UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant

x

|

|

|

|

Filed by a Party other than the Registrant

o

|

|

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

o

|

Soliciting Material under §240.14a-12

|

|

|

|

BLUE APRON HOLDINGS, INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

On May 20, 2019, Blue Apron Holdings, Inc. filed a Current Report on Form 8-K, issued a press release and sent an email to all full-time employees including the disclosures below that update certain information included in the Company’s proxy statement for its 2019 annual meeting of stockholders, to be held on June 13, 2019.

(i)

The disclosure from the Current Report on Form 8-K is as follows:

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On May 17, 2019, Blue Apron Holdings, Inc. (the “Company”) was notified by the New York Stock Exchange (the “NYSE”) that the average per share trading price of its Class A common stock was below the NYSE’s continued listing standard relating to minimum average share price. Rule 802.01C of the NYSE’s Listed Company Manual requires that a company’s common stock trade at a minimum average closing price of $1.00 over a consecutive 30 trading-day period.

The Company has six months from receipt of the notice to regain compliance with the NYSE’s price condition. In accordance with the NYSE’s rules, the Company provided the NYSE with written notice of its receipt of the notice and of its intention to cure the share price non-compliance within the six-month cure period. Subject to the NYSE’s rules, during the cure period, the Company’s Class A common stock will continue to be listed and trade on the NYSE as usual. The Company is currently in compliance with all other NYSE continued listing standards.

The Company can regain compliance at any time during the six-month cure period if on the last trading day of any calendar month during the cure period the Company has a closing share price of at least $1.00 and an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of that month or on the last day of the cure period.

A copy of the press release announcing the notice of non-compliance with the NYSE trading share price continued listing standard, as well as the Company’s proposal to authorize a reverse stock split, is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

(ii)

The disclosure from the press release is as follows:

Blue Apron Announces Reverse Stock Split Proposal

New York, NY — May 20, 2019 — Blue Apron Holdings, Inc. (NYSE: APRN) today announced that the Company is actively pursuing plans to effect a reverse stock split.

On April 17, 2019, the Company’s Board of Directors unanimously approved and recommended for stockholder approval a proposal to authorize the Company to implement a reverse stock split of the Company’s Class A common stock and Class B common stock based on a split ratio between 1-for-5 to 1-for-15, with the implementation and exact split ratio to be determined by its Board of Directors. This proposal, which is further described in the Company’s definitive proxy statement filed with the Securities and Exchange Commission (SEC) on April 29, 2019, is subject to stockholder approval at the Company’s upcoming Annual Meeting of Stockholders on June 13, 2019.

The primary purpose for the proposed reverse stock split is to increase the market price of the Company’s Class A common stock. The Company believes that the increased market price that is expected as a result of implementing the reverse stock split will improve the marketability and liquidity of the Company’s Class A common stock and may encourage interest and trading in the stock. The Company also anticipates that, if approved by the Company’s stockholders at the Annual Meeting and thereafter promptly implemented by the Company, the effects of the reverse stock split will be sufficient for the Company to regain compliance with the continued listing standards of the New York Stock Exchange (NYSE), as further described below, by as early as July 1, 2019.

The Company received written notice from the NYSE on May 17, 2019 that the price of the Company’s Class A common stock has fallen below the NYSE’s continued listing standard. The NYSE requires that the average closing price of a listed company’s common stock not be less than $1.00 per share over a period of 30 consecutive trading days. The Company has notified the NYSE of its intent to cure this non-compliance through implementation of the proposed reverse stock split.

Under the NYSE rules, the Company can regain compliance with the NYSE’s continued listing standards if, as of the last trading day of any calendar month during a six-month period following the Company’s receipt of the NYSE notice, the Company’s Class A common stock has a closing share price of at least $1.00 and an average closing share price of at least $1.00 over the prior 30 trading-day period.

The NYSE’s notification does not affect the Company’s business operations or the current listing of the Company’s Class A common stock, which will continue to trade on the NYSE during the six-month cure period subject to the Company’s compliance with the other NYSE continued listing standards, and does not conflict with, or cause an event of default under, any of the Company’s material debt or other agreements.

