SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of

Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of August, 2019

Commission File Number: 001-12102

YPF Sociedad Anónima

(Exact name of registrant as specified in its charter)

Macacha

Güemes 515

C1106BKK Buenos Aires, Argentina

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

YPF Sociedad Anónima

TABLE OF CONTENTS

|

|

|

ITEM

|

|

|

|

1 Investor Presentation September 2019

|

INVESTOR PRESENTATION SEPTEMBER 2019INVESTOR PRESENTATION SEPTEMBER

2019

IMPORTANT NOTICE Safe harbor statement under the US Private Securities

Litigation Reform Act of 1995. This document contains statements that YPF believes constitute forward-looking statements within the meaning of the US Private Securities Litigation Reform Act of 1995. These forward-looking statements may include

statements regarding the intent, belief, plans, current expectations or objectives of YPF and its management, including statements with respect to YPF’s future financial condition, financial, operating, reserve replacement and other ratios,

results of operations, business strategy, geographic concentration, business concentration, production and marketed volumes and reserves, as well as YPF’s plans, expectations or objectives with respect to future capital expenditures,

investments, expansion and other projects, exploration activities, ownership interests, divestments, cost savings and dividend payout policies. These forward-looking statements may also include assumptions regarding future economic and other

conditions, such as future crude oil and other prices, refining and marketing margins and exchange rates. These statements are not guarantees of future performance, prices, margins, exchange rates or other events and are subject to material risks,

uncertainties, changes and other factors which may be beyond YPF’s control or may be difficult to predict. YPF’s actual future financial condition, financial, operating, reserve replacement and other ratios, results of operations,

business strategy, geographic concentration, business concentration, production and marketed volumes, reserves, capital expenditures, investments, expansion and other projects, exploration activities, ownership interests, divestments, cost savings

and dividend payout policies, as well as actual future economic and other conditions, such as future crude oil and other prices, refining margins and exchange rates, could differ materially from those expressed or implied in any such forward-looking

statements. Important factors that could cause such differences include, but are not limited to, oil, gas and other price fluctuations, supply and demand levels, currency fluctuations, exploration, drilling and production results, changes in

reserves estimates, success in partnering with third parties, loss of market share, industry competition, environmental risks, physical risks, the risks of doing business in developing countries, legislative, tax, legal and regulatory developments,

economic and financial market conditions in various countries and regions, political risks, wars and acts of terrorism, natural disasters, project delays or advancements and lack of approvals, as well as those factors described in the filings made

by YPF and its affiliates with the Securities and Exchange Commission, in particular, those described in “Item 3. Key Information—Risk Factors” and “Item 5. Operating and Financial Review and Prospects” in YPF’s

Annual Report on Form 20- F for the fiscal year ended December 31, 2018 filed with the US Securities and Exchange Commission. In light of the foregoing, the forward-looking statements included in this document may not occur. Except as required by

law, YPF does not undertake to publicly update or revise these forward-looking statements even if experience or future changes make it clear that the projected performance, conditions or events expressed or implied therein will not be realized.

These materials do not constitute an offer to sell or the solicitation of any offer to buy any securities of YPF S.A. in any jurisdiction. Securities may not be offered or sold in the United States absent registration with the U.S. Securities and

Exchange Commission or an exemption from such registration. Cautionary Note to U.S. Investors — The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to separately disclose proved,

probable and possible reserves that a company has determined in accordance with the SEC rules. We may use certain terms in this presentation, such as resources, that the SEC’s guidelines strictly prohibit us from including in filings with the

SEC. U.S. Investors are urged to consider closely the disclosure in our Form 20-F, File No. 1-12102 available on the SEC website www.sec.gov. Our estimates of EURs, included in our Development Costs, are by their nature more speculative than

estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized, particularly in areas or zones where there has been limited history. Actual locations drilled and quantities

that may be ultimately recovered from our concessions will differ substantially. Ultimate recoveries will be dependent upon numerous factors including actual encountered geological conditions and the impact of future oil and gas pricing. Unless

otherwise indicated the calculation of the main financial figures in U.S. dollars before 2019 is derived from the calculation of the consolidated financial results expressed in Argentine pesos using the average exchange rate for each period. For

