UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule

13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of: August 2019

Commission file number: 001-33562

PLATINUM GROUP METALS LTD.

Suite 838 – 1100 Melville Street, Vancouver BC, V6E 4A6,

CANADA

Address of Principal Executive Office

Indicate by check mark whether the registrant files or will

file annual reports under cover:

Form 20-F [X]

Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

THIS REPORT OF FORM 6-K IS HEREBY INCORPORATED BY REFERENCE

INTO THE REGISTRANT’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-226580),

AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS SUBMITTED, TO THE

EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

On August 15, 2019, Platinum Group Metals Ltd. (“we” or the

“Company”) entered into a new credit agreement (the "New Credit Facility") with

Platinum Group Metals (RSA) Proprietary Limited (“PTM RSA”), as guarantor,

Sprott Private Resource Lending II (Collector), LP (“Sprott”), as agent, and

several lenders from time to time party thereto (the "Sprott Lenders"), to

establish a $20.0 million principal amount senior secured credit facility. The

maturity date of the New Credit Facility is August 21, 2021, subject to our

option to extend the maturity date by one year. If we elect to exercise our

option to extend the maturity date of the New Credit Facility by one year, we

will be required, at our option, to either: (i) issue the Sprott Lenders an

additional number of our common shares equal to 3% of the outstanding principal

amount under the New Credit Facility on the date that is two business days prior

to August 21, 2021 (the "Measurement Date"), divided by the volume weighted

average trading price of our common shares on the TSX for the five trading days

immediately preceding the Measurement Date; or (ii) make a cash payment to the

Sprott Lenders in the amount of 3% of the outstanding principal amount under the

New Credit Facility on the Measurement Date. Amounts outstanding under the New

Credit Facility will bear interest at a rate of 11.00% per annum, compounded

monthly. Interest is payable monthly in arrears on the last business day of each

month. We may prepay the amounts outstanding under the New Credit Facility, in

whole or in part, without penalty, provided that among other things, not less

than six months of interest has been paid on maximum principal amount under the

New Credit Facility. Any amounts prepaid under the New Credit Facility may not

be re-borrowed thereunder. The New Credit Facility also includes certain

mandatory prepayment requirements. If either we or PTM RSA (collectively, the

"Credit Parties") or any of our controlled subsidiaries dispose of any assets

outside the ordinary course of business for cash proceeds in excess of

$1,000,000 in the aggregate, then such Credit Party or such controlled

subsidiary will either reinvest the proceeds into the Waterberg Project or pay

the net proceeds from such sale to the Sprott Lenders in prepayment of the New

Credit Facility, subject to certain exceptions. The New Credit Facility further

stipulates that, if the Credit Parties or any of their controlled subsidiaries

close one or more equity financings (other than (i) the sale to Deepkloof

Limited of 6,940,000 common shares at a price of $1.32 per common share (the

“Deepkloof Private Placement”), (ii) the sale to Liberty Metals & Mining

Holdings, LLC (“LMM”) of 7,575,758 common shares at a price of $1.32 per common

share (the “LMM Private Placement”), and our public offering of shares of

8,326,957 common shares at a price of $1.25 per common share, including any

exercise of the over-allotment option thereunder (the “Public Offering”), each

of which was completed on August 21, 2019), the Credit Parties will pay 50% of

the net proceeds to the Sprott Lenders in prepayment of the New Credit Facility.

The New Credit Facility further stipulates that if any portion of our

outstanding warrants is exercised by the holders thereof, we will pay 75% of the

proceeds to the Sprott Lenders in prepayment of the New Credit Facility.

Under the New Credit Facility, the Sprott Lenders will have a

first priority lien on (i) the issued shares of PTM RSA and Waterberg JV

Resources Proprietary Limited that we or PTM RSA hold (and such other claims and

rights described in the applicable pledge agreement) and (ii) all of our present

and after-acquired personal property. The New Credit Facility is also guaranteed

by PTM RSA.

