Filed pursuant to Rule 424(b)(4)

Registration Statement No. 333-232654

PROSPECTUS

Dated July 31, 2019

LEAFBUYER TECHNOLOGIES, INC.

29,999,998 Shares of Common Stock

37,499,996 Shares of Common Stock Underlying Warrants

This Prospectus relates to the resale from time to time of an aggregate of up to 29,999,998 shares of the common stock par value $0.001 per share (the “Common Shares”) of LeafBuyer Technologies, Inc., a Nevada corporation, by Anson Investments Master Fund LP ("Anson") and Hudson Bay Master Fund LTD ("Hudson"), or any of their pledgees, assignees or successors-in-interest (each a “Selling Stockholder”, and collectively, the "Selling Stockholders"), which were acquired from the Company on July 8, 2019 for an aggregate purchase price of $4,499,999.72. The Selling Stockholders have informed us that they are not “underwriters” within the meaning of the Securities Act. The Securities and Exchange Commission (“SEC”) may take the view that, under certain circumstances, any broker-dealers or agents that participate with the Selling Stockholders in the distribution of the Common Shares may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”). Commissions, discounts or concessions received by any such broker-dealer or agent may be deemed to be underwriting commissions under the Securities Act. The Selling Stockholders may sell Common Shares from time to time in the principal market on which the Registrant’s Common Stock is quoted and traded at the prevailing market price or in negotiated transactions. We will not receive any of the proceeds from the sale of those Common Shares being sold by the Selling Stockholders. We did, however, receive net proceeds of approximately $4,065,099 pursuant to the sale of the Common Shares to the Selling Stockholders. We will pay the expenses of registering these Common Shares.

The Selling Stockholders are also offering up to an additional aggregate amount of 37,499,996 shares of our Common Stock underlying Warrants (the "Warrant Shares"), which were acquired from the Company on July 8, 2019 as part of the Common Shares private placement transaction described in further detail in this prospectus. Pursuant to registration rights granted to the Selling Stockholders, we are obligated to register the Common Shares and the Warrant Shares. We will not receive any proceeds from the sale of the Warrant Shares by the Selling Stockholders. We will, however, receive proceeds from any exercise of the Warrant Shares by the Selling Stockholders.

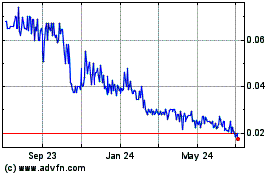

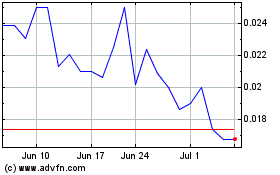

Our common stock is quoted on the over-the-counter market on the OTCQB and trades under the symbol “LBUY”. The last reported sale price of the Common Stock on the OTCQB on July 12, 2019 was $0.60 per share.

The Selling Stockholders are offering the Common Shares and the Warrant Shares. The Selling Stockholders may sell all or a portion of these Common Shares or Warrant Shares from time to time in market transactions through any market on which the Common Stock is then traded, in negotiated transactions or otherwise, and at prices and on terms that will be determined by the then prevailing market price or at negotiated prices directly or through a broker or brokers, who may act as agent or as principal or by a combination of such methods of sale. The Selling Stockholders will receive all proceeds from such sales of the Common Shares and the Warrant Shares. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution.”

Ignoring any beneficial ownership limitations on the number of Common Shares that the Selling Stockholders may own at any time, the Selling Stockholders may each sell up to 33,749,997 Common Shares under this Prospectus, consisting of 14,999,999 Common Shares, and 18,749,998 Warrant Shares, assuming a reset floor price of the Common Shares and the reset floor exercise price of the Warrants of $0.15 per share. In aggregate, the Selling Stockholders may sell up to 67,499,994 Common Shares under this Prospectus, consisting of 29,999,998 Common Shares, and 37,499,996 Warrant Shares, assuming a reset floor price of the Common Shares and a reset floor exercise price of the Warrants of $0.15 per share. We are obligated to file a supplemental registration statement or registration statements in order to register all of the Common Shares and Warrant Shares, in the event that all Common Shares and Warrant Shares cannot be registered pursuant to this Prospectus.

Investing in these securities involves significant risks. See “Risk Factors” beginning on page 7.

We may amend or supplement this Prospectus from time to time by filing amendments or supplements as required. You should read the entire Prospectus and any amendments or supplements carefully before you make your investment decision.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The purchase of the securities offered through this prospectus involves a high degree of risk. You should invest in our common stock only if you can afford to lose your entire investment. You should carefully read and consider the section of this prospectus titled "Risk Factors" beginning on page 7 before buying any shares of our common stock.

The date of this Prospectus is July 31, 2019.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this Prospectus or that we have referred you to via this Prospectus. We have not authorized any dealer, salesperson or other person to provide you with information concerning us except for the information contained in this Prospectus. The information contained in this Prospectus is complete and accurate only as of the date on the front cover page of this Prospectus regardless of when the time of delivery of this Prospectus or the sale of any Common Stock occurs. Neither the delivery of this Prospectus nor any sale made in connection with this Prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this Prospectus or that the information contained herein this Prospectus by reference thereto is correct as of any time after its date.

This Prospectus is not an offer to sell nor is it a solicitation of an offer to buy Common Stock in any jurisdiction in which such offer or sale is not permitted.

PROSPECTUS SUMMARY

The following summary highlights selected information contained in this Prospectus and in the documents incorporated by reference into this Prospectus. This summary does not contain all the information you should consider before investing in the Common Stock. Before making an investment decision, you should carefully read the entire Prospectus and the documents incorporated by reference into this Prospectus, including the “RISK FACTORS” section, the financial statements and the notes to the financial statements. As used throughout this Prospectus, the term “Registrant” refers to LeafBuyer Technologies, Inc. and the terms “Company”, “we,” “us,” or “our” refer to LeafBuyer Technologies, Inc. and its consolidated subsidiaries unless the context otherwise requires.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the documents that we incorporate by reference, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements include those that express plans, anticipation, intent, contingency, goals, targets or future development and/or otherwise are not statements of historical fact. These forward-looking statements are based on our current expectations and projections about future events and they are subject to risks and uncertainties known and unknown that could cause actual results and developments to differ materially from those expressed or implied in such statements.

In some cases, you can identify forward-looking statements by terminology, such as “expects,” “anticipates,” “intends,” “estimates,” “plans,” “believes,” “seeks,” “may,” “should,” “could” or the negative of such terms or other similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties that could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this prospectus.

