Current Report Filing (8-k)

July 03 2019 - 3:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 1, 2019

ACNB Corporation

(Exact name of Registrant as specified in its charter)

|

Pennsylvania

|

|

1-35015

|

|

23-2233457

|

|

(State or other

jurisdiction of

incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

16 Lincoln Square, Gettysburg, PA

|

|

17325

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

717.334.3161

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (

see

General Instruction A.2. below):

x

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Securities registered pursuant to Section 12(b) of the Act:

|

Title Of Each Class

|

|

Trading Symbol(s)

|

|

Name Of Each Exchange On Which Registered

|

|

Common Stock, $2.50 par value per share

|

|

ACNB

|

|

The NASDAQ Stock Market, LLC

|

CURRENT REPORT ON FORM 8-K

ITEM 1.01

Entry Into a Material Definitive Agreement

On July 1, 2019, ACNB Corporation (“ACNB”) and its wholly-owned subsidiaries, ACNB Bank and ACNB South Acquisition Subsidiary, LLC (“Acquisition Subsidiary”), and Frederick County Bancorp, Inc. (“FC Bancorp”) and its wholly-owned subsidiary, Frederick County Bank (“FC Bank”), entered into an Agreement and Plan of Reorganization (the “Agreement”) which provides that, subject to the terms and conditions set forth in the Agreement, FC Bancorp will merge with and into Acquisition Subsidiary with Acquisition Subsidiary surviving the merger. In addition, as soon as practicable after the merger of FC Bancorp with and into Acquisition Subsidiary, FC Bank will merge with and into ACNB Bank.

Subject to the terms and conditions of the Agreement, each share of FC Bancorp common stock will be converted into the right to receive 0.9900 share of ACNB common stock. The Agreement contains customary representations and warranties from the parties, and the parties have agreed to customary covenants and agreements, including, among others, covenants and agreements relating to (1) conduct of their respective businesses during the interim period between execution of the Agreement and the closing of the merger, (2) FC Bancorp’s obligation to facilitate its stockholders’ consideration of, and voting upon, the necessary approval and adoption of the Agreement, (3) ACNB’s obligation to facilitate its shareholders’ consideration of, and voting upon, the issuance of the common stock to FC Bancorp stockholders, (4) the recommendation of the board of directors of FC Bancorp in favor of the necessary approval by its stockholders, (5) FC Bancorp’s non-solicitation and other obligations relating to alternative business combinations, and (6) the addition of one (1) member of FC Bancorp’s current board of directors to the boards of directors of ACNB and ACNB Bank.

The boards of directors of ACNB and FC Bancorp have unanimously approved the Agreement. The Agreement and the transactions contemplated by it are subject to the approval of FC Bancorp’s stockholders, ACNB’s shareholders, regulatory approvals, and other customary closing conditions. The transaction is intended to qualify as a tax-free reorganization for federal income tax purposes.

The Agreement provides certain termination rights for both ACNB and FC Bancorp. Upon termination of the Agreement under certain circumstances, FC Bancorp will be obligated to pay ACNB a termination fee of $2.4 million.

The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreement, which is attached hereto as Exhibit 2.1 and is incorporated herein by reference. The representations, warranties and covenants of each party set forth in the Agreement have been made only for purposes of, and were and are solely for the benefit of the parties to, the Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Accordingly, the representations and warranties may not describe the actual state of affairs at the date they were made or at any other time, and investors should not rely on them as statements of fact. In addition, such representations

2

and warranties (1) will not survive consummation of the merger, unless otherwise specified therein, and (2) were made only as of the date of the Agreement or such other date as is specified in the Agreement. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Agreement, which subsequent information may or may not be fully reflected in the parties’ public disclosures. Accordingly, the Agreement is included with this filing only to provide investors with information regarding the terms of the Agreement, and not to provide investors with any other factual information regarding ACNB or FC Bancorp, their respective affiliates or their respective businesses. The Agreement should not be read alone, but should instead be read in conjunction with the other information regarding ACNB, FC Bancorp, their respective affiliates or their respective businesses, the Agreement and the merger that will be contained in, or incorporated by reference into, the registration statement on Form S-4 that will include a proxy statement of FC Bancorp and ACNB and a prospectus of ACNB, as well as in the Forms 10-K, Forms 10-Q, Forms 8-K, and other filings that ACNB makes with the Securities and Exchange Commission (“the SEC”).

