Apollo Global Management, Inc. (NYSE: APO) (together with its

consolidated subsidiaries, “Apollo”) today announced several

leadership changes across its investing business.

“These new appointments reflect Apollo’s deep

reservoir of proven investment talent and lay the foundation for

the firm’s next generation of leadership,” said Leon Black,

Founder, Chairman and Chief Executive Office of Apollo.

Within Apollo’s flagship private equity

business, Senior Partners Matt Nord and David Sambur have been

promoted to Co-Lead Partners of Private Equity. Both Nord and

Sambur have spent the majority of their careers at Apollo and they

each bring nearly two decades of industry experience to the role.

These changes will be effective immediately, and Nord and Sambur

will continue to report to Scott Kleinman.

Apollo’s Co-Presidents, Scott Kleinman and James

Zelter, said: “Matt and David have been at the helm of numerous

successful private equity transactions during their tenure at

Apollo across an array of industries. They have also been very

involved in the day to day operations of Apollo’s flagship private

equity business and have established themselves as leaders from a

strategy and culture standpoint. Given the breadth of their

experience, we believe Matt and David are poised to lead the

private equity business as we seek to maximize value in Funds VII

and VIII, continue to deploy capital in Fund IX, and position the

business for the future.“

Senior Partners Olivia Wassenaar and Geoff

Strong have been promoted to Co-Leads of Apollo’s Natural Resources

business, where they will oversee the firm’s existing and future

natural resources funds. Wassenaar, who joined Apollo more than a

year ago, has 15 years of investing experience in conventional oil

and gas, the broader energy value chain and resource

sustainability, and Strong, who joined Apollo in 2012, has 16 years

of experience investing in the energy, power, renewables and

infrastructure sectors. These new appointments will be effective

immediately, and Wassenaar and Strong will report to Scott

Kleinman.

Dylan Foo will be joining the firm as a Senior

Partner and Co-Lead of Apollo‘s Infrastructure business. Foo is an

industry veteran with 20 years of infrastructure investing

experience, most recently at AMP Capital. In order to optimize the

inherent synergies between Apollo’s infrastructure and natural

resources investment activities, Geoff Strong has also been

appointed as Co-Lead of Infrastructure. Foo and Strong will report

to Kleinman and Zelter.

Greg Beard, in his capacity as Senior Partner

and Global Head of Natural Resources, will be transitioning to a

role as a Senior Advisor to Apollo through mid-2020. The firm is

grateful for Greg’s many contributions and would like to thank him

for his dedication and commitment as he helped to build Apollo’s

natural resources franchise over the past ten years.

Mr. Kleinman and Mr. Zelter commented:

“Infrastructure and Natural Resources are key areas of investment

focus for Apollo, and we believe this new leadership structure will

best position these businesses for the future. Olivia, Geoff, and

Dylan have outstanding investment track records and leadership

experience, and they will work closely together to drive investment

strategy and talent, source attractive opportunities, and continue

to build value for our investors.”

About Matt NordMr. Nord, 40, is

a Senior Partner at Apollo Private Equity having joined in 2003.

Prior to that time, he was a member of the Investment Banking

division of Salomon Smith Barney Inc. Mr. Nord serves on the board

of directors of ADT, Intrado, Lifepoint Health, Presidio and Exela

Technologies, Inc. Mr. Nord previously served on the boards of

directors of Affinion Group, Constellium NV, EVERTEC, Hughes

Telematics, MidCap Financial, Mobile Satellite Ventures, Noranda

Aluminum and SourceHOV. Mr. Nord also serves on the board of

trustees of Montefiore Health System and on the board of overseers

of the University of Pennsylvania’s School of Design. He graduated

summa cum laude with a BS in economics from the University of

Pennsylvania’s Wharton School of Business.

About David SamburMr. Sambur,

39, is a Senior Partner at Apollo Private Equity having joined in

2004. Prior to that time, Mr. Sambur was a member of the Investment

Banking division of Salomon Smith Barney Inc. He serves on the

board of directors of CareerBuilder, Coinstar LLC, ClubCorp,

Diamond Resorts International Inc., EcoATM LLC, Mood Media, PlayAGS

Inc., Rackspace Inc., Redbox Automated Retail LLC, and Shutterfly.

Mr. Sambur previously served on the boards of directors of Caesars

Entertainment, Hexion Holdings, LLC, Momentive Performance

Materials, Inc. and Verso Paper Corporation. He is also a member of

the board of directors of Arbor Brothers, the Mount Sinai

Department of Medicine Advisory Board, and the Deans Advisory

Council for Emory College. Mr. Sambur graduated summa cum laude and

Phi Beta Kappa from Emory University with a BA in economics.

About Geoff StrongMr. Strong,

44, is a Senior Partner at Apollo Private Equity having joined in

2012, and is focused on the firm’s natural resources and

infrastructure investing activities. Prior to that time, Mr. Strong

worked in the Private Equity and Infrastructure groups at

Blackstone, where he focused primarily on investments in the energy

sector. Before Blackstone, he was a Vice President of Morgan

Stanley Capital Partners, the private equity business within Morgan

Stanley. Mr. Strong serves or has served on the board of directors

of the following Apollo portfolio companies or affiliates: Apex

Energy, Apollo Royalties Management, AIE Caledonia Holdings LLC,

Caelus Energy, Chisolm Oil and Gas, CPV Fairview, Double Eagle

Energy I, Double Eagle Energy II, Double Eagle Energy III,

Freestone Midstream, Momentum Minerals, Northwoods Energy, Pipeline

Funding Company LLC, Roundtable Energy, Spartan Energy Acquisition

Corp, Tumbleweed Royalty, and Vistra Energy. Mr. Strong graduated

summa cum laude with a BS in business administration from Western

Oregon University, graduated cum laude with a JD from Lewis &

Clark College, and graduated with an MBA from the University of

Pennsylvania’s Wharton School of Business. Mr. Strong also serves

as a member of the Wharton Alumni Board.

