UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

W

ashington

,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14a INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934 (Amendment No. )

Filed

by the Registrant [X]

Filed

by a Party other than the Registrant [ ]

Check

the appropriate box:

|

[ ]

|

Preliminary

Proxy Statement

|

|

[ ]

|

Confidential,

for use of the Commission Only (as permitted by Rule 14a-6(e) (2)

|

|

[X]

|

Definitive

Proxy Statement

|

|

[ ]

|

Definitive

Additional Materials

|

|

[ ]

|

Soliciting

Material Pursuant to §240.14a-12

|

MANHATTAN

BRIDGE CAPITAL, INC.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

[X]

No fee required.

[ ]

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

[ ]

Fee paid previously with preliminary materials.

[ ]

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

(1)

Amount Previously Paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

MANHATTAN

BRIDGE CAPITAL, INC.

60

Cutter Mill Road

Great

Neck, NY 11021

Notice

of Annual Meeting of Shareholders

To

be held on Friday, June 21, 2019

To

Our Shareholders:

You

are invited to attend the 2019 Annual Meeting of Shareholders of Manhattan Bridge Capital, Inc. at 9:00 a.m. local time, on Friday,

June 21, 2019, at the offices of Zysman, Aharoni, Gayer and Sullivan & Worcester LLP, 1633 Broadway, 32

nd

Floor,

New York, NY 10019.

The

Notice of Meeting and Proxy Statement on the following pages describe the matters to be presented at the meeting.

It

is important that your shares be represented at this meeting to ensure the presence of a quorum. Whether or not you plan to attend

the meeting, we hope that you will have your shares represented by signing, dating and returning your proxy in the enclosed envelope,

which requires no postage if mailed in the United States,

as soon as possible

. Your shares will be voted in accordance

with the instructions you have given in your proxy.

Thank

you for your continued support.

|

|

Sincerely,

|

|

|

|

|

|

Assaf

Ran

|

|

|

President

and Chief Executive Officer

|

MANHATTAN

BRIDGE CAPITAL, INC.

60

Cutter Mill Road

Great

Neck, NY 11021

Notice

of Annual Meeting of Shareholders

To

be held on Friday, June 21, 2019

The

Annual Meeting of Shareholders of Manhattan Bridge Capital, Inc. (the “Company”) will be held at the offices of Zysman,

Aharoni, Gayer and Sullivan & Worcester LLP, 1633 Broadway, 32

nd

Floor, New York, NY 10019, on Friday, June 21,

2019 at 9:00 a.m., local time, for the purpose of considering and acting upon the following:

|

|

1.

|

Election

of four (4) directors to serve until the next Annual Meeting of Shareholders and until their respective successors have been

duly elected and qualified.

|

|

|

|

|

|

|

2.

|

Advisory

approval of the appointment of Hoberman & Lesser, LLP as the Company’s independent auditors for the fiscal year

ending December 31, 2019.

|

|

|

|

|

|

|

3.

|

To

consider and approve, by a nonbinding advisory vote, the compensation of our named executive officers as described in the

accompanying proxy statement.

|

|

|

|

|

|

|

4.

|

To

recommend, by a nonbinding advisory vote, the frequency (every one, two or three years) of future advisory votes of stockholders

on the compensation of our named executive officers.

|

|

|

|

|

|

|

5.

|

The

transaction of such other business as may properly come before the meeting and any adjournment or adjournments thereof.

|

The

Company’s Board of Directors has set the close of business on May 3, 2019 as the record date for the determination of shareholders

entitled to notice of and to vote at the meeting, or any adjournment or adjournments thereof. A complete list of such shareholders

will be available for examination by any shareholder at the meeting. The meeting may be adjourned from time to time without notice

other than by announcement at the meeting.

|

|

By

|

order

of the Board of Directors

|

|

|

|

|

|

|

|

Vanessa

Kao

|

|

|

|

Secretary

|

Great

Neck, New York

May

21, 2019

|

IMPORTANT:

|

IT

IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING REGARDLESS OF THE NUMBER OF SHARES YOU HOLD. WHETHER OR NOT YOU

PLAN TO ATTEND THE MEETING IN PERSON, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND MAIL IT PROMPTLY IN THE ENCLOSED

RETURN ENVELOPE. THE PROMPT RETURN OF PROXIES WILL ENSURE A QUORUM AND SAVE THE COMPANY THE EXPENSE OF FURTHER SOLICITATION.

EACH PROXY GRANTED MAY BE REVOKED BY THE SHAREHOLDER APPOINTING SUCH PROXY AT ANY TIME BEFORE IT IS VOTED. IF YOU RECEIVE

MORE THAN ONE PROXY CARD BECAUSE YOUR SHARES ARE REGISTERED IN DIFFERENT NAMES OR ADDRESSES, EACH SUCH PROXY CARD SHOULD BE

SIGNED AND RETURNED TO ENSURE THAT ALL OF YOUR SHARES WILL BE VOTED.

|

We

appreciate your giving this matter your prompt attention.

IMPORTANT

NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS

FOR

THE SHAREHOLDER MEETING TO BE HELD ON FRIDAY, JUNE 21, 2019

|

The

proxy materials for the Annual Meeting, including the Annual Report and the Proxy Statement

are also

available

at

http://www.manhattanbridgecapital.com/meeting-2019.html

|

MANHATTAN

BRIDGE CAPITAL, INC.

60

Cutter Mill Road

Great

Neck, NY 11021

PROXY

STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

To

be held on Friday, June 21, 2019

Proxies

in the form enclosed with this Proxy Statement are solicited by the Board of Directors (the “Board”) of Manhattan

Bridge Capital, Inc. (the “Company,” “we,” “us,” “our,” or any derivative thereof)

to be used at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held at the offices of Zysman, Aharoni,

Gayer and Sullivan & Worcester LLP, 1633 Broadway, 32

nd

Floor, New York, NY 10019, on Friday, June 21, 2019 at

9:00 a.m., local time, for the purposes set forth in the Notice of Meeting and this Proxy Statement. The Company’s principal

executive offices are located at 60 Cutter Mill Road, Suite 205, Great Neck, NY 11021. The approximate date on which this Proxy

Statement, the accompanying Proxy and Annual Report for the year ended December 31, 2018 will be mailed to shareholders is May

21, 2019.

