UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2019.

Commission File Number 33-65728

CHEMICAL

AND MINING COMPANY OF CHILE INC.

(Translation of registrant’s

name into English)

El Trovador 4285, Santiago,

Chile (562) 2425-2000

(Address of principal executive

office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F:

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits

the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits

the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed

to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission

or other Commission filing on EDGAR.

Santiago, Chile, May 23, 2019

–Sociedad

Química y Minera de Chile S.A. (SQM) (NYSE: SQM; Santiago Stock Exchange: SQM-B, SQM-A) held a conference call to discuss

the first quarter 2019 results, which were published on May 23, 2019. The following items were discussed by executive management

as part of the conference call:

Our revenue for the three months ended

March 31, 2019, and our net income reached US$80 million. We reported a lower Adjusted EBITDA this year, when compared to the first

quarter last year, reachingUS$169 million.

In general, we saw higher prices related

to the iodine and potassium chloride business lines when compared to the same period last year. In fact, we reported the highest

quarterly iodine revenue since 2013. Sales volumes in the iodine, specialty plant nutrition and lithium business lines also increased.

We believe our commercial lithium strategy

was successful during the first quarter. As a result of our short-term contract and spot sales approach, we saw average prices

in the lithium business line of approximately US$14,600 per ton.

We continued with our plans to increase

our lithium carbonate capacity in Chile. We currently have a capacity of 70,000 metric tons. Flexibility is key for our successful

participation in a fast-growing market such as lithium, so we are working to ensure we can meet the changing and more demanding

requirements of our customers.

Iodine sales volumes reached 3.5k metric

tons, higher compared to previous quarters. Also, iodine prices reached the highest levels reported since 2015, surpassing US$27/kilo.

Our Adjusted EBITDA and gross profit decreased

in the first quarter 2019, primarily as a result of lower margins in the lithium business line. This was in line with expectations,

and was significantly impacted by higher lease payments to Corfo, which became effective on April 10, 2018. During the first quarter

this year, we paid approximately US$30 million more in lease payments to Corfo when compared to the same period last year. We

remind you, that our variable payments to Corfo are a function of the price of lithium, the lower the price, the lower the effective

lease payment rate.

El Trovador 4285

Las Condes, Santiago, Chile

7550079

sqm.com

Lower sales volumes of potassium chloride

also impacted our gross profit and adjusted EBITDA. Sales volumes in the business line decreased approximately 24% in the first

quarter 2019 compared to the same period last year. Additionally, sales volumes in the industrial chemical business line decreased

approximately 40%, related to lower solar salt sales volumes. However, during 2019, we expect to report similar sales volumes for

the industrial chemical business line as we reported last year. Iodine prices are up significantly, which has a positive impact

on our gross profit and Adjusted EBITDA.

When we look past the first quarter, we

continue to believe that demand in the lithium market could reach close to 1 million tons by 2025. We feel that demand in 2019

will grow approximately 17%. New supply will have an impact on pricing this year, and our average price could fall an additional

20%, reaching approximately US$11,000-12,000 per metric ton during the second half of this year. Our production for 2019 is expected

to be about 60,000 metric tons, and our sales volumes are expected to reach between 45,000-50,000 metric tons, as previously estimated.

In 2020, we expect our sales volumes in the lithium business line are expected to grow about 30%. The vast majority of the growth

that we are seeing in the market is related to electric vehicles, with batteries coming from Japan, South Korea and China. As anticipated,

we sold little, if any product in China during the early months of the year. It is probable that we will return to sell in China

in the coming quarters.

In the iodine and potassium nitrate markets,

growth is expected to be 3% and 6%, respectively. Our sales volumes will likely grow with the market in both business lines. We

hope to see the upward price trend in iodine continue, but this of course will depend on the supply/demand balance.

We believe that operational flexibility

is essential for the future success of SQM, and this is a key component of our strategy. Both the lithium carbonate and lithium

hydroxide markets are growing at significant and unprecedented levels, and therefore, we are currently working on our lithium carbonate

expansion to produce 120,000 metric tons per year. We believe this expansion will be completed during the second half of 2021,

with a capex of approximately US$280 million. We are also expanding our lithium hydroxide capacity in Chile to reach 29,500 metric

tons in 2021, with an expected capex of US$100 million.

On a separate note, a few weeks ago we

successfully placed a 144 A bond in international markets. We issued a US$450 million ten-year bond with a coupon rate of 4.250%.