2019, the calculation of the main financial figures in U.S. dollars is derived from the sum of: (1) YPF S.A. individual financial results expressed in Argentine pesos divided by the average exchange rate of the period and (2) the financial results

of YPF S.A.’s subsidiaries expressed in Argentine pesos divided by the exchange rate at the end of period. 2IMPORTANT NOTICE Safe harbor statement under the US Private Securities Litigation Reform Act of 1995. This document contains statements

that YPF believes constitute forward-looking statements within the meaning of the US Private Securities Litigation Reform Act of 1995. These forward-looking statements may include statements regarding the intent, belief, plans, current expectations

or objectives of YPF and its management, including statements with respect to YPF’s future financial condition, financial, operating, reserve replacement and other ratios, results of operations, business strategy, geographic concentration,

business concentration, production and marketed volumes and reserves, as well as YPF’s plans, expectations or objectives with respect to future capital expenditures, investments, expansion and other projects, exploration activities, ownership

interests, divestments, cost savings and dividend payout policies. These forward-looking statements may also include assumptions regarding future economic and other conditions, such as future crude oil and other prices, refining and marketing

margins and exchange rates. These statements are not guarantees of future performance, prices, margins, exchange rates or other events and are subject to material risks, uncertainties, changes and other factors which may be beyond YPF’s

control or may be difficult to predict. YPF’s actual future financial condition, financial, operating, reserve replacement and other ratios, results of operations, business strategy, geographic concentration, business concentration, production

and marketed volumes, reserves, capital expenditures, investments, expansion and other projects, exploration activities, ownership interests, divestments, cost savings and dividend payout policies, as well as actual future economic and other

conditions, such as future crude oil and other prices, refining margins and exchange rates, could differ materially from those expressed or implied in any such forward-looking statements. Important factors that could cause such differences include,

but are not limited to, oil, gas and other price fluctuations, supply and demand levels, currency fluctuations, exploration, drilling and production results, changes in reserves estimates, success in partnering with third parties, loss of market

share, industry competition, environmental risks, physical risks, the risks of doing business in developing countries, legislative, tax, legal and regulatory developments, economic and financial market conditions in various countries and regions,

political risks, wars and acts of terrorism, natural disasters, project delays or advancements and lack of approvals, as well as those factors described in the filings made by YPF and its affiliates with the Securities and Exchange Commission, in

particular, those described in “Item 3. Key Information—Risk Factors” and “Item 5. Operating and Financial Review and Prospects” in YPF’s Annual Report on Form 20- F for the fiscal year ended December 31, 2018

filed with the US Securities and Exchange Commission. In light of the foregoing, the forward-looking statements included in this document may not occur. Except as required by law, YPF does not undertake to publicly update or revise these

forward-looking statements even if experience or future changes make it clear that the projected performance, conditions or events expressed or implied therein will not be realized. These materials do not constitute an offer to sell or the

solicitation of any offer to buy any securities of YPF S.A. in any jurisdiction. Securities may not be offered or sold in the United States absent registration with the U.S. Securities and Exchange Commission or an exemption from such registration.

Cautionary Note to U.S. Investors — The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to separately disclose proved, probable and possible reserves that a company has determined

in accordance with the SEC rules. We may use certain terms in this presentation, such as resources, that the SEC’s guidelines strictly prohibit us from including in filings with the SEC. U.S. Investors are urged to consider closely the

disclosure in our Form 20-F, File No. 1-12102 available on the SEC website www.sec.gov. Our estimates of EURs, included in our Development Costs, are by their nature more speculative than estimates of proved, probable and possible reserves and

accordingly are subject to substantially greater risk of being actually realized, particularly in areas or zones where there has been limited history. Actual locations drilled and quantities that may be ultimately recovered from our concessions will

differ substantially. Ultimate recoveries will be dependent upon numerous factors including actual encountered geological conditions and the impact of future oil and gas pricing. Unless otherwise indicated the calculation of the main financial

figures in U.S. dollars before 2019 is derived from the calculation of the consolidated financial results expressed in Argentine pesos using the average exchange rate for each period. For 2019, the calculation of the main financial figures in U.S.

dollars is derived from the sum of: (1) YPF S.A. individual financial results expressed in Argentine pesos divided by the average exchange rate of the period and (2) the financial results of YPF S.A.’s subsidiaries expressed in Argentine pesos

divided by the exchange rate at the end of period. 2

YPF TODAY A 97-year-old The largest World-class The leading downstream YPF

Luz fifth- company O&G producer shale producer player in Argentina largest power in Argentina generator in The biggest 3 refineries: 50% of Argentina´s Argentina: outside the US capacity. ~ 320 kbbl/day 507 Kboe/d 1.8 GW VM Gross Acreage