IMPORTANT

NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS

FOR

THE SHAREHOLDER MEETING TO BE HELD ON FRIDAY, JUNE 21, 2019

The

proxy materials for the Annual Meeting, including the Annual Report and the Proxy Statement are also available at

http://www.manhattanbridgecapital.com/meeting-2019.html

THE

VOTING AND VOTE REQUIRED

Record

Date and Quorum

Only

shareholders of record at the close of business on May 3, 2019 (the “Record Date”), are entitled to notice of and

vote at the Annual Meeting. On the Record Date, there were 9,659,977 outstanding shares of our common stock, par value $.001 per

share, (“Common Share”). Each Common Share is entitled to one vote. Common Shares represented by each properly executed,

unrevoked proxy received in time for the Annual Meeting will be voted as specified. Common Shares were our only voting securities

outstanding on the Record Date. A quorum will be present at the Annual Meeting of shareholders when such shareholders owning a

majority of the Common Shares outstanding on the Record Date are present at the meeting in person or by proxy.

Voting

of Proxies

The

persons acting as proxies (the “Proxyholders”) pursuant to the enclosed Proxy will vote the shares represented as

directed in the signed proxy. Unless otherwise directed in the proxy, the Proxyholders will vote the shares represented by the

proxy: (i) for the election of the director nominees named in this Proxy Statement; (ii) for the advisory approval of the appointment

of Hoberman & Lesser, LLP (“H&L”) as the Company’s independent auditors for the fiscal year ending December

31, 2019; (iii) for the approval, by a nonbinding advisory vote, of the compensation of our named executive officers as described

in the accompanying proxy statement; (iv) to recommend, by a nonbinding advisory vote, a frequency of every three years for future

advisory votes of stockholders on the compensation of our named executive officers; and (v) in their discretion, on any other

business that may come before the Annual Meeting and any adjournments of the Annual Meeting.

All

votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative

and negative votes, abstentions and broker non-votes. All shares represented by valid proxies will be voted in accordance with

the instructions contained therein. In the absence of instructions, proxies will be voted FOR each of Proposals No. 1 through

3 and for a frequency of every THREE YEARS for Proposal No. 4 at the Annual Meeting. A proxy may be revoked by the shareholder

giving the proxy at any time before it is voted at the Annual Meeting, by written notice addressed to and received by the Secretary

of the Company or Secretary of the Annual Meeting, and a prior proxy is automatically revoked by a shareholder giving a subsequent

proxy or attending and voting in person at the Annual Meeting. Attendance at the Annual Meeting, however, in and of itself, does

not revoke a prior proxy. In the case of the election of directors, shares represented by a proxy which are marked “WITHHOLD

AUTHORITY” to vote for all director nominees will not be counted in determining whether a plurality vote has been received

for the election of directors. Shares represented by proxies that are marked “ABSTAIN” on any other proposal will

not be counted in determining whether the requisite vote has been received for such proposal. In instances where brokers are prohibited

from exercising discretionary authority for beneficial owners who have not returned proxies (“broker non-votes”),

including with respect to the election of directors, those shares will not be included in the vote totals and, therefore, will

have no effect on the outcome of the vote.

Voting

Requirements

Election

of Directors and Approval of the Non-Binding Advisory Vote on the Frequency of an Advisory Vote on Executive Compensation (the

“Frequency Vote”)

. The election of the four director nominees and the approval of the Frequency Vote will require

a plurality of the votes cast on each of the matters at the Annual Meeting. With respect to the election of directors, votes may

be cast in favor of or withheld with respect to each nominee. Votes that are withheld will be excluded entirely from the vote

and will have no effect on the outcome of the vote. With respect to the Frequency Vote, a stockholder may vote to set the Frequency

Vote to occur every year, every two years, or every three years, or the stockholder may vote to abstain. An abstention will be

excluded entirely from the vote and will have no effect on the outcome of the vote.

Advisory

Approval of the Appointment of Independent Auditors and Approval of the Non-Binding Advisory Resolution Relating to Executive

Compensation

. The affirmative vote of a majority of the votes cast on the matter by stockholders entitled to vote at the Annual

Meeting is required to approve the appointment of H&L as the Company’s independent auditors for the fiscal year ending

December 31, 2019 and the non-binding advisory resolution relating to executive compensation. An abstention from voting on approval

of auditors will be treated as “present” for quorum purposes. However, since an abstention is not treated as a “vote”

for or against the matter, it will have no effect on the outcome of the vote on either matter.

Proposal

No. 1

ELECTION

OF DIRECTORS

The

current members of our Board are Lyron Bentovim, Eran Goldshmit, Michael J. Jackson and Assaf Ran. All four directors are to be

elected at the Annual Meeting. All directors hold office until the next annual meeting of shareholders and until their successors

are duly elected and qualified.

It

is intended that votes pursuant to the enclosed proxy will be cast for the election of the four nominees named below. In the event

that any such nominee should become unable or unwilling to serve as a director, the Proxy will vote for the election of an alternate

candidate, if any, as shall be designated by the Board. Our Board has no reason to believe these nominees will be unable to serve

if elected. Each nominee has consented to be named in this Proxy Statement and to serve if elected. All four nominees are

currently members of our Board. There are no family relationships among any of the executive officers or directors of the Company.

Our

director nominees and their respective ages as of the Record Date are as follows:

|

Name

|

|

Age

|

|

Position

|

|

Assaf

Ran

|

|

53

|

|

Founder,

Chairman of the Board, Chief Executive Officer and President

|

|

Lyron

Bentovim

(1)

|

|

49

|

|

Director

|

|

Eran

Goldshmit

(1)(2)(3)

|

|

52

|

|

Director

|

|

Michael

J. Jackson

(1)(2)(3)

|

|

54

|

|

Director

|

|

|

(1)

|

Member

of the Audit Committee.

|

|

|

(2)

|

Member

of the Compensation Committee.

|

|

|

(3)

|

Member

of the Corporate Governance and Nominating Committee.

|

Set

forth below is a brief description of the background and business experience of our director nominees:

Assaf

Ran,

our founder, has been our Chief Executive Officer, president and chairman since our inception in 1989. Mr. Ran has 30

years of senior management experience leading public and private businesses. Mr. Ran started several yellow page businesses from

the ground up and managed to make each one of them successful. Mr. Ran’s professional experience and background with us,

as our director since March 1999, have given him the expertise needed to serve as one of our directors.

Lyron

Bentovim

has been a member of the Board since December 2008. Mr. Bentovim currently serves as The President and Chief Executive

Officer of the Glimpse Group, a virtual reality and augmented reality company as well as a Managing Partner at Darklight Partners

in New York, NY. Darklight Partners is a strategic advisor to small and mid-size public and private companies. Prior to Darklight

Partners, from July 2014 to August 2015, Mr. Bentovim was Chief Operating Officer/Chief Financial Officer of Top Image Systems

(Nasdaq: TISA), and from March 2013 to July 2014, Mr. Bentovim served as Chief Operating Officer/Chief Financial Officer

of NIT Health and Chief Operating Officer/Chief Financial Officer and managing director at Cabrillo Advisors. From August 2009

until July 2012, Mr. Bentovim has served as the Chief Operating Officer and the Chief Financial Officer of Sunrise Telecom, Inc.