Caution Regarding Forward-Looking Statements

This information presented herein contains forward-looking statements. These forward-looking statements include, but are not limited to, statements about (i) the benefits of the proposed merger between ACNB and

FC Bancorp, (ii) ACNB’s and FC Bancorp’s plans, obligations, expectations and intentions, and (iii) other statements presented herein that are not historical facts. Words such as “anticipates”, “believes”, “intends”, “should”, “expects”, “will” and variations of similar expressions are intended to identify forward-looking statements. These statements are based on the beliefs of the respective managements of ACNB and FC Bancorp as to the expected outcome of future events and are not guarantees of future performance. These statements involve certain risks, uncertainties and assumptions that are difficult to predict with regard to timing, extent, and degree of occurrence. Results and outcomes may differ materially from what may be expressed or forecasted in forward-looking statements. Factors that could cause results and outcomes to differ materially include, among others, the ability to obtain required regulatory and shareholder approvals and meet other closing conditions to the transaction; the ability to complete the merger as expected and within the expected timeframe; disruptions to customer and employee relationships and business operations caused by the merger; the ability to implement integration plans associated with the transaction, which integration may be more difficult, time-consuming or costly than expected; the ability to achieve the cost savings and synergies contemplated by the merger within the expected timeframe, or at all; changes in local and national economies, or market conditions; changes in interest rates; regulations and accounting principles; changes in policies or guidelines; loan demand and asset quality, including real estate values and collateral values; deposit flow; the impact of competition from traditional or new sources; and, the other factors detailed in ACNB’s publicly filed documents, including its Annual Report on

Form 10-K

for the year ended December 31, 2018. ACNB and FC Bancorp assume no obligation to revise, update or clarify forward-looking statements to reflect events or conditions after the date of this report.

3

No Offer or Solicitation

The information presented herein does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Additional Information about the Merger and Where to Find It

In connection with the proposed merger, ACNB will file with the SEC a registration statement on Form S-4 with respect to the offering of ACNB common stock as the merger consideration under the Securities Act of 1933, as amended, which will include a proxy statement of

FC Bancorp and ACNB and a prospectus of ACNB. A definitive proxy statement/prospectus will be sent to the shareholders of FC Bancorp and ACNB seeking the required shareholder approvals.

Before making any voting or investment decision, investors and security holders are urged to read the registration statement and proxy statement/prospectus and other relevant documents when they become available because they will contain important information about ACNB,

FC Bancorp

, and the merger.

Investors and security holders will be able to obtain free copies of these documents through the website maintained by the SEC at http://www.sec.gov. Investors and security holders may also obtain free copies of these documents by directing a request by mail or telephone to ACNB Corporation at 16 Lincoln Square, P.O. Box 3129, Gettysburg, PA 17325 or (717) 339-5085, or by directing a request by mail or telephone to Frederick County Bancorp, Inc. at 9 North Market Street, P.O. Box 1100, Frederick, MD 21702 or (301) 620-1400.

ACNB, FC Bancorp, and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of FC Bancorp and ACNB in connection with the merger. Information about the directors and executive officers of FC Bancorp and ACNB and their ownership of FC Bancorp and ACNB common stock may be obtained by reading the proxy statement/prospectus regarding the merger when it becomes available. Additional information regarding the interests of these participants and other persons who may be deemed participants in the merger may be obtained by reading the joint proxy statement/prospectus regarding the merger when it becomes available.

ITEM 9.01

Financial Statements and Exhibits

(d) Exhibits.

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

2.1

|

|

Agreement and Plan of Reorganization by and among ACNB Corporation, ACNB South Acquisition Subsidiary, LLC, ACNB Bank, Frederick County Bancorp, Inc. and Frederick County Bank dated as of July 1, 2019. (Schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K. ACNB Corporation agrees to furnish supplementally to the SEC a copy of any omitted schedule upon request.)

|

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

ACNB CORPORATION

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

Dated: July 3, 2019

|

/s/ Lynda L. Glass

|

|

|

Lynda L. Glass

|

|

|

Executive Vice President/

|

|

|

Secretary & Chief Governance Officer

|

6

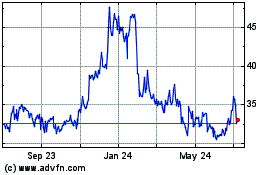

ACNB (NASDAQ:ACNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

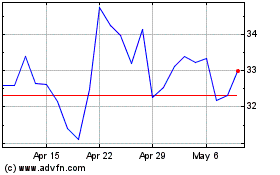

ACNB (NASDAQ:ACNB)

Historical Stock Chart

From Apr 2023 to Apr 2024