You should read this prospectus and the documents that we reference herein and therein and have filed as exhibits to the registration statement, of which this prospectus is part, completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus or such prospectus supplement only. Because the risk factors referred to above, as well as the risk factors incorporated herein by reference, could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as may be required under applicable law. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this prospectus and particularly our forward-looking statements, by these cautionary statements.

ABOUT LEAFBUYER TECHNOLOGIES, INC.

Business Overview

Leafbuyer.com Platform

LB Media Group, LLC introduced Leafbuyer.com in 2013 as a consumer portal that would allow cannabis consumers to find the best deals and information from their favorite local dispensary. The platform also allowed cannabis businesses to attract new customers by posting more information and better cannabis deals. As the market has matured and our clients have become more sophisticated, their needs have expanded. The Company is now focused on developing multiple technology solutions to help our customers achieve their objectives. Resources are being put into broadening the platform in several key areas. The fully-developed Leafbuyer platform will host many tools for our clients to attract, retain and grow customers. We plan to expand the platform into a full-service solution that can be monetized while also providing a solution for our customers.

The current market is extremely fragmented and there are few significant companies that have achieved scale in operations. We plan to grow organically and through strategic acquisitions to achieve our long-term goals.

The Team

The Company has 25 full-time employees working out of its headquarters in Greenwood Village, Colorado. In addition, the company currently has sales teams in Washington, Oklahoma, California and Oregon. Leafbuyer also has relationships with approximately 23 independent contractors which it retains from time to time.

A majority of our employees are involved in sales and customer service. Other services, such as website content and graphics design are outsourced to independent contractors.

One of the Company’s top priorities in 2019 has been opening offices in Los Angeles that will handle all West Coast Markets as well as hiring sales representatives in Oklahoma. We anticipate a continuing search for acquisition targets that align with our core objectives.

Growth State by State

Our primary customers have been legal cannabis dispensaries and companies who create cannabis-related products. As more states legalize cannabis, we hope the consumer and potential customer base will expand. We believe that the transformation in California from a purely medical legal state to a recreational state will create great opportunities for our company. We intend to duplicate the model that has worked for us in Colorado in each market as it develops.

The marginal cost for Leafbuyer to enter a market is minimal in comparison to growers or retail operations. In order for us to enter a new market, most of our costs include sales and marketing personnel and grassroots efforts to grow the consumer base in the new market. We believe that we can replicate our success in Colorado in the past four years of operations in other states that adopt legal cannabis use. However, there can be no assurance that we will be able to do so.

Other companies who deal with cannabis directly have significant legal and capital barriers impeding their growth into another state. However, since we are an ancillary company, most of the current regulations and strict cannabis laws do not pertain to our operations. Because of the overall growth in the market and low legal barriers, we believe that growth opportunities are very significant for the foreseeable future.

2019 and Beyond

The global legal marijuana market size is expected to reach $66.3 billion by the end of 2025, according to a new report by Grand View Research, Inc. It is anticipated to expand at a compound annual growth rate of 23.9% during the forecast period. Increasing legalization of marijuana for medicinal and recreational purposes is expected to continue.

● 11 States have currently legalized marijuana for recreation use.

●

·

Source: http://disa.com/map-of-marijuana-legality-by-state

Our business model is designed to benefit from this trend. When a new state passes a medical or recreational cannabis law, we can start marketing to consumers and businesses in that state with minimal marginal cost. Because Leafbuyer is not involved in the production or sale of cannabis, we do not have to build expensive grow operations and open brick and mortar stores. As more states pass laws to offer legal cannabis products, we begin marketing into the state and sign up dispensaries to be on the platform.

We plan to grow the company organically through the aggressive deployment of sales and marketing resources into legal cannabis states. We understand that to become a significant player in the industry in the future will require us to look for acquisitions for a significant portion of that growth. However, there can be no assurance that we will be able to locate and acquire such opportunities or that they will be on terms that are favorable to the Company.

Corporate History

The Company was formed as AP Event, Inc., a Nevada corporation on October 16, 2014. The Registrant was originally in the business of travel agency to provide individual and group leisure tours to music festivals, and concerts combined with local excursions.

On March 21, 2017, August Petrov, the principal shareholder, President, Chief Executive Officer and Chief Financial Officer of AP Event, Inc. consummated the sale of 5,000,000 shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”) owned by Mr. Petrov to LB Media Group, LLC a Colorado limited liability Company (“LB Media”). The sale of the Shares, which represented approximately eighty percent (80%) of the outstanding common stock of the Company, represented a change in control of the Company. In connection with the sale, Mr. Petrov resigned as officer and director of the Company and forgave and discharged any indebtedness of any kind owed to him by the Company.

On March 23, 2017, the Registrant consummated an Agreement and Plan of Merger (the “Merger Agreement”) with LB Media, the principal stockholder of the Registrant, and LB Acquisition Corp., a Colorado corporation a wholly-owned subsidiary of the Registrant (“Acquisition”) whereby Acquisition was merged with and into LB Media (the “Merger”) in consideration for: cash in the amount of Six Hundred Thousand Dollars ($600,000); 2,351,355 newly-issued, pre-split shares of the Company’s Common Stock (the “Merger Shares”); and 324,327 pre-split shares of the Company’s Series A Convertible Preferred Stock, par value $0.001 per share (the “Series A Shares,” and collectively with the Merger Shares, the “Merger Consideration”). The Series A Shares initially convert at the rate of one vote per share (the “Series A Conversion Rate”) and provides that the Series A Conversion Rate shall be adjusted based upon the number of shares outstanding such that the holders of the Series A Shares would not hold less than, fifty-five percent (55%) of the number of outstanding shares of Common Stock on a fully-diluted basis. Pursuant to the terms of the Merger Agreement, LB Media agreed to retire 5,000,000 shares of Common Stock of the Company held immediately prior to the Merger.

Simultaneously with the Merger, the Registrant accepted subscriptions in a private placement offering (the “Offering”) of its Common Stock at purchase prices of $0.12 and $0.15 per share, offered pursuant to Regulation D of the Securities Act of 1933, as amended (the “Securities Act”) for the aggregate offering amount of $600,000. The Company also accepted a subscription from a single investor in the amount of Two Hundred Fifty Thousand Dollars ($250,000) for 27,027 shares of the Registrant’s Series B Convertible Preferred Stock, par value $0.001 per share (the “Series B Shares”) also in accordance with Rule 506 of Regulation D of the Securities Act. The Series B Shares convert, following six months after issuance, into shares of Common Stock at the post-Split rate of sixteen (16) votes per share. The Series B Shares cannot be converted by the investor if such conversion would result in the investor owning more than 4.99% of the outstanding common stock.

