UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM

8-K

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

August 20, 2019

______________________

Fiesta Restaurant Group, Inc.

(Exact name of registrant as specified in its charter)

______________________

|

|

|

|

|

|

|

|

|

Delaware

|

001-35373

|

90-0712224

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

14800 Landmark Boulevard, Suite 500

|

|

|

|

Dallas

|

Texas

|

|

75254

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code (

972

)

702-9300

N/A

(Former name or former address, if changed since last report.)

______________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading Symbol

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $0.01 per share

|

|

FRGI

|

|

NASDAQ Global Select Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02. DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

On August 20, 2019, Fiesta Restaurant Group, Inc. (the "

Company

") appointed Dirk Montgomery as Senior Vice President, Chief Financial Officer and Treasurer of the Company effective September 9, 2019 (the "

Effective Date

"). Mr. Montgomery, age 56, served as Chief Financial Officer of Hooters International from August 2016 until September 2019. Mr. Montgomery also served as Chief Financial Officer of European Wax Centers from April 2015 until July 2016, Chief Financial Officer of Health Insurance Innovations from September 2014 until March 2015, Executive Vice President and Chief Financial Officer of Ascena Retail Group, Inc. from January 2013 until August 2014 and Chief Financial Officer and Global Productivity Executive (2005-2011) and Chief Value Chain Officer (2012-2013) of Bloomin' Brands, Inc. Mr. Montgomery does not have any other relationships with the Company that would be required to be reported pursuant to Item 404(a) of Regulation S-K.

Mr. Montgomery's annual base salary will be $475,000 ("

Base Salary

") and his incentive bonus target will be set at 50% of the Base Salary subject to the terms of the Company's applicable bonus plan and in the discretion of the Company's Compensation Committee. Mr. Montgomery will be eligible to receive a one-time special incentive bonus of $178,000 which will be payable on or before March 15, 2020 (the "

Incentive Bonus Amount

"), provided that the Incentive Bonus Amount is subject to forfeiture in the event Mr. Montgomery voluntarily terminates his employment with the Company or the Company terminates Mr. Montgomery's employment for cause prior to March 15, 2020. On the Effective Date, Mr. Montgomery will also receive an award of 20,000 restricted shares of the Company's common stock (the "

Stock Award

") pursuant to the Company's 2012 Stock Incentive Plan, as amended (the "

Plan

") which will vest in two equal installments of (i) 50% on the second anniversary of the Effective Date and (ii) 50% on the fourth anniversary of the Effective Date or in the event of Mr. Montgomery's termination of employment by the Company without cause (as defined in the Company's form award agreement) or termination of employment with the Company by Mr. Montgomery for good reason (as defined in the Company's form award agreement). Mr. Montgomery is also eligible to receive an annual stock award with a market value of the shares on the date of the award equal to $475,000, pursuant to the Plan subject to the final discretion and approval of the Company's Compensation Committee and to be granted with such terms and at such time as applicable to the Company's other executive officers. Mr. Montgomery will receive a $1,500 per month temporary living allowance for costs related to living in Addison, Texas subject to change or cancellation at any time in the Company's sole discretion, provided that if Mr. Montgomery permanently relocates or if his employment with the Company terminates for any reason, such allowance payment will cease.

The Company and Mr. Montgomery will also enter into a severance agreement which will provide for severance payments by the Company upon termination of Mr. Montgomery's employment by the Company without cause (to be defined in the severance agreement), for reasons other than death or "permanent and total disability" or termination of employment with the Company by Mr. Montgomery for good reason (to be defined in the severance agreement). The severance payments will include an amount equal to one (1) times Mr. Montgomery's annual base salary in effect prior to the date of termination of employment and an amount equal to the pro rata portion of the aggregate bonus that Mr. Montgomery would have been entitled to receive in the fiscal year of the date of termination of employment.

In connection with Mr. Montgomery's appointment and on the Effective Date, Cheri Kinder will cease to be Interim Chief Financial Officer and Treasurer of the Company and will remain as Vice President, Corporate Controller and Chief Accounting Officer of the Company.

The Company issued a press release on August 21, 2019 announcing, among other items, the appointment of Mr. Montgomery, the full text of which is attached as

Exhibit 99.1

hereto and incorporated by reference into this Item 5.02.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

|

|

|

|

|

|

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FIESTA RESTAURANT GROUP, INC.

Date: August 21, 2019

By:

/s/ Louis DiPietro

Name: Louis DiPietro

Title: Senior Vice President, General Counsel and Secretary

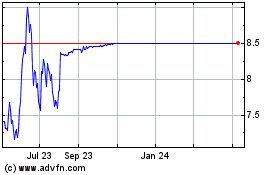

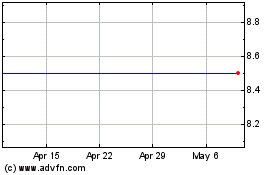

Fiesta Restaurant (NASDAQ:FRGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fiesta Restaurant (NASDAQ:FRGI)

Historical Stock Chart

From Apr 2023 to Apr 2024