Current Report Filing (8-k)

May 22 2019 - 4:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 22, 2019

2U, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

DELAWARE

(STATE OF INCORPORATION)

|

001-36376

|

|

26-2335939

|

|

(COMMISSION FILE NUMBER)

|

|

(IRS EMPLOYER ID. NUMBER)

|

|

7900 Harkins Road

|

|

|

|

Lanham, MD

|

|

20706

|

|

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

|

|

(ZIP CODE)

|

(301) 892-4350

(REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

Common stock, $0.001 par value per share

|

|

TWOU

|

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 1.01.

Entry into a Material Definitive Agreement.

As previously announced, on April 7, 2019, 2U, Inc. (the “Company”), Skywalker Purchaser, LLC, a wholly owned subsidiary of the Company (“Purchaser”) and Skywalker Sub, Inc., a wholly owned subsidiary of the Company (“Merger Sub”), entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”) with Trilogy Education Services, Inc. (“Trilogy”) and Fortis Advisors LLC, in its capacity as the Stockholder Representative thereunder, pursuant to which the Company agreed to acquire Trilogy.

On May 22, 2019, (the “Closing Date”), the Company entered into the Credit Agreement (as defined below). The information set forth in Item 2.03 below with respect to the Credit Agreement is incorporated herein by reference.

Item 1.02.

Termination of a Material Definitive Agreement.

On the Closing Date, the Company terminated all commitments (other than any obligations related to any outstanding letters of credit) and repaid all amounts outstanding under the Amended and Restated Revolving Credit Agreement, dated as of December 31, 2013 (as amended, restated, or otherwise modified from time to time) by and among the Company and Comerica Bank, as Administrative Agent and as a Lender, Issuing Lender and Swing Line Lender and Square 1 Bank as a Lender.

Item 2.01.

Completion of Acquisition or Disposition of Assets.

On the Closing Date, the Company completed its acquisition of Trilogy pursuant to the Merger Agreement. Merger Sub was merged with and into Trilogy (the “First Merger”), with Trilogy continuing as the surviving corporation and a direct, wholly owned subsidiary of the Company, followed by the merger (the “Second Merger” and, together with the First Merger, the “Mergers”) of Trilogy with and into Purchaser, with Purchaser continuing as the surviving company. As a result of the First Merger, former holders of capital stock of Trilogy and options to purchase capital stock of Trilogy received their applicable portion of (a) approximately $415.5 million in cash and (b) approximately 4,608,100 shares of common stock of the Company (the “Shares”).

Item 2.03.

Creation of a Direction Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

On the Closing Date, the Company entered into a credit agreement (the “Credit Agreement”), by and among the Company, as borrower, the Guarantors from time to time party thereto, the Lenders from time to time party thereto (the “Lenders”), Owl Rock Capital Corporation, as administrative agent and collateral agent and Owl Rock Capital Advisors LLC, as Lead Arranger and Bookrunner.

The Credit Agreement provides for a $250 million term loan facility (the “Term Loans”). The Credit Agreement allows for incremental borrowings from time to time in an aggregate amount for all such incremental amounts not to exceed $50 million, plus certain specified prepayments of indebtedness, plus an unlimited amount so long as, (i) if such amount is determined prior to the Conversion Date (as defined in the Credit Agreement), the Company’s First Lien Net LQA University Segment Revenue Leverage Ratio (as defined in the Credit Agreement) is less than or equal to 0.60:1.00, subject to certain conditions set forth in the Credit Agreement or (ii) if such amount is determined on or after the Conversion Date, the Company’s First Lien Net Leverage Ratio (as defined in the Credit Agreement) is less than or equal to 6.50:1.00. The existing Lenders under the Credit Agreement will be entitled, but not obligated, to provide such incremental commitments.

The Term Loans bear interest, at the Company’s option, at variable rates based on (a) a customary base rate (with a floor of 2.00%) plus an applicable margin of 4.75% or (b) an adjusted LIBOR rate (with a floor of 1.00%) for the interest period relevant to such borrowing plus an applicable margin of 5.75%.

The Term Loans mature on the fifth anniversary of the Closing Date.