~1,600 gas stations. (LTM Q2 2019) 2 Publicly traded (MM ACRES) 36% Market Share corporation 50% stake in • 1.8 Oil (~53%) 57% Market Share of diesel 36% Market since 1993 Ensenada de and gasoline sales (as of 1H19) 1 Share : • 1.2 Gas

(~44%) Barragán Thermal on the NY and power plant BA Exchanges #1 petrochemical manufacturer: • 43% Oil 82 Kboe/d (560 MW) output of ~2.5 mm tons/year • 32% Gas 60 new wells 103 branches covering the Agribusiness 1) Source IAPG -

May 2019 in 1H 2019 3 2) 20-F 2018YPF TODAY A 97-year-old The largest World-class The leading downstream YPF Luz fifth- company O&G producer shale producer player in Argentina largest power in Argentina generator in The biggest 3 refineries: 50%

of Argentina´s Argentina: outside the US capacity. ~ 320 kbbl/day 507 Kboe/d 1.8 GW VM Gross Acreage ~1,600 gas stations. (LTM Q2 2019) 2 Publicly traded (MM ACRES) 36% Market Share corporation 50% stake in • 1.8 Oil (~53%) 57% Market

Share of diesel 36% Market since 1993 Ensenada de and gasoline sales (as of 1H19) 1 Share : • 1.2 Gas (~44%) Barragán Thermal on the NY and power plant BA Exchanges #1 petrochemical manufacturer: • 43% Oil 82 Kboe/d (560 MW) output

of ~2.5 mm tons/year • 32% Gas 60 new wells 103 branches covering the Agribusiness 1) Source IAPG - May 2019 in 1H 2019 3 2) 20-F 2018

SAFETY AND SUSTAINABILITY ARE EMBEDDED IN THE DAILY ACTIVITY AND CORPORATE

STRATEGY TOTAL IFR # of people injured for each million hours worked 2009 – 1H 2019 1.89 ESG REPORTING • Tracking ESG performance under DJSI and MSCI ESG Ratings • Part of BYMA’s Corporate Governance Panel and BYMA’s

1.27 Sustainability Index 1.05 1.05 • Committed to the Ten Principles of the United Nation’s 0.82 0.91 Global Compact 0.74 0.72 • Members of EITI Argentina 0.60 0.57 0.51 RENEWABLES AND NEW ENERGY SOLUTIONS • Renewables

energy consumption representing 17% of total energy consumed • Research in Y-TEC 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 1H 2019 • Launched YPF ventures to focus on new energy and mobility • First peer to invest in

micromobility 4SAFETY AND SUSTAINABILITY ARE EMBEDDED IN THE DAILY ACTIVITY AND CORPORATE STRATEGY TOTAL IFR # of people injured for each million hours worked 2009 – 1H 2019 1.89 ESG REPORTING • Tracking ESG performance under DJSI and

MSCI ESG Ratings • Part of BYMA’s Corporate Governance Panel and BYMA’s 1.27 Sustainability Index 1.05 1.05 • Committed to the Ten Principles of the United Nation’s 0.82 0.91 Global Compact 0.74 0.72 • Members of

EITI Argentina 0.60 0.57 0.51 RENEWABLES AND NEW ENERGY SOLUTIONS • Renewables energy consumption representing 17% of total energy consumed • Research in Y-TEC 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 1H 2019 • Launched

YPF ventures to focus on new energy and mobility • First peer to invest in micromobility 4

MAIN FINANCIAL FIGURES: STABLE EBITDA MARGIN AND NET LEVERAGE < 2x (1)

REVENUES Upstream Downstream CAPEX (In Billions of USD) Gas & Power Other (In Billions of USD) 4.3 15.5 15.3 14.7 14.3 3.7 3.5 3.3 2016 2017 2018 LTM Q2 2019 2016 2017 2018 LTM Q2 2019 (2) (3) ADJUSTED EBITDA & MARGIN NET LEVERAGE (In