Prior to joining Sunrise Telecom, Inc., from January 2002, Mr. Bentovim was a Portfolio Manager for Skiritai Capital LLC, an investment

advisor based in San Francisco. Mr. Bentovim has over 20 years of management experience, including his experience as a member

of the board of directors at Blue Sphere, RTW Inc., Ault, Inc., Top Image Systems Ltd., Three-Five Systems Inc., Sunrise Telecom

Inc., and Argonaut Technologies Inc. Prior to his position in Skiritai Capital LLC, Mr. Bentovim served as the President, Chief

Operating Officer and co-founder of WebBrix, Inc. Additionally, Mr. Bentovim spent time as a Senior Engagement Manager with strategy

consultancies USWeb/CKS, the Mitchell Madison Group LLC and McKinsey & Company Inc. Mr. Bentovim has an MBA from Yale School

of Management and a law degree from the Hebrew University. Mr. Bentovim’s professional experience and background with other

companies and with us have given him the expertise needed to serve as one of our directors.

Eran

Goldshmit

has been a member of the Board since March 1999. Since August 2001, he has been the president of the New York Diamond

Center, New York, NY. From December 1998 until July 2001, Mr. Goldshmit was the general manager of the Carmiel Shopping Center

in Carmiel, Israel. Mr. Goldshmit received certification as a financial consultant in February 1993 from the School for Investment

Consultants, Tel Aviv, Israel, and a BA in business administration from the University of Humberside, England, in December 1998.

Mr. Goldshmit’s professional experience and background with other companies and with us have given him the expertise needed

to serve as one of our directors.

Michael

J. Jackson

has been a member of the Board since July 2000. Since May 2017, Mr. Jackson has been the Chief Financial Officer

of Radius Global Market Research. From March 2016 through April 2017, Mr. Jackson served as the Chief Financial Officer and executive

vice president of both Ethology, Inc., a digital marketing agency, and Tallwave, LLC, a business design and innovation agency.

From April 2007 through February 2016, he was the Chief Financial Officer and the executive vice president of iCrossing, Inc.,

a digital marketing agency. From October 1999 to April 2007, he was the executive vice president and Chief Financial Officer of

AGENCY.COM, a global Internet professional services company. He served as the chief accounting officer of AGENCY.com from May

2000 and as its corporate controller from August 1999 until September 2001. From October 1994 until August 1999, Mr. Jackson was

a manager at Arthur Andersen, LLP and Ernst and Young. Mr. Jackson also served on the New York State Society Auditing Standards

and Procedures Committee from 1998 to 1999 and served on the New York State Society’s SEC Committee from 1999 to 2001. Mr.

Jackson holds an M.B.A. in Finance from Hofstra University and is a certified public accountant. For the five years ended May

2008, Mr. Jackson was a member of the board of directors of Adstar, Inc. (OTC PINK: ADST). Mr. Jackson’s professional experience

and background with other companies and with us have given him the expertise needed to serve as one of our directors.

The

Board recommends a vote FOR the election of each of the director nominees

and

proxies that are signed and returned will be so voted

unless

otherwise instructed.

*

* * * *

EXECUTIVE

OFFICERS

The

following table identifies our executive officers as of the Record Date:

|

Name

|

|

Age

|

|

Position

|

|

In

Current Position Since

|

|

Assaf

Ran

(1)

|

|

53

|

|

President

and Chief Executive Officer

|

|

1989

|

|

|

|

|

|

|

|

|

|

Vanessa

Kao

(2)

|

|

41

|

|

Chief

Financial Officer, Vice President, Treasurer and Secretary

|

|

2011

|

|

|

(1)

|

Mr.

Ran’s biographical information is provided above.

|

|

|

(2)

|

Ms.

Kao has been our Chief Financial Officer, vice president, treasurer and secretary since rejoining us in June 2011. From January

2014 through April 2016, she was also the Chief Financial Officer of Jewish Marketing Solutions LLC. Since April 2016, she

has been serving as a consultant to Jewish Marketing Solutions LLC. From July 2004 through April 2006, she served as our assistant

Chief Financial Officer. From April 2006 through December 2013, she was the Chief Financial Officer of DAG Jewish Directories,

Inc. Ms. Kao holds an M.B.A. in Finance and MIS/E-Commerce from the University of Missouri and a Bachelor degree of

Business Administration in Finance from the National Taipei University in Taiwan.

|

Code

of Ethics

We

have adopted a Code of Ethics that applies to our principal executive officer, principal financial officer and other persons performing

similar functions, as well as our subsidiary, MBC Funding II Corp. Our current Code of Ethics is posted on our web site at www.manhattanbridgecapital.com.

We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding an amendment to, or waiver from, a provision

of our Code of Ethics by posting such information on the website address specified above.

Director

Independence

The

Board has determined, in accordance with Nasdaq’s Stock Market Rules, that: (i) Messrs. Jackson, Goldshmit and Bentovim

(the “Independent Directors”) are independent and represent a majority of its members; (ii) Messrs. Jackson, Goldshmit

and Bentovim, as the members of the Audit Committee, are independent for such purposes; and (iii) Messrs. Jackson and Goldshmit,

as the members of the Compensation Committee, are independent for such purposes. In determining director independence, the Board

applies the independence standards set by the Nasdaq. In its application of such standards the Board takes into consideration

all transactions with Independent Directors and the impact of such transactions, if any, on any of the Independent Directors’

ability to continue to serve on the Board.

Board

and Committees

During

fiscal year 2018, the Board held four meetings, our Audit Committee held four meetings and our Compensation Committee held one

meeting. Our Corporate Governance and Nominating Committee did not meet. All directors attended or participated in all meetings

of the Board and of the Board’s committees on which each applicable director served. It is the Company’s policy that

directors are invited and encouraged to attend the Annual Meeting. All of our then current directors attended our annual meeting

held in 2018.

Committees

of the Board of Directors

We

have three standing committees: an Audit Committee, a Compensation Committee and a Corporate Governance and Nominating Committee.

Each committee is made up entirely of independent directors as defined under the Nasdaq Stock Market Rules. The members of the

Audit Committee are Michael Jackson, who serves as chairman, Eran Goldshmit and Lyron Bentovim. The members of the Compensation

Committee and the Corporate Governance and Nominating Committee are Michael Jackson and Eran Goldshmit. Current copies of each

committee’s charter are available on our website at www.manhattanbridgecapital.com.

Audit

Committee.