We were very pleased with the results, and believe this shows the market’s continued and strong interest in our Company,

and the markets in which we participate.

Finally, I would like to welcome the new

Board members who were elected last month.

El Trovador 4285

Las Condes, Santiago, Chile

7550079

sqm.com

About SQM

SQM´s business strategy is to be

a global company, with people committed to excellence, dedicated to the extraction of minerals and selectively integrated in the

production and sale of products for the industries essential for human development (e.g. food, health, technology). This strategy

was built on the following five principles:

|

|

•

|

ensure availability of key resources required to support current goals and medium and long-term

growth of the business;

|

|

|

•

|

consolidate a culture of lean operations (M1 excellence) through the entire organization, including

operations, sales and support areas;

|

|

|

•

|

significantly increase nitrate sales in all its applications and ensure consistency with iodine

commercial strategy;

|

|

|

•

|

maximize the margins of each business line through appropriate pricing strategy;

|

|

|

•

|

successfully develop and implement all lithium expansion projects of the Company, acquire more

lithium and potassium assets to generate a competitive portfolio.

|

These

principles are based on the following key concepts:

|

|

•

|

strengthen the organizational structure to support the development of the Company's strategic plan,

focusing on the development of critical capabilities and the application of the corporate values of Excellence, Integrity and Safety;

|

|

|

•

|

develop a robust risk control and mitigation process to actively manage business risk;

|

|

|

•

|

improve our stakeholder management to establish links with the community and communicate to Chile

and worldwide our contribution to industries essential for human development.

|

For further information, contact:

Gerardo Illanes 56-2-24252022 / gerardo.illanes@sqm.com

Kelly O’Brien 56-2-24252074 / kelly.obrien@sqm.com

Irina Axenova 56-2-24252280 / irina.axenova@sqm.com

For media inquiries, contact:

Pablo Pisani / pablo.pisani@sqm.com

Tamara Rebolledo / tamara.rebolledo@sqm.com (Northern

Region)

Cautionary Note Regarding Forward-Looking

Statements

This news release contains “forward-looking

statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by words such as: “anticipate,” “plan,” “believe,”

“estimate,” “expect,” “strategy,” “should,” “will” and similar references

to future periods. Examples of forward-looking statements include, among others, statements we make concerning the Company’s

business outlook, future economic performance, anticipated profitability, revenues, expenses, or other financial items, anticipated

cost synergies and product or service line growth.

Forward-looking statements are neither

historical facts nor assurances of future performance. Instead, they are estimates that reflect the best judgment of SQM management

based on currently available information. Because forward-looking statements relate to the future, they involve a number of risks,

uncertainties and other factors that are outside of our control and could cause actual results to differ materially from those

stated in such statements. Therefore, you should not rely on any of these forward-looking statements. Readers are referred to the

documents filed by SQM with the United States Securities and Exchange Commission, specifically the most recent annual report on

Form 20-F, which identifies important risk factors that could cause actual results to differ from those contained in the forward-looking

statements. All forward-looking statements are based on information available to SQM on the date hereof and SQM assumes no obligation

to update such statements, whether as a result of new information, future developments or otherwise, except as required by law.

El Trovador 4285

Las Condes, Santiago, Chile

7550079

sqm.com

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

CHEMICAL AND MINING COMPANY

OF CHILE INC.

(Registrant)

|

Date: May 23, 2019

|

/s/ Gerardo Illanes

|

By: Gerardo Illanes

CFO

Persons who are to respond to the collection

of information contained SEC 1815 (04-09) in this form are not required to respond unless the form displays currently valid OMB

control number.

El Trovador 4285

Las Condes, Santiago, Chile

7550079

sqm.com

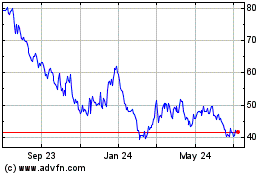

Sociedad Quimica y Miner... (NYSE:SQM)

Historical Stock Chart

From Mar 2024 to Apr 2024

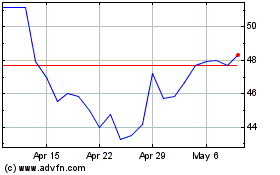

Sociedad Quimica y Miner... (NYSE:SQM)

Historical Stock Chart

From Apr 2023 to Apr 2024