Highway Holdings Reports Fiscal 2019 Fourth Quarter and Year-End Results

July 02 2019 - 4:00PM

Highway Holdings Limited (

Nasdaq: HIHO) today

reported results for its fiscal fourth quarter and year ended March

31, 2019 – reflecting the impact of lower orders from certain

customers experiencing soft product demand and the loss of business

due to continued inflationary pressures in China.

Net loss for the fiscal fourth quarter was

$186,000, or $0.05 per diluted share, compared with net income of

$742,000, or $0.20 per diluted share, in the same quarter a year

ago. Net sales for the same period were $3.8 million compared with

$4.2 million a year ago.

Net loss for fiscal 2019 was $630,000, or $0.17

per share, compared with net income of $1,550,000, or $0.41 per

diluted share, a year earlier. Net sales for fiscal 2019 were $14.3

million compared with $19.2 million a year ago.

The sales decrease for fiscal 2019 reflects

sharply reduced orders from two of the company’s major customers –

including a year-over-year sales reduction of approximately 30

percent from one customer alone.

“We remain cautiously optimistic that business

will improve in the future -- supported by ongoing pro-active

strategic initiatives, particularly the increasing utilization of

our Myanmar complex and the expected cost-savings and competitive

advantage it provides for the long term. In the short term, we will

not realize all the benefits from the favorable labor cost savings

derived from our emerging Myanmar operation because these savings

are being passed through to our customers, which contributes to

lower pricing and lower sales turnover. Nonetheless, our ability to

offer lower cost manufacturing in Myanmar is a benefit to customers

seeking an increasingly attractive alternative to the inflationary

trends in China. Furthermore, an escalating trade war between the

United States and China enhances the appeal of our expanding

capacity and manufacturing capabilities in Myanmar,” said Roland

Kohl, chairman, president and chief executive officer of Highway

Holdings.

Gross profit margin for fiscal 2019 was 25

percent compared with 35 percent a year earlier, due to increasing

manufacturing costs related to the sharp reduction in sales and

lower overhead absorption.

Selling, general and administrative expenses

decreased to $1.1 million from $1.3 million, and $4.3 million from

$4.8 million for the fiscal fourth quarter and 12-month period,

respectively, on a year-over-year basis -- despite cost increases

related to the relocation of machinery and equipment from China to

the company’s operation in Myanmar.

Currency exchange rates slightly affected the

company’s net loss for fiscal 2019. The company realized a small

currency exchange loss in fiscal 2019 of $8,000 compared with a

currency exchange gain of $63,000 a year ago, mainly due to the

weakening of the RMB. The company does not undertake any currency

hedging transactions.

Kohl noted the company’s balance sheet remains

strong, despite the losses. Total current assets at March 31, 2019

were $13.4 million, with working capital of $8.3 million and a

current ratio of 2.6:1. Total cash was $8.8 million after a

long-term rental prepayment of $950,000 in Myanmar and a cash

outlay for constructing an additional factory and an office

building at the company’s Myanmar complex. Cash on hand totaled

$2.32 per diluted share, exceeding all current and long-term

liabilities combined by $3.7 million.

Kohl highlighted the company’s total equity of

$10 million at March 31, 2019 -- representing approximately $2.67

per diluted share.

About Highway HoldingsHighway

Holdings produces a wide variety of high-quality products for blue

chip original equipment manufacturers -- from simple parts and

components to sub-assemblies and finished products. Highway

Holdings’ administrative offices are in Hong Kong, with

manufacturing and assembly facilities located in Shenzhen in the

People’s Republic of China and in Yangon, Myanmar.

Except for the historical information contained

herein, the matters discussed in this press release are

forward-looking statements, including but not limited to the

Company’s ability to maintain lower costs at the Myanmar facility,

the effects of lower costs in Myanmar on customer retention, the

Company’s ability to streamline its operations through robotics and

automation, the timing of future business, and the Company’s growth

prospects. These forward-looking statements involve numerous

risks and uncertainties, including economic, competitive,

governmental, political and technological factors affecting the

company's revenues, operations, markets, products and prices, and

other factors discussed in the company’s various filings with the

Securities and Exchange Commission, including without limitation,

the company’s annual reports on Form 20-F. The

forward-looking statements are made only as of the date of this

press release and the Company undertakes no obligation to publicly

update such forward-looking statements to reflect subsequent events

or circumstance.

(Financial Tables Follow)

HIGHWAY HOLDINGS LIMITED AND

SUBSIDIARIESConsolidated Statement of

Income(Dollars in thousands, except per share data)

| |

Three Months

Ended |

|

Year

Ended |

| |

March

31,(Unaudited) |

|

March

31,(Audited) |

| |

|

|

|

|

|

|

|

| |

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

| |

|

|

|

|

|

|

|

| Net sales |

$ |

3,782 |

|

|

$ |

4,177 |

|

|

$ |

14,277 |

|

|

$ |

19,166 |

|

| Cost of sales |

|

2,956 |

|

|

|

2,012 |

|

|

|

10,697 |

|

|

|

12,424 |

|

| Gross profit |

|

826 |

|

|

|

2,165 |

|

|

|

3,580 |

|

|

|

6,742 |

|

| Selling, general and administrative expenses |

|

1,057 |

|

|

|

1,276 |

|

|

|

4,335 |

|

|

|

4,804 |

|

| Operating (loss)/income |

|

(231 |

) |

|

|

889 |

|

|

|

(755 |

) |

|

|

1,938 |

|

| |

|

|

|

|

|

|

|

| Non-operating items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exchange gain/(loss), net |

|

13 |

|

|

|

72 |

|

|

|

(8 |

) |

|

|

63 |

|

|

Interest income |

|

16 |

|

|

|

4 |

|

|

|

33 |

|

|

|

16 |

|

|

Gain/(Loss) on disposal of assets |

|

- |

|

|

|

2 |

|

|

|

28 |

|

|

|

50 |

|

|

Other income / (expenses) |

|

- |

|

|

|

5 |

|

|

|

8 |

|

|

|

5 |

|

|

Total non-operating income / (expenses) |

|

29 |

|

|

|

83 |

|

|

|

61 |

|

|

|

134 |

|

| |

|

|

|

|

|

|

|

| Share of profits (loss) of equity investee |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Net (loss)/income before income tax and non-controlling

