Donaldson achieved record sales of $2.85

billion in 2019, an increase of 4.0 percent from 2018

In 2019, Donaldson invested $150 million of

capital and returned $229 million to shareholders

Fiscal 2020 sales forecasted between a 2

percent decline and 4 percent increase

Operating margin expected to grow 0.3 to 0.9

percentage points in 2020, driven by gross margin

Donaldson Company, Inc. (NYSE: DCI) today reported 2019 net

earnings of $58.0 million in fourth quarter and $267.2 million for

the full year, compared with $102.4 million and $180.3 million,

respectively, in 2018. Excluding certain one-time items in the

current and prior years,1 adjusted earnings per share (EPS)2 were

$0.61 in fourth quarter and $2.21 for the full-year 2019, an

increase of 5.2 percent and 10.5 percent, respectively, from 2018.

A reconciliation of GAAP to non-GAAP measures is attached to this

press release.

“We generated record sales and profit in 2019, due in part to

strong performance in our Advance and Accelerate3 businesses, and

we made a record level of investments to drive long-term profitable

growth,” said Tod Carpenter, chairman, president and chief

executive officer. “We were pleased with sales results last

quarter, which matched our forecast, and earnings were also in line

as a better-than-expected tax rate offset the impact of demand

volatility on gross margin.

“Our fiscal 2020 plan reflects focused portfolio management in

an uneven demand environment. It is likely that uncertainty related

to global trade and the political environment will keep our

customers cautious, and some of our engine-related end markets are

nearing the peak of their economic cycle. As these factors affect

demand, our innovative products with recurring revenue, combined

with disciplined expense planning, give us greater stability and

flexibility as we remain focused on the future. We are making

incremental investments to drive our strategic priorities in 2020,

and we are aggressively pursuing gross margin improvement

opportunities. Our company is aligned on our strategic and

operational objectives, and we are excited about our path to

delivering another year of record profit.”

1

See the “Accounting Considerations”

section for more information about the adjusting items.

2

All earnings per share figures refer to

diluted earnings per share. Adjusted earnings are a non-GAAP

financial measure that exclude the impact of certain items not

related to ongoing operations.

3

Advance & Accelerate includes

Industrial Air Filtration (IAF) replacement parts, Engine

Aftermarket, Venting Solutions, Process Filtration, Semiconductor

and Industrial Hydraulics.

Operating Results

Fourth quarter 2019 sales increased 0.3 percent to $726.9

million from $724.7 million in 2018. Included within the

year-over-year change are the following items:

- The acquisition of BOFA International LTD (BOFA), which was

completed during first quarter 2019, added approximately 1.3

percentage points,

- Price increases added approximately 0.9 percentage points,

- Adoption of the revenue recognition accounting standard

(revenue recognition) added approximately 0.6 percentage points,

and

- Currency translation reduced sales by approximately 2.0

percent.

Three Months Ended

Twelve Months Ended

July 31, 2019

July 31, 2019

Reported % Change

Constant Currency % Change

Reported % Change

Constant Currency % Change

Off-Road

(10.1

)

%

(8.0

)

%

(3.7

)

%

(0.8

)

%

On-Road

1.5

2.2

16.6

18.4

Aftermarket

0.3

2.5

4.2

7.1

Aerospace and Defense

4.0

5.7

9.8

11.7

Total Engine Products segment

(1.1

)

%

0.9

%

4.2

%

6.9

%

Industrial Filtration Solutions

6.2

%

8.8

%

8.0

%

11.1

%

Gas Turbine Systems

6.9

8.5

(8.0

)

(6.5

)

Special Applications

(8.8

)

(8.0

)

(2.6

)

(0.7

)

Total Industrial Products segment

3.3

%

5.5

%

3.8

%

6.5

%

Total Company

0.3

%

2.3

%

4.0

%

6.8

%

Fourth quarter sales of Engine Products (Engine) decreased 1.1

percent from last year on a reported basis, and the sales increased

0.9 percent when excluding the negative impact from currency

translation. Engine realized benefits from pricing and revenue

recognition of 1.1 percent and 0.9 percent, respectively. Engine

faced mixed conditions across geographies and markets, with On-Road

experiencing continued strength in the US/CA market while Off-Road

and Aftermarket were stronger internationally. Timing of orders

contributed to the year-over-year growth in Aerospace and

Defense.

