Current Report Filing (8-k)

May 23 2019 - 8:51AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 22, 2019

S&W SEED COMPANY

(Exact name of registrant as specified in Its charter)

|

Nevada

|

001-34719

|

27-1275784

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

|

106 K Street, Suite 300

Sacramento, California

|

|

95814

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code:

(559) 884-2535

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

o

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

SANW

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 1.01 Entry into a Material Definitive Agreement.

Corteva Agreements

On May 22, 2019 (the "Effective Date"), S&W Seed Company (the "Company") entered into two agreements with Pioneer Hi-Bred International, Inc., a subsidiary

of Corteva Agriscience (together, "Corteva Agriscience"): (a) a Termination Agreement; and (b) an Alfalfa License Agreement (together, the "Corteva

Agreements"). Under the terms of the Corteva Agreements, among other things:

-

The Company is entitled to receive (a) $45 million in cash, payable within ten business days after the Effective Date and (b) an aggregate of $25 million in payments on the dates and in the

amounts as set forth below.

|

Date

|

Payment Amount

|

|

September 15, 2019

|

$5,551,371.52

|

|

January 15, 2020

|

$5,551,371.52

|

|

February 15, 2020

|

$5,551,371.52

|

|

September 15, 2020

|

$3,750,926.70

|

|

January 15, 2021

|

$2,500,617.80

|

|

February 15, 2021

|

$2,100,518.95

|

|

Total:

|

$25,006,178.00

|

-

Corteva Agriscience received a fully pre-paid, exclusive license to produce and distribute certain of the Company's alfalfa varieties world-wide (except South America). The

licensed varieties include certain of the Company's existing commercial conventional (non-GMO) alfalfa varieties and six pre-commercial dormant alfalfa varieties. Corteva Agriscience received no

license to the Company's other commercial alfalfa varieties or pre-commercial alfalfa pipeline products and no rights to any future products developed by the Company.

-

Corteva Agriscience agreed to purchase seed inventory for certain alfalfa varieties from the Company with a book value of approximately $25 million.

-

The Company assigned to Corteva Agriscience grower production contract rights, and Corteva Agriscience assumed grower production contract obligations, related to the licensed and certain

other alfalfa varieties.

-

Effective as of the Effective Date, each of the following agreements between the parties terminated: (a) the Alfalfa Distribution Agreement, dated December 31, 2014, as amended (the

"Distribution Agreement"), related to conventional (non-GMO) alfalfa varieties; and (b) the Contract Alfalfa Production Services Agreement, dated December 31, 2014, as amended (the

"Production Agreement"), related to GMO-traited alfalfa varieties.

-

The Distribution Agreement was scheduled to expire on September 30, 2024. The Distribution Agreement had provided Corteva Agriscience with exclusive distribution rights to the Company's

conventional alfalfa varieties in the United States and other select international markets. Under the Distribution Agreement, Corteva Agriscience was obligated to make minimum annual purchases

from the Company. The Company had expected to generate approximately $22 million in revenue from the Distribution Agreement in its 2020 fiscal year.

-

The Production Agreement was scheduled to expire on May 31, 2019. Under the Production Agreement, the Company had produced GMO-traited alfalfa varieties on behalf of Corteva

Agriscience. Pursuant to the Termination Agreement, the Company is obligated to complete certain ongoing research trials pursuant to previously-approved protocols.

KeyBank Agreement

On May 22, 2019, the Company entered into a consent letter with KeyBank National Association ("KeyBank") related to the Company's Credit and Security Agreement, dated as of

September 22, 2015 with KeyBank (as amended, the "Credit Agreement"). Under the consent letter, among other things:

-

KeyBank consented to the Company completing the transactions contemplated by the Corteva Agreements.

-

KeyBank agreed to waive the Company's compliance with the fixed charge coverage ratio covenant in the Credit Agreement for each of the

fiscal quarters ending

June 30, 2019, September 30, 2019 and December 31, 2019.

-

The parties amended the Credit Agreement (a) to reduce the borrowing base by $16 million and (b) to provide KeyBank with the ability to terminate its lending commitment at any time on or

after January 15, 2020 by providing the Company with at least 30 days' advance notice.

The Company and KeyBank are in discussions regarding a new structure for the Credit Agreement.

Item 1.02 Termination of Material Agreement.

The information set forth in Item 1.01 of this current report is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Matthew K. Szot

|

|

|

Executive Vice President of Finance and Administration and Chief Financial Officer

|

Date: May 23, 2019

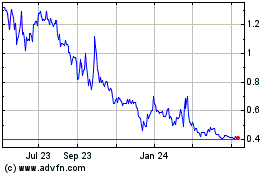

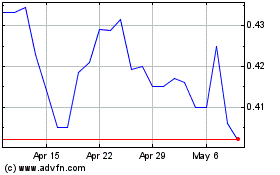

S and W Seed (NASDAQ:SANW)

Historical Stock Chart

From Mar 2024 to Apr 2024

S and W Seed (NASDAQ:SANW)

Historical Stock Chart

From Apr 2023 to Apr 2024