Current Report Filing (8-k)

July 19 2019 - 4:01PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 19, 2019

ETHEMA

HEALTH CORPORATION

f/k/a GREENESTONE HEALTHCARE CORPORATION

(Exact name of registrant as specified in its charter)

|

Colorado

|

000-15078

|

84-1227328

|

|

(State

or other jurisdiction of

|

(Commission

File Number)

|

(IRS

Employer

|

|

incorporation

or organization)

|

|

Identification

No.)

|

810

Andrews Avenue

Delray

Beach, Florida 33483

(Address

of principal executive offices)

(Registrant’s telephone

number, including

area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

[ ] Written communications

pursuant to Rule 425 under the Securities Act

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act

[

] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[

] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material

Definitive Agreement.

On

July 15, 2019, Ethema Health Corporation, a Colorado corporation, f/k/a/ GreeneStone Healthcare Corporation (the “Company”)

closed on a private offering (the “Private Offering”) to raise USD$282,000.00 in capital. Pursuant to the Private

Offering, the Company issued one convertible promissory note (the "Note"), bearing a principal amount of USD$282,000.00

in total, to Labrys Fund LLC (the “Investor”).

Unless

otherwise provided for in the Note, the Note bears a 10% interest rate and matures 180 days from the date of issuance, on January

11, 2020 (the “Maturity Date”). The Investor has conversion rights under the Note, from time to time and at any time

after 180 days from the Note issuance date, to convert all or any part of the outstanding and unpaid principal amount of the Note

into fully paid and non-assessable shares of the Company’s common stock, subject to various other terms and conditions specified

in the Note. The Company has the right to pay off the Note prior to 180 days from the start of the Note by paying the outstanding

principal and interest and prepayment penalties specified in the Note.

The

Note was offered and issued without registration under the Securities Act of 1933, as amended (the “Securities Act”),

in reliance on the exemptions provided by Section 4(a)(2) of the Securities Act, as provided in Rule 506 of Regulation D promulgated

thereunder. The Note, and the shares of common stock issuable upon exercise of the conversion features of the Note, have not been

registered under the Securities Act, or any other applicable securities laws, and unless so registered may not be offered or sold

in the United States, except pursuant to an exemption from the registration requirements of the Securities Act.

The

proceeds raised in the Private Offering have been used to cover operational costs for the Company.

The

foregoing description of the Note does not purport to be complete and is qualified in its entirety by reference to the form of

the Note, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 2.03 Creation

of a Direct Financial Obligation.

The

information provided in Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 2.03.

Item 3.02 Unregistered

Sales of Equity Securities.

The

applicable information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 3.02.

In acquiring the Note, the Investor made representations to the Company that it met the accredited investor definition of Rule

501 of the Securities Act, and the Company relied on such representations. The Note was offered and sold without registration

under the Securities Act, in reliance on the exemptions provided by Section

4(a)(2) of

the Securities Act, as provided in Rule 506 of Regulation D promulgated thereunder, and in reliance on similar exemptions under

applicable state laws.

The

offering of the Note was not conducted in connection with a public offering, and no public solicitation or advertisement was made

or relied upon by the Investor in connection with the offering. This Current Report on Form 8-K shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall such securities be offered or sold in the United States absent registration

or an applicable exemption from the registration requirements.

Item 9.01 Financial

Statements and Exhibits

(d)

Exhibits.

The following exhibit is furnished with this report:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

|

Date:

July 19, 2019

|

By: /s/ Shawn E.

Leon

|

|

|

|

|

Name:

Shawn E. Leon

|

|

|

|

|

Title: CEO

|

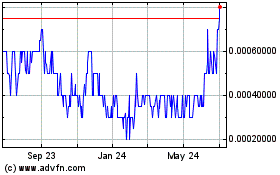

Ethema Health (PK) (USOTC:GRST)

Historical Stock Chart

From Mar 2024 to Apr 2024

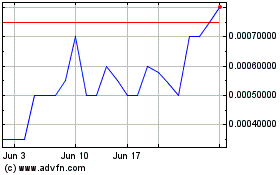

Ethema Health (PK) (USOTC:GRST)

Historical Stock Chart

From Apr 2023 to Apr 2024