Fourth quarter sales of Industrial Products (Industrial)

increased 3.3 percent from last year. Industrial realized benefits

of 3.9 percent from BOFA and 0.5 percent from pricing, partially

offset by a negative impact from currency translation of 2.2

percent. Sales of Industrial Filtration Solutions (IFS) increased

6.2 percent, reflecting benefits from BOFA and replacement parts,

partially offset by lower sales of new equipment. Gas Turbine

Systems (GTS) sales increased due to the timing of new equipment

sales, and the Special Applications (SA) sales decline was due to

Disk Drive filters.

Fourth quarter 2019 operating income as a rate of sales

(operating margin) declined to 14.4 percent from 14.9 percent in

2018,4 including a negative impact of 0.1 percentage point from

revenue recognition.

Fourth quarter gross margin was 33.5 percent, compared with 34.9

percent in 2018, including a negative impact of 0.2 percentage

points from revenue recognition. The year-over-year gross margin

decline was driven by unfavorable mix of product sales within

markets, combined with higher raw materials and supply chain costs.

These gross margin pressures were partially offset by pricing

benefits. Operating expense as a percent of sales (expense rate)

improved 0.8 percentage points to 19.2 percent from 20.0 percent in

2018, reflecting lower incentive compensation expense, partially

offset by higher salary and other employee-related expenses.

Fourth quarter other expense was $0.5 million, compared with

income of $0.9 million in the prior year. The year-over-year change

was driven by charges related to Donaldson’s global cash

optimization efforts. Fourth quarter 2019 interest expense declined

to $5.2 million from $5.6 million in 2018.

Donaldson’s fourth quarter income tax expense included a charge

of $19.1 million related to final tax regulations that clarify

provisions of the Federal Tax Cuts and Jobs Act. Excluding this

impact, the fourth quarter 2019 adjusted tax rate was 21.4 percent,

compared with an adjusted tax rate of 26.2 percent in 2018. The

year-over-year decline was driven by benefits from a lower U.S.

corporate tax rate, combined with the favorable settlement of a tax

audit.

During fourth quarter 2019, Donaldson repurchased 500 thousand

shares of its common stock at an average price of $49.45 for a

total investment of $24.7 million. For the full year, the Company

repurchased 2.0 percent of its outstanding shares for a total

investment of $129.2 million. Donaldson paid dividends of $26.8

million in fourth quarter and $99.7 million for the full year.

Fiscal 2020 Outlook

Donaldson expects fiscal 2020 GAAP EPS between $2.21 and $2.37,

compared with fiscal 2019 GAAP and adjusted EPS of $2.05 and $2.21,

respectively.

Compared with 2019, fiscal 2020 sales are projected in a range

between a 2 percent decline and a 4 percent increase, including a

negative impact from currency translation of 1 to 2 percent that is

partially offset by price benefits of approximately 1 percent.

Compared with 2019, fiscal 2020 Engine sales are projected in a

range between a 4 percent decline and a 2 percent increase,

reflecting growth in Aerospace and Defense and Aftermarket,

combined with lower year-over-year sales in the Company’s first-fit

On-Road and Off-Road businesses. Industrial sales are expected to

increase from fiscal 2019 between 2 and 8 percent, reflecting

growth in IFS and GTS, partially offset by declining sales in SA.

Within Industrial, growth in IFS is due in part to one quarter of

incremental benefits from the acquisition of BOFA. Currency

translation is expected to negatively impact both segments by 1 to

2 percent.

4

Prior-period profit rates and other income

conform to the adoption of new accounting standards, which are

described in the “Accounting Considerations” section of this press

release.

Donaldson expects fiscal 2020 operating margin between 13.9 and

14.5 percent, compared with 13.6 percent in 2019. The

year-over-year improvement is due to higher gross margin, partially

offset by a higher expense rate.

The Company expects full-year 2020 interest expense between $18

million and $20 million, and other income is forecast between $4

million and $8 million. Donaldson’s fiscal 2020 effective income

tax rate is forecast between 25.0 and 27.0 percent.

The Company expects fiscal 2020 capital expenditures between

$110 million and $130 million, and cash conversion is forecast

between 80 and 95 percent. Donaldson expects to repurchase

approximately 2 percent of its outstanding shares during fiscal

2020.