Billions of USD and %) NET DEBT / ADJ. EBITDA (x) 28% 28% 28% 27% 6.000 2.0x 5.000 2.0x 4.4 4.1 1.9x 4.1 4.0 4.000 1.7x 15% 3.000 2.000 1.000 0 0% 2016 2017 2018 LTM Q2 2019 2016 2017 2018 LTM Q2 2019 (1) Q2 2019 capex includes around USD 200 MN

from Ensenada Barragán and Aguada del Chañar acquisitions. (2) Adjusted EBITDA = Operating income + Depreciation and impairment of property, plant and equipment + Depreciation of assets for own use + Amortization of intangible assets +

unproductive exploratory drillings. Excludes IFRS 16 effects. 5 (3) See description of Net debt in footnote (4) on page 16. MAIN FINANCIAL FIGURES: STABLE EBITDA MARGIN AND NET LEVERAGE < 2x (1) REVENUES Upstream Downstream CAPEX (In Billions of

USD) Gas & Power Other (In Billions of USD) 4.3 15.5 15.3 14.7 14.3 3.7 3.5 3.3 2016 2017 2018 LTM Q2 2019 2016 2017 2018 LTM Q2 2019 (2) (3) ADJUSTED EBITDA & MARGIN NET LEVERAGE (In Billions of USD and %) NET DEBT / ADJ. EBITDA (x) 28% 28%

28% 27% 6.000 2.0x 5.000 2.0x 4.4 4.1 1.9x 4.1 4.0 4.000 1.7x 15% 3.000 2.000 1.000 0 0% 2016 2017 2018 LTM Q2 2019 2016 2017 2018 LTM Q2 2019 (1) Q2 2019 capex includes around USD 200 MN from Ensenada Barragán and Aguada del Chañar

acquisitions. (2) Adjusted EBITDA = Operating income + Depreciation and impairment of property, plant and equipment + Depreciation of assets for own use + Amortization of intangible assets + unproductive exploratory drillings. Excludes IFRS 16

effects. 5 (3) See description of Net debt in footnote (4) on page 16.

ORGANIC INCREASE IN RESERVES Reserve Replacement Ratio 178% Shale P1

reserves representing 19% of total reserves TOTAL HYDROCARBON PROVED RESERVES (MBOE) Crude + NGL Gas 1,226 1,212 1,132 1,113 1,083 1,080 1,014 1,005 982 979 929 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 6ORGANIC INCREASE IN RESERVES

Reserve Replacement Ratio 178% Shale P1 reserves representing 19% of total reserves TOTAL HYDROCARBON PROVED RESERVES (MBOE) Crude + NGL Gas 1,226 1,212 1,132 1,113 1,083 1,080 1,014 1,005 982 979 929 2008 2009 2010 2011 2012 2013 2014 2015 2016

2017 2018 6

LOWER NATURAL GAS DEMAND IMPACTING TOTAL PRODUCTION; FOCUS ON SHALE OIL

TOTAL NET PRODUCTION NET SHALE PRODUCTION (KBOE/D) (KBOE/D) 15% 90,0 15% 577.4 80,0 76.8 11% 555.0 530.2 501.1 70,0 10% 7% 57.7 60,0 5% 50,0 5% 36.8 40,0 29.9 30,0 0% 20,0 10,0 -5% 2016 2017 2018 1H19 2016 2017 2018 1H19 Crude oil Natural Gas Crude

Oil Natural Gas NGL NGL % of total production 7LOWER NATURAL GAS DEMAND IMPACTING TOTAL PRODUCTION; FOCUS ON SHALE OIL TOTAL NET PRODUCTION NET SHALE PRODUCTION (KBOE/D) (KBOE/D) 15% 90,0 15% 577.4 80,0 76.8 11% 555.0 530.2 501.1 70,0 10% 7% 57.7

60,0 5% 50,0 5% 36.8 40,0 29.9 30,0 0% 20,0 10,0 -5% 2016 2017 2018 1H19 2016 2017 2018 1H19 Crude oil Natural Gas Crude Oil Natural Gas NGL NGL % of total production 7

CONTINUE INCREASING SHALE OIL PRODUCTION AND REDUCING COSTS Active wells - V

Active wells - H New wells SHALE OIL WELLS NET SHALE OIL PRODUCTION 70 59 (KBOE/D) 40 23 31.3 800 60 40 20 0 700 -20 -40 -60 593 608 -80 -100 600 -120 534 -140 495 -160 -180 -200 500 22.5 -220 -240 -260 -280 -300 400 -320 -340 -360 -380 -400 16.6

300 -420 -440 14.5 -460 -480 -500 200 -520 -540 -560 -580 -600 100 -620 -640 -660 -680 0 -700 2016 2017 2018 1H19 2016 2017 2018 1H19 SHALE OIL STAGES & RIGS (1) DEVELOPMENT & OPEX COST - LOMA CAMPANA (USD/BOE) Stages Active rigs 19 Develop.