The New Credit Facility also contains various covenants,

including restrictions on the Credit Parties and their subsidiaries with respect

to additional borrowing, granting of security, modifications to material

contracts and transfers of assets, a requirement that the Credit Parties

maintain a working capital level of greater than $500,000, as well as

unrestricted cash and cash equivalents in an aggregate amount to exceed

$1,000,000, and a requirement that we receive approval from the South African

Reserve Bank in respect of the transactions contemplated under the New Credit

Facility by November 30, 2019.

We closed the $20.0 million dollar advance under the New Credit

Facility (the “Advance”) concurrently with the closing of the Public Offering on

August 21, 2019 and used the proceeds of the Advance, the Public Offering, the

Deepkloof Private Placement and the LMM Private Placement to repay our prior

secured credit facility with LMM (the “LMM Facility”) in full. In connection

with the $20.0 million advance, we issued the Sprott Lenders 800,000 common

shares, which was equal to $1.0 million divided by the sale price of common

shares in the Public Offering. We are also liable for all of the Sprott Lenders'

legal fees and other reasonable costs, charges and expenses incurred in

connection with the New Credit Facility.

Following closing of the Advance, the Public Offering, the

Deepkloof Private Placement and the LMM Private Placement, and the application

of the proceeds therefrom to repay the LMM Facility in full, based on our

planned definitive feasibility study and Waterberg Project expenditures, debt

service expenditures and historical average monthly burn rate for general and

administrative costs over the three month period ended May 31, 2019 of

approximately $295,000 (unaudited), we expect to have sufficient capital to maintain operations until March 31, 2020, after which time we will require additional capital to satisfy our obligations, including under our indebtedness. If additional

financing is raised by the issuance of our shares from treasury or other securities convertible into common shares, control of the Company may change, security holders will suffer dilution and the price of our common shares may decrease. Failure to

obtain such additional financing could result in the delay or indefinite postponement of further development of our properties, or even a loss of property interests.

This report on Form 6-K contains forward-looking information within the meaning of Canadian securities laws and forward-looking statements within the meaning of U.S. securities laws (collectively “forward-looking statements”).

Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, plans, postulate and similar expressions, or are those, which, by their nature, refer to future events. All statements that are not

statements of historical fact are forward-looking statements. Forward-looking statements in this press release include, without limitation, statements regarding the approval of the New Credit Facility by the South African Reserve Bank, our estimated

expenditures, the adequacy of our capital and the timing for additional capital requirements. Although we believe the forward-looking statements in this press release are reasonable, we can give no assurance that the expectations and assumptions in

such statements will prove to be correct. We caution investors that any of our forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as

a result of various factors, including, but not limited to, our ability to comply with the terms of our indebtedness; cash flow and going concern risks; risks related to the Waterberg definitive feasibility study; risks of delays in the development

of the Waterberg Project; variations in market conditions; the nature, quality and quantity of any mineral deposits that may be located; metal prices; other prices and costs; currency exchange rates; any disagreements with other shareholders

of our subsidiaries; our ability to obtain any necessary permits, consents or authorizations required for our activities and to comply with applicable regulations; our ability to produce minerals from our properties successfully or profitably, to

continue our projected growth, or to be fully able to implement our business strategies; our ability to regain compliance with NYSE American continued listing standards; and other risk factors described in our Form 20-F annual report, annual

information form and other filings with the SEC and Canadian securities regulators, which may be viewed at www.sec.gov and www.sedar.com, respectively. Any forward-looking statement speaks only as of the date on which it is made and, except as

required by applicable securities laws, we disclaim any intent or obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

Date: September 5,

2019

|

|

/s/ Frank Hallam

|

|

|

|

FRANK HALLAM

|

|

|

|

CHIEF FINANCIAL OFFICER

|

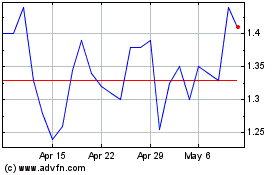

Platinum Group Metals (AMEX:PLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

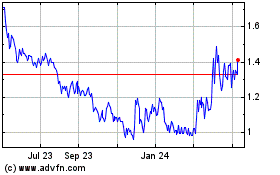

Platinum Group Metals (AMEX:PLG)

Historical Stock Chart

From Apr 2023 to Apr 2024