The Audit Committee oversees our accounting and financial reporting processes, internal systems of accounting

and financial controls, relationships with auditors and audits of financial statements. Specifically, the Audit Committee’s

responsibilities include the following:

|

|

●

|

selecting,

hiring and terminating our independent auditors;

|

|

|

|

|

|

|

●

|

evaluating

the qualifications, independence and performance of our independent auditors;

|

|

|

|

|

|

|

●

|

approving

the audit and non-audit services to be performed by the independent auditors;

|

|

|

|

|

|

|

●

|

reviewing

the design, implementation and adequacy and effectiveness of our internal controls and critical policies;

|

|

|

|

|

|

|

●

|

overseeing

and monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they

relate to our financial statements and other accounting matters;

|

|

|

|

|

|

|

●

|

with

management and our independent auditors, reviewing any earnings announcements and other public announcements regarding our

results of operations; and

|

|

|

|

|

|

|

●

|

preparing

the report that the Securities and Exchange Commission (the “SEC”) requires in our annual proxy statement.

|

The

Board has determined that Michael Jackson is qualified as an Audit Committee Financial Expert pursuant to Item 407(d)(5) of Regulation

S-K. Each Audit Committee member is independent, as that term is defined in Section 10A(m)(3) of the Securities Exchange Act of

1934, as amended (the “Exchange Act”) and their relevant experience is more fully described above.

Compensation

Committee.

The Compensation Committee assists the Board in determining the compensation of our officers and directors.

Specific responsibilities include the following:

|

|

●

|

approving

the compensation and benefits of our executive officers;

|

|

|

|

|

|

|

●

|

reviewing

the performance objectives and actual performance of our officers; and

|

|

|

|

|

|

|

●

|

administering

our stock option and other equity and incentive compensation plans.

|

The

Compensation Committee is comprised entirely of directors who satisfy the standards of independence applicable to compensation

committee members under Section 16(b) of the Exchange Act.

Corporate

Governance and Nominating Committee.

The Corporate Governance and Nominating Committee assists the Board by identifying

and recommending individuals qualified to become members of the Board. Specific responsibilities include the following:

|

|

●

|

evaluating

the composition, size and governance of the Board and its committees and making recommendations regarding future planning

and the appointment of directors to our committees;

|

|

|

|

|

|

|

●

|

establishing

a policy for considering shareholder nominees to the Board;

|

|

|

|

|

|

|

●

|

reviewing

our corporate governance principles and making recommendations to the Board regarding possible changes; and

|

|

|

|

|

|

|

●

|

reviewing

and monitoring compliance with our code of ethics and insider trading policy.

|

Audit

Committee Report

The

Audit Committee oversees our financial reporting process on behalf of the Board. The Audit Committee consists of three members

of the Board who meet the independence and experience requirements of Nasdaq and the SEC.

The

Audit Committee retains our independent registered public accounting firm and approves in advance all permissible non-audit services

performed by them and other auditing firms. Although management has the primary responsibility for the financial statements and

the reporting process including the systems of internal control, the Audit Committee consults with management and our independent

registered public accounting firm regarding the preparation of financial statements, the adoption and disclosure of our critical

accounting estimates and generally oversees the relationship of the independent registered public accounting firm with our Company.

The

Audit Committee reviewed our audited financial statements for the year ended December 31, 2018, and met with management to discuss

such audited financial statements. The Audit Committee has discussed with H&L, our independent accountants, the matters required

to be discussed pursuant to the applicable requirements of the Public Company Accounting Oversight Board (the “PCOAB”)

and the SEC. The Audit Committee has received the written disclosures and the letter from H&L required by applicable requirements

of the PCOAB regarding the independent accountant’s communications with the Audit Committee concerning independence and

has discussed with H&L its independence from us and our management. Based on its review and discussions, the Audit Committee

recommended to the Board that our audited financial statements for the year ended December 31, 2018 be included in our Annual

Report on Form 10-K for the year then ended for filing with the SEC.

|

|

AUDIT

COMMITTEE:

|

|

|

|

|

|

Michael

J. Jackson, Chairman

|

|

|

Eran

Goldshmit

|

|

|

Lyron

Bentovim

|

Board

Leadership Structure

Mr.

Ran has served as Chairman of the Board, Chief Executive Officer and President since our inception in 1989. Our By-Laws give the

Board the flexibility to determine whether the roles of Chairman and Chief Executive Officer should be held by the same person

or by two separate individuals. Each year, the Board evaluates our leadership structure and determines the most appropriate structure

for the coming year based upon its assessment of our position, strategy, and our long term plans. The Board also considers the

specific circumstances we face and the characteristics and membership of the Board. At this time, the Board has determined that

having Mr. Ran serve as both the Chairman and Chief Executive Officer is in the best interest of our shareholders. We believe

this structure makes the best use of the Chief Executive Officer’s extensive knowledge of our business and personnel, our

strategic initiatives and our industry, and also fosters real-time communication between management and the Board.

The

Board’s Oversight of Risk Management

The

Board recognizes that companies face a variety of risks, including credit risk, liquidity risk, strategic risk, and operational

risk. The Board believes an effective risk management system will (1) timely identify the material risks that we face, (2) communicate

necessary information with respect to material risks to senior executives and, as appropriate, to the Board or relevant Board

committee, (3) implement appropriate and responsive risk management strategies consistent with our risk profile, and (4) integrate

risk management into our decision-making. The Board encourages and management promotes a corporate culture that incorporates risk

management into our corporate strategy and day-to-day business operations. The Board also continually works, with the input of

our management and executive officers, to assess and analyze the most likely areas of future risk for us.

Shareholder

Communications

The

Board has established a process to receive communications from shareholders. Shareholders and other interested parties may contact

any member (or all members) of the Board, or the non-management directors as a group, any Board committee or any chair of any

such committee by mail or electronically. To communicate with the Board, any individual director or any group or committee of

directors, correspondence should be addressed to the Board or any such individual director or group or committee of directors

by either name or title. All such correspondence should be sent c/o Corporate Secretary at 60 Cutter Mill Road, Suite 205, Great

Neck, NY 11021.

All

communications received as set forth in the preceding paragraph will be opened by the Secretary for the sole purpose of determining

whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions

of a product or service, patently offensive material or matters deemed inappropriate for the Board will be forwarded promptly

to the addressee. In the case of communications to the Board or any group or committee of directors, the Secretary will make sufficient

copies of the contents to send to each director who is a member of the group or committee to which the envelope or e-mail is addressed.

