Amended Current Report Filing (8-k/a)

June 19 2019 - 4:57PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

June 18, 2019

Arch Coal, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

1-13105

|

|

43-0921172

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

CityPlace One

One CityPlace Drive, Suite 300

St. Louis, Missouri 63141

(Address, including zip code, of principal executive offices)

Registrant’s telephone number, including area code:

(314) 994-2700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value

|

|

ARCH

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

£

Explanatory Note

Arch Coal, Inc. is filing this Amendment No. 1 to Current Report on Form 8-K (this “Amendment”) to amend its Current Report on Form 8-K, as originally filed with the U.S. Securities and Exchange Commission on June 19, 2019 (the “Original Form 8-K”), solely for the purpose of filing a copy of the Implementation Agreement referenced therein as Exhibit 2.1 and to revise the last paragraph of Item 1.01 and the exhibit index in Item 9.01 to reflect that the Implementation Agreement is being filed as an exhibit.

Except as noted above, this Amendment does not modify or update in any way the disclosures made in the Original Form 8-K.

Item 1.01

Entry into a Material Definitive Agreement.

On June 18, 2019, Arch Coal, Inc. (“Arch”), entered into a definitive implementation agreement (the “Implementation Agreement”) with

Peabody Energy Corporation (“Peabody”), to establish a joint venture that will combine the respective Powder River Basin and Colorado mining operations of Arch and Peabody. Pursuant to the terms of the Implementation Agreement, Arch will hold a 33.5% economic interest, and Peabody will hold a 66.5% economic interest in the joint venture. At the closing, certain of the respective subsidiaries of Arch and Peabody will enter into an Amended and Restated Limited Liability Company Agreement (the “LLC Agreement”) in substantially the form attached as an exhibit to the Implementation Agreement. Under the terms of the LLC Agreement, the governance of the joint venture will be overseen by the joint venture’s board of managers, which will initially be comprised of three representatives appointed by Peabody and two representatives appointed by Arch. Decisions of the board of managers will be determined by a majority vote subject to certain specified matters set forth in the LLC Agreement that will require a supermajority vote. Peabody, or one of its affiliates, will initially be appointed as the operator of the joint venture and will manage the day-to-day operations of the joint venture, subject to the supervision of the joint venture’s board of managers.

Formation of the joint venture is subject to customary closing conditions, including the termination or expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, the receipt of certain other required regulatory approvals and the absence of injunctions or other legal restraints preventing the formation of the joint venture. The obligation of Arch to consummate the transaction is also conditioned upon (a) Arch having obtained consents or refinanced all outstanding indebtedness under Arch’s senior secured term loan facility, Arch’s inventory based revolving credit facility and Arch’s existing accounts receivable securitization facility and (b) Arch having either obtained an exemptive order from the U.S. Securities and Exchange Commission (the “SEC”) or other exemptive determination under the Investment Company Act of 1940 (the “1940 Act”). The obligation of Peabody to consummate the transaction is also conditioned upon Peabody having obtained consents or refinanced all outstanding indebtedness under Peabody’s existing senior secured credit facility, the indenture governing Peabody’s 6.000% Notes due 2022 and 6.375% Notes due 2025 and Peabody’s existing receivables securitization facility. Formation of the joint venture does not require approval of the respective stockholders of either Arch or Peabody.

The Implementation Agreement contains customary representations, warranties and covenants, including an obligation for each of Arch and Peabody to use its best efforts to take all actions necessary to obtain required regulatory approvals, subject to the limitations set forth in the Implementation Agreement.

The Implementation Agreement may be terminated by mutual written agreement of Arch and Peabody and by either Arch or Peabody if, among other things, the closing has not occurred on or prior to December 18, 2020, except that (a) the right to terminate will not be available to a party whose failure to

1

perform any of its obligations under the Implementation Agreement has been a principal cause of or resulted in the failure of the closing to occur on or prior to such date and (b) the right to terminate will not be available to Arch until June 18, 2021 if all closing conditions have been satisfied other than the receipt by Arch of an exemptive order (or other determination) under the 1940 Act.

Additionally, if the closing has not occurred on or prior to June 18, 2020 and all required regulatory approvals have not been obtained, the Implementation Agreement may be terminated by either Arch or Peabody no later than June 29, 2020 following written notice and the payment by the terminating party to the non-terminating party of a termination fee of $40 million;

provided

,

however

, that the non-terminating party may elect to extend the Implementation Agreement until September 18, 2020. If the non-terminating party exercises this option to extend, the termination fee payable to the non-terminating party by the terminating party if the closing does not occur on or prior to September 18, 2020 will be reduced to $25 million.

