Finding the Right Gold Stock

May 29 2019 - 11:40AM

InvestorsHub NewsWire

Finding the Right Gold Stock

May 29, 2019 -- InvestorsHub NewsWire -- via microcapspeculators.com --

Gold prices touched a more than one-week high on Monday as

fears of a protracted U.S.-China trade war hurt risk sentiment,

while poor economic data from the United States bolstered bets

of a U.S. Federal Reserve rate cut. Now is the time to

look at gold stocks.

One under the radar gold company worth your time,

Inception Mining, Inc (USOTC:

IMII) owns and operates a producing mine with the

capacity to produce 1000 tons per day. The company’s 2018

revenues were up 9% and are on pace to be up even higher in

2019. IMII recently released a report on the mine, so now may

be the time to dig in.

The 5 Gold Stocks we are highlighting: Inception Mining,

Inc. (USOTC:

IMII), Harmony Gold Mining Company Ltd. (HMY), Eldorado Gold

Corporation (NYSE:

EGO), Barrick Gold Corporation (NYSE:

GOLD), and Gold Fields Limited (NYSE:

GFI).

Inception Mining, Inc. (USOTC:

IMII) (Market Cap: $14.689M; Share Price:

$0.25655) announced in March that the company has

completed a National Instrument 43-101 Technical Report that

includes an estimate on its Clavo Rico Project, located in El

Corpus, Departamento Choluteca, Honduras. The Technical

Report can be found on the company’s website at http://inceptionmining.com/clavorico/43-101-report/.

Highlights of the Report include:

- Economic mineralization at Clavo Rico is contained in three

distinct zones, including an oxide zone, a supergene enrichment

zone, and a sulfide zone.

- Data on 96 recent and historic drill holes totaling 6264 meters

of drill core yielding 2552 assays together with 827 channel

samples collected from historic adits.

- Data on an oxide zone. The oxide zone has been producing since

2015.

- Data on a sulfide zone that was calculated using two different

modeling techniques to reflect geologic uncertainties:

- Data of the supergene enrichment zone

- The conceptual geologic model, supported by field mapping,

production records and both recent and historic drill programs

suggests that significant potential exists to increase the known

mineral resource with additional drilling.

Inception Mining is a producing gold mining company engaged in

the identification, exploration, acquisition and development of

mineral properties. IMII owns and operates the Clavo Rico

mine. In addition, the company also holds the UP &

Burlington mine.

________

Harmony Gold Mining Company Ltd. (HMY) (Market Cap: $

804.313M; Share Price: $1.57) is off to a strong

start for the shortened week. Harmony Gold is the third

largest gold mining company in South Africa. Harmony operates

in South Africa and in Papua New Guinea. The company has nine

underground mines, one open-pit mine and several surface operations

in South Africa.

________

Eldorado Gold Corporation (NYSE:

EGO) (Market Cap: $575.953M; Share Price:

$3.62) announced that it has priced its offering of

US$300 million aggregate principal amount of 9.5% senior secured

second lien notes due 2024, which will be offered at 98% of

par. The settlement date for the issue of the Notes is

expected to be on or about June 5, 2019.

________

Barrick Gold Corporation (NYSE:

GOLD) (Market Cap: $20.674B; Share Price:

$11.74) proposed an expansion into Pueblo Viejo,

already one of the world’s Tier One gold mines, includes an

expansion of the mine’s processing plant and tailings capacity with

an estimated initial capital investment of more than a

billion dollars (100% basis) and the potential to extend the life

of the mine into the 2030s and beyond. Barrick expects to

complete a feasibility study for the expansion project during

2020. The proposed capital investment would more than double

the contribution the mine has already made to the Dominican

Republic.

________

Gold Fields Limited (NYSE:

GFI) (Market Cap: $3.084B; Share Price:

$3.87) announced the successful buyback

of $250m of the outstanding 2020 notes at 102% of par as

compared with a premium of 101.73% of par at the close of business

on Friday, 24 May 2019. Following the bond issuances

on 9 May 2019, Gold Fields commenced a tender process to buy

back up to $250m of the 2020 notes.

The remainder of the 2020 notes ($600m), due in October

2020, is expected to be repaid from a combination of available cash

and bank debt facilities.

Legal Disclaimer:

This article was written by Regal Consulting, LLC (“Regal

Consulting”). Regal Consulting has agreed to a three-month

term consulting agreement with IMII signed 02/12/2019. The

agreement calls for $25,000 in cash and 10,000 restricted shares of

IMII per month. All payments were made directly by Inception

Mining, Inc. to Regal Consulting, LLC to provide investor relations

services, of which this article is a part of. Regal

Consulting also paid one thousand dollars cash to

microcapspeculators.com to distribute this article. Regal

Consulting may have a position in the securities mentioned in this

article at the time of publication, and may increase or decrease

its position without notice. This article is based on public

information and the opinions of Regal Consulting. IMII was given an

opportunity to edit this article. This article contains

forward-looking statements that are subject to certain risks and

uncertainties that could cause actual results to differ materially

from any results predicted herein. Regal Consulting is not

registered with any financial or securities regulatory authority,

and does not provide or claim to provide investment advice.

http://www.regalconsultingllc.com/full

legal disclaimer/

Full Legal Disclaimer Click Here.

Contact Information:

Company Name: ACR Communication LLC.

Contact Person: Media Manager

Email: info@microcapspeculators.com

Phone: 1-702-720-6310

Country: United States

SOURCE: microcapspeculators.com

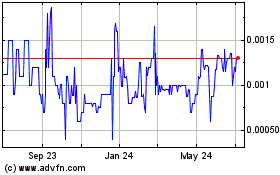

Inception Mining (PK) (USOTC:IMII)

Historical Stock Chart

From Mar 2024 to Apr 2024

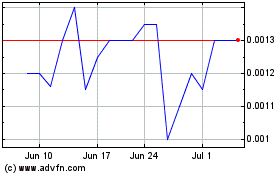

Inception Mining (PK) (USOTC:IMII)

Historical Stock Chart

From Apr 2023 to Apr 2024