Executive

Compensation

The

following Summary Compensation Table sets forth all compensation earned by or paid to, in all capacities, during the years ended

December 31, 2018 and 2017 by (i) the Company’s Chief Executive Officer and (ii) the most highly compensated executive officers,

other than the CEO, who were serving as executive officers and whose total compensation exceeded $100,000 (the individuals falling

within categories (i) and (ii) are collectively referred to as the “Named Executives”):

Summary

Compensation Table

|

Name

and Principal Position

|

|

Year

|

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

All

Other Compensation

($)

(1)

|

|

|

Total

($)

|

|

|

Assaf

Ran

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chief

Executive Officer and President

|

|

|

2018

|

|

|

$

|

305,000

|

|

|

$

|

78,000

|

|

|

$

|

9,150

|

|

|

$

|

392,150

|

|

|

|

|

|

2017

|

|

|

$

|

290,000

|

|

|

$

|

78,000

|

|

|

$

|

8,700

|

|

|

$

|

376,700

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vanessa

Kao

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chief

Financial Officer, Vice President,

|

|

|

2018

|

|

|

$

|

137,000

|

|

|

$

|

26,000

|

|

|

$

|

4,110

|

|

|

$

|

167,110

|

|

|

Treasurer

and Secretary

|

|

|

2017

|

|

|

$

|

137,000

|

|

|

$

|

26,000

|

|

|

$

|

4,110

|

|

|

$

|

167,110

|

|

(1)

Company’s matching contributions are made pursuant to its Simple IRA Plan.

Employment

Contracts

We

have an employment agreement with Assaf Ran, our President and Chief Executive Officer, pursuant to which: (i) Mr. Ran’s

employment term renews automatically on June 30th of each year for successive one-year periods unless either party gives to the

other written notice at least 180 days prior to June 30th of its intention to terminate the agreement; (ii) Mr. Ran receives a

current annual base salary of $305,000 ($275,000 effective June 2016 and $305,000 effective June 2017) and annual bonuses as determined

by the Compensation Committee of the Board, in its sole and absolute discretion, and is eligible to participate in all executive

benefit plans established and maintained by us; and (iii) Mr. Ran agreed to a one-year non-competition period following the termination

of his employment. If the employment agreement is terminated by Mr. Ran for “good reason” (as defined in the employment

agreement) he shall be paid (1) his base compensation up to the effective date of such termination; (2) his full share of any

incentive compensation payable to him for the year in which the termination occurs; and (3) a lump sum payment equal to 100% of

the average cash compensation paid to, or accrued for, him in the two calendar years immediately preceding the calendar year in

which the termination occurs. The Compensation Committee approved an annual bonus of $78,000 to Mr. Ran in 2018, and a special

bonus of $33,000 and an annual bonus of $45,000 to Mr. Ran in 2017.

Restricted

Stock Grant

In

September 2011, upon shareholders approval at the 2011 annual meeting of shareholders, we granted 1,000,000 restricted common

shares (the “Restricted Shares”) to Mr. Ran, our Chief Executive Officer. Under the terms of the restricted shares

agreement, among other things, Mr. Ran may not sell, convey, transfer, pledge, encumber or otherwise dispose of the Restricted

Shares until the earliest to occur of the following: (i) September 9, 2026, with respect to 1/3 of the Restricted Shares, September

9, 2027 with respect to an additional 1/3 of the Restricted Shares and September 9, 2028 with respect to the final 1/3 of the

Restricted Shares; (ii) the date on which Mr. Ran’s employment is terminated by us for any reason other than for “Cause”

(i.e., misconduct that is materially injurious to us monetarily or otherwise, including engaging in any conduct that constitutes

a felony under federal, state or local law); or (iii) the date on which Mr. Ran’s employment is terminated on account of

(A) his death; or (B) his disability, which, in the opinion of his personal physician and a physician selected by us prevents

him from being employed with us on a full-time basis (each such date being referred to as a “Risk Termination Date”).

If at any time prior to a Risk Termination Date Mr. Ran’s employment is terminated by us for Cause, or by Mr. Ran voluntarily

for any reason other than death or disability, Mr. Ran will forfeit that portion of the Restricted Shares which has not previously

vested. Mr. Ran has the power to vote the Restricted Shares and will be entitled to all dividends payable with respect to the

Restricted Shares.

In

connection with the Compensation Committee’s approval of the foregoing grant of Restricted Shares, the Compensation Committee

consulted with and obtained the concurrence of independent compensation experts and informed Mr. Ran that it had no present intention

of continuing its prior practice of annually awarding stock options to Mr. Ran as Chief Executive Officer. Also, Mr. Ran advised

the Compensation Committee that he would not seek future stock option grants.

Termination

and Change of Control Arrangement

In

the event of termination, Mr. Ran will not be entitled to receive any severance and any non-vested options will be automatically

forfeited. If at any time prior to a Risk Termination Date Mr. Ran’s employment is terminated by us for cause or by Mr.

Ran voluntarily for any reason other than death or disability, Mr. Ran will forfeit that portion of the Restricted Shares which

have not previously vested. If Mr. Ran is terminated for any reason other than for cause, the Restricted Shares become immediately

transferable.

Compensation

of Directors

Generally,

each independent director of the Company is granted an option for 7,000 common shares upon first taking office. During 2018, the

annual cash compensation paid to each independent member of the Board was $7,500, plus an additional $300 for each committee meeting

attended. In June 2018, the Compensation Committee elected to increase the annual cash compensation paid to each independent member

of the Board to $10,000, effective beginning in fiscal year 2019. Other than the grant of options at the time each independent

director first takes office, we do not currently anticipate granting our directors additional options as part of their compensation.

The

table below summarizes the compensation paid to our independent directors for the year ended December 31, 2018. Mr. Ran’s

compensation is described below under “Executive Compensation.”

Director

Compensation

|

Name

(a)

|

|

Fees

Earned or Paid

in Cash

($)

|

|

|

Michael

Jackson

|

|

$

|

9,300

|

|

|

Eran

Goldshmit (1)

|

|

$

|

9,000

|

|

|

Lyron

Bentovim

|

|

$

|

9,000

|

|

|

(1)

|

At

December 31, 2018, Mr. Goldshmit held stock options to purchase an aggregate of 7,000 common shares at an exercise price of

$2.92 per share.

|

Outstanding

Equity Awards at Fiscal Year-End

The

following table sets forth information concerning outstanding equity awards to the Named Executives as of December 31, 2018.

|

Name

|

|

Stock

Awards

Number

of Shares or

Units

of Stock

That

Have Not Vested (#)

|

|

Market

Value of Shares or

Units

of Stock

That

Have Not Vested

($)

|

|

|

Assaf

Ran

|

|

|

|

|

|

|

|

Chief

Executive Officer and President

|

|

1,000,000

|

|

|

5,620,000

|

(1)(2)

|

|

(1)

|

Calculated

based on the closing market price of $5.62 at the end of the last completed fiscal year on December 31, 2018.

|

|

|

|

|

(2)

|

Mr.