Except as set forth above, neither party will be required to pay a termination fee if the Implementation Agreement is terminated. If all closing conditions have been satisfied other than the receipt by Arch of an exemptive order (or other determination) under the 1940 Act, Arch will reimburse Peabody for regulatory transaction expenses.

The foregoing description of the Implementation Agreement and the LLC Agreement and the transactions contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety by reference to, the Implementation Agreement, including the form of LLC Agreement attached as an exhibit thereto, a copy of which is attached as Exhibit 2.1 hereto and incorporated by reference herein. The Implementation Agreement, including the form of LLC Agreement attached as an exhibit thereto, is included solely to provide investors with information regarding its terms. It is not intended to provide any other factual information about Arch, Peabody or the operations of their respective businesses. In particular, the assertions embodied in the representations and warranties in the Implementation Agreement were made as of a specified date, are modified or qualified by information in confidential disclosure letters prepared in connection with the execution and delivery of the Implementation Agreement, may be subject to a contractual standard of materiality different from what might be viewed as material to shareholders, or may have been used for the purpose of allocating risk between the parties. Accordingly, the representations and warranties in the Implementation Agreement are not necessarily characterizations of the actual state of facts about Arch, Peabody or the operations of their respective businesses at the time they were made or otherwise and should only be read in conjunction with the other information that Arch makes publicly available in reports, statements and other documents filed with the SEC.

Item 7.01

Regulation FD Disclosure.

On June 19, 2019, Arch issued a press release announcing its entry into the Implementation Agreement. A copy of the press release is furnished as

Exhibit 99.1

hereto and incorporated by reference herein.

The information set forth in and incorporated into this Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 is being furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any of Arch’s filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing. The filing of this Item 7.01 of this Current Report on Form 8-K shall not be deemed an admission as to the materiality of any information herein that is required to be disclosed solely by reason of Regulation FD.

2

Item 9.01

Financial Statements and Exhibits.

(d)

Exhibits

*

Certain schedules to the Implementation Agreement have been omitted pursuant to Item 601(a)(5) of Regulation S-K. Arch hereby undertakes to furnish copies of any of the omitted schedules upon request by the SEC.

** Previously filed

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” — that is, statements related to future, not past, events. In this context, forward-looking statements often address Arch’s expected future business and financial performance, and often contain words such as “expects,” “aims,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Particular uncertainties arise from Arch’s ability to complete the joint venture transaction in a timely manner, including obtaining regulatory approvals and satisfying other closing conditions; from Arch’s ability to achieve the expected synergies from the joint venture; from Arch’s ability to successfully integrate the operations of certain mines in the joint venture; from Arch’s emergence from Chapter 11 bankruptcy protection; changes in the demand for coal by the domestic electric generation and steel industries; from legislation and regulations relating to the Clean Air Act and other environmental initiatives; from competition within Arch’s industry and with producers of competing energy sources; from Arch’s ability to successfully acquire or develop coal reserves; from operational, geological, permit, labor and weather-related factors; from the Tax Cuts and Jobs Act and other tax reforms; from the effects of foreign and domestic trade policies, actions or disputes; from fluctuations in the amount of cash Arch generates from operations, which could impact, among other things, Arch’s ability to pay dividends or repurchase shares in accordance with Arch’s announced capital allocation plan; from Arch’s ability to successfully integrate the operations that Arch acquires; and from numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive or regulatory nature. These uncertainties may cause Arch’s actual future results to be materially different than those expressed in Arch’s forward-looking statements. Arch does not undertake to update its forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. For a description of some of the risks and uncertainties that may affect Arch’s future results, you should see the risk factors described from time to time in the reports Arch files with the Securities and Exchange Commission.

3

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: June 19, 2019

|

Arch Coal, Inc.

|

|

|

|

|

|

|

By:

|

/s/ Robert G. Jones

|

|

|

|

Robert G. Jones

|

|

|

|

Senior Vice President — Law, General Counsel and Secretary

|

4

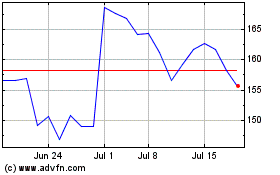

Arch Resources (NYSE:ARCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

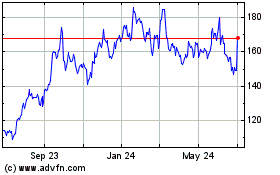

Arch Resources (NYSE:ARCH)

Historical Stock Chart

From Apr 2023 to Apr 2024