Accounting

Considerations

Following the enactment of the Federal Tax Cuts and Jobs Act

(TCJA), the Company engaged in additional efforts related to

optimizing its global cash. During fourth quarter 2019, Donaldson

enhanced its subsidiary structure to leverage cash optimization

benefits made possible by the TCJA. This enhancement resulted in a

charge of $2.1 million in fourth quarter 2019. Other TCJA-related

matters resulted in fourth quarter and full-year 2019 net charges

of $19.1 million and $18.6 million, respectively, compared with a

benefit of $26.0 million in fourth quarter 2018 and a full-year

2018 charge of $84.1 million. The fourth quarter charge was driven

by final tax regulations issued during Donaldson’s fiscal fourth

quarter that were clarifying provisions of the TCJA. The fiscal

2019 and 2018 amounts are excluded from the Company’s calculation

of adjusted earnings.

On August 1, 2018, Donaldson adopted the FASB standards ASU

2014-09, Revenue from Contracts with Customers (“revenue

recognition”), and ASU 2017-07, Compensation – Retirement Benefits

(“pension accounting”).

Donaldson elected to adopt the new revenue recognition standard

using the modified retrospective method; therefore, fiscal 2019

results conform with the new standard, while results prior to

August 1, 2018, conform to the previous standard. Adoption of the

new standard resulted in additional sales in fourth quarter and

full-year 2019 of $4.5 million and $14.8 million, respectively. The

adoption also added $0.1 million to gross profit in fourth quarter

and reduced full-year 2019 gross profit by $0.5 million.

Under the new pension accounting standard, Donaldson continued

reporting the service component of retirement costs in operating

income and the non-service components was now reported in other

income. The new standard requires use of a retrospective method in

accounting for the change; therefore, results in all periods

presented conform with the new standard.

Miscellaneous

The Company will webcast its fourth quarter and full-year 2019

earnings conference call today at 9:00 a.m. CDT. To listen to the

webcast, visit the “Events & Presentations” section of

Donaldson’s Investor Relations website (IR.Donaldson.com), and

click on the “listen to webcast” option. The webcast replay will be

available at approximately 12:00 p.m. CDT today.

Statements in this release regarding future events and

expectations, such as forecasts, plans, trends and projections

relating to the Company’s business and financial performance, are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, and are identified by

words or phrases such as “will likely result,” “are expected to,”

“will continue,” “will allow,” “estimate,” “project,” “believe,”

“expect,” “anticipate,” “forecast,” “plan,” and similar

expressions. These forward-looking statements speak only as of the

date such statements are made and are subject to risks and

uncertainties that could cause the Company’s results to differ

materially from these statements. These factors include, but are

not limited to, economic and industrial conditions worldwide; the

Company's ability to maintain competitive advantages; threats from

disruptive innovation; highly competitive markets with pricing

pressure; the Company's ability to protect and enforce its

intellectual property; the difficulties in operating globally;

customer concentration in certain cyclical industries; significant

demand fluctuations; unavailable raw materials or material cost

inflation; inability of operations to meet customer demand;

difficulties with information technology systems and security;

foreign currency fluctuations; governmental laws and regulations;

litigation; changes in tax laws and tax rates, regulations and

results of examinations; the Company's ability to attract and

retain qualified personnel; changes in capital and credit markets;

execution of the Company's acquisition strategy; the possibility of

intangible asset impairment; the Company's ability to manage

productivity improvements; unexpected events and the disruption on

operations; the Company's ability to maintain an effective system

of internal control over financial reporting; and the United

Kingdom’s decision to end its membership in the European Union.

These and other risks and uncertainties are described in Item 1A of

the Company’s Annual Report on Form 10-K for the year ended July

31, 2018. The Company undertakes no obligation to publicly update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, unless required by

law. The results presented herein are preliminary, unaudited and

subject to revision until the Company files its results with the

United States Securities and Exchange Commission on Form 10-K.

About Donaldson Company

Founded in 1915, Donaldson Company is a global leader in the

filtration industry with sales, manufacturing and distribution

locations around the world. Donaldson’s innovative technologies are

designed to solve complex filtration challenges and enhance

customers’ equipment performance. For more information, visit

www.Donaldson.com.