Ran may not sell, convey, transfer, pledge, encumber or otherwise dispose of the Restricted Shares until the earliest to occur

of the following: (i) September 9, 2026, with respect to 1/3 of the Restricted Shares, September 9, 2027 with respect to an

additional 1/3 of the Restricted Shares and September 9, 2028 with respect to the final 1/3 of the Restricted Shares; (ii)

the date on which Mr. Ran’s employment is terminated by us for any reason other than for “Cause;” or (iii)

on a Risk Termination Date. If at any time prior to a Risk Termination Date Mr. Ran’s employment is terminated by us

for Cause or Mr. Ran voluntarily terminates his employment for any reason other than death or disability, Mr. Ran will forfeit

that portion of the Restricted Shares which have not previously vested.

|

Equity

Compensation Plan Information

The

following table summarizes the options granted under our 2009 Stock Option Plan, as amended (the “Plan”) as of December

31, 2018. The shares covered by outstanding options are subject to adjustment for changes in capitalization, stock splits, stock

dividends and similar events.

|

|

|

Equity

Compensation Plan Table

|

|

|

|

|

Number

of

securities to be

issued upon

exercise of

outstanding

options, warrants

and rights

|

|

|

Weighted-

average

exercise

price of

outstanding

options, warrants

and rights

|

|

|

Number

of

securities

remaining

available for

future

issuance

under equity

compensation

plans

|

|

|

Equity

Compensation Plans Approved By Security Holders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Grants

under the Company’s 2009 Stock Option Plan

|

|

|

7,000

|

|

|

$

|

2.92

|

|

|

|

269,000

|

|

|

Equity

Compensation Plans Not Approved By Security Holders

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Total

|

|

|

7,000

|

|

|

$

|

2.92

|

|

|

|

269,000

|

|

The

table above does not include: (i) 5-year warrants to purchase 3,000 Common Shares, with an exercise price of $3.5625 per Common

Share, issued to the representative of the underwriters of the Company’s public offering in July 2014. These warrants are

exercisable at any time, and from time to time, in whole or in part, commencing on July 28, 2015 and expire on July 28, 2019;

(ii) 5-year warrants to purchase 9,650 Common Shares, with an exercise price of $5.4875 per Common Share, issued to the representative

of the underwriters of the Company’s public offering in May 2015. These warrants are exercisable at any time, and from time

to time, in whole or in part, commencing on May 22, 2016 and expire on May 22, 2020; and (iii) 5-year warrants to purchase 33,612

Common Shares, with an exercise price of $7.4375 per Common Share, issued to the representative of the underwriters of the Company’s

public offering in August 2016. These warrants are exercisable at any time, and from time to time, in whole or in part, commencing

on August 9, 2017 and expire on August 9, 2021.

The

purpose of the Plan is to align the interests of our officers, other key employees, consultants and non-employee directors and

those of our subsidiaries, if any, with those of our shareholders to afford an incentive to such officers, employees, consultants

and directors to continue as such, to increase their efforts on our behalf and to promote the success of our business. The availability

of additional shares will enhance our ability to achieve these goals and to attract qualified employees. The basis of participation

in the Plan is upon discretionary grants of awards by the board of directors.

The

Plan is administered by the Compensation Committee of the Board. 269,000 common shares are reserved for award grants under the

Plan, subject to adjustment as provided in the Plan. As of December 31, 2018, approximately five persons were eligible to participate

in the Plan, consisting of two executive officers and three independent directors. The Board has resolved not to grant any options

to Mr. Ran until all of the Restricted Shares have vested. The Plan expires on June 23, 2019.

Amendment

and Termination of the Plan

The

Board may at any time, and from time to time, suspend or terminate the Plan in whole or in part or amend it from time to time.

Exercise

Price

The

exercise price of an option granted under the Plan may be no less than the fair market value of a common share on the date of

grant, unless, with respect to nonqualified stock options that are not intended as incentive stock options within the meaning

of Section 422 of the Internal Revenue Code of 1986, as amended from time to time, otherwise determined by the Compensation Committee.

However, incentive stock options granted to a ten percent shareholder must be priced at no less than 110% of the fair market value

of our common shares on the date of grant and their term may not exceed five years. All options granted under the Plan are for

a term of no longer than ten years unless otherwise determined by the Compensation Committee. The Compensation Committee also

determines the exercise schedule of each option grant.

Certain

Relationships and Related Transactions

In

the beginning of 2018, Mr. Ran, our Chief Executive Officer, made three short term bridge loans to the Company in the aggregate

amount of $950,000, at an interest rate of 6% per annum. All loans were repaid in full on February 9, 2018. During the second

quarter of 2018, Mr. Ran and entities he controls made seven short term loans to the Company in the aggregate amount of $2,741,227,

at an interest rate of 6% per annum. Two of the loans in the aggregate amount of $311,227 were repaid in full in May 2018. The

remaining loans, in the aggregate amount of $2,430,000 were repaid in full as of July 11, 2018. The aggregate interest expense

for these loans was $10,509.

Security

Ownership of Certain Beneficial Owners

The

following table, together with the accompanying footnotes, sets forth information, as of the Record Date, regarding the beneficial

ownership of our common shares by all persons known by us to beneficially own more than 5% of our outstanding common shares, each

Named Executive, each director, and all of our directors and executive officers as a group:

|

Name

of Beneficial Owner

|

|

Amount

of Beneficial

Ownership (1)

|

|

|

Percentage

of Class

|

|

|

Executive

Officers and Directors

|

|

|

|

|

|

|

|

|

|

Assaf

Ran (2)

|

|

|

2,531,000

|

|

|

|

26.2

|

%

|

|

Vanessa

Kao

|

|

|

5,236

|

|

|

|

*

|

|

|

Michael

Jackson

|

|

|

35,000

|

|

|

|

*

|

|

|

Eran

Goldshmit

|

|

|

16,050

|

|

|

|

*

|

|

|

Lyron

Bentovim

|

|

|

38,887

|

|

|

|

*

|

|

|

All

executive officers and directors as a group (5 persons)

|

|

|

2,626,173

|

|

|

|

27.2

|

%

|

*Less

than 1%

|

(1)

|

A

person is deemed to be a beneficial owner of securities that can be acquired by such person within 60 days from the Record

Date upon the exercise of options and warrants or conversion of convertible securities. Each beneficial owner’s percentage

ownership is determined by assuming that options, warrants and convertible securities that are held by such person (but not

held by any other person) and that are exercisable or convertible within 60 days from the Record Date have been exercised

or converted. Except as otherwise indicated, and subject to applicable community property and similar laws, each of the persons

named has sole voting and investment power with respect to the shares shown as beneficially owned. All percentages are determined

based on 9,659,977 shares outstanding on the Record Date.

