Current Report Filing (8-k)

September 16 2019 - 7:02AM

Edgar (US Regulatory)

false 0001418819 0001418819 2019-09-13 2019-09-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) September 13, 2019

Iridium Communications Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-33963

|

|

26-1344998

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

1750 Tysons Boulevard

Suite 1400

McLean, VA 22102

(Address of principal executive offices)

703-287-7400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.001 par value

|

|

IRDM

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On September 13, 2019, Iridium Communications Inc. (“Iridium” or the “Company”), through its wholly owned subsidiary, Iridium

Government Services LLC, entered into a multi-year, fixed-price contract with the U.S. Air Force Space Command for Enhanced Mobile Satellite Services (the “EMSS Contract”). The EMSS Contract is effective September 15, 2019. Under the EMSS Contract, Iridium will provide satellite airtime services, including unlimited global secure and unsecure voice, paging, fax, Short Burst Data®, Iridium Burst®, RUDICS and Distributed Tactical Communications System (DTCS) services for an unlimited number of Department of Defense and other federal government subscribers. The fixed-price rate in each of the seven contract years is as follows:

|

|

|

|

|

|

|

Contract Year (September 15-September 14)

|

|

Fixed Price Rate

|

|

|

Year 1: 2019/2020

|

|

$

|

100 million

|

|

|

Year 2: 2020/2021

|

|

$

|

103 million

|

|

|

Year 3: 2021/2022

|

|

$

|

106 million

|

|

|

Year 4: 2022/2023

|

|

$

|

106 million

|

|

|

Year 5: 2023/2024

|

|

$

|

106 million

|

|

|

Year 6: 2024/2025

|

|

$

|

107 million

|

|

|

Year 7: 2025/2026

|

|

$

|

110.5 million

|

|

|

|

|

|

|

|

|

Total Contract Value

|

|

$

|

738.5 million

|

|

|

|

|

|

|

|

The Company may provide other services, such as Iridium Certus®, to the U.S. government under separate arrangements for an additional fee. In addition, the Company intends to invest approximately $10-$12 million over the next three years in support of the U.S. government to implement enhanced services at its dedicated gateway, which will be accounted for as additional cost of services.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On September 16, 2019, the Company announced an updated expectation for the performance of its broadband business. Iridium now expects that revenue from its broadband business will ramp to an annual run rate of approximately $75 million by the end of 2021, with a higher growth rate expected in 2021 compared to 2020. This change in expectations is driven by delayed activations of new Iridium CertusTM broadband terminals, largely caused by a longer than anticipated sales cycle, a longer period between sale and installation due to ship availability in ports, delays in terminal availability and delays in regulatory approvals in the aviation vertical. The Company continues to expect significant growth in its broadband business beyond 2021 and additionally continues to expect meaningful growth from Iridium Certus products in the mid-band range beyond 2021, as those products are introduced to the market and begin to be deployed.

The Company also affirmed its full-year 2019 outlook for total service revenue growth, OEBITDA(1), cash taxes and net leverage. The Company continues to expect:

|

|

•

|

Total service revenue of approximately $440 million for the full-year 2019.

|

|

|

•

|

OEBITDA of between $325 and $335 million in 2019.

|

|

|

•

|

Negligible cash taxes in 2019. Cash taxes are expected to be negligible through approximately 2023.

|

|

|

•

|

Net leverage of approximately 4.5x OEBITDA at the end of 2019.

|

On September 16, 2019, the Company issued a press release regarding the EMSS Contract, the text of which is included as Exhibit 99.1 to this Form 8-K.

The information contained herein, including Exhibit 99.1, is not filed for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and is not deemed incorporated by reference by any general statements incorporating by reference this report or future filings into any filing under the Securities Act or the Exchange Act, except to the extent the Registrant specifically incorporates the information by reference. By including this Item 7.01 disclosure and Exhibit 99.1 in the filing of this Current Report on Form 8-K and furnishing this information, the Registrant makes no admission as to the materiality of any information in this report.

