Amended Annual Report (10-k/a)

May 24 2019 - 4:19PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K/A

(Amendment

No.1)

(Mark

One)

☒

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended June 30, 2018

☐

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from __ to_______________________________

Commission

File Number: 000-54853

|

SMARTMETRIC,

INC

|

|

(Exact

name of registrant as specified in its charter)

|

|

Nevada

|

|

05-0543557

|

|

(State or other jurisdiction

of

|

|

(I.R.S. Employer

identification No.)

|

|

incorporation or

organization)

|

|

|

|

|

|

|

|

3960

Howard Hughes Parkway, Suite 500, Las Vegas, NV

|

|

89109

|

|

(Address of principal

executive offices)

|

|

(Zip Code)

|

|

|

|

|

|

Registrant’s

telephone number, including area code

|

|

(702) 990-3687

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

Trading

Symbol(s)

|

Name

of each exchange on which registered

|

|

None

|

None

|

None

|

Securities

registered pursuant to section 12(g) of the Act: Common Stock, par value $0.001 per share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

☒

Yes ☐ No

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant

to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit such files).

☒

Yes ☐ No

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

|

Smaller reporting company ☒

|

Emerging

growth company ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

☐ Yes ☒ No

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transaction period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. { }

The

aggregate market value of the voting and non-voting common equity held by non-affiliates was $9,598,786.14 computed by reference

to the closing price of the registrant’s common stock as quoted on the OTCQB maintained by OTC Markets, Inc. on June 30,

2018 (which was $0.06 per share). For purposes of the above statement only, all directors, executive officers and 10% shareholders

are assumed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for any other

purpose.

As

of October 2, 2018, there were 254,650,085 shares of common stock, par value $0.001 issued and outstanding.

EXPLANATORY

NOTE

This

Amendment No. 1 on Form 10-K/A (“Form 10-K/A”) to our Annual Report on Form 10-K for the year

ended June 30, 2018, initially filed with the Securities and Exchange Commission on October 12, 2018 (the “Original Filing”),

is being filed solely to revise Part II, Item 9A. “Controls and Procedures” in response to comments received

from the staff of the Securities and Exchange Commission’s Division of Corporation Finance. This Form 10-K/A amends and

restates in its entirety Part II, Item 9A of the Original Filing. Except as stated above, this Form 10-K/A does not

reflect events occurring after the Original Filing and does not modify or update in any way the disclosures contained in the Original

Filing. Accordingly, this Form 10-K/A should be read in conjunction with the Original Filing.

As

required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, new certifications by our principal executive officer

and principal financial officer are filed as exhibits to this Amendment under Item 15 of Part IV hereof.

|

Item 9A.

|

Controls

and Procedures

|

Evaluation

of Disclosure Controls and Procedures

We

maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our reports,

filed under the Securities Exchange Act of 1934, is recorded, processed, summarized and reported within the time periods specified

in the SEC’s rules and forms, and that such information is accumulated and communicated to our management, including our

chief executive officer and chief financial officer, as appropriate, to allow timely decisions regarding required disclosure.

In designing and evaluating the disclosure controls and procedures, management recognized that any controls and procedures, no

matter how well designed and operated, can provide only reasonable and not absolute assurance of achieving the desired control

objectives. In reaching a reasonable level of assurance, management necessarily was required to apply its judgment in evaluating

the cost-benefit relationship of possible controls and procedures. In addition, the design of any system of controls also is based

in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed

in achieving its stated goals under all potential future conditions. Over time, a control may become inadequate because of changes

in conditions or the degree of compliance with policies or procedures may deteriorate. Because of the inherent limitations in

a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

As

required by the SEC Rules 13a-15(b) and 15d-15(b), we carried out an evaluation under the supervision and with the participation

of our management, including our principal executive officer and principal financial officer, of the effectiveness of the design

and operation of our disclosure controls and procedures as of the end of the period covered by this report. Based on the foregoing,

our principal executive officer and principal financial officer concluded that our disclosure controls and procedures were not

effective at the reasonable assurance level due to the material weaknesses described below.