|

|

|

|

|

(2)

|

Includes

1,000,000 Restricted Shares granted to Mr. Ran on September 9, 2011, which was approved by shareholders at our 2011 annual

meeting of shareholders. Mr. Ran may not sell, convey, transfer, pledge, encumber or otherwise dispose of the Restricted Shares

until the earliest to occur of the following: (i) September 9, 2026, with respect to 1/3 of the Restricted Shares, September

9, 2027 with respect to an additional 1/3 of the Restricted Shares and September 9, 2028 with respect to the final 1/3 of

the Restricted Shares; (ii) the date on which Mr. Ran’s employment is terminated by us for any reason other than for

“Cause;” or (iii) on a Risk Termination Date. If at any time prior to a Risk Termination Date Mr. Ran’s

employment is terminated by us for Cause or Mr. Ran voluntarily terminates his employment for any reason other than death

or disability, Mr. Ran will forfeit that portion of the Restricted Shares which have not previously vested. Mr. Ran’s

address is c/o Manhattan Bridge Capital, Inc., 60 Cutter Mill Road, Suite 205, Great Neck, New York 11021.

|

Proposal

No. 2

Advisory

approval

OF THE APPOINTMENT OF INDEPENDENT

AUDITORS

H&L

has been our independent registered public accounting firm since November 2014 when Hoberman, Goldstein & Lesser, CPAs, P.C.

(“HG&L”), our independent registered public accounting firm at the time, effectively resigned when the ownership

interest in HG&L changed and formed H&L as a new successor entity to HG&L. As a result, H&L was engaged as our

new independent registered public accounting firm. One or more representatives of H&L is expected to be at the Annual Meeting

and will have an opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate

questions from our shareholders.

Selection

of the independent accountants is not required to be submitted to a vote of our shareholders for ratification. In addition, the

Sarbanes-Oxley Act of 2002 requires the Audit Committee to be directly responsible for the appointment, compensation and oversight

of the audit work of the independent auditors. The Audit Committee expects to appoint H&L to serve as independent auditors

to conduct an audit of our accounts for the 2019 fiscal year. However, the Board is submitting this matter to our shareholders

as a matter of good corporate practice. If the shareholders fail to vote on an advisory basis in favor of the selection, the Audit

Committee will take that into consideration when deciding whether to retain H&L, and may retain that firm or another without

re-submitting the matter to the shareholders. Even if shareholders vote on an advisory basis in favor of the appointment, the

Audit Committee may, in its discretion, direct the appointment of different independent auditors at any time during the year if

it determines that such a change would be in our and our shareholders’ best interests.

The

Board recommends a vote FOR this proposal

and

proxies that are signed and returned will be so voted

unless

otherwise instructed

*

* * * *

Independent

Registered Public Accounting Firm Fees and Other Matters

The

aggregate fees billed by our principal accounting firm, H&L, for the fiscal years ended December 31, 2018 and 2017 are as

follows:

2018

The

aggregate fees incurred during 2018 for our principal accountant were $65,500, covering the audit of our annual financial statements

and the review of our financial statements for the first, second and third quarters of 2018.

2017

The

aggregate fees incurred during 2017 for our principal accountant were $65,500, covering the audit of our annual financial statements

and the review of our financial statements for the first, second and third quarters of 2017.

There

were no audit-related fees billed by our principal accountant during 2018 or 2017.

There

were no tax fees billed by our principal accountant during 2018 or 2017.

No

other fees, beyond those disclosed above, were billed during 2018 or 2017 except that we were billed $21,500 in 2018 by our principal

accountant for services rendered in connection with our Registration Statement on Form S-3 for our public offering in July 2018.

Pre-Approval

Policies and Procedures

Our

Audit Committee approved the engagement with H&L. These services were pre-approved by our Audit Committee to assure that such

services do not impair the auditor’s independence from us.

Proposal

No. 3

ADVISORY

VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

In

accordance with the requirements of Section 14A of the Exchange Act and related rules of the SEC, we are including a separate

proposal subject to stockholder vote to approve, on a non-binding, advisory basis, the compensation of those of our executive

officers listed in the Summary Compensation Table appearing elsewhere in this Proxy Statement, or our named executive officers,

as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K. To learn more about our executive compensation, see

“Executive Compensation” elsewhere in this Proxy Statement.

The

vote on this proposal is not intended to address any specific element of compensation; rather, the vote relates to the compensation

of our named executive officers, as described in this Proxy Statement in accordance with the compensation disclosure rules of

the SEC. To the extent there is any significant vote against our named executive officer compensation as disclosed in this Proxy

Statement, the Compensation Committee will evaluate whether any actions are necessary to address the concerns of stockholders.

Based

on the above, we request that you indicate your support for our executive compensation philosophy and practices, by voting in

favor of the following resolution:

“RESOLVED,

that the Company’s stockholders approve, on a non-binding, advisory basis, the compensation of the Company’s named

executive officers as described in this Proxy Statement, including the “Executive Compensation” section, the compensation

tables and the other narrative compensation disclosures.”

The

affirmative vote of the holders of a majority of the stock having voting power present in person or represented by proxy shall

be sufficient to approve this Proposal No. 3. The opportunity to vote on this Proposal No. 3 is required pursuant to Section 14A

of the Exchange Act. However, as an advisory vote, the vote on Proposal No. 3 is not binding upon us and serves only as a recommendation

to our Board. Nonetheless, the Compensation Committee, which is responsible for designing and administering our executive compensation

program, and the Board value the opinions expressed by stockholders, and will consider the outcome of the vote when making future

compensation decisions for our named executive officers.

The

Board recommends a vote FOR this proposal

and

proxies that are signed and returned will be so voted

unless

otherwise instructed

*

* * * *

Proposal

No. 4

ADVISORY

VOTE ON THE FREQUENCY OF THE ADVISORY VOTE ON COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

In

accordance with the requirements of Section 14A of the Exchange Act and related rules of the SEC, we are including a separate

proposal subject to stockholder vote to recommend, on a non-binding, advisory basis, whether a non-binding, advisory stockholder

vote to approve the compensation of our named executive officers (that is, a vote similar to the non-binding, advisory vote in

Proposal No. 3 above) should occur every one, two or three years.

By

voting with respect to this Proposal No. 4, stockholders may indicate whether they would prefer that we conduct future advisory

votes on our named executive officer compensation once every one, two, or three years. Stockholders also may, if they so wish,

abstain from casting a vote on this proposal.

The

Board has considered the frequency of the advisory vote on the compensation of our named executive officers that it should recommend.