Opex 45 18.0 7 7 7 40 10 15.0 35 32 30 26 12.0 11.0 -10 25 20 16 ~9 20 9.1 15 -30 6.0 10 ~5.5 5 0 -50 2016 2017 2018 1H19 2016 2017 2018 1H19 (1) Loma Campana development costs have been recalculated based on new expected EUR. 8CONTINUE INCREASING

SHALE OIL PRODUCTION AND REDUCING COSTS Active wells - V Active wells - H New wells SHALE OIL WELLS NET SHALE OIL PRODUCTION 70 59 (KBOE/D) 40 23 31.3 800 60 40 20 0 700 -20 -40 -60 593 608 -80 -100 600 -120 534 -140 495 -160 -180 -200 500 22.5 -220

-240 -260 -280 -300 400 -320 -340 -360 -380 -400 16.6 300 -420 -440 14.5 -460 -480 -500 200 -520 -540 -560 -580 -600 100 -620 -640 -660 -680 0 -700 2016 2017 2018 1H19 2016 2017 2018 1H19 SHALE OIL STAGES & RIGS (1) DEVELOPMENT & OPEX COST -

LOMA CAMPANA (USD/BOE) Stages Active rigs 19 Develop. Opex 45 18.0 7 7 7 40 10 15.0 35 32 30 26 12.0 11.0 -10 25 20 16 ~9 20 9.1 15 -30 6.0 10 ~5.5 5 0 -50 2016 2017 2018 1H19 2016 2017 2018 1H19 (1) Loma Campana development costs have been

recalculated based on new expected EUR. 8

PBN CLUSTER OIL N°2 UNLOCKING VALUE OF SHALE OIL ACREAGE ChSN PH PH FMo

N N CLUSTER OIL N° 1 DEVELOPMENT EXPANSION BDT BDT Loma Campana, La Amarga Aguada del Chañar LdM SDH Chica & Bandurria Sur acquisition BdT Curve Type 2018 CLMi LaMa 1.800 Qo BdT.x-6(h) LaMa LaMa CLUSTER OIL N° 2 Qo BdT.x-7(h)

1.600 San CA 1.400 Roque PILOTS EOR 1.200 PY • Bajo del Toro II 1.000 • Narambuena AdCh LA LA Ch Ch 800 • Chihuido de CLUSTER OIL N°1 600 BA la Sierra Negra AdC ADLA BS BS ñ 400 APE EXPLORATION 200 LC LC LCa APO Las

Manadas 0 LLL LLL Sur Sur 0 2 4 LRi I Months Embalse EUR 933 kboe IP60 1,800 boe/d LRi II RDM LLL Embalse O MBE CLUSTER OIL N° 3 Cha Lindero LTa Atravesado LLL-SB EXPLORATION AVi Sierra Barrosa-Loma La Lata, Loma La Lata Oeste & AND CLUSTER

OIL N°3 CBN Al Norte de la Dorsal 9 Normalized Oil Production (bbl/d per 2,000 m)PBN CLUSTER OIL N°2 UNLOCKING VALUE OF SHALE OIL ACREAGE ChSN PH PH FMo N N CLUSTER OIL N° 1 DEVELOPMENT EXPANSION BDT BDT Loma Campana, La Amarga Aguada

del Chañar LdM SDH Chica & Bandurria Sur acquisition BdT Curve Type 2018 CLMi LaMa 1.800 Qo BdT.x-6(h) LaMa LaMa CLUSTER OIL N° 2 Qo BdT.x-7(h) 1.600 San CA 1.400 Roque PILOTS EOR 1.200 PY • Bajo del Toro II 1.000 •

Narambuena AdCh LA LA Ch Ch 800 • Chihuido de CLUSTER OIL N°1 600 BA la Sierra Negra AdC ADLA BS BS ñ 400 APE EXPLORATION 200 LC LC LCa APO Las Manadas 0 LLL LLL Sur Sur 0 2 4 LRi I Months Embalse EUR 933 kboe IP60 1,800 boe/d LRi II

