-power.com

https://www.otcmarkets.com/stock/ACCR/profile

We own the following websites:

http://www.mycbdpets.com

http://www.grandhavenmedicalmarijuana.com

http://www.grandrapidsmedicalmarijuana.com

http://www.mimedicalmarijuana.com

http://www.mi-medicalmarijuana.com

http://www.ca-medicalmarijuana.com

http://www.uclamarijuana.com

http://www.uscmarijuana.com

http://www.dubaimedicalmarijuana.com

ACCR recently filed a FORM 1120 US Corporation Income Tax. This represents

the first tax return filed by our Corporation with the Internal Revenue

Service in 18 years.

As of October 2, 2019

Authorized Common Stock: 500,000,000

Outstanding Common Stock: 244,144,121

Estimated Float: Less than 5,000,000

Restricted Common Stock: 129,641,475

As of October 1, 2019, we have $1.45 in our Premiere Checking account now.

Our #1 GOAL IS TO GET ACCESS-POWER, INC OFF THE GREY SHEETs.

I hope to accomplish the unthinkable, and that is bring back our company

from the grey sheets to a quote service with OTCMarkets.com. There are

only a handful of Companies that have accomplished this unthinkable feat.

I would like to save enough money in the Premiere Checking account,

to one day pay their $5,000.00 fee in order to file a Company Disclosure

with OTCMarkets.com. This may not occur until 2020. However, I am a

skilled salesman, and will try my very best to save money in the Premiere

Checking account over time. I personally own about 54% of the common

stock of this Corporation, and have full control over our destiny.

Very best regards,

PATRICK

Part I. Financial Information

Item 1. Financial Statements

ACCESS-POWER, INC.

(An Emerging Growth Company)

UNAUDITED

Balance Sheets Comps

Assets

September 30, June 30,

2019 2019

------------------ -------------------

(unaudited)

Current assets:

Cash $ 1.58 $ 500.00

CDs

Accounts receivable $ 0 $ 0

Prepaid expenses $1,000.00 $ 0

---------------------------------------

Total current assets $1,000.00 $ 500.00

---------------------------------------

Property and equipment, net $ 0 $ 0

Other assets $ 0 $ 0

---------------------------------------

Total assets $1,01.58 $ 500.00

=======================================

Liabilities and

Stockholders' Equity

(Deficit)

Current liabilities:

Accounts payable and accrued

expenses $0 $ 0

Current portion of

long-term debt - -

Total current liabilities $ 0 $ 0

Convertible debentures $ 0 $ 0

------------------ ------------------

Total liabilities $ 0 $ 0

---------------------------------------

Stockholders' equity

(deficit):

Common stock,

$.001 par value,

authorized

500,000,000 shares,

issued and outstanding

244,144,121 $244,144.12 $244,144.12

=======================================

Total liabilities

and stockholders'

equity (deficit) $244,144.12 $244,144.12

=======================================

|

ACCESS-POWER, INC

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS (unaudited)

THREE MONTHS ENDED September 30, 2019:

CASH FLOW

REVENE $

COST OF REVENUE $ 2,000.00

----------------------------------------------------------

GROSS PROFIT (LOSS) $ 1,950.00

|

OPERATING EXPENSES

Selling, general and administrative exp

rent, and utilities $ 0.00

Consulting fees $ 0.00

Professional fees and related expenses $ 50.00

TOTAL OPERATING EXPENSES $ 0.00

Salaries $ 1,950.00

Fair value of derivative liability $ 0.00

OTHER INCOME nonrecurring $ 0.00

Gain on debt extinguishment $ 0.00

(LOSS) INCOME BEFORE PROVISION FOR $ 0.00

INCOME TAXES $ 0.00

PROVISION FOR INCOME TAXES

treated as prepaid expense on

balance sheet $ 0.00

NET (LOSS) INCOME $ (000.00)

BASIC (LOSS) INCOME PER SHARE

DILUTED (LOSS) INCOME PER SHARE $ nil

WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING BASIC 244,144,121 shares

RESTRICTED SHARES 129,641,475 shares

ESTIMATED FLOAT LESS THAN 5,000,000 shares to

10,000,000 shares

/s/

Patrick J Jensen

|

Item 2. MANAGEMENT'S DISCUSSION AND ANALYSIS

Overview and Plan of Operation

Business Overview

Access-Power, INC, or ACCR is a public holding company that serves the

various sectors in our economy. As of today, we only service the Work at

Home business model. Access-Power, Inc. has one (1) key employee.