After considering the benefits and consequences of each alternative for the frequency of submitting the advisory vote on the compensation

of our named executive officers to stockholders, the Board recommends submitting the advisory vote on the compensation of our

named executive officers to our stockholders every three years. The Board has utilized this frequency since 2013, the first time

it was required to include such an advisory vote.

In

determining to recommend that stockholders vote for a frequency of once every three years, the Board considered its past practice

of successfully utilizing this frequency, as well as how an advisory vote at this frequency provides our stockholders with sufficient

time to evaluate the effectiveness of our overall compensation philosophy, policies and practices in the context of our long-term

business results for the corresponding period, while avoiding over-emphasis on short term variations in compensation and business

results. An advisory vote occurring once every three years also permits our stockholders to observe and evaluate the impact of

any changes to our executive compensation policies and practices which have occurred since the last advisory vote on executive

compensation, including changes made in response to the outcome of a prior advisory vote on executive compensation. We will continue

to engage with our stockholders regarding our executive compensation program during the period between advisory votes on executive

compensation.

For

the above reasons, the Board recommends that you vote to hold a non-binding, advisory vote on the compensation of our named executive

officers every three years. Your vote, however, is not to approve or disapprove the Board’s recommendation.

When

voting on this proposal, you have four choices: you may elect that we hold an advisory vote on the compensation of our named executive

officers every year, every two years or every three years, or you may abstain from voting. If you properly complete your proxy

and fail to indicate your preference or abstention, your shares will be voted to select every three years as the frequency with

which our stockholders will be asked to hold a non-binding, advisory vote on the compensation of our named executive officers.

The

choice of frequency that receives the highest number of “FOR” votes will be considered as the frequency with which

our stockholders will be asked to hold a non-binding, advisory vote on the compensation of our named executive officers. The Board

will consider the outcome of the vote when making future decisions on executive compensation. However, as an advisory vote, the

vote on this Proposal No. 4 is not binding upon us, and the Board may decide that it is in the best interests of our stockholders

and the Company to hold an advisory vote on executive compensation more or less frequently than the alternative approved by our

stockholders. Although our Board has utilized the three year frequency in the past, our Board has not yet determined the frequency

with which we will hold future stockholder advisory votes on named executive officer compensation required by Section 14A of the

Exchange Act or when the next such stockholder advisory vote on named executive officer compensation will occur following the

Meeting.

The

Board recommends a vote FOR the holding of an advisory vote on executive compensation

every

“three years” and proxies that are signed and returned will be

so

voted unless otherwise instructed

*

* * * *

MISCELLANEOUS

Other

Matters

Management

knows of no matter other than the foregoing to be brought before the Annual Meeting, but if such other matters properly come before

the meeting, or any adjournment thereof, the persons named in the accompanying form of proxy will vote such proxy on such matters

in accordance with their best judgment.

Solicitation

of Proxies

The

accompanying proxy is solicited by and on behalf of our Board, whose notice of meeting is attached to this Proxy Statement, and

the entire cost of the solicitation of proxies will be borne by us. Proxies may be solicited by directors, officers and regular

employees of ours, without extra compensation, by telephone, telegraph, mail or personal interview. Solicitation is not to be

made by specifically engaged employees or paid solicitors. We will also request that brokers, nominees, custodians and other fiduciaries

forward soliciting materials to the beneficial owners of shares held of record by such brokers, nominees, custodians and other

fiduciaries. We will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses

for sending proxies and proxy material to the beneficial owners of our Common Shares.

Shareholder

Proposals for the 2020 Annual Meeting of Shareholders

Shareholders

who intend to have a proposal considered for inclusion in our proxy materials for presentation at our 2020 Annual Meeting of Shareholders

pursuant to Rule 14a-8 under the Exchange Act must submit the proposal to our Secretary at our offices at 60 Cutter Mill Road,

Suite 205, Great Neck, NY 11021, in writing not later than January 23, 2020. Shareholders who wish to present a proposal at our

next annual meeting of stockholders without the inclusion of such proposal in our proxy materials must advise our Secretary

of such proposals in writing by April 10, 2020.

Householding

of Annual Meeting Materials

Some

banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements

and annual reports. This means that only one copy of our proxy statement or annual report may have been sent to multiple shareholders

in your household. We will promptly deliver a separate copy of either document to you if you call or write us at the following

address or phone number: 60 Cutter Mill Road, Suite 205, Great Neck, NY 11021, (516) 444-3400. If you want to receive separate

copies of the annual report and proxy statement in the future or if you are receiving multiple copies and would like to receive

only one copy for your household, you should contact your bank, broker, or other nominee record holders, or you may contact us

at the above address and phone number.

Certain

information contained in this Proxy Statement relating to the occupations and security holdings of our directors and officers

is based upon information received from the individual directors and officers.

WE

WILL FURNISH, WITHOUT CHARGE, A COPY OF OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2018, INCLUDING FINANCIAL

STATEMENTS AND SCHEDULES THERETO, BUT NOT INCLUDING EXHIBITS, TO EACH OF OUR SHAREHOLDERS OF RECORD ON THE RECORD DATE AND TO

EACH BENEFICIAL SHAREHOLDER ON THAT DATE UPON WRITTEN REQUEST MADE TO OUR SECRETARY. A REASONABLE FEE WILL BE CHARGED FOR COPIES

OF REQUESTED EXHIBITS.

PLEASE

DATE, SIGN AND RETURN THE PROXY CARD AT YOUR EARLIEST CONVENIENCE IN THE ENCLOSED RETURN ENVELOPE. A PROMPT RETURN OF YOUR PROXY

CARD WILL BE APPRECIATED AS IT WILL SAVE THE EXPENSE OF FURTHER MAILINGS.

EVERY

SHAREHOLDER, WHETHER OR NOT HE OR SHE EXPECTS TO ATTEND THE ANNUAL MEETING IN PERSON, IS URGED TO EXECUTE THE PROXY AND RETURN

IT PROMPTLY IN THE ENCLOSED BUSINESS REPLY ENVELOPE.

|

|

By

order of the Board of Directors

|

|

|

|

|

|

|

|

|

Vanessa

Kao

|

|

|

Secretary

|

Great

Neck, New York

May

21, 2019

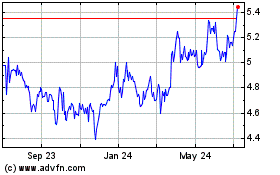

Manhattan Bridge Capital (NASDAQ:LOAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

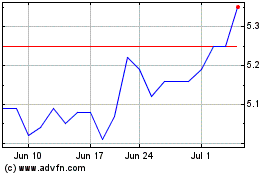

Manhattan Bridge Capital (NASDAQ:LOAN)

Historical Stock Chart

From Apr 2023 to Apr 2024