As a result of the Merger, LB Media became a wholly-owned subsidiary of the Registrant, and following the consummation of the Merger and giving effect to the securities sold in the Offering, the members of LB Media will beneficially own approximately fifty-five (55%) of the issued and outstanding Common Stock of the Registrant. The parties have taken the actions necessary to provide that the Merger is treated as a “tax free exchange” under Section 368 of the Internal Revenue Code of 1986, as amended.

On March 24, 2017, the Registrant amended its Articles of Incorporation (the “Amendment”) to (i) change its name to LeafBuyer Technologies, Inc., (ii) to increase the number of its authorized shares of capital stock from 75,000,000 to 160,000,000 shares of which 150,000,000 shares were designated common stock, par value $0.001 per share (the “Common Stock”) and 10,000,000 shares were designated “blank check” preferred stock, par value $0.001 per share (the “Preferred Stock”) and (iii) to effect a forward split such that 9.25 shares of Common Stock were issued for every 1 share of Common Stock issued and outstanding immediately prior to the Amendment (the “Split”).

On April 19, 2018, the Company entered into a Standby Equity Distribution Agreement (the “SEDA”) with YA II PN Ltd. (“Investor”), a Cayman Island exempt limited partnership and an affiliate of Yorkville Advisors Global, LLC, whereby the Company sold and the Investor purchased 869,565 shares (the “Initial Shares”) of the Company’s common stock, par value $0.001 per share (the “Common Stock”) for the purchase price of One Million Dollars ($1,000,000), Additionally, under the SEDA the Company may sell to the Investor up to $5 million of shares of Common Stock over a two-year commitment period. Under the terms of the SEDA, the Company may from time to time, in its discretion, sell newly-issued shares of its common stock to the Investor at a discount to market of 8% of the lowest daily volume weighted average price during the relevant pricing period. The Company registered the Initial Shares, the Commitment Shares (as defined below), and the shares of Common Stock issuable under the SEDA pursuant to a registration statement under the Securities Act, which became effective on August 1, 2018.

The Company is not obligated to utilize any portion of the SEDA and there are no minimum commitments or minimum use penalties provided the Company does not terminate the SEDA within 18 months wherein the Company would be required to pay a termination fee of $100,000. The Company issued One Hundred Thousand (100,000) shares of Common Stock as a commitment fee (the “Commitment Shares”) to an affiliate of the Investor. The total amount of funds that ultimately can be raised under the SEDA over the two-year term will depend on the market price for the Company’s common stock and the number of shares actually sold.

On November 6, 2018, Leafbuyer Technologies, Inc. (the “Registrant”), entered into and consummated a Stock Purchase Agreement (the “Agreement”) to acquire all of the issued and outstanding capital stock (the “Purchase Shares”) of Greenlight Technologies, Inc., a Nevada corporation (“Greenlight”) from the Greenlight shareholders (the “Sellers”) in consideration for 2,666,667 shares of the Registrant’s common stock, par value $0.001 per share (the “Common Stock”), cash in the amount of $150,000 at the closing of the Purchase Shares (the “Closing”), an additional payment of $300,000 in cash on or before January 31, 2019, and up to 1,200,000 additional shares of Common Stock as “Incentive Shares” based on certain development goals as set forth in the Agreement.

Private Placement

On July 3, 2019, Leafbuyer Technologies, Inc., entered into a Securities Purchase Agreement (the "Purchase Agreement") with the Selling Stockholders, pursuant to which the Company agreed to issue and sell directly to the Selling Stockholders in a private offering, an aggregate of 7,211,538 Common Shares, par value $0.001 per share, at $0.624 per Share or a 20% discount to the closing price as of July 2, 2019, for gross proceeds of approximately $4,500,000 before deducting offering expenses. The Common Shares are subject to an adjustment period, with a floor reset price of $0.15 per share. The Common Shares were offered by the Company pursuant to the exemption provided in Section 4(a)(2) under the Securities Act, and Rule 506(b) promulgated thereunder. The Company is obligated in accordance with the terms of a Registration Rights Agreement (the "Rights Agreement") to register the Common Shares and the shares of common stock underlying the warrants described below, within 90 days from the date of the Purchase Agreement. Dawson James Securities, Inc. (“Dawson James”) acted as exclusive placement agent in the Private Placement. The Company agreed to pay Dawson James a cash fee equal to 8% of the gross proceeds received by the Company from Purchasers on July 3, 2019 and to grant to Dawson James warrants (the “Placement Agent Warrants”) to purchase up to 360,577 shares of Common Stock at an initial exercise price of $0.78 per share. The Company also agreed to reimburse Dawson James up to $25,000 of expenses (including legal fees and expenses) incurred in connection with the Private Placement. The Placement Agent Warrants are not being registered as part of this prospectus.

As additional consideration for the purchase of the Common Shares, the Company agreed to issue to the Investors Series A, Series B, and Series C Warrants (collectively, the "Warrants"). The Series A Warrants allow the Investors to purchase an aggregate of 7,211,538 shares of common stock, subject to adjustment, at any time until the five-year anniversary of the warrant. The Series B Warrants allow the Investors to purchase an aggregate of 1,802,884 shares of common stock, subject to adjustment, at any time until the one-year anniversary of the warrant. The Series A and Series B Warrants will initially be exercisable at a price of $0.624 per share (the "Exercise Price"), subject to adjustment; provided, however, on each of (i) the 3rd Trading Day following the effective date (the "Effective Date") of the Registration Statement filed by the Company (the “Interim True-Up Date”), and (ii) the 6th Trading Day following the Effective Date (the “Final True-Up Date”), the Exercise Price shall be reduced, and only reduced, to equal the lower of (1) the then Exercise Price and (2) 100% of the lowest VWAP during the 2 Trading Days prior to the Interim True-Up Date or 5 Trading Days prior to the Final True-Up Date, as applicable, immediately following the Effective Date, with a floor exercise price of $0.15. The Series C Warrants, which are considered pre-funded, allow each Investor to purchase an amount of shares equal to the sum of (a) any shares purchased by the Investor pursuant to the Purchase Agreement that would have resulted in the beneficial ownership of greater than 4.99% of the outstanding common shares of the Company, (b) on the 3

rd

Trading Day following the Effective Date, if 80% of the lowest VWAP during the 2 Trading Days immediately prior to such date (“Primary Effective Date Price”) is less than $0.624, then a number of shares of Common Stock equal to such Investor's Purchase Agreement purchase amount divided by the Primary Effective Date Price less any shares of Common Stock (i) issued at the Closing and (ii) issuable pursuant to clause (a) above, if any, and (c) on the 6