The Company will be required to repay outstanding Term Loans with the proceeds from (a) certain debt issuances, (b) certain asset sales, (c) certain casualty events and (d) between 0% and 50% of annual excess cash flow (depending on the Company’s First Lien Net Leverage Ratio), in each case, subject to customary exceptions. Voluntary prepayments and mandatory prepayments following or in connection with any asset sales, debt issuance or casualty events or following any acceleration of the Term Loans are subject to a 2% prepayment premium if made

2

prior to the first anniversary of the Closing Date, and a 1% prepayment premium if made on or after the first anniversary of the Closing Date, but prior to the second anniversary of the Closing Date;

provided

, that a 1% prepayment penalty shall apply to the extent the prepayment is made prior to the first anniversary of the Closing Date with the proceeds from the sale of equity securities, equity-linked securities and/or derivative securities settled in or convertible into equity securities.

The obligations under the Credit Agreement are guaranteed by the Company and each direct or indirect wholly owned material domestic subsidiary (whether owned on the Closing Date or formed or acquired thereafter) of the Company (other than certain excluded subsidiaries) (the Company and the guarantors, collectively, the “Credit Parties”). The obligations under the Credit Agreement are secured, subject to customary permitted liens and other agreed-upon exceptions, by a perfected security interest in (i) all tangible and intangible assets of the Credit Parties, except for certain customary excluded assets, and (ii) all of the capital stock owned by the Credit Parties (limited, in the case of the stock of certain non-U.S. subsidiaries of the Credit Parties and certain domestic subsidiaries with no material assets other than the equity interests of one or more foreign subsidiaries, to 65% of the capital stock of such subsidiaries).

The Credit Agreement contains customary affirmative covenants for transactions of this type and other affirmative covenants agreed to by the parties, including, among others, the provision of annual and quarterly financial statements and compliance certificates, maintenance of property, insurance, compliance with laws and environmental matters. The Credit Agreement contains customary negative covenants, including, among others, restrictions on the incurrence of indebtedness, granting of liens, making investments and acquisitions, paying dividends, repurchases of equity interests in the Company, entering into affiliate transactions and asset sales. The Credit Agreement contains financial covenants that require the Company to maintain minimum Liquidity (as defined in the Credit Agreement) of $25 million and minimum LQA University Segment Revenue (as defined in the Credit Agreement) and LTM Short Course Revenue (as defined in the Credit Agreement). The Credit Agreement also provides for a number of customary events of default, including, among others: failure to make a payment of principal or any premium when due, or failure to make an interest or other payment; bankruptcy or other specified insolvency event, failure to comply with covenants; breach of representations or warranties; defaults under certain other obligations of the Company or its subsidiaries relating to indebtedness; impairment of any lien on any material portion of the Collateral (as defined in the Credit Agreement); failure of any material provision of the Credit Agreement or any guaranty to remain in full force and effect; a change of control of the Company; and judgment defaults. Under certain circumstances, a default interest rate will apply on all overdue obligations under the Credit Agreement at a per annum rate equal to 2.00% above the applicable interest rate for any overdue principal and 2.00% above the rate applicable for base rate loans for any other overdue amounts. The occurrence of an event of default could result in the acceleration of obligations under the Credit Agreement.

The description of the Credit Agreement set forth above does not purport to be complete and is qualified in its entirety by reference to the full text of the Credit Agreement, a copy of which is filed as Exhibit 10.1 hereto and incorporated by reference into this Item 2.03. The Credit Agreement and the above description have been included to provide investors with information regarding the terms of the Credit Agreement. It is not intended to provide any other factual information about the Company or any other parties to the Credit Agreement or their respective affiliates or equityholders.

Item 3.02.

Unregistered Sales of Equity Securities.

Pursuant to the Merger Agreement, the Company issued the Shares at the closing of the Mergers. The issuance of the Shares was exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2) and Rule 506 promulgated under Regulation D under the Securities Act. The former holders of capital stock of Trilogy and options to purchase capital stock of Trilogy receiving Shares are “accredited investors” as such term is defined in Rule 501 of Regulation D.

This filing does not constitute an offer to sell or the solicitation of an offer to buy any securities. The Shares were issued in a private placement pursuant to the terms of the Merger Agreement, and may only be offered or sold pursuant to an effective registration statement or an exemption from registration under the Securities Act.

3

Item 7.01.

Regulation FD Disclosure.