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS

(In millions, except per share

amounts)

(Unaudited)

Three Months Ended

Twelve Months Ended

July 31,

July 31,

2019

2018

Change

2019

2018

Change

Net sales

$726.9

$724.7

0.3

%

$

2,844.9

$

2,734.2

4.0

%

Cost of sales

483.1

471.9

2.4

1,896.6

1,798.4

5.5

Gross profit

243.8

252.8

(3.6

)

948.3

935.8

1.3

Operating expenses

139.4

144.6

(3.6

)

560.1

558.8

0.2

Operating income

104.4

108.2

(3.5

)

388.2

377.0

3.0

Interest expense

5.2

5.6

(7.1

)

19.9

21.3

(6.6

)

Other expense (income), net

0.5

(0.9)

(155.6

)

(6.9

)

(7.9

)

(12.7

)

Earnings before income taxes

98.7

103.5

(4.6

)

375.2

363.6

3.2

Income taxes

40.7

1.1

3,600.0

108.0

183.3

(41.1

)

Net earnings

$58.0

$102.4

(43.4

)

%

$

267.2

$

180.3

48.2

%

Weighted average shares – basic

128.0

129.5

(1.2

)

%

128.3

130.3

(1.5

)

%

Weighted average shares – diluted

129.7

131.4

(1.3

)

%

130.3

132.2

(1.5

)

%

Net earnings per share – basic

$0.45

$0.79

(43.0

)

%

$

2.08

$

1.38

50.7

%

Net earnings per share – diluted

$0.45

$0.78

(42.3

)

%

$

2.05

$

1.36

50.7

%

Cash dividends paid per share

$0.21

$0.19

10.5

%

$

0.78

$

0.73

6.8

%

Note: Amounts may not foot due to

rounding.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In millions)

(Unaudited)

July 31,

July 31,

2019

2018

Assets

Current assets:

Cash and cash equivalents

$

177.8

$

204.7

Accounts receivable, net

529.5

534.6

Inventories, net

332.8

334.1

Prepaid expenses and other current

assets

82.5

52.3

Total current assets

1,122.6

1,125.7

Property, plant and equipment, net

588.9

509.3

Goodwill

303.1

238.4

Intangible assets, net

70.9

35.6

Deferred income taxes

14.2

19.2

Other long-term assets

42.9

48.4

Total assets

$

2,142.6

$

1,976.6

Liabilities and shareholders’

equity

Current liabilities:

Short-term borrowings

$

2.1

$

28.2

Current maturities of long-term debt

50.2

15.3

Trade accounts payable

237.5

201.3

Other current liabilities

193.1

224.6

Total current liabilities

482.9

469.4

Long-term debt

584.4

499.6

Non-current income taxes payable

110.9

105.3

Deferred income taxes

13.2

4.2

Other long-term liabilities

48.5

40.3

Total liabilities

1,239.9

1,118.8

Redeemable non-controlling interest

10.0

—

Total shareholders’ equity

892.7

857.8

Total liabilities & shareholders’

equity

$

2,142.6

$

1,976.6

CONDENSED CONSOLIDATED

STATEMENT OF CASH FLOWS

(In millions)

(Unaudited)

Twelve Months Ended

July 31,

2019

2018

Operating Activities

Net earnings

$

267.2

$

180.3

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Depreciation and amortization

81.1

76.7

Deferred income taxes

10.2

7.0

Stock-based compensation expense

15.0

16.7

Other, net

(8.8

)

(30.3

)

Changes in operating assets and

liabilities, excluding effect of acquired businesses

(18.9

)

12.5

Net cash provided by operating

activities

345.8

262.9

Investing Activities

Net expenditures on property, plant and

equipment

(150.4

)

(95.9

)

Acquisition, net of cash acquired

(96.0

)

0.5

Net cash used in investing activities

(246.4

)

(95.4

)

Financing Activities

Proceeds from long-term debt

155.0

197.7

Repayments of long-term debt

(45.9

)

(272.4

)

Change in short-term borrowings

(25.3

)

6.0

Purchase of treasury stock

(129.2

)

(122.0

)

Dividends paid

(99.7

)

(94.7

)

Tax withholding for stock compensation

transactions

(4.1

)

(2.6

)