th

Trading Day following the Effective Date, if 80% of the lowest VWAP during the 5 Trading Days immediately prior to such date (“Secondary Effective Date Price”) is less than $0.624, then a number of shares of Common Stock equal to such Holder’s Subscription Amount at the Closing divided by the Secondary Effective Date Price less any shares of common stock (i) issued at the Closing, (ii) issuable pursuant to clause (a) above, if any, (iii) issuable pursuant to clause (b) above, if any. The Series C Warrants are exercisable at a price of $0.001 per share. If at any time after the six-month anniversary of the Warrants, there is not an effective registration statement registering the resale of the shares of common stock underlying the Warrants, then the Warrants may be exercised by means of a cashless exercise. The Series A and Series B Warrants do not allow for any exercise that would result in the beneficial ownership of greater than 4.99% (Anson) and 9.99% (Hudson) of the number of shares of the Company's common stock outstanding immediately after giving effect to such exercise. The Series C Warrants held by each of the Selling Stockholders do not allow for any exercise that would result in the beneficial ownership of greater than 9.99% of the number of shares of the Company's common stock outstanding immediately after giving effect to such exercise.

About This Prospectus

This Prospectus relates to a total of up to an aggregate of 29,999,998 Common Shares and 37,499,996 Warrant Shares, assuming the floor reset price of the Common Shares and the floor exercise price of the Warrants of $0.15, which may be offered by the Selling Stockholders (the “Resale Shares”).

Number of Shares Outstanding After This Offering

As of July 31, 2019, we had 55,038,137 Common Shares issued and outstanding. Assuming the Selling Stockholders exercise all of the Warrant Shares, and assuming the Warrant Shares are exercised at the floor exercise price of $0.15, then the number of shares of Common Stock outstanding after this offering is expected to be 115,326,593.

THE OFFERING

|

Common Stock Being

Offered by Selling

Stockholders

|

|

Up to 29,999,998 Common Shares and 37,499,996 Warrant Shares in aggregate, assuming a reset price of the Common Shares and a reset exercise price of the Warrants of $0.15, held by the Selling Stockholders.

|

|

|

|

|

|

Terms of the

Offering

|

|

The Selling Stockholders will determine when and how they will each sell the Common Shares and Warrant Shares offered in this prospectus.

|

|

|

|

|

|

Termination of the

Offering

|

|

The offering will conclude upon the earliest of (i) such time as all of the Common Shares and Warrant Shares have been sold pursuant to the registration statement, (ii) until such time as all of the Common Shares and Warrant Shares have been sold in accordance with Rule 144; or (iii) such time as all of the Common Shares and Warrant Shares become eligible for resale without volume or manner-of-sale restrictions and without current public information pursuant to Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”), or any other rule of similar effect.

|

|

|

|

|

|

Use of Proceeds

|

|

We are not selling any Common Shares in this offering and, as a result, will not receive any proceeds from this offering, with the exception that we will receive proceeds from the exercise of the Warrant Shares.

|

|

|

|

|

|

Trading Symbol

|

|

“LBUY.QB”

|

|

|

|

|

|

Risk Factors

|

|

The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 7.

|

RISK FACTORS

An investment in our Common Stock is subject to risks. The material risks and uncertainties that management believes affect us are described below. Before making an investment decision, you should carefully consider the risks and uncertainties described below together with all of the other information included in this Prospectus including information in the section of this document entitled “Information Regarding Forward Looking Statements”. This Prospectus is qualified in its entirety by these risk factors.

If one or more, or a combination of any of the following risks actually materialize into a negative event or circumstance, our business, financial condition and/or our results of operations could be materially and adversely affected. If this were to happen, the value of our Common Stock could decline significantly and you could lose all or part of your investment.

Risk Factors Related to Our Company and Our Business

We have minimal financial resources. Our independent registered auditors’ report includes an explanatory paragraph stating that there is substantial doubt about our ability to continue as a going concern.

Leafbuyer Technologies, Inc. is an early stage company and has minimal financial resources. We had a cash balance of $375,938 as of June 30, 2018 and a cash balance of $563,383 as of March 31, 2019. We had an accumulated deficit of $3,938,210 at June 30, 2018 and an accumulated deficit of $8,755,126 as of March 31, 2019. Our independent registered auditors included an explanatory paragraph in their opinion on our financial statements as of and for the year ended June 30, 2018 that states that Company losses from operations raise substantial doubt about its ability to continue as a going concern. We may seek additional financing. The financing sought may be in the form of equity or debt financing from various sources as yet unidentified. No assurances can be given that we will generate sufficient revenue or obtain the necessary financing to continue as a going concern.

Leafbuyer is and will continue to be completely dependent on the services of our president, chief executive officer and chief financial officer, the loss of whose services may cause our business operations to cease, and we will need to engage and retain qualified employees and consultants to further implement our strategy.

Leafbuyer’s operations and business strategy are completely dependent upon the knowledge and business connections of Messrs. Rossner and Breen our executive officers. They are under no contractual obligation to remain employed by us. If any should choose to leave us for any reason or become ill and unable to work for an extended period of time before we have hired additional personnel, our operations will likely fail. Even if we are able to find additional personnel, it is uncertain whether we could find someone who could develop our business along the lines described in this Prospectus. We will likely fail without the services of our officers or an appropriate replacement(s).

Because we have only recently commenced business operations, we face a high risk of business failure.

The Company was formed in April 2013. All of our efforts to date have related to developing our business plan and beginning business activities. We face a high risk of business failure. The likelihood of the success of the Company must be considered in light of the expenses, complications and delays frequently encountered in connection with the establishment and expansion of new businesses and the competitive environment in which the Company will operate. There can be no assurance that future revenues will occur or be significant enough or that we will be able to sell its products and services at a profit, if at all. Future revenues and/or profits, if any, will depend on many various factors, including, but not limited to both initial and continued market acceptance of the Company’s website and the successful implementation of its planned growth strategy.

We may not be successful in hiring technical personnel because of the competitive market for qualified technical people.

The Company's future success depends largely on its ability to attract, hire, train and retain highly qualified technical personnel to provide the Company's services. Competition for such personnel is intense. There can be no assurance that the Company will be successful in attracting and retaining the technical personnel it requires to conduct and expand its operations successfully and to differentiate itself from its competition. The Company's results of operations and growth prospects could be materially adversely affected if the Company were unable to attract, hire, train and retain such qualified technical personnel.

We will face competition from companies with significantly greater resources and name recognition.