|

|

(1)

|

In addition to disclosing financial results that are determined in accordance with U.S. GAAP, the Company provides Operational EBITDA, which is a non-GAAP financial measure, as a supplemental measure to help investors evaluate the Company’s fundamental operational performance. Operational EBITDA represents earnings before interest, income taxes, depreciation and amortization, loss from investment in Aireon (if applicable during the period), and share-based

|

|

|

|

compensation expenses. U.S. GAAP requires that certain of the expenses associated with the approximately $3 billion construction cost of Iridium NEXT (the “Construction Costs”) be expensed. These Construction Costs, which beginning in 2018 principally consisted of in-orbit insurance, will continue to be excluded from Operational EBITDA through the first quarter of 2020. Operational EBITDA does not represent, and should not be considered, an alternative to U.S. GAAP measurements such as net income or loss, and the Company’s calculations thereof may not be comparable to similarly titled measures reported by other companies. By eliminating interest, income taxes, depreciation and amortization, loss from investment in Aireon, and share-based compensation expenses, the Company believes the result is a useful measure across time in evaluating its fundamental core operating performance. Management also uses Operational EBITDA to manage the business, including in preparing its annual operating budget, debt covenant compliance, financial projections and compensation plans. The Company believes that Operational EBITDA is also useful to investors because similar measures are frequently used by securities analysts, investors and other interested parties in their evaluation of companies in similar industries. However, there is no standardized measurement of Operational EBITDA, and Operational EBITDA as the Company presents it may not be comparable with similarly titled non-GAAP financial measures used by other companies. As indicated, Operational EBITDA does not include interest expense on borrowed money, the payment of income taxes, amortization of the Company’s definite-lived intangible assets, or depreciation expense on the Company’s capital assets, which are necessary elements of the Company’s operations. It also excludes the loss from investment in Aireon. Since Operational EBITDA does not account for these and other expenses, its utility as a measure of the Company’s operating performance has material limitations. Due to these limitations, the Company’s management does not view Operational EBITDA in isolation, but also uses other measurements, such as net income, revenues and operating profit, to measure operating performance.

|

Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve a number of risks and uncertainties such as those, among others, relating to the value, term, services and benefits of the Company’s new DoD contract, future revenue from Iridium Certus broadband and mid-band offerings, and the Company’s expectations with respect to total service revenue growth, OEBITDA, cash taxes, and leverage for 2019 and cash taxes over the longer-term. Forward-looking statements can be identified by the words “anticipates,” “may,” “can,” “believes,” “expects,” “projects,” “intends,” “likely,” “will,” “to be” and other expressions that are predictions or indicate future events, trends or prospects. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Iridium to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, uncertainties regarding the development and functionality of Iridium services, and the Company’s ability to maintain the health, capacity and content of its satellite constellation, as well as general industry and economic conditions, and competitive, legal, governmental and technological factors. Other factors that could cause actual results to differ materially from those indicated by the forward-looking statements include those factors listed under the caption “Risk Factors” in the Company’s Form 10-K for the year ended December 31, 2018, filed with the Securities and Exchange Commission (the “SEC”) on February 28, 2019, as well as other filings Iridium makes with the SEC from time to time. There is no assurance that Iridium’s expectations will be realized. If one or more of these risks or uncertainties materialize, or if Iridium’s underlying assumptions prove incorrect, actual results may vary materially from those expected, estimated or projected. Iridium’s forward-looking statements speak only as of the date of this report, and Iridium undertakes no obligation to update forward-looking statements.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IRIDIUM COMMUNICATIONS INC.

|

|

|

|

|

|

|

|

|

|

Date: September 16, 2019

|

|

|

|

By:

|

|

/s/ Thomas J. Fitzpatrick

|

|

|

|

|

|

Name:

|

|

Thomas J. Fitzpatrick

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

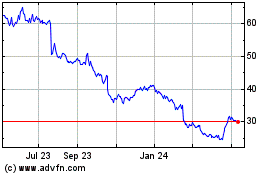

Iridium Communications (NASDAQ:IRDM)

Historical Stock Chart

From Mar 2024 to Apr 2024

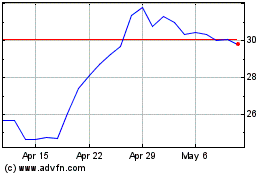

Iridium Communications (NASDAQ:IRDM)

Historical Stock Chart

From Apr 2023 to Apr 2024