Management’s

Annual Report on Internal Control Over Financial Reporting.

The

management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting (“ICFR”)

for the Company. Our internal control system was designed to, in general, provide reasonable assurance to the Company’s

management and board regarding the preparation and fair presentation of published financial statements, but because of its inherent

limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation

of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions,

or that the degree of compliance with the policies or procedures may deteriorate.

Our

management assessed the effectiveness of the Company’s internal control over financial reporting as of June 30, 2018. The

framework used by management in making that assessment was the criteria set forth in the document entitled “2013 Internal

Control – Integrated Framework” issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based

on that assessment, management concluded that, during the period covered by this report, such internal controls and procedures

were not effective as of June 30, 2018 and that material weaknesses in ICFR existed as more fully described below.

A

material weakness is a deficiency, or a combination of deficiencies, within the meaning of Public Company Accounting Oversight

Board (“PCAOB”) Auditing Standard AS 2201, in internal control over financial reporting, such that there is a reasonable

possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or

detected on a timely basis. Management has identified the material weaknesses described below which have caused management to

conclude that as of June 30, 2018 our internal controls over financial reporting were not effective at the reasonable assurance

level.

Due

to our size and nature, segregation of all conflicting duties may not always be possible and may not be economically feasible.

However, to the extent possible, the initiation of transactions, the custody of assets and the recording of transactions are being

performed by separate individuals. Management evaluated the impact of our failure to have segregation of duties in all of our

financially significant processes and have concluded that this control deficiency represented a material weakness. We plan to

remediate this weakness over the next 12 months.

Notwithstanding

the assessment that our ICFR was not effective and that there are material weaknesses as identified herein, we believe that our

consolidated financial statements contained in this Annual Report fairly present our financial position, results of operations

and cash flows for the years covered thereby in all material respects.

This

Annual Report does not include an attestation report of the Company’s registered public accounting firm regarding internal

control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public

accounting firm as we are a smaller reporting company and are not required to provide the report.

Changes

in Internal Controls

During

the fiscal year ended June 30, 2018, there have been no changes in our internal control over financial reporting that have materially

affected or are reasonably likely to materially affect our internal controls over financial reporting

INDEX

TO EXHIBITS

SIGNATURES

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report

to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

SMARTMETRIC,

INC.

|

|

|

|

|

Date: May 24, 2019

|

By:

|

/s/

Chaya Hendrick

|

|

|

|

Chaya Hendrick

|

|

|

|

President, Chief

Executive Officer and Chairman (Principal Executive Officer)

|

Pursuant

to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf

of the registrant and in the capacities and on the dates indicated.

|

Name

|

|

Title

|

|

Date

|

|

/s/

Chaya Hendrick

|

|

Chief Executive

Officer and Director (principal executive officer)

|

|

May

24, 2019

|

|

Chaya Hendrick

|

|

|

|

|

|

|

|

|

|

|

|

/s/

Jay Needelman

|

|

Chief Financial

Officer (principal financial and accounting officer) and Director

|

|

May

24, 2019

|

|

Jay Needelman

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Elizabeth

Ryba

|

|

Director

|

|

May 24, 2019

|

|

Elizabeth Ryba

|

|

|

|

|

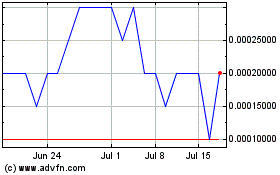

SmartMetric (PK) (USOTC:SMME)

Historical Stock Chart

From Mar 2024 to Apr 2024

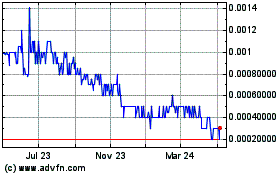

SmartMetric (PK) (USOTC:SMME)

Historical Stock Chart

From Apr 2023 to Apr 2024