The markets in which the Company will operate are characterized by intense competition from several types of solution and technical service providers. The Company expects to face further competition from new market entrants and possible alliances among competitors in the future as the convergence of information processing and telecommunications continues. Many of the Company's current and potential competitors have significantly greater financial, technical, marketing and other resources than the Company. As a result, they may be better able to respond or adapt to new or emerging technologies and changes in client requirements or to devote greater resources to the development, marketing and sales of their services than the Company. There can be no assurance that the Company will be able to compete successfully. In addition, the Company will be faced with numerous competitors, both strategic and financial, in attempting to obtain competitive products. Many actual and potential competitors we believe are part of much larger companies with substantially greater financial, marketing and other resources than the Company, and there can be no assurance that the Company will be able to compete effectively against any of its future competitors.

To fully develop our business plan we will need additional financing.

We will have to obtain additional financing in order to conduct our business in a manner consistent with our proposed operations. There is no guaranty that additional funds will be available when, and if, needed. If we are unable to obtain financing, or if its terms are too costly, we may be forced to curtail expansion of operations until such time as alternative financing may be arranged, which could have a materially adverse impact on our operations and our shareholders' investment.

We may not receive any additional funding from the Warrants.

Because the market for our Common Stock has historically exhibited low liquidity levels and has been limited, sporadic and often volatile, the Selling Stockholders may choose not to exercise the Warrants. If the price of our Common Stock falls below the floor price of $0.15 per share, the Selling Stockholders would most likely not exercise the Warrants, and we would not receive the additional funding that would occur pursuant to the exercise of the Warrants.

Risk Factors Related to Our Common Stock

Risks Related to Our Securities

Our officers and directors currently own the majority of our voting power, and through this ownership, control our Company and our corporate actions.

Our current Board of Directors and executive officers hold approximately 55% of the voting power of the Company’s outstanding voting capital stock. These parties have a controlling influence in determining the outcome of any corporate transaction or other matters submitted to our stockholders for approval, including mergers, consolidations and the sale of all or substantially all of our assets, election of directors, and other significant corporate actions. As such, these shareholders have the power to prevent or cause a change in control; therefore, without the aforementioned consent we could be prevented from entering into transactions that could be beneficial to us. The interests of our executive officers may give rise to a conflict of interest with the Company and the Company’s shareholders.

There is a substantial lack of liquidity of our common stock and volatility risks.

Our common stock is quoted on the OTC Markets platform under the symbol “LBUY.” The liquidity of our common stock may be very limited and affected by our limited trading market. The OTC Markets quotation platform is an inter-dealer market much less regulated than the major exchanges, and is subject to abuses, volatilities and shorting. There is currently no broadly followed and established trading market for our common stock. An established trading market may never develop or be maintained. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders. Absence of an active trading market reduces the liquidity of the shares traded.

The trading volume of our common stock may be limited and sporadic. This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained. As a result of such trading activity, the quoted price for our common stock on the OTC Markets may not necessarily be a reliable indicator of our fair market value. In addition, if our shares of common stock cease to be quoted, holders would find it more difficult to dispose of or to obtain accurate quotation as to the market value of, our common stock and as a result, the market value of our common stock likely would decline.

The market price for our stock may be volatile and subject to fluctuations in response to factors, including the following:

|

|

·

|

the increased concentration of the ownership of our shares by a limited number of affiliated stockholders following the share exchange may limit interest in our securities;

|

|

|

|

|

|

|

·

|

variations in quarterly operating results from the expectations of securities analysts or investors;

|

|

|

|

|

|

|

·

|

revisions in securities analysts' estimates or reduction in security analysts' coverage;

|

|

|

|

|

|

|

·

|

announcements of new products or services by us or our competitors;

|

|

|

|

|

|

|

·

|

reductions in the market share of our products;

|

|

|

|

|

|

|

·

|

announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures, or capital commitments;

|

|

|

|

|

|

|

·

|

general technological, market or economic trends;

|

|

|

|

|

|

|

·

|

investor perception of our industry or prospects;

|

|

|

|

|

|

|

·

|

insider selling or buying;

|

|

|

|

|

|

|

·

|

investors entering into short sale contracts;

|

|

|

|

|

|

|

·

|

regulatory developments affecting our industry; and

|

|

|

|

|

|

|

·

|

additions or departures of key personnel.

|

Many of these factors are beyond our control and may decrease the market price of our common stock, regardless of our operating performance. We cannot make any predictions or projections as to what the prevailing market price for our common stock will be at any time, including as to whether our common stock will sustain current market prices, or as to what effect that the sale of shares or the availability of common stock for sale at any time will have on the prevailing market price.

Our common stock may never be listed on a major stock exchange.

We currently do not satisfy the initial listing standards and cannot ensure that we will be able to satisfy such listing standards or that our common stock will be accepted for listing on any such exchange. Should we fail to satisfy the initial listing standards of such exchanges, or our common stock is otherwise rejected for listing, the trading price of our common stock could suffer, the trading market for our common stock may be less liquid, and our common stock price may be subject to increased volatility.

A decline in the price of our common stock could affect our ability to raise working capital and adversely impact our ability to continue operations.

A prolonged decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise capital. A decline in the price of our common stock could be especially detrimental to our liquidity and our operations. Such reductions may force us to reallocate funds from other planned uses and may have a significant negative effect on our business plan and operations, including our ability to develop new services and continue our current operations. If our common stock price declines, we can offer no assurance that we will be able to raise additional capital or generate funds from operations sufficient to meet our obligations. If we are unable to raise sufficient capital in the future, we may not be able to have the resources to continue our normal operations.

Concentrated ownership of our common stock creates a risk of sudden changes in our common stock price.

The sale by any shareholder of a significant portion of their holdings could have a material adverse effect on the market price of our common stock.

Sales of our currently issued and outstanding stock may become freely tradable pursuant to Rule 144 and may dilute the market for your shares and have a depressive effect on the price of the shares of our common stock.

A number of the outstanding shares of common stock are “restricted securities” within the meaning of Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”) (“Rule 144”). As restricted shares, these shares may be resold only pursuant to an effective registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under the Securities Act and as required under applicable state securities laws. Rule 144 provides in essence that a non-affiliate who has held restricted securities for a period of at least six months may sell their shares of common stock. Under Rule 144, affiliates who have held restricted securities for a period of at least six months may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed the greater of 1% of a company’s outstanding shares of common stock or the average weekly trading volume during the four calendar weeks prior to the sale (the four calendar week rule does not apply to companies quoted on the OTC Markets). A sale under Rule 144 or under any other exemption from the Securities Act, if available, or pursuant to subsequent registrations of our shares of common stock, may have a depressive effect upon the price of our shares of common stock in any active market that may develop.

If we issue additional shares or derivative securities in the future, it will result in the dilution of our existing stockholders

.

