Stocks: Altria's E-Cigarette Bet Becomes Drag on Shares -- WSJ

September 20 2019 - 3:02AM

Dow Jones News

By Akane Otani

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 20, 2019).

America's biggest tobacco company is being burned by its

investment in e-cigarettes.

Altria Group Inc. shares have tumbled 19% in 2019 to a roughly

five-year low, with selling accelerating in recent weeks after

health officials and politicians stepped up scrutiny of e-cigarette

device Juul.

That is even as the broader market has rallied, with the S&P

500 up 20% and within striking distance of a record.

The slide shows how Altria's $12.8 billion investment in Juul

Labs Inc. -- which the company touted as a way for it to tap into a

rapidly growing market while offsetting the broader decline in

traditional smokers -- hasn't worked out exactly as it had

hoped.

Juul has been hit by a number of setbacks this year that have

put its future in doubt. President Trump has said he plans to ban

most vaping flavors because of growing health concerns; the Federal

Trade Commission is investigating whether Juul used influencers

with large social-media followings to appeal to minors; and sales

of the company's vaporizers were abruptly halted in China in

September.

Worries about the firm's potential merger with rival Philip

Morris International Inc. have also hurt the stock. Analysts have

raised questions since the two companies confirmed in late August

that they were discussing potentially reuniting, with Citigroup's

Adam Spielman saying in a note earlier this month that a deal might

only increase the combined firm's reliance on traditional nicotine

products at a time when cigarette use is declining.

One silver lining: after taking a hit, Altria's stock looks

relatively cheap. It is trading at around 9.1 times its expected

earnings over the next 12 months, well below its five-year average

of 17 times. And shareholders can expect to reap relatively hefty

dividends, too: Altria offers a dividend yield of around 8.2%,

according to FactSet, around four times that of the S&P

500.

Not that it is helping draw investors back in yet.

The regulatory outlook for vaping products looks riskier than

initially expected, said Piper Jaffray analyst Michael Lavery in a

note earlier in September. He's lowered his rating for the stock to

"neutral" from "overweight."

Write to Akane Otani at akane.otani@wsj.com

(END) Dow Jones Newswires

September 20, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

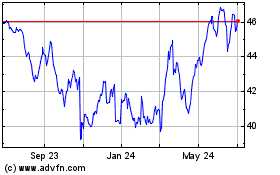

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

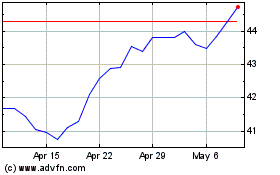

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024