RDM LLL Embalse O MBE CLUSTER OIL N° 3 Cha Lindero LTa Atravesado LLL-SB EXPLORATION AVi Sierra Barrosa-Loma La Lata, Loma La Lata Oeste & AND CLUSTER OIL N°3 CBN Al Norte de la Dorsal 9 Normalized Oil Production (bbl/d per 2,000

m)

PRODUCTIVITY IMPROVEMENT TIMELINE LOMA CAMPANA LA AMARGA CHICA BANDURRIA

SUR – SE ZONE (KBbl) (KBbl) (KBbl) 2wells Avg. Campaign 2016 Avg. Campaign 2016 375 375 375 Avg. Campaign 2017 Avg. Campaign 2017 Avg. Campaign 2018 Avg. Campaign 2018 Avg. Campaign 2019 Avg. Campaign 2019 300 300 300 6wells 2wells 37 wells

9wells 56 wells 30 wells 225 225 225 18 wells Avg. Campaign 2017 11 wells Avg. Campaign 2018 8wells 150 150 150 75 75 75 0 0 0 0 6 12 18 24 30 36 0 6 12 18 24 30 36 0 6 12 18 24 30 36 Months Months Months EUR 905 kboe EUR 800 kboe EUR 980 kboe 2018

campaign 2018 campaign 2018 campaign 10PRODUCTIVITY IMPROVEMENT TIMELINE LOMA CAMPANA LA AMARGA CHICA BANDURRIA SUR – SE ZONE (KBbl) (KBbl) (KBbl) 2wells Avg. Campaign 2016 Avg. Campaign 2016 375 375 375 Avg. Campaign 2017 Avg. Campaign 2017

Avg. Campaign 2018 Avg. Campaign 2018 Avg. Campaign 2019 Avg. Campaign 2019 300 300 300 6wells 2wells 37 wells 9wells 56 wells 30 wells 225 225 225 18 wells Avg. Campaign 2017 11 wells Avg. Campaign 2018 8wells 150 150 150 75 75 75 0 0 0 0 6 12 18

24 30 36 0 6 12 18 24 30 36 0 6 12 18 24 30 36 Months Months Months EUR 905 kboe EUR 800 kboe EUR 980 kboe 2018 campaign 2018 campaign 2018 campaign 10

ENSURING THE NECESSARY INFRASTRUCTURE TO EVACUATE SHALE OIL PRODUCTION San

Lorenzo Poliducts LC-VM-MC-SL LUJÁN DE CUYO MC-SL VM-JN-LM Montecristo VM-MC REFINERY 100% YPF No bottleneck expected LC-VM 105.5 kbbl/d / 100% YPF in the short-term Villa Mercedes VM-JN-LM AXION PH – CILC Pipeline Performing meticulous

Junín RAIZEN 100% YPF study of the oil midstream LA PLATA REFINERY sector, including: 189 kbbl/d / 100% YPF • Reverting some PR – CILP Pipeline existing pipelines 100% YPF OTC 35% YPF Trasandino Pipeline • Increasing OLDELVAL

107 kbbl/d OTA NODO 35% YPF pumping capacity PH 428 km • Upgrading the existing LC-LP Pipeline Medanito export terminal in TRAFIGURA 85% YPF OLDELVAL the Atlantic 37% YPF PLAZA HUINCUL OTE Allen – PR 163 kbbl/d REFINERY 30% YPF •

Reactivating export Puerto Allen 513 km Rosales 25 kbbl/d / 100% YPF route to the Pacific 11ENSURING THE NECESSARY INFRASTRUCTURE TO EVACUATE SHALE OIL PRODUCTION San Lorenzo Poliducts LC-VM-MC-SL LUJÁN DE CUYO MC-SL VM-JN-LM Montecristo VM-MC

REFINERY 100% YPF No bottleneck expected LC-VM 105.5 kbbl/d / 100% YPF in the short-term Villa Mercedes VM-JN-LM AXION PH – CILC Pipeline Performing meticulous Junín RAIZEN 100% YPF study of the oil midstream LA PLATA REFINERY sector,

including: 189 kbbl/d / 100% YPF • Reverting some PR – CILP Pipeline existing pipelines 100% YPF OTC 35% YPF Trasandino Pipeline • Increasing OLDELVAL 107 kbbl/d OTA NODO 35% YPF pumping capacity PH 428 km • Upgrading the