Our Articles of Incorporation authorize the issuance of up to 150,000,000 shares of common stock, $0.001 par value per share, and 10,000,000 shares are designated as “blank check” preferred stock, par value $0.001 per share (the “Preferred Stock”). Our board of directors may choose to issue some or all of such shares, or derivative securities to purchase some or all of such shares, to provide additional financing in the future. In addition, if the Warrant Shares are exercised in full by the Selling Stockholders at the floor exercise price of $0.15, it would result in the issuance of an additional 37,499,996 shares, causing substantial dilution to our current shareholders.

We do not plan to declare or pay any dividends to our stockholders in the near future.

We have not declared any dividends in the past, and we do not intend to distribute dividends in the near future. The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors and will depend upon, among other things, the results of operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and if dividends are paid, there is no assurance with respect to the amount of any such dividend.

The requirements of being a public company may strain our resources and distract management.

As a result of filing the resignation statement, we are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). These requirements are extensive. The Exchange Act requires that we file annual, quarterly and current reports with respect to our business and financial condition. The Sarbanes-Oxley Act requires that we maintain effective disclosure controls and procedures and internal controls over financial reporting.

We may incur significant costs associated with our public company reporting requirements and costs associated with applicable corporate governance requirements. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. This may divert management’s attention from other business concerns, which could have a material adverse effect on our business, financial condition and results of operations. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Persons associated with securities offerings, including consultants, may be deemed to be broker dealers.

In the event that any of our securities are offered without engaging a registered broker-dealer, we may face claims for rescission and other remedies. If any claims or actions were to be brought against us relating to our lack of compliance with the broker-dealer requirements, we could be subject to penalties, required to pay fines, make damages payments or settlement payments, or repurchase such securities. In addition, any claims or actions could force us to expend significant financial resources to defend our company, could divert the attention of our management from our core business and could harm our reputation.

Future changes in financial accounting standards or practices may cause adverse unexpected financial reporting fluctuations and affect reported results of operations.

A change in accounting standards or practices can have a significant effect on our reported results and may even affect our reporting of transactions completed before the change is effective. New accounting pronouncements and varying interpretations of accounting pronouncements have occurred and may occur in the future. Changes to existing rules or the questioning of current practices may adversely affect our reported financial results or the way we conduct business.

“Penny Stock” rules may make buying or selling our common stock difficult.

Trading in our common stock is subject to the “penny stock” rules. The SEC has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. These rules require that any broker-dealer that recommends our common stock to persons other than prior customers and accredited investors, must, prior to the sale, make a special written suitability determination for the purchaser and receive the purchaser’s written agreement to execute the transaction. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the risks associated with trading in the penny stock market. In addition, broker-dealers must disclose commissions payable to both the broker-dealer and the registered representative and current quotations for the securities they offer. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in our common stock, which could severely limit the market price and liquidity of our common stock.

Our ability to issue preferred stock may adversely affect the rights of holders of our Common Stock and may make takeovers more difficult, possibly preventing you from obtaining the optimal price for our Common Stock.

Our Articles of Incorporation authorizes the issuance of shares of “blank check” preferred stock, which would have the designations, rights and preferences as may be determined from time to time by the Board of Directors. Accordingly, the Board of Directors is empowered, without shareholder approval, to issue preferred stock with dividend, liquidation, conversion, voting or other rights that could adversely affect the voting power or other rights of the holders of the Common Shares. The issuance of preferred stock could be used, under certain circumstances, as a method of discouraging, delaying or preventing a change in control of the Company.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained in this Prospectus that are not statements of historical facts constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, notwithstanding that such statements are not specifically identified as such. These forward-looking statements are based on current expectations and projections about future events. The words “estimates”, “projects”, “plans”, “believes”, “expects”, “anticipates”, “intends”, “targeted”, “continue”, “remain”, “will”, “should”, “may” and other similar expressions, or the negative or other variations thereof, as well as discussions of strategy that involve risks and uncertainties, are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Examples of forward-looking statements include but are not limited to statements about or relating to: (i) future revenues, expenses, income or loss, cash flow, earnings or loss per Common Share, the payment or nonpayment of dividends, capital structure and other financial items, (ii) plans, objectives and expectations of the Company or its management or Board of Directors, (iii) the Company’s business plans, products or services, (iv) future economic or financial performance, and (v) assumptions underlying such statements. We urge you to be cautious of the forward-looking statements and other similar forecasts and statements of expectations since such statements (i) reflect our current beliefs with respect to future events, (ii) involve, and are subject to, known and unknown risks, uncertainties and other factors affecting our operations and growth strategy, and (iii) could cause the Company's actual results, financial or operating performance or achievements to differ from future results, financial or operating performance, or achievements expressed or implied by such forward-looking statements. Forecasts, projections and assumptions contained and expressed herein were reasonably based on information available to the Company at the time so furnished and as of the date of this Prospectus. All such forecasts, projections and assumptions are subject to significant uncertainties and contingencies, many of which are beyond the Company's control, and no assurance can be given that such forecasts, projections or assumptions will be realized. No assurance can be given regarding the achievement of future results, as our actual results may differ materially from our projected future results as a result of the risks we face, and actual future events may differ from anticipated events because of the assumptions underlying the forward-looking statements that have been made regarding such anticipated events.

Potential investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

PRIVATE PLACEMENT OF SHARES OF COMMON STOCK AND WARRANTS

On July 3, 2019, Leafbuyer Technologies, Inc., entered into a Securities Purchase Agreement (the "Purchase Agreement") with the Selling Stockholders, pursuant to which the Company agreed to issue and sell directly to the Selling Stockholders in a private offering, an aggregate of 7,211,538 Common Shares, par value $0.001 per share, at $0.624 per Share or a 20% discount to the closing price as of July 2, 2019, for gross proceeds of approximately $4,500,000 before deducting offering expenses. The Common Shares are subject to an adjustment period, with a reset floor price of $0.15 per share. The Common Shares were offered by the Company pursuant to the exemption provided in Section 4(a)(2) under the Securities Act, and Rule 506(b) promulgated thereunder. The Company is obligated in accordance with the terms of a Registration Rights Agreement (the "Rights Agreement") to register the Common Shares and the shares of common stock underlying the warrants described below, within 90 days from the date of the Purchase Agreement. Dawson James Securities, Inc. (“Dawson James”) acted as exclusive placement agent in the Private Placement. The Company agreed to pay Dawson James a cash fee equal to 8% of the gross proceeds received by the Company from Purchasers on July 3, 2019 and to grant to Dawson James warrants (the “Placement Agent Warrants”) to purchase up to 360,577 shares of Common Stock at an initial exercise price of $0.78 per share. The Company also agreed to reimburse Dawson James up to $25,000 of expenses (including legal fees and expenses) incurred in connection with the Private Placement. The Placement Agent Warrants are not being registered as part of this prospectus.

