Current Report Filing (8-k)

June 21 2019 - 5:01PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 21, 2019

PROPANC

BIOPHARMA, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

000-54878

|

|

33-0662986

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

302,

6 Butler Street

Camberwell,

VIC, 3124 Australia

(Address

of principal executive offices) (Zip Code)

61

03 9882 6723

(Registrant’s

telephone number, including area code)

n/a

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(g) of the Securities Exchange Act of 1934:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of principal U.S. market on which traded

|

|

Common

stock, $0.001 par value

|

|

PPCB

|

|

OTCQB

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

Item

5.07

|

Submission

of Matters to a Vote of Security Holders.

|

The

information set forth in Item 8.01 below is incorporated herein by reference.

Propanc Biopharma, Inc. (the “Company”) has received confirmation from the Financial Industry

Regulatory Authority to be able to effectuate a 1-for-500 reverse stock split (the “Reverse Stock Split”) of all of

the Company’s issued and outstanding shares of common stock, $0.001 par value per share (the “Common Stock”).

The Reverse Stock Split will take effect in the market at the open of business on June 24, 2019 (the “Effective Date”),

the Company’s trading symbol will temporarily change to “PPCBD” and the shares of Common Stock will trade on

the OTCQB at the new split-adjusted price. That extra “D” will remain for 20 business days after which the trading

symbol will revert to “PPCB”.

As

a result of the Reverse Stock Split, every five hundred (500) shares of the pre-split issued and outstanding shares of Common

Stock will automatically convert into one (1) post-split share of Common Stock, without any change in the par value of the shares.

The number of the Company’s authorized shares of Common Stock shall be fixed at 100,000,000 after the Reverse Stock Split.

All fractional shares will be rounded up. The new CUSIP number for the Common Stock will be 74346N206.

As

a result of the Reverse Stock Split, all options and warrants of the Company outstanding immediately prior to the Reverse Stock

Split will be adjusted by dividing the number of shares of Common Stock into which the options and warrants are exercisable by

500 and multiplying the exercise price thereof by 500, and all restricted stock units of the Company outstanding immediately prior

to the Reverse Stock Split will be adjusted by dividing the number of shares of Common Stock underlying such restricted stock

units by 500, all in accordance with the terms of the plans, agreements or arrangements governing such options, warrants and restricted

stock units.

The

Company’s stockholders who are holding their shares in electronic form at brokerage firms do not need to take any action,

as the effect of the Reverse Stock Split will automatically be reflected in their brokerage accounts. Stockholders who hold shares

electronically in book-entry form with the transfer agent will not need to take action to receive shares of post-Reverse Stock

Split common stock. Stockholders who hold shares of common stock with a bank, broker, custodian or other nominee and who have

any questions in this regard are encouraged to contact their banks, brokers, custodians or other nominees. Stockholders who hold

shares in certificated form will be sent a transmittal letter by the Company’s transfer agent, Action Stock Transfer Corporation,

containing instructions on how a stockholder may surrender certificates to the transfer agent in exchange for certificates representing

post-Reverse Stock Split shares.

As

described in the Company’s definitive Information Statement on Schedule 14C, filed with the U.S. Securities and Exchange

Commission on March 18, 2019, on March 4, 2019, the Company’s Board of Directors (the “Board”) approved and

authorized, and the Company’s stockholders approved by written consent, in accordance with Delaware corporate law, for the

Company to file a Certificate of Amendment to its Certificate of Incorporation (the “Certificate of Amendment”) with

the Secretary of State of the State of Delaware, to effect the Reverse Stock Split, as described above, subject to the Board determining

the ratio of the Reverse Stock Split. The Certificate of Amendment as corrected by the Company’s Certificate of Correction,

was filed with the Secretary of State of the State of Delaware and became effective June 14, 2019, pursuant to which the Company

effected the Reverse Stock Split on the Delaware state level and fixed the number of the authorized shares of its common stock

at 100,000,000 after the Reverse Stock Split. The foregoing description is qualified by reference to the Certificate of Amendment

and the Certificate of Correction, copies of which are filed as Exhibits 3.1 and 3.2, respectively, to this Current Report on

Form 8-K.

|

Item

9.01

|

Financial

Statements and Exhibits.

|

(d)

Exhibits:

*

Filed herewith

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

PROPANC

BIOPHARMA, INC.

|

|

|

|

|

|

|

By:

|

/s/

James Nathanielsz

|

|

|

Name:

|

James

Nathanielsz

|

|

Dated:

June 21, 2019

|

Title:

|

Chief

Executive Officer

|

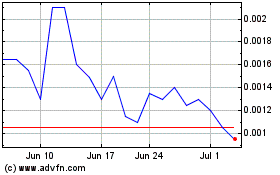

Propanc Biopharma (PK) (USOTC:PPCB)

Historical Stock Chart

From Mar 2024 to Apr 2024

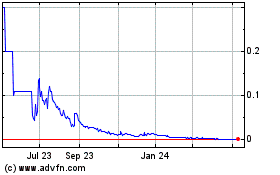

Propanc Biopharma (PK) (USOTC:PPCB)

Historical Stock Chart

From Apr 2023 to Apr 2024