existing LC-LP Pipeline Medanito export terminal in TRAFIGURA 85% YPF OLDELVAL the Atlantic 37% YPF PLAZA HUINCUL OTE Allen – PR 163 kbbl/d REFINERY 30% YPF • Reactivating export Puerto Allen 513 km Rosales 25 kbbl/d / 100% YPF route to

the Pacific 11

GAS MARKET: TAKING SEVERAL MEASURES TO MITIGATE OVERSUPPLY NATURAL GAS

PRODUCTION (Mm3/d) NG Production Production curtailments 50 10 46 8 42 6 ESCOBAR 38 4 BSAS RING 34 2 VACA BAHÍA MUERTA BLANCA 30 0 TGN TGS TO Chile Short-term levers Medium FSRU to long-term levers • Exports to Chile LNG BARGE • LNG

floating barge MEGA SEPARATION • Sizeable LNG terminal MEGA FRACTIONATION • Ensenada Barragán • Profertil expansion • Underground gas storage 12GAS MARKET: TAKING SEVERAL MEASURES TO MITIGATE OVERSUPPLY NATURAL GAS

PRODUCTION (Mm3/d) NG Production Production curtailments 50 10 46 8 42 6 ESCOBAR 38 4 BSAS RING 34 2 VACA BAHÍA MUERTA BLANCA 30 0 TGN TGS TO Chile Short-term levers Medium FSRU to long-term levers • Exports to Chile LNG BARGE • LNG

floating barge MEGA SEPARATION • Sizeable LNG terminal MEGA FRACTIONATION • Ensenada Barragán • Profertil expansion • Underground gas storage 12

DOWNSTREAM: SOLID MARKET LEADERSHIP Others (2) GASOLINE GASOLINE SALES (YoY

variation) MARKET SHARE YPF Market (1) (2) 3% BREAKDOWN (%) 8% 5% 4% 15% 57% 0% 20% -4% -8% Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 (2) DIESEL SALES (YoY variation) Others DIESEL YPF Market MARKET SHARE 5% (1) (2) 6% BREAKDOWN (%) 8% 17% 57%

4% 0% 15% -4% -8% Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 (1) Market share as of 1H 2019. 13 (2) YPF volumes exclude bunker sales to the foreign market and sales to other companies.DOWNSTREAM: SOLID MARKET LEADERSHIP Others (2) GASOLINE

GASOLINE SALES (YoY variation) MARKET SHARE YPF Market (1) (2) 3% BREAKDOWN (%) 8% 5% 4% 15% 57% 0% 20% -4% -8% Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 (2) DIESEL SALES (YoY variation) Others DIESEL YPF Market MARKET SHARE 5% (1) (2) 6%

BREAKDOWN (%) 8% 17% 57% 4% 0% 15% -4% -8% Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 (1) Market share as of 1H 2019. 13 (2) YPF volumes exclude bunker sales to the foreign market and sales to other companies.

GRADUAL ADJUSTMENTS IN FUEL PRICES TO BRIDGE GAP WITH IMPORT PARITY (1)

FUELS BLENDED PRICE VS IMPORT PARITY (% VARIATION) Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 Mar-19 Apr-19 May-19 Jun-19 Jul-19 Aug-19 * Fuels Blended Price Import Parity (1) Import parity

includes international reference price for heating oil, RBOB and biofuels, each of them weighted by sales volumes of our regular and premium diesel and gasoline. Fuels blended prices and Import Parity prices based on monthly average prices. January

2018 = base 0. 14 th (2) (*) August 2019: preliminary data as of August 25 2019. GRADUAL ADJUSTMENTS IN FUEL PRICES TO BRIDGE GAP WITH IMPORT PARITY (1) FUELS BLENDED PRICE VS IMPORT PARITY (% VARIATION) Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18

Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 Mar-19 Apr-19 May-19 Jun-19 Jul-19 Aug-19 * Fuels Blended Price Import Parity (1) Import parity includes international reference price for heating oil, RBOB and biofuels, each of them weighted

by sales volumes of our regular and premium diesel and gasoline. Fuels blended prices and Import Parity prices based on monthly average prices. January 2018 = base 0. 14 th (2) (*) August 2019: preliminary data as of August 25 2019.

