Current Report Filing (8-k)

September 05 2019 - 5:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 30, 2019

W&T Offshore, Inc.

(Exact name of registrant as specified in its charter)

1-32414

(Commission File Number)

|

Texas

|

72-1121985

|

|

(State or Other Jurisdiction

of Incorporation)

|

(I.R.S. Employer

Identification No.)

|

Nine Greenway Plaza, Suite 300

Houston, Texas 77046

(Address of Principal Executive Offices)

713.626.8525

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol

|

|

Name of each exchange on which

registered

|

|

Common Stock, par value $0.00001

|

|

WTI

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934

Emerging growth company☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Item 2.01 Completion of Acquisition or Disposition of Assets.

On August 30, 2019, W&T Offshore, Inc. (the “Company”) completed the previously announced purchase (the “Transaction”) of ExxonMobil Corporation’s interests in and operatorship of oil and gas producing properties in the eastern region of the Gulf of Mexico, offshore Alabama, and related onshore and offshore facilities and pipelines. After taking into account customary closing adjustments and an effective date of January 1, 2019, cash consideration paid by the Company was $167.6 million, which includes a previously funded $10.0 million deposit made pursuant to a purchase and sale agreement, dated as of June 26, 2019 . The Company has estimated net proved reserves acquired to be approximately 74 million barrels of oil equivalents (Boe) (using a 6 Mcf to 1 barrel equivalency) as of the effective date of January 1, 2019, based on October 15, 2018 New York Mercantile Exchange (“NYMEX”) forward strip Henry Hub natural gas and West Texas Intermediate oil prices, of which 22% are liquids and 99% are proved developed producing. Net production from the assets acquired in the Transaction averaged 19,800 net Boe per day (25% liquids) during the first quarter 2019. The properties acquired include working interests in nine offshore producing fields in the Gulf of Mexico and an onshore treatment facility that are adjacent to existing properties owned and operated by the Company. The acquisition was funded by cash on hand and borrowings under the Company’s previously undrawn revolving bank credit facility. The Company will also assume asset retirement obligations associated with these assets.

Item 7.01 Regulation FD Disclosure.

On September 3, 2019, the Company issued a press release announcing the closing of the Transaction. The Company also announced in the press release that it is the apparent high bidder on two shallow water blocks in the Gulf of Mexico Outer Continental Shelf Region-wide Oil and Gas Lease Sale 253 held by the Bureau of Ocean Energy Management on August 21, 2019. A copy of the press release is furnished herewith as Exhibit 99.1.

The information in this Item 7.01 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

(a)

|

Financial Statements of Business Acquired.

|

The Company will file the financial statements with respect to the Transaction described in Item 2.01 as required by this Item not later than 71 calendar days after the latest date on which this Form 8-K is required to be filed.

|

(b)

|

Pro Forma Financial Information.

|

The Company will file the pro forma financial statements with respect to the Transaction described in Item 2.01 as required by this Item not later than 71 calendar days after the latest date on which this Form 8-K is required to be filed.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

W&T OFFSHORE, INC.

(Registrant)

|

|

|

|

|

|

|

|

Dated: September 5, 2019

|

By:

|

/s/ Shahid A. Ghauri

|

|

|

|

Name:

|

Shahid A. Ghauri

|

|

|

|

Title:

|

Vice President, General Counsel and Corporate Secretary

|

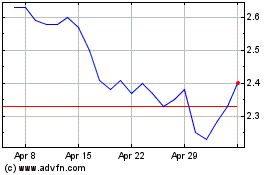

W and T Offshore (NYSE:WTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

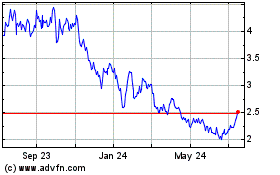

W and T Offshore (NYSE:WTI)

Historical Stock Chart

From Apr 2023 to Apr 2024