Interest |

|

(202 |

) |

|

|

972 |

|

|

|

(694 |

) |

|

|

2,072 |

|

| Income taxes |

|

26 |

|

|

|

(244 |

) |

|

|

26 |

|

|

|

(512 |

) |

| Net (loss)/income before

non-controlling interests |

|

(176 |

) |

|

|

728 |

|

|

|

(668 |

) |

|

|

1,560 |

|

| |

|

|

|

|

|

|

|

| Less: Net gain / (loss)

attributable to non-controlling Interests |

|

10 |

|

|

|

(14 |

) |

|

|

(38 |

) |

|

|

10 |

|

| Net (loss)/income attributable to Highway Holdings Limited

shareholders |

($ |

186 |

) |

|

$ |

742 |

|

|

($ |

630 |

) |

|

$ |

1,550 |

|

|

|

|

|

|

|

|

|

|

| Net income/(loss) per share: |

|

|

|

|

|

|

|

|

Basic |

($ |

0.05 |

) |

|

$0.20 |

|

($ |

0.17 |

) |

|

$ |

0.41 |

|

|

Diluted |

($ |

0.05 |

) |

|

$ |

0.20 |

|

|

($ |

0.17 |

) |

|

$ |

0.41 |

|

| |

|

|

|

|

|

|

|

| Weighted average number of shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

3,802 |

|

|

3,802 |

|

|

3,802 |

|

|

|

3,802 |

|

|

Diluted |

|

3,802 |

|

|

3,802 |

|

|

3,802 |

|

|

|

3,802 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HIGHWAY HOLDINGS LIMITED AND

SUBSIDIARIESConsolidated Balance

Sheet(In thousands, except per share data)

| |

March 31, |

March 31, |

|

|

|

2019 |

|

|

2018 |

|

| Current assets: |

|

|

|

Cash and cash equivalents |

$ |

8,827 |

|

$ |

11,267 |

|

|

Accounts receivable, net of doubtful accounts |

|

2,264 |

|

|

2,223 |

|

|

Inventories |

|

1,539 |

|

|

2,933 |

|

|

Prepaid expenses and other current assets |

|

722 |

|

|

749 |

|

|

Total current assets |

|

13,352 |

|

|

17,172 |

|

| |

|

|

| Property, plant and equipment,

(net) |

|

886 |

|

|

770 |

|

| Goodwill |

|

- |

|

|

77 |

|

| Long-term deposits |

|

66 |

|

|

111 |

|

| Long-term loan receivable |

|

75 |

|

|

- |

|

| Long-term rental

prepayment |

|

871 |

|

|

- |

|

| Investments in equity method

investees |

|

- |

|

|

- |

|

|

Total assets |

$ |

15,250 |

|

$ |

18,130 |

|

|

|

|

|

| Current liabilities: |

|

|

|

Accounts payable |

$ |

1,161 |

|

$ |

900 |

|

|

Accrual expenses and other liabilities |

|

2,989 |

|

|

3,982 |

|

|

Income tax payable |

|

602 |

|

|

803 |

|

|

Dividend payable |

|

329 |

|

|

623 |

|

|

Total current liabilities |

|

5,081 |

|

|

6,308 |

|

| Long term liabilities: |

|

|

|

Deferred income taxes |

|

32 |

|

|

32 |

|

|

Total liabilities |

|

5,113 |

|

|

6,340 |

|

| |

|

|

| Shareholders' equity: |

|

|

|

Common shares, $0.01 par value |

|

38 |

|

|

38 |

|

|

Additional paid-in capital |

|

11,370 |

|

|

11,370 |

|

|

Retained earnings |

|

(1,233 |

) |

|

347 |

|

|

Accumulated other comprehensive (loss)/income |

|

(35 |

) |

|

- |

|

|

Treasury shares, at cost – 5,049 shares as of March 31, 2019 and

2018, respectively |

|

(14 |

) |

|

(14 |

) |

|

Non-controlling interest |

|

11 |

|

|

49 |

|

|

Total equity |

|

10,137 |

|

|

11,790 |

|

|

Total liabilities and shareholders' equity |

$ |

15,250 |

|

$ |

18,130 |

|

|

|

|

|

|

|

|

|

CONTACT:Gary S. MaierMaier & Company,

Inc.(310) 471-1288

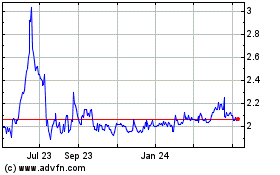

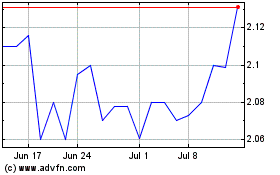

Highway (NASDAQ:HIHO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Highway (NASDAQ:HIHO)

Historical Stock Chart

From Apr 2023 to Apr 2024