By AnnaMaria Andriotis and David Benoit

For about three years, Al Sanzari carried two JPMorgan Chase

& Co. credit cards: a United Airlines card and the Sapphire

Reserve.

He canceled the United card in March. The Sapphire card doles

out more points for travel and dining, and he likes that he can

redeem them for a variety of rewards -- including United

flights.

"There wasn't anything the United card was doing for me that the

Chase Sapphire Reserve couldn't," said Mr. Sanzari, a 29-year-old

nutrition coach and personal trainer.

JPMorgan's Sapphire Reserve has been a huge hit with frequent

travelers and big spenders since its launch nearly three years ago.

That is a problem for United Continental Holdings Inc., which wants

those same customers to sign up for and spend on the airline's

credit cards.

For JPMorgan and other banks, promoting their own branded cards

while keeping airline partners happy is a tough balancing act.

Banks in recent years have tripped over each other to lure big

spenders with ever more generous rewards. At the same time, they

are trying to stay in the good graces of their airline partners,

which have come to rely on the revenue from their card deals with

banks.

United executives have told JPMorgan they believe the Sapphire

Reserve card is competing directly with the airline's cards and

siphoning off customer spending, according to people familiar with

the matter.

While the deal lasts for another six years, according to people

familiar with the matter, United President Scott Kirby has said

publicly that the airline has had tough conversations about the

JPMorgan partnership and wants to get more money out of it.

The airline has asked JPMorgan to pay it more for miles, among

other things, according to people familiar with the conversations.

JPMorgan, meanwhile, insists the cards aren't direct competitors

and believes the airline should be doing more to earn traveler

loyalty, the people said.

"This is a solid, longstanding relationship, and we're working

together to find new ways to grow our partnership for years to

come," the companies said in a joint statement to The Wall Street

Journal.

At least half of airlines' cash earnings in the next five years

will come from the sale of miles to card issuers and frequent

fliers, according to estimates from Stifel airline analyst Joseph

DeNardi.

"When you talk to the card issuers, the general sense is the

balance of economics is generally skewed in [favor] of the

airlines, and if you talk to the airlines they say 'we have more

room to go,'" said Mr. DeNardi.

JPMorgan and United have been partners since 1987. Today, it

issues five cards for the airline with different rewards

structures.

When the bank launched Sapphire Reserve in 2016, applications

for the United cards slowed, according to people familiar with the

matter. United executives were unhappy, the people said. Among

their complaints: JPMorgan was offering a more generous sign-up

bonus for Sapphire Reserve than the United cards, the people

said.

JPMorgan pays United for the miles cardholders accrue. The

airline gets paid before customers book flights, and a portion of

the miles is never redeemed. United also gets a cut of the swipe

fees merchants pay when customers use the cards.

It works differently with Sapphire Reserve. Customers collect

points they can use to buy tickets on a number of airlines,

including United, through the bank's Ultimate Rewards website.

JPMorgan then buys the tickets from the airline when cardholders

redeem their points for a flight. It doesn't share the swipe

fees.

Sapphire Reserve points are worth 50% more when used to book

travel, making the card particularly attractive to frequent

travelers who aren't loyal to a particular airline.

The perks on airline cards have been enhanced in recent years to

better compete with banks' premium offerings. Some United and

American Airlines cards, for example, added 2 miles per dollar

spent at restaurants last year.

Airline cards "have felt the heat from bank cards," said Brian

Kelly, founder and chief executive of rewards website The Points

Guy.

Airlines still have plenty of leverage with the banks. A series

of mergers that created a few mega-airlines in the U.S. has

strengthened their hand.

When Delta Air Lines Inc. renewed its card partnership with

American Express Co. earlier this year, the airline said it

expected its financial benefit from the deal to double to nearly $7

billion annually by 2023. Delta is AmEx's largest card partner,

accounting for some 21% of its world-wide credit-card balances at

the end of 2018.

Citigroup Inc. and American Airlines Group Inc. also are

discussing possible changes to their card benefits, according to

people familiar with the matter. One of the issues that has come up

over the course of the partnership: Citigroup wants its customers

to be able to transfer American miles to its Prestige credit card,

according to people familiar with the matter. American hasn't

historically allowed for that.

Banks say there is room for both airline and premium cards in

consumers' wallets.

Kristi Fergason charged nearly all her expenses on her United

Airlines credit card for about 16 years. That changed when she

signed up for Sapphire Reserve shortly after it rolled out.

Ms. Fergason, 49, moved most of her travel and dining expenses

-- about a third of her card purchases -- to Sapphire Reserve for

the extra points. She uses the United card for almost everything

else.

She also uses Sapphire Reserve points to book airfare on United

and Southwest Airlines Co., to rent cars and for hotel stays, a

strategy she employed for a recent family trip to Wyoming, South

Dakota, Arizona and Nevada.

"Hotels, rental cars, cruises and all restaurants used to go on

the United card, but now go on the Sapphire Reserve," she said.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com and

David Benoit at david.benoit@wsj.com

(END) Dow Jones Newswires

June 27, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

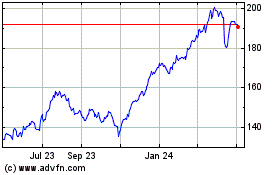

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

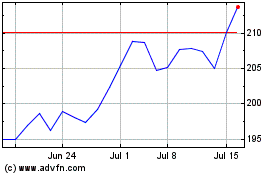

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024