Exercise of stock options

25.9

19.2

Net cash used in financing activities

(123.3

)

(268.8

)

Effect of exchange rate changes on

cash

(3.0

)

(2.4

)

Decrease in cash and cash equivalents

(26.9

)

(103.7

)

Cash and cash equivalents, beginning of

year

204.7

308.4

Cash and cash equivalents, end of year

$

177.8

$

204.7

CONSOLIDATED RATE

ANALYSIS

(Unaudited)

Three Months Ended

Twelve Months Ended

July 31,

July 31,

2019

2018

2019

2018

Gross margin

33.5

%

34.9

%

33.3

%

34.2

%

Operating expenses rate

19.2

%

20.0

%

19.7

%

20.4

%

Operating income rate

14.4

%

14.9

%

13.6

%

13.8

%

Other (expense) income, net rate

(0.1

)%

0.1

%

0.2

%

0.3

%

Depreciation and amortization rate

2.9

%

2.7

%

2.9

%

2.8

%

EBITDA rate

17.2

%

17.7

%

16.7

%

16.9

%

Effective tax rate

41.2

%

1.1

%

28.8

%

50.4

%

Cash conversion ratio

145.7

%

79.4

%

73.1

%

92.6

%

Three Months Ended

Twelve Months Ended

July 31,

July 31,

2019

2018

2019

2018

ADJUSTED RATES

Gross margin

33.5

%

34.9

%

33.3

%

34.2

%

Operating expenses rate

19.2

%

20.0

%

19.7

%

20.4

%

Operating income rate

14.4

%

14.9

%

13.6

%

13.8

%

Other income, net rate

0.2

%

0.1

%

0.3

%

0.3

%

Depreciation and amortization rate

2.9

%

2.7

%

2.9

%

2.8

%

EBITDA rate

17.2

%

17.7

%

16.7

%

16.9

%

Effective tax rate

21.4

%

26.2

%

23.7

%

27.3

%

Cash conversion ratio

106.8

%

106.4

%

70.7

%

76.4

%

Note: Rate analysis metrics are computed

by dividing the applicable amount by net sales, cash conversion

ratio reflects free cash flow divided by net income. Adjusted rates

are non-GAAP measures; see Reconciliation of Non-GAAP Financial

Measures schedule for additional information. Amounts may not foot

due to rounding.

SEGMENT DETAIL

(In millions)

(Unaudited)

Three Months Ended July 31,

Twelve Months Ended July 31

2019

2018

Change

2019

2018

Change

NET SALES

Engine Products segment

Off-Road

$

75.1

$

83.6

(10.1

)

%

$

315.1

$

327.4

(3.7

)

%

On-Road

44.2

43.5

1.5

179.8

154.2

16.6

Aftermarket

335.3

334.2

0.3

1,315.3

1,261.9

4.2

Aerospace and Defense

32.1

30.9

4.0

115.8

105.5

9.8

Total Engine Products segment

$

486.8

$

492.2

(1.1

)

%

$

1,926.0

$

1,849.0

4.2

%

Industrial Products segment

Industrial Filtration Solutions

$

172.5

$

162.5

6.2

%

$

641.7

$

594.3

8.0

%

Gas Turbine Systems

25.8

24.1

6.9

106.3

115.5

(8.0

)

Special Applications

41.9

45.9

(8.8

)

170.8

175.4

(2.6

)

Total Industrial Products segment

$

240.2

$

232.5

3.3

%

$

918.8

$

885.2

3.8

%

Total Company

$

726.9

$

724.7

0.3

%

$

2,844.9

$

2,734.2

4.0

%

EARNINGS BEFORE

INCOME TAXES

Engine Products segment

$

66.0

$

74.9

(11.9

)

%

$

254.6

$

258.8

(1.6

)

%

Industrial Products segment

38.6

39.8

(3.0

)

140.1

135.5

3.4

Corporate and Unallocated

(5.9

)

(11.2

)

(47.3

)

(19.5

)

(30.7

)

(36.5

)

Total Company

$

98.7

$

103.5

(4.6

)

%

$

375.2

$

363.6

3.2

%

EARNINGS BEFORE

INCOME TAXES %

Engine Products segment

13.6

%

15.2

%

(1.6

)

13.2

%

14.0

%

(0.8

)

Industrial Products segment

16.1

%

17.1

%

(1.0

)

15.2

%

15.3

%

(0.1

)

Note: Percentage is calculated by dividing

earnings before income taxes by sales. Amounts may not foot due to

rounding.

