Current Report Filing (8-k)

August 28 2019 - 5:23PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D)

OF

THE SECURITIES EXCHANGE ACT OF 1934

|

Date of report (Date of earliest event reported)

|

July 26, 2019

|

|

TGI SOLAR POWER GROUP INC.

|

|

(Exact Name of Registrant as Specified in Its Charter)

|

|

Delaware

|

|

001-51059

|

|

20-2976749

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

1011 Whitehead Road Ext, Suite 101, Ewing, NJ

|

|

08638

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

(609) 201-2099

|

|

(Registrant's Telephone Number, Including Area Code)

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

◻

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

◻

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

◻

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

◻

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ◻

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered:

|

|

Common Stock

|

|

TSPG

|

|

OTC Markets

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Notes and Exchange

Agreement

On

July 26, 2019, TGI Solar Power Group Inc., a Delaware corporation (the “Company”), consummated the offering of two

8% Promissory Notes in the principal aggregate amount of $275,000 (collectively, the “Notes”) in private placement

to Ensure HR, LLC and Meros HR, LLC. In connection with the sale of the Notes, the Company also entered into a Securities Exchange

Agreement relating to the sale of the Notes, pursuant to which two shareholders surrendered any aggregate amount of 275,000 Series

C Convertible Preferred Stock, par value $1.00 (the “Series C Stock”), in exchange for the Notes (the “Exchange

Agreement”).

Offering

of the Notes

The

Notes will mature on July 26, 2021, and bears interest at the rate of 8% per annum. The Notes may be prepaid in full. The Notes

are subject to certain additional terms and conditions, including certain remedies in connection with certain customary events

of default.

In

connection with the sale of Notes, the Company entered into a Exchange Agreement relating to the sale of the Note which includes

certain customary representations and warranties, and pursuant to which the Company agreed to comply with certain customary affirmative

and negative covenants during the period the Notes are outstanding.

The

foregoing descriptions of the Notes and Exchange Agreement do not purport to be complete and are qualified in their entirety by

reference to the forms of Note and the Exchange Agreement filed hereto as Exhibit 10.1 and 10.2, respectively.

Joint

Venture

On

August 15, 2019, the Company entered into an agreement (the “Agreement”) with Aviastar Invest Corp., a Delaware corporation

(“AIC”), and its subsidiary, State-Private Enterprise “Energy Independence” LLC. Pursuant to the Agreement,

the Company and AIC will evenly share all profits in connection with the construction and management of solar projects by the Company

on land provided by AIC in Ukraine and the Company will transfer to AIC shares representing 10% of the Company’s outstanding

stock as additional consideration.

The

foregoing description of the Joint Venture Agreement does not purport to be complete and is qualified in its entirety by reference

to the form of Joint Venture Agreement filed hereto as Exhibit 10.3.

Item 2.03.

Creation of a Direct Financial Obligation or an Obligation under an Off Balance Sheet Arrangement of a Registrant.

The

information set forth in Item 1.01 is incorporated by reference into this Item 2.03.

Item 3.02.

Unregistered Sales of Equity Securities.

The

information set forth in Item 1.01 is incorporated by reference into this Item 3.02.

The

offer and sale of the Notes (and the shares of Common Stock into which the Notes are convertible) were made pursuant to the exemption

from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended, including pursuant to Rule 506 thereunder,

because, among other things, the transaction did not involve a public offering, the purchasers are accredited investors who acquired

the securities for investment and not resale, and the Company took appropriate measures to restrict the transfer of the securities.

Item 5.01. Changes

in Control of Registrant.

The disclosures set forth

in Item 1.01 are hereby incorporated by reference into this Item 5.01. The Series C Stock is convertible into a number of shares

of the Company’s common stock, par value $0.001 per share (the “Common Stock”) at the conversion price of $0.0000161240

per share and votes on an as converted basis, multiplied by 1.9. As a result, the surrender of the Series C Stock resulted in a

change of control of the Company. Mr. Henry Val, our sole officer and director, now holds and/or beneficially holds the voting

stock constituting control of the Company. Such control was assumed from James Radvany and Todd McNulty as the holders of voting

and dispositive control of Ensure HR, LLC and Meros HR, LLC, respectively. Including 310,000,000 shares held by Netter Capital,

Inc., of which Mr. Val holds voting and dispositive power, Mr. Val beneficially owns 327,000,000 shares of common stock of the

Company and 2,377,000,000 shares of voting stock of the Company.

Item 9.01. Financial Statements and

Exhibits.

(d) Exhibits

|

Exhibit Number

|

|

Description

|

|

10.1*

|

|

Form of Promissory Note

|

|

10.2*

|

|

Form of Exchange Agreement

|

|

10.3*

|

|

Form of Joint Venture Agreement

|

|

· To be filed by amendment.

|

SIGNATURES

PURSUANT TO THE REQUIREMENTS OF THE SECURITIES

EXCHANGE ACT OF 1934, THE REGISTRANT HAS DULY CAUSED THIS REPORT TO BE SIGNED ON ITS BEHALF BY THE UNDERSIGNED THEREUNTO DULY

AUTHORIZED.

|

|

TGI SOLAR POWER, GROUP INC.

|

|

|

|

|

|

|

|

Date: August 28, 2019

|

By:

|

/s/ Henry Val

|

|

|

|

Name: Henry Val

Title: Chairman, Chief Executive Officer

|

|

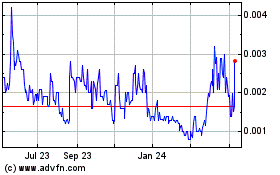

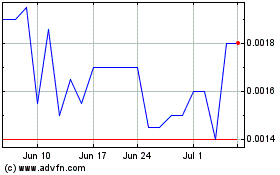

TGI Solar Power (PK) (USOTC:TSPG)

Historical Stock Chart

From Mar 2024 to Apr 2024

TGI Solar Power (PK) (USOTC:TSPG)

Historical Stock Chart

From Apr 2023 to Apr 2024