Current Report Filing (8-k)

August 16 2019 - 4:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 15, 2019

SpartanNash Company

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Michigan

|

|

000-31127

|

|

38-0593940

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification no.)

|

|

|

|

|

|

850 76

th

Street, S.W.

P.O. Box 8700

Grand Rapids, Michigan

|

|

49518-8700

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (616) 878-2000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, no par value

|

|

SPTN

|

|

NASDAQ Global Select Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

ITE

M 5.02

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 15, 2019, SpartanNash Company (the “Company”) and Dennis Eidson, Interim President and Chief Executive Officer of the Company, agreed to the terms of his compensation. Mr. Eidson was appointed Interim President and Chief Executive Officer of the Company on August 9, 2019, and such compensation is effective as of such appointment and continues until the termination of his appointment, which shall occur upon the earlier of August 8, 2020 or 30 days following the commencement date of a new chief executive officer (the “Termination Date”), if not terminated earlier by the Company or Mr. Eidson.

Mr. Eidson will receive an annual base salary of $1,400,000 and a sign-on cash bonus of $600,000. He will be eligible to receive an aggregate cash bonus of up to $800,000, divided into four bonus opportunities of $200,000 for each three month period following the commencement of his employment (the “Quarterly Periods”), the actual amount to be determined based upon the achievement of certain performance targets. Mr. Eidson will be entitled to receive a pro-rata portion of such bonus payable for the applicable Quarterly Period if his employment is terminated by the Company without cause, by Mr. Eidson with good reason, upon Mr. Eidson’s death or disability, or due to the commencement of employment by the Company of a new chief executive officer, with such termination to occur 30 days following the commencement of employment of a new chief executive officer (each, a “Qualifying Termination”).

Mr. Eidson also will receive an award of restricted stock or phantom stock units with respect to 101,010.10 shares of common stock. In addition, Mr. Eidson is eligible to receive restricted stock or phantom stock units with an aggregate value of $430,000 per Quarterly Period, with the number of shares of restricted stock or shares of common stock underlying such phantom stock units to be determined based upon the closing price of the common stock on the trading day immediately prior to the last day of the Quarterly Period. If the awards are denominated in phantom stock units, then such phantom stock units shall not represent the right to receive shares of common stock, but shall represent the right to receive the economic benefits thereof, including dividend equivalent rights and the right to receive the value of the appreciation of the underlying shares upon cash settlement of the phantom stock units. Mr. Eidson will be entitled to receive a pro-rata portion of the restricted stock or phantom stock units for the applicable Quarterly Period upon a Qualifying Termination. All outstanding shares of restricted stock or phantom stock units will vest upon the earlier of a Qualifying Termination or the Termination Date.

The terms of Mr. Eidson’s compensation do not provide for severance upon termination of employment. He will be eligible to participate in the Company’s 401(k) plan, health insurance plan and other benefit programs offered to its employees.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

Date: August 16, 2019

|

SpartanNash Company

|

|

|

|

|

|

By:

|

/s/ Mark E. Shamber

|

|

|

|

Mark E. Shamber

Executive Vice President and Chief Financial Officer (Principal Financial Officer)

|

3

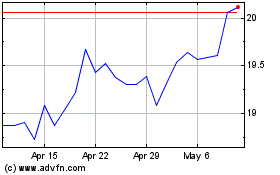

SpartanNash (NASDAQ:SPTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

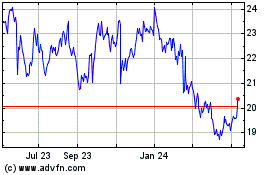

SpartanNash (NASDAQ:SPTN)

Historical Stock Chart

From Apr 2023 to Apr 2024