SEGMENT SALES PERCENT CHANGE

FROM PRIOR PERIODS BY GEOGRAPHY, AS REPORTED

(Unaudited)

Three Months Ended July 31,

2019

Engine Products segment

TOTAL

US/CA

EMEA

APAC

LATAM

Off-Road

(10.1

)

%

(16.4

)

%

5.2

%

(17.0

)

%

(49.7

)

%

On-Road

1.5

26.1

(20.1

)

(26.7

)

(32.5

)

Aftermarket

0.3

(1.3

)

(4.3

)

6.4

6.5

Aerospace and Defense

4.0

(7.1

)

29.6

55.1

Total Engine Products segment

(1.1

)

%

(1.2

)

%

(0.6

)

%

(3.4

)

%

2.1

%

Industrial Products segment

Industrial Filtration Solutions

6.2

%

4.6

%

9.4

%

9.5

%

(14.3

)

%

Gas Turbine Systems

6.9

24.4

15.1

(32.0

)

9.7

Special Applications

(8.8

)

9.4

2.1

(13.4

)

(48.7

)

Total Industrial Products segment

3.3

%

7.2

%

9.3

%

(4.8

)

%

(13.6

)

%

Total Company

0.3

%

0.9

%

3.2

%

(4.0

)

%

(0.8

)

%

Twelve Months Ended July 31

2019

Engine Products segment

TOTAL

US/CA

EMEA

APAC

LATAM

Off-Road

(3.7

)

%

(9.2

)

%

7.1

%

(2.6

)

%

(55.7

)

%

On-Road

16.6

32.5

(1.1

)

0.8

(26.5

)

Aftermarket

4.2

6.4

(1.1

)

4.6

6.6

Aerospace and Defense

9.8

8.1

13.6

1.9

Total Engine Products segment

4.2

%

6.8

%

1.9

%

2.5

%

1.7

%

Industrial Products segment

Industrial Filtration Solutions

8.0

%

7.0

%

9.5

%

6.3

%

9.6

%

Gas Turbine Systems

(8.0

)

(5.2

)

7.7

(42.6

)

(14.4

)

Special Applications

(2.6

)

14.2

3.7

(6.2

)

(27.6

)

Total Industrial Products segment

3.8

%

5.3

%

8.7

%

(3.9

)

%

5.1

%

Total Company

4.0

%

6.4

%

4.5

%

(0.2

)

%

2.2

%

Note: Amounts may not foot due to

rounding.

SEGMENT SALES PERCENT CHANGE

FROM PRIOR PERIODS BY GEOGRAPHY, CONSTANT CURRENCY

(Unaudited)

Three Months Ended July 31,

2019

Engine Products segment

TOTAL

US/CA

EMEA

APAC

LATAM

Off-Road

(8.0

)

%

(16.4

)

%

10.0

%

(15.2

)

%

(48.8

)

%

On-Road

2.2

26.1

(16.0

)

(26.2

)

(31.6

)

Aftermarket

2.5

(1.3

)

0.5

10.2

8.4

Aerospace and Defense

5.7

(7.1

)

35.5

57.1

Total Engine Products segment

0.9

%

(1.2

)

%

4.3

%

(0.6

)

%

4.0

%

Industrial Products segment

Industrial Filtration Solutions

8.8

%

4.6

%

14.4

%

12.9

%

(13.9

)

%

Gas Turbine Systems

8.5

24.4

17.4

(28.6

)

9.6

Special Applications

(8.0

)

9.4

6.9

(13.4

)

(47.6

)

Total Industrial Products segment

5.5

%

7.2

%

14.0

%

(3.1

)

%

(13.2

)

%

Total Company

2.3

%

0.9

%

8.0

%

(1.7

)

%

0.8

%

Twelve Months Ended July 31

2019

Engine Products segment

TOTAL

US/CA

EMEA

APAC

LATAM

Off-Road

(0.8

)

%

(9.2

)

%

12.7

%

0.7

%

(52.0

)

%

On-Road

18.4

32.5

4.5

3.8

(23.0

)

