Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

May 23 2019 - 5:01PM

Edgar (US Regulatory)

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed

by the Registrant

o

Filed

by a Party other than the Registrant

x

Check the appropriate box:

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

o

|

Soliciting Material Under Rule 14a-12

|

HomeStreet, Inc.

(Name of Registrant as Specified In Its

Charter)

Roaring

Blue Lion Capital Management, L.P.

Blue

Lion Opportunity Master Fund, L.P.

BLOF

II LP

Charles

W. Griege, Jr.

Ronald

K. Tanemura

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (check the appropriate

box):

|

x

|

No fee required.

|

|

|

|

|

o

|

Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11.

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act

|

|

Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4)

|

Date Filed:

|

BLUE LION EXPRESSES DISAPPOINTMENT WITH

HOMESTREET’S MISREPRESENTATIONS OF ITS PRIOR INTERACTIONS WITH DWIGHT CAPITAL

Believes HomeStreet’s Board Has

a Fiduciary Duty to Fully Evaluate Dwight Capital’s Offer

DALLAS, May 23, 2019 /PRNewswire/ -- Blue Lion Capital,

a Dallas-based investment firm ("Blue Lion") that beneficially owns approximately 6.5% of the stock of HomeStreet, Inc.

(Nasdaq: HMST) ("HomeStreet" or the "Company"), issued a statement today about the Company’s failure

to fully engage with Dwight Capital regarding their expressed interest in acquiring HomeStreet’s Fannie Mae DUS lending operations

and related mortgage servicing rights.

Blue Lion stated:

“We were surprised and disappointed to learn

yesterday from a Dwight Capital press release that HomeStreet’s Chairman and CEO Mark Mason has apparently misrepresented

the interactions that took place between the two firms dating back to 2017. On April 29, 2019, Dwight Capital expressed its interest

in acquiring HomeStreet’s Fannie Mae DUS lending operations and associated MSRs.

On April 30, HomeStreet stated that it was “not

aware of Dwight Capital’s interest until their press release, as they had not previously contacted us.” The Board of

HomeStreet also pledged to review the letter and respond as appropriate.

Now, it appears that HomeStreet’s first statement

was false and the second a prelude to perfunctory action.

Dwight Capital openly disputed HomeStreet’s

assertion that the Company was unaware of their interest as members of their management team had sent emails to Mark Mason in 2017

and 2018. Further, Mark Mason responded to the emails.

How can the Chairman of the Board and CEO have received

and sent emails and then claimed the Company knew nothing of Dwight Capital’s interest? Further, when HomeStreet’s

press release stated it was “unaware of Dwight Capital’s interest,” was that the Board speaking or simply a misrepresentation

to the Board by its Chairman and CEO?

Blue Lion does not know the people at Dwight Capital

and we do not know whether the transaction they would propose would be attractive to HomeStreet. But, we do know that when a public

company makes a representation to shareholders, that representation MUST be true.

It also appears that HomeStreet is not intending

to substantively consider Dwight Capital’s expression of interest. According to their press release, HomeStreet has refused

to even have a meeting or perform due diligence.

We continue to be astounded by what we believe to

be the inability of HomeStreet’s Board to perform its fiduciary duties. Blue Lion expects the Board to fully engage with

Dwight Capital and communicate

truthfully

to shareholders the outcome of the discussions.

Blue Lion has nominated two seasoned financial

professionals to the Board of Directors at this year’s annual meeting of HomeStreet shareholders and recommends shareholders

vote the

BLUE

proxy card

FOR

the election of Charles W. Griege and Ronald

K. Tanemura and

FOR

Blue Lion’s proposal to separate the roles of Chairman and CEO.

Blue Lion encourages its fellow shareholders

to review its proxy materials, investor presentations and shareholder letters, all of which are available at www.FixHMST.com.

Important Information

Roaring Blue Lion Capital Management, L.P., Blue Lion Opportunity

Master Fund, L.P., BLOF II LP, Charles W. Griege, Jr. (collectively, "Blue Lion") and Ronald K. Tanemura (together with

Blue Lion, the "Participants") have filed with the Securities and Exchange Commission (the "SEC") a definitive

proxy statement and accompanying form of proxy to be used in connection with the solicitation of proxies from shareholders of HomeStreet,

Inc. (the "Company"). All shareholders of the Company are advised to read the definitive proxy statement and other documents

related to the solicitation of proxies by the Participants, as they contain important information, including additional information

related to the Participants. The definitive proxy statement and an accompanying proxy card is being furnished to some or all of

the Company's shareholders and is, along with other relevant documents, available at no charge on the SEC website at http://www.sec.gov/

or from the Participants' proxy solicitor, Morrow Sodali, LLC.

Information about the Participants and a description of their direct

or indirect interests by security holdings is contained in the definitive proxy statement on Schedule 14A filed by Blue Lion with

the SEC on May 16, 2019. This document is available free of charge from the sources indicated above.

Investor Contact:

Blue Lion Capital Management

Justin Hughes

214-855-2430

Justin@bluelioncap.com

Shareholder Contact:

Morrow Sodali, LLC

Mike Verrechia / Bill Dooley

(800) 662-5200

BlueLion@MorrowSodali.com

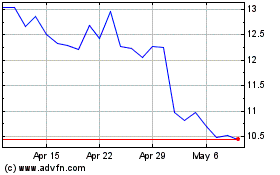

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Mar 2024 to Apr 2024

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Apr 2023 to Apr 2024