About Olivia Wassenaar Ms.

Wassenaar, 39, is a Senior Partner at Apollo Private Equity having

joined the firm in 2018, and is focused on the firm’s natural

resources investing activities. She serves on the boards of several

Apollo portfolio companies, including Apex Energy, American

Petroleum Partners, LifePoint Health, Pegasus Optimization

Managers, and Talos Energy (NYSE: TALO). Prior to joining

Apollo, Ms. Wassenaar was a Managing Director at Riverstone

Holdings, where she was a member of the investment team for ten

years. Previously, Ms. Wassenaar worked at Goldman Sachs in the

Investment Banking Division focusing on natural resources and at

The World Bank Group. Ms. Wassenaar also serves on the investment

committee of The Brearley School. She received her AB, magna cum

laude, from Harvard College and an MBA from the University of

Pennsylvania’s Wharton School of Business.

About Dylan FooMr. Foo, 42,

will be joining Apollo as a Senior Partner and Co-Lead of

Infrastructure. He is currently a Partner and Head of

Americas Infrastructure Equity at AMP Capital, where he is

primarily focused on investments in the transportation,

communications and social infrastructure sectors. Mr. Foo

has experience executing infrastructure transactions across

the globe and he brings significant experience building

infrastructure investment platforms. Mr. Foo has previously served

on the board of directors of Angel Trains (UK), Everstream,

Millennium Parking Garages, Smarte Karte, and ITS ConGlobal. He was

previously based in London, where he was focused on originating

European infrastructure assets. Before AMP Capital, Mr. Foo was a

member of the banking divisions at Westpac Bank and Morgan Stanley,

in Sydney and London, respectively. Mr. Foo holds a Bachelor of

International Business degree from Q.U.T., Australia and a Masters

of Applied Finance degree from Macquarie University, Australia.

About ApolloApollo is a leading

global alternative investment manager with offices in New York, Los

Angeles, San Diego, Houston, Bethesda, London, Frankfurt, Madrid,

Luxembourg, Mumbai, Delhi, Singapore, Hong Kong, Shanghai and

Tokyo. Apollo had assets under management of approximately $312

billion as of June 30, 2019 in private equity, credit and real

assets funds invested across a core group of nine industries where

Apollo has considerable knowledge and resources. For more

information about Apollo, please visit www.apollo.com.

Forward Looking StatementsThis

press release may contain forward looking statements that are

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These statements include, but are not limited to,

discussions related to Apollo’s expectations regarding the

performance of its business, its liquidity and capital resources

and the other non-historical statements in the discussion and

analysis. These forward-looking statements are based on

management's beliefs, as well as assumptions made by, and

information currently available to, management. When used in this

press release, the words “believe,” “anticipate,” “estimate,”

“expect,” “intend” and similar expressions are intended to identify

forward-looking statements. Although management believes that the

expectations reflected in these forward-looking statements are

reasonable, it can give no assurance that these expectations will

prove to have been correct. These statements are subject to certain

risks, uncertainties and assumptions, including risks relating to

our dependence on certain key personnel, our ability to raise new

private equity, credit or real asset funds, market conditions,

generally, our ability to manage our growth, fund performance,

changes in our regulatory environment and tax status, the

variability of our revenues, net income and cash flow, our use of

leverage to finance our businesses and investments by our funds and

litigation risks, among others. We believe these factors include

but are not limited to those described under the section entitled

“Risk Factors” in Apollo’s annual report on Form 10-K filed with

the Securities and Exchange Commission (the “SEC”) on March 1,

2019, and in Apollo’s quarterly report on Form 10-Q filed with the

SEC on August 6, 2019, as such factors may be updated from time to

time in our periodic filings with the SEC, which are accessible on

the SEC’s website at www.sec.gov. These factors should not be

construed as exhaustive and should be read in conjunction with the

other cautionary statements that are included in this press release

and in other filings. We undertake no obligation to publicly update

or review any forward-looking statements, whether as a result of

new information, future developments or otherwise, except as

required by applicable law. This press release does not constitute

an offer of any Apollo fund.

Contact Information

Apollo Global Management

For investors please contact:Gary M. SteinHead

of Corporate CommunicationsApollo Global Management, LLC(212)

822-0467gstein@apollo.com

Ann DaiInvestor Relations ManagerApollo Global

Management, LLC(212) 822-0678adai@apollo.com

For media inquiries please contact:Charles

ZehrenRubenstein Associates, Inc. for Apollo Global Management,

LLC(212) 843-8590czehren@rubenstein.com

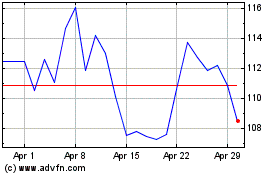

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Mar 2024 to Apr 2024

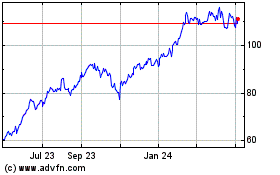

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Apr 2023 to Apr 2024