As additional consideration for the purchase of the Common Shares, the Company agreed to issue to the Investors Series A, Series B, and Series C Warrants (collectively, the "Warrants"). The Series A Warrants allow the Investors to purchase an aggregate of 7,211,538 shares of common stock, subject to adjustment, at any time until the five-year anniversary of the warrant. The Series B Warrants allow the Investors to purchase an aggregate of 1,802,884 shares of common stock, subject to adjustment, at any time until the one-year anniversary of the warrant. The Series A and Series B Warrants will initially be exercisable at a price of $0.624 per share (the "Exercise Price"), subject to adjustment; provided, however, on each of (i) the 3rd Trading Day following the effective date (the "Effective Date") of the Registration Statement filed by the Company (the “Interim True-Up Date”), and (ii) the 6th Trading Day following the Effective Date (the “Final True-Up Date”), the Exercise Price shall be reduced, and only reduced, to equal the lower of (1) the then Exercise Price and (2) 100% of the lowest VWAP during the 2 Trading Days prior to the Interim True-Up Date or 5 Trading Days prior to the Final True-Up Date, as applicable, immediately following the Effective Date, with a floor exercise price of $0.15. The Series C Warrants, which are considered pre-funded, allow each Investor to purchase an amount of shares equal to the sum of (a) any shares purchased by the Investor pursuant to the Purchase Agreement that would have resulted in the beneficial ownership of greater than 4.99% of the outstanding common shares of the Company, (b) on the 3

rd

Trading Day following the Effective Date, if 80% of the lowest VWAP during the 2 Trading Days immediately prior to such date (“Primary Effective Date Price”) is less than $0.624, then a number of shares of Common Stock equal to such Investor's Purchase Agreement purchase amount divided by the Primary Effective Date Price less any shares of Common Stock (i) issued at the Closing and (ii) issuable pursuant to clause (a) above, if any, and (c) on the 6

th

Trading Day following the Effective Date, if 80% of the lowest VWAP during the 5 Trading Days immediately prior to such date (“Secondary Effective Date Price”) is less than $0.624, then a number of shares of Common Stock equal to such Holder’s Subscription Amount at the Closing divided by the Secondary Effective Date Price less any shares of common stock (i) issued at the Closing, (ii) issuable pursuant to clause (a) above, if any, (iii) issuable pursuant to clause (b) above, if any. The Series C Warrants are exercisable at a price of $0.001 per share. If at any time after the six-month anniversary of the Warrants, there is not an effective registration statement registering the resale of the shares of common stock underlying the Warrants, then the Warrants may be exercised by means of a cashless exercise. The Series A and Series B Warrants do not allow for any exercise that would result in the beneficial ownership of greater than 4.99% (Anson) and 9.99% (Hudson) of the number of shares of the Company's common stock outstanding immediately after giving effect to such exercise. The Series C Warrants held by each of the Selling Stockholders do not allow for any exercise that would result in the beneficial ownership of greater than 9.99% of the number of shares of the Company's common stock outstanding immediately after giving effect to such exercise. The Warrants and the shares of our common stock issuable upon the exercise of the Warrants were offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act, and Rule 506(b) promulgated thereunder.

USE OF PROCEEDS

This prospectus relates to the resale of up to 29,999,998 Common Shares purchased by the Selling Stockholders, assuming a reset floor price of $0.15 per share. The Company received approximately $4,500,000 in gross proceeds, and $4,065,099 in net proceeds from the sale of the Common Shares, after deducting offering expenses. The Company also issued Warrants to the Selling Stockholders. We will not receive any proceeds from the sales of Common Shares or Warrant Shares by the Selling Stockholders, but we will receive proceeds in the event of an exercise of the Warrants held by the Selling Stockholders. The current exercise price of the Warrants is $0.624 per share, with a floor exercise price of $0.15, or $5,624,999 in aggregate, if all Warrants are exercised. We will pay the cost of registering the shares offered by this prospectus. The proceeds from the sale of the Common Shares plus the exercise price of the Warrants, if any, will be used for working capital and general corporate expenses.

SELLING STOCKHOLDERS

The Common Shares being offered by the Selling Stockholders are those previously issued to the Selling Stockholders, and those issuable to the Selling Stockholders, upon exercise of the Warrants. For additional information regarding the issuances of those shares of common stock and warrants, see “Private Placement of Shares of Common Stock and Warrants” above. We are registering the shares of common stock in order to permit the Selling Stockholders to offer the Common Shares for resale from time to time. Except for the ownership of the Common Shares and Warrants, the Selling Stockholders have not had any material relationship with us within the past three years.

The table below lists the Selling Stockholders and other information regarding the beneficial ownership of the shares of common stock by each of the Selling Stockholders. The second column lists the number of Common Shares beneficially owned by each Selling Stockholder, based on its ownership of the Common Shares and Warrants, as of July 31, 2019, assuming exercise of the Warrants held by the Selling Stockholders on that date, without regard to any limitations on exercises.

The third column lists the Common Shares being offered by this prospectus by the Selling Stockholders.

In accordance with the terms of a registration rights agreement with the Selling Stockholders, this prospectus generally covers the resale of the sum of (i) the number of Common Shares issued to the Selling Stockholders in the “Private Placement of Shares of Common Stock and Warrants” described above and (ii) the maximum number of shares of common stock issuable upon exercise of the related Warrants, determined as if the outstanding Warrants were exercised in full as of the trading day immediately preceding the date this registration statement was initially filed with the SEC, each as of the trading day immediately preceding the applicable date of determination and all subject to adjustment as provided in the registration right agreement, without regard to any limitations on the exercise of the warrants.

The fourth column assumes the sale of all of the shares offered by the Selling Stockholders pursuant to this prospectus.

