Schlumberger Names Le Peuch as CEO -- WSJ

July 20 2019 - 3:02AM

Dow Jones News

By Colin Kellaher and Christopher M. Matthews

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 20, 2019).

Schlumberger Ltd. named Olivier Le Peuch its next chief

executive, as the Houston oil-field-services company also said it

continues to suffer from a slowdown in spending by U.S. shale

drillers.

Mr. Le Peuch replaces the retiring Paal Kibsgaard, effective

Aug. 1. Schlumberger announced the change with its second-quarter

results, in which the company reported an 11% decrease in North

American revenue.

Schlumberger's North American business has been hurt in recent

quarters by the cutback in spending by U.S. shale drillers. The

company estimates U.S. producers have cut spending in 2019 by about

10%, but that has been offset by efficiency gains enabling drillers

to get more oil with less spending.

"North America land remains a challenging environment," Mr. Le

Peuch said Friday. Schlumberger continues to see U.S. shale oil

production growing at a slowing rate and expects prices to stay

around the present levels.

Globally, Schlumberger expects exploration spending to fall in

North America, but rise overseas. "The oil demand forecast for 2019

has been reduced slightly on trade war fears and current global

geopolitical tensions, but we do not anticipate a change in the

structural demand outlook for the midterm," Mr. Kibsgaard said.

In the second quarter, Schlumberger's North American revenue

fell to $2.8 billion, while international revenue rose 8% to $5.46

billion.

Shares of Schlumberger, down 42% over the past year, slipped 7

cents Friday to $38.71.

Schlumberger said Mark Papa, one of the pioneers of the U.S.

shale boom who joined the board as a nonindependent director in

October, will become nonexecutive chairman, while Peter Currie will

continue to serve as lead independent director.

Mr. Papa, the former chief executive of shale-industry

bellwether EOG Resources Inc., is chairman and chief executive of

smaller independent shale company Centennial Resource Development

Inc.

Schlumberger management was asked if the addition of Mr. Papa

indicated an increased focus on the U.S. shale market, but Mr.

Kibsgaard said not to read to much into it.

Mr. Le Peuch, who has spent 32 years with Schlumberger, was

named chief operating officer in February, a signal that he was in

line to succeed Mr. Kibsgaard. Both Mr. Kibsgaard and his

predecessor, Andrew Gould, each served as chief operating officer

for just over a year before moving into the top post.

Mr. Le Peuch said shale companies are increasingly focused on

avoiding parent-child well problems, which is when wells are

drilled too closely, and one siphons production off the other. This

is leading to increased demand for Schlumberger's products that

help mitigate the issue, seen as a primary reason shale wells

aren't producing as much as forecast.

Mr. Kibsgaard, who joined Schlumberger in 1997, has been chief

executive since August 2011 and chairman since April 2015. He also

is retiring from the board, the company said.

For the second quarter, the Houston company reported a profit of

$492 million, or 35 cents a share, up from $430 million, or 31

cents a share, a year earlier. Adjusted earnings were 35 cents a

share, in-line with the average analyst estimate on FactSet.

Total sales fell 0.4% year-over-year to $8.27 billion, but still

finished above the consensus forecast of $8.11 billion.

Aisha Al-Muslim contributed to this article.

Write to Colin Kellaher at colin.kellaher@wsj.com and

Christopher M. Matthews at christopher.matthews@wsj.com

(END) Dow Jones Newswires

July 20, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

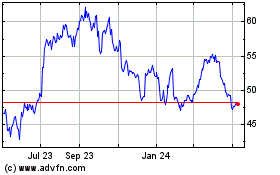

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

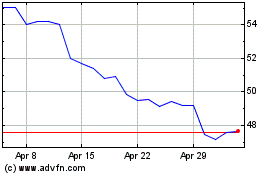

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2023 to Apr 2024