FINANCING CAPEX WITH OWN CASHFLOW GENERATION (1) (2) CONSOLIDATED STATEMENT

OF ADJUSTED CASH FLOW Q2 2019 FREE CASH FLOW (In Millions of USD) (In Millions of USD) 420 929 929 1,576 1,587 -1,105 -191 -42 23 -906 Cash & Cash flow Net Capex Interest Others Cash & -99 equivalents from financing payments equivalents -92

at the operations at the end -7 -176 beginning of Q2 2019 of Q2 2019 CFO Capex FCF pre Ens. Bar. A. del Others FCF acq. Chañar ( (1) Q2 2019 capex includes around USD 200 MN from M&A activities. 2) Free Cash Flow = Cash Flow from Operations

minus CAPEX – M&A. 15FINANCING CAPEX WITH OWN CASHFLOW GENERATION (1) (2) CONSOLIDATED STATEMENT OF ADJUSTED CASH FLOW Q2 2019 FREE CASH FLOW (In Millions of USD) (In Millions of USD) 420 929 929 1,576 1,587 -1,105 -191 -42 23 -906 Cash

& Cash flow Net Capex Interest Others Cash & -99 equivalents from financing payments equivalents -92 at the operations at the end -7 -176 beginning of Q2 2019 of Q2 2019 CFO Capex FCF pre Ens. Bar. A. del Others FCF acq. Chañar ( (1) Q2

2019 capex includes around USD 200 MN from M&A activities. 2) Free Cash Flow = Cash Flow from Operations minus CAPEX – M&A. 15

FINANCIAL DISCIPLINE AND SOLID CASH POSITION Bonds (1) (2) PRINCIPAL DEBT

AMORTIZATION SCHEDULE DETAILS Q2 2019 Trade financing (In Millions of USD) Bank loans ~90% of our cash & debt 2,265 denominated in USD Average interest rates 1,587 1,491 of 7.54% in USD 1,450 and 44.76% in Pesos 1,082 961 Average life of 6.14

years 747 625 490 Net Debt /LTM Adj. (3)(4) EBITDA 1.9x Cash & 2019 2020 2021 2022 2023 2024 2025 2026+ (3) Equivalents (1) As of June 30, 2019. Excludes IFRS 16 effects. (2) Converted to USD using the June 30, 2019 exchange rate of Ps 42.36 to

U.S $1.00. (3) Includes cash & equivalents, including Argentine sovereign bonds BONAR 2020 and BONAR 2021. (4) Net debt is calculated as total debt less cash & equivalents and financial derivatives. Net debt to LTM Adj. EBITDA calculated in

USD. Net debt at period end exchange rate of Ps 42.36 to U.S $1.00 and LTM Adj. EBITDA calculated as sum of quarters. 16FINANCIAL DISCIPLINE AND SOLID CASH POSITION Bonds (1) (2) PRINCIPAL DEBT AMORTIZATION SCHEDULE DETAILS Q2 2019 Trade financing

(In Millions of USD) Bank loans ~90% of our cash & debt 2,265 denominated in USD Average interest rates 1,587 1,491 of 7.54% in USD 1,450 and 44.76% in Pesos 1,082 961 Average life of 6.14 years 747 625 490 Net Debt /LTM Adj. (3)(4) EBITDA 1.9x

Cash & 2019 2020 2021 2022 2023 2024 2025 2026+ (3) Equivalents (1) As of June 30, 2019. Excludes IFRS 16 effects. (2) Converted to USD using the June 30, 2019 exchange rate of Ps 42.36 to U.S $1.00. (3) Includes cash & equivalents,

including Argentine sovereign bonds BONAR 2020 and BONAR 2021. (4) Net debt is calculated as total debt less cash & equivalents and financial derivatives. Net debt to LTM Adj. EBITDA calculated in USD. Net debt at period end exchange rate of Ps

42.36 to U.S $1.00 and LTM Adj. EBITDA calculated as sum of quarters. 16

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

YPF Sociedad Anónima

|

|

|

|

|

|

|

Date: August 30, 2019

|

|

|

|

By:

|

|

/s/ Ignacio Rostagno

|

|

|

|

|

|

Name:

|

|

Ignacio Rostagno

|

|

|

|

|

|

Title:

|

|

Market Relations Officer

|

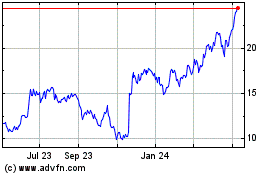

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Mar 2024 to Apr 2024

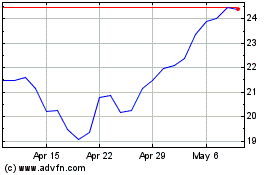

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Apr 2023 to Apr 2024