The Series A and Series B Warrants do not allow for any exercise that would result in the beneficial ownership of greater than 4.99% (Anson) and 9.99% (Hudson) of the number of shares of the Company's common stock outstanding immediately after giving effect to such exercise. The Series C Warrants held by each of the Selling Stockholders do not allow for any exercise that would result in the beneficial ownership of greater than 9.99% of the number of shares of the Company's common stock outstanding immediately after giving effect to such exercise, excluding for purposes of such determination shares of common stock issuable upon exercise of the Warrants which have not been exercised. The number of shares in the second column does not reflect this limitation. The Selling Stockholders may sell all, some or none of their shares in this offering. See "Plan of Distribution."

|

Name of Selling Stockholder

|

|

Number of

shares of

Common Stock Owned Prior to Offering

|

|

|

Maximum

Number of

shares of

Common Stock

to be Sold

Pursuant to this Prospectus

|

|

|

Number of

shares of

Common Stock Owned After Offering

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Anson Investments Master Fund

|

|

|

8,112,980

|

|

|

|

33,749,997

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hudson Bay Master Fund LTD

|

|

|

8,112,980

|

|

|

|

33,749,997

|

|

|

|

0

|

|

PLAN OF DISTRIBUTION

Each Selling Stockholder (the “

Selling Stockholders

”) of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby on the principal Trading Market or any other stock exchange, market or trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. A Selling Stockholder may use any one or more of the following methods when selling securities:

|

|

·

|

ordinary brokerage transactions and transactions in which the broker‑dealer solicits purchasers;

|

|

|

|

|

|

|

·

|

block trades in which the broker‑dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

|

|

|

|

·

|

purchases by a broker‑dealer as principal and resale by the broker‑dealer for its account;

|

|

|

|

|

|

|

·

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

|

|

|

|

·

|

privately negotiated transactions;

|

|

|

|

|

|

|

·

|

settlement of short sales;

|

|

|

|

|

|

|

·

|

in transactions through broker‑dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated price per security;

|

|

|

|

|

|

|

·

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

|

|

|

|

·

|

a combination of any such methods of sale; or

|

|

|

|

|

|

|

·

|

any other method permitted pursuant to applicable law.

|

The Selling Stockholders may also sell securities under Rule 144 or any other exemption from registration under the Securities Act of 1933, as amended (the “

Securities Act

”), if available, rather than under this prospectus.

Broker‑dealers engaged by the Selling Stockholders may arrange for other brokers‑dealers to participate in sales. Broker‑dealers may receive commissions or discounts from the Selling Stockholders (or, if any broker‑dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with FINRA IM-2440.

In connection with the sale of the securities or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling Stockholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each Selling Stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the securities.

The Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus effective until the earlier of (i) the date on which the securities may be resold by the Selling Stockholders without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for the Company to be in compliance with the current public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the securities have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

DESCRIPTION OF SECURITIES

General

The Company’s authorized capital stock consists of 160,000,000 shares of capital stock, par value $0.0001 per share, of which 150,000,000 shares are common stock, par value $0.001 per share and 10,000,000 shares are “blank check” preferred stock, par value $0.001 per share.

Common Stock

Holders of the Company’s common stock are entitled to one vote per share on each matter submitted to vote at a meeting of the Company’s stockholders. Holders of common stock do not have cumulative voting rights. Stockholders do not have any preemptive rights or other similar rights to acquire additional shares of the Company’s common stock or other securities. Subject to preferences that may be applicable to any then-outstanding preferred stock, holders of common stock are entitled to share in all dividends that the board of directors, in its discretion, declares from legally available funds. In the event of liquidation, dissolution or winding up, subject to preferences that may be applicable to any then-outstanding preferred stock, each outstanding share of common stock entitles its holder to participate ratably in all remaining assets of the Company that are available for distribution to stockholders after providing for each class of stock, if any, having preference over the common stock.

Holders of common stock have no conversion, preemptive or other subscription rights, and there are no redemption or sinking fund provisions applicable to the common stock. The rights of the holders of common stock are subject to any rights that may be fixed for holders of preferred stock, when and if any preferred stock is authorized and issued.

Preferred Stock

The Company’s Articles of Incorporation authorizes the issuance of 10,000,000 shares of “Blank Check” Preferred Stock, par value $0.001 per share, subject to any limitations prescribed by law, without further vote or action by the stockholders, to issue from time to time shares of preferred stock in one or more series. Each such series of Preferred Stock shall have such number of shares, designations, preferences, voting powers, qualifications, and special or relative rights or privileges as shall be determined by the Company’s board of directors, which may include, among others, dividend rights, voting rights, liquidation preferences, conversion rights and preemptive rights. There are currently 324,326 shares of Series A Convertible Preferred Stock and 72,500 shares of Series B Convertible Preferred Stock issued and outstanding.

Series A Convertible Preferred Stock

Series A Preferred Stock rank junior to the Common Stock both as to the payment of dividends and distributions but prior to all subsequently issued securities junior to the Series A Shares. The Series A Shares are convertible into the greater of one share of Common Stock or a number of shares of Common Stock so that the Series A holders would hold 55% of the number of outstanding shares of Common Stock. The Series A Shares vote on an “as-converted” basis.

Series B Convertible Preferred Stock

The Series B Preferred Stock (the “Series B Shares”) shall be entitled to receive, upon consolidation, merger, change of control, liquidation, or dissolution of the Company the stated value of the Series B Preferred Stock. The Series B Preferred Stock is convertible at the rate of 16 shares of Common Stock for each Series B share converted and vote on an “as-converted” basis. The Series B Preferred Stock may not be converted if the conversion would result in the holder owning more than 4.99% of the outstanding Common Stock.

Transfer Agent

The Company’s transfer agent and registrar of its Common Stock is Globex Transfer, LLC, 780 Deltona Boulevard, Deltona, Florida 32725.

Outstanding Common Stock and Holders

At July 31, 2019 there were 55,038,137 shares of Common Stock issued and outstanding and, based upon the number of record holders plus the number of individual participants in security position listings at such date, there were approximately 83 holders of Common Stock.

LEGAL MATTERS

The validity of our Common Stock offered hereby will be passed upon by Ward and Smith, P.A., Wilmington, North Carolina.

EXPERTS

Our audited consolidated financial statements as of and for the year ended June 30, 2018, the six month transition period ended June 30, 2017, and the year ended December 31, 2016 appearing in this Prospectus have been audited by BF Borgers CPA PC., independent registered public accounting firm, as set forth in their report thereon appearing elsewhere in this Prospectus and are included in reliance upon such report given upon the authority of such firm as experts in accounting and auditing.

DESCRIPTION OF BUSINESS

Business Overview

Leafbuyer.com Platform

LB Media Group, LLC introduced Leafbuyer.com in 2013 as a consumer portal that would allow cannabis consumers to find the best deals and information from their favorite local dispensary. The platform also allowed cannabis businesses to attract new customers by posting more information and better cannabis deals. As the market has matured and our clients have become more sophisticated, their needs have expanded. The Company is now focused on developing multiple technology solutions to help our customers achieve their objectives. Resources are being put into broadening the platform in several key areas. The fully-developed Leafbuyer platform will host many tools for our clients to attract, retain and grow customers. We plan to expand the platform into a full-service solution that can be monetized while also providing a solution for our customers.