The Company issued a press release on May 22, 2019 announcing the completion of the acquisition of Trilogy. A copy of the press release is furnished with this Current Report on Form 8-K as Exhibit 99.1.

In accordance with General Instruction B.2. of Form 8-K, the information in this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any of the Company’s filings under the Securities Act, or the Exchange Act, whether made before or after the date hereof, regardless of any incorporation language in such a filing, except as expressly set forth by specific reference in such a filing.

Item 9.01.

Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit

Number

|

|

Exhibit Description

|

|

10.1*

|

|

Credit Agreement, by and among 2U, Inc., as borrower, the Guarantors from time to time party thereto, the Lenders from time to time party thereto, Owl Rock Capital Corporation, as administrative agent and collateral agent and Owl Rock Capital Advisors LLC, as Lead Arranger and Bookrunner

|

|

|

|

|

|

99.1

|

|

Press Release issued by 2U, Inc., dated May 22, 2019

|

* Schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The registrant hereby undertakes to supplementally furnish to the Securities and Exchange Commission copies of any of the omitted schedules and exhibits upon request by the Securities and Exchange Commission.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995 concerning the Company, Trilogy, the Mergers and other matters. In some cases, you can identify forward-looking statements by the words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue” and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. Examples of forward-looking statements include, among others, statements we make regarding the Mergers, future results of the operations and financial position of the Company, including financial targets, business strategy, and plans and objectives for future operations, are forward-looking statements. The Company has based these forward-looking statements largely on its estimates of its financial results and its current expectations and projections about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy, short term and long-term business operations and objectives, and financial needs as of the date of this press release. We undertake no obligation to update these statements as a result of new information or future events. These forward-looking statements are subject to a number of risks, uncertainties and assumptions that could cause actual results to differ materially from the results predicted, including, risks related to the Mergers, including integration risks and failure to achieve the anticipated benefits of the Mergers, trends in the higher education market and the market for online education, and expectations for growth in those markets; the acceptance, adoption and growth of online learning by colleges and universities, faculty, students, employers, accreditors and state and federal licensing bodies; our ability to comply with evolving regulations and legal obligations related to data privacy, data protection and information security; our expectations about the potential benefits of our cloud-based software-as-a-service, or SaaS, technology and technology-enabled services to university clients and students; our dependence on third parties to provide certain technological services or components used in our platform; our ability to meet the anticipated launch dates of our graduate programs and short courses; our expectations about the predictability, visibility and recurring nature of our business model; our ability to acquire new university clients and expand our graduate programs and short courses with existing university clients; our ability to successfully integrate the operations of Get Educated International Proprietary Limited, or GetSmarter, achieve the expected benefits of the acquisition and manage, expand and grow the combined company; our ability to execute our growth strategy in the international, undergraduate and non-degree alternative markets; our ability to continue to acquire prospective students for our graduate programs and short courses; our ability to affect or increase student retention in our graduate programs; our

4

ability to attract, hire and retain qualified employees; our expectations about the scalability of our cloud-based platform; our expectations regarding future expenses in relation to future revenue; potential changes in regulations applicable to us or our university clients; and our expectations regarding the amount of time our cash balances and other available financial resources will be sufficient to fund our operations. These and other potential risks and uncertainties that could cause actual results to differ from the results predicted are more fully detailed under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2018 and other reports filed with the Securities and Exchange Commission. Moreover, the Company operates in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for the Company management to predict all risks, nor can the Company assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements the Company may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Current Report on Form 8-K may not occur and actual results could differ materially and adversely from those anticipated.

5

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

2U, INC.

|

|

|

|

|

|

Date: May 22, 2019

|

By:

|

/s/ Christopher J. Paucek

|

|

|

Name:

|

Christopher J. Paucek

|

|

|

Title:

|

Chief Executive Officer

|

6

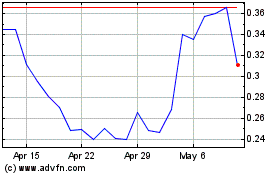

2U (NASDAQ:TWOU)

Historical Stock Chart

From Mar 2024 to Apr 2024

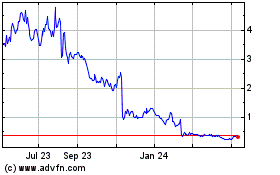

2U (NASDAQ:TWOU)

Historical Stock Chart

From Apr 2023 to Apr 2024