We were incorporated back on October 10, 1996. There was a change in

control in the Registrant on June 4, 2018.

ACCR is not currently offering any stock for sale.

Any stock to be purchased is available in the open market.

We are currently quoted in the grey market of the OTC.

We are current in our obligation to report with the SEC.

Access-Power, INC owns at the moment Hunter Venture, a Michigan

for profit Limited Liability Corporation. On June 4, 2018, Hunter

Venture became a wholly owned subsidiary of the Corporation.

Patrick J Jensen is a director with our company, and currently the only

employee working with Hunter Venture.

We had a FINRA processed name change, and made the daily sheet list

in September 2018:

https://otce.finra.org/otce/dailyList

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

NONE.

Item 2. Changes in Securities and Use of Proceeds

NONE.

ILLUSTRATIVE PURPOSES BELOW:

At $.0001 BID, the entire value of the Company shares on a fully

diluted basis is: $24,414.41

At $.001 BID, the entire value of the Company shares on a fully

diluted basis is: $244,144.12

At $.01 BID, the entire value of the Company shares on a fully

diluted basis is: $2,441,441.21

At $.06 BID, the entire value of the Company shaes on a fully

diluted basis is: $14,648,647.26

Management will make informed well processed decisions, and management

will succeed, as failure is not an option.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

There is no current risk with management. Everything is under control.

**********

Item 4. Controls and Procedures

Access-Power, Inc. will forever employ good management decisions.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

NONE

**********

Item 1A. Risk Factors

MANY

**********

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

NONE

**********

Item 3. Defaults Upon Senior Securities

NONE

**********

Item 4. Other Information

NONE.

**********

Item 5. Exhibits

(a) No Exhibits are being filed.

Patrick J Jensen profile on LinkedIn:

https://www.linkedin.com/in/patrick-j-jensen-564946b4

At a closing price of $.0001, the whole Company is valued at $24,414.21

My contact information is:

pjensen@myaccess-power.com

616-312-5390

Our comeback song:

https://www.youtube.com/watch?v=xbhCPt6PZIU

Access-Power, Inc. was the victim of naked convertible short selling. The

previous funders through BISH gutted our Company stock, and left it on the

side of the road to die. I am going to bring us back from the DEAD.

There is NO DILUTION PERIOD in Access-Power, INC.

I have a vision to one day to generate revenue with http://www.mycbdpets.com,

and offer a home delivery service of Medical Marijuana clones in a brown

paperbag only to our Medical Marijuana patients in the area. We own $1,000.00

worth of symbolic seeds with clonning potential to help our dreams come true.

Respectfully yours,

PATRICK

SIGNATURES*

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on

its behalf by the undersigned thereunto duly authorized.

In accordance with the requirements of the Exchange Act, the Company caused this

report to be signed on its behalf by the undersigned, thereunto duly authorized.

ACCESS-POWER, INC.

BY:

/s/

Patrick J. Jensen

President, Treasurer, and Director

October 2, 2019

|

Caution Concerning Forward Looking Statements:

Please also see our annual reports on Form 10-K and quarterly reports on Form

10-Q that we file with the SEC. Caution Concerning Forward Looking Statements

Our public communications and SEC filings may contain "forward-looking

statements" - that is, statements related to future, not past, events. In this

context, forward-looking statements often address our expected future business

and financial performance and financial condition, and o ften contain words

such as "expect," "anticipate," "intend," "plan," " believe," "seek," "see,"

"will," and "would." This section contains important information about

our forward-looking statements

Forward-looking statements by their nature address matters that are, to

different degrees, uncertainty and statements about potential business or asset

dispositions. For us, particular uncertainties that could cause our actual

results to be materially different than those expressed in our forward-looking

statements.

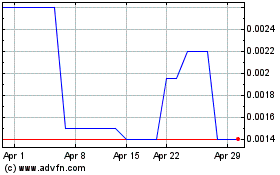

Access Power & (PK) (USOTC:ACCR)

Historical Stock Chart

From Mar 2024 to Apr 2024

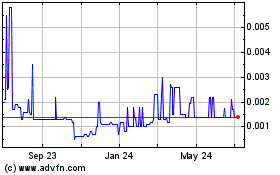

Access Power & (PK) (USOTC:ACCR)

Historical Stock Chart

From Apr 2023 to Apr 2024