Aftermarket

7.1

6.4

4.7

9.5

10.7

Aerospace and Defense

11.7

8.1

19.5

5.1

Total Engine Products segment

6.9

%

6.8

%

7.6

%

6.8

%

5.7

%

Industrial Products segment

Industrial Filtration Solutions

11.1

%

7.0

%

15.3

%

10.3

%

13.0

%

Gas Turbine Systems

(6.5

)

(5.2

)

10.1

(39.2

)

(14.3

)

Special Applications

(0.7

)

14.2

9.0

(4.8

)

(22.8

)

Total Industrial Products segment

6.5

%

5.3

%

14.0

%

(1.3

)

%

8.1

%

Total Company

6.8

%

6.4

%

10.0

%

3.4

%

6.1

%

Note: The constant currency presentation,

which is a non-GAAP measure, excludes the impact of fluctuations in

foreign currency exchange rates. The Company believes providing

constant currency information provides valuable supplemental

information regarding its results of operations. The Company

calculates constant currency percentages by converting its current

period local currency financial results using the prior period

exchanges rates and compared these adjusted amounts to its prior

period reported results. Amounts may not foot due to rounding.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

(In millions, except per share

amounts)

(Unaudited)

Three Months Ended

Twelve Months Ended

July 31,

July 31,

2019

2018

2019

2018

Net cash provided by operating

activities

$

122.5

$

104.2

$

345.8

$

262.9

Net capital expenditures

(38.0

)

(22.8

)

(150.4

)

(95.9

)

Free cash flow

$

84.5

$

81.4

$

195.4

$

167.0

Free cash flow

$

84.5

$

81.4

$

195.4

$

167.0

Discretionary cash contribution to U.S.

pension plans

—

—

8.0

35.0

Adjusted free cash flow

$

84.5

$

81.4

$

203.4

$

202.0

Net earnings

$

58.0

$

102.4

$

267.2

$

180.3

Income taxes

40.7

1.1

108.0

183.3

Interest expense

5.2

5.6

19.9

21.3

Depreciation and amortization

21.4

19.3

81.1

76.7

EBITDA

$

125.3

$

128.4

$

476.2

$

461.6

Net earnings

$

58.0

$

102.4

$

267.2

$

180.3

Tax (benefit) expense for Federal Tax Cuts

and Jobs Act(a)

19.1

(26.0

)

18.6

84.1

Restructuring(a)

2.1

—

2.1

—

Adjusted Net Earnings

$

79.2

$

76.4

$

287.9

$

264.4

Diluted EPS

$

0.45

$

0.78

$

2.05

$

1.36

Tax (benefit) expense for Federal Tax Cuts

and Jobs Act(a)

0.14

(0.20

)

0.14

0.64

Restructuring(a)

0.02

—

0.02

—

Adjusted diluted EPS

$

0.61

$

0.58

$

2.21

$

2.00

(a) See the “Accounting Considerations”

section of this press release for additional information.

Note: Although free cash flow, adjusted

free cash flow, EBITDA, adjusted net earnings, adjusted diluted EPS

and adjusted effective tax rate are not measures of financial

performance under GAAP, the Company believes they are useful in

understanding its financial results. Free cash flow is a commonly

used measure of a company’s ability to generate cash in excess of

its operating needs. EBITDA is a commonly used measure of operating

earnings less non-cash expenses. The Company evaluates its results

of operations both on an as reported and a constant currency basis.

The adjusted basis presentation excludes the impact of certain

matters not related to the Company’s ongoing operations. A

shortcoming of these financial measures is that they do not reflect

the Company’s actual results under GAAP. Management does not intend

these items to be considered in isolation or as a substitute for

the related GAAP measures. Amounts may not foot due to

rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190905005196/en/

Brad Pogalz (952) 887-3753

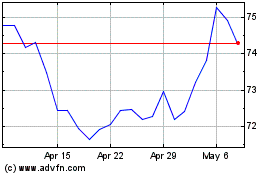

Donaldson (NYSE:DCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

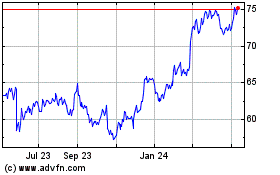

Donaldson (NYSE:DCI)

Historical Stock Chart

From Apr 2023 to Apr 2024