2

Forward-Looking Statements

This press release includes statements concerning Blue Apron Holdings, Inc. and its future expectations, plans and prospects that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. For this purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of these terms or other similar expressions. The company has based these forward-looking statements largely on its current expectations and projections about future events and financial trends that it believes may affect its business, financial condition and results of operations. These forward-looking statements speak only as of the date of this press release and are subject to a number of risks, uncertainties and assumptions including, without limitation, the company’s ability to attain the necessary stock price levels to regain compliance with the NYSE continued listing standards or, if achieved, to continue to satisfy the NYSE’s qualitative and quantitative continued listing standards in the future, including due to the company’s financial condition or results of operations, market conditions or the market perception of the company’s business, financial condition or results of operations; unanticipated adjournments or postponements of the Annual Meeting; the failure of stockholders to approve the proposed reverse stock split; a determination by the company’s Board of Directors not to promptly implement or to abandon the proposed reverse stock split in its discretion; and other risks more fully described in the company’s Definitive Proxy Statement on Schedule 14A filed with the SEC on April 29, 2019, the company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2019 filed with the SEC on April 30, 2019, and in other filings that the company may make with the SEC in the future. The company assumes no obligation to update any forward-looking statements contained in this press release as a result of new information, future events or otherwise.

###

About Blue Apron

Blue Apron’s mission is to make incredible home cooking accessible to everyone. Launched in 2012, Blue Apron is reimagining the way that food is produced, distributed, and consumed, and as a result, building a better food system that benefits consumers, food producers, and the planet. The company has developed an integrated ecosystem that enables the company to work in a direct, coordinated manner with farmers and artisans to deliver high-quality products to customers nationwide at compelling values.

Contact:

Media & Investors

Louise.Ward@blueapron.com

(iii)

The disclosure from the email to all full-time employees is as follows:

To: Full Time Employees

From: Tim Bensley

Subject: Addressing Our Stock Price

Date: Monday May 20

Team,

As you may know, we’ve seen a further decline in the company’s stock price over the past two weeks. As we’ve discussed, public company stocks often experience volatility, including for reasons both related and unrelated to the company’s performance. While it’s difficult to pinpoint what has driven our recent volatility, I want to share an update with you regarding some important plans we have to proactively address our current trading price.

Before I delve into our plans, I first want to reiterate that we should not let ourselves become distracted by fluctuations in our stock price. As you know, we recently reached some key milestones that demonstrate financial and operational improvements in the business, and continue to feel that we are well positioned to unlock opportunities for sustainable, profitable growth under Linda’s leadership. Over the next few weeks, there will be opportunities to hear from Linda and the team on the strategic initiatives that we believe will have the highest impact on the business, which we’ll be focusing on executing organization-wide.

Our stock price is nonetheless important in two respects that I want to address briefly. First, having a higher share price can help Blue Apron attract more long-term institutional investors. Second, as an NYSE-listed company, we are required to keep our average share price above a certain minimum threshold, and we are currently trading under this threshold. Under NYSE rules, we have a six-month “cure period” to bring our average share price above the required threshold, during which time we continue to trade on the NYSE as usual. We are taking proactive measures to bring our stock price back above the threshold in the near future (more on that below).

Over the past couple of months we have determined that a reverse stock split is an appropriate measure to address these two matters. Therefore, in our proxy statement filed with the Securities and Exchange Commission on April 29th, we proposed a reverse stock split for approval by our shareholders at our upcoming Annual Meeting on June 13th.

3

For those of you unfamiliar with the term, a reverse stock split is a corporate transaction in which a company reduces the number of total outstanding shares by “combining” its total outstanding shares into a smaller number of outstanding shares. In turn, this results in a corresponding increase in the per share price of the company stock.

Importantly, this action does not independently impact a company’s overall market value, meaning the total value of the shares you hold immediately before and immediately after the reverse stock split will not change upon implementation of the split. For further information on reverse stock splits and our implementation plans, I encourage you to read the Q&As below as well as our proxy statement, a copy of which is available on our

Investor Relations website

.

Assuming we receive shareholder approval for the reverse stock split and promptly implement the split afterwards, we are confident that we will bring our stock price back above the NYSE minimum share price requirement by July 1

st

(well within the six-month “cure period”). Doing the reverse split now would also allow us to focus on serving our customers without the distraction of compliance and stock volatility.

Please feel free to reach out to me or Christina Halliday directly with any questions. You can also sign up for my Office Hours

here

.

Tim

Reverse Stock Split Q&As

What is a reverse stock split?

·

A reverse stock split is a corporate transaction in which a company reduces the number of its outstanding shares.

·

This process involves dividing the existing total quantity of outstanding shares by a number such as ten (referred to as a 1-for-10 reverse stock split) or fifteen (referred to as a 1-for-15 reverse stock split), which results in an increase in the per share price of the company’s stock due to the reduced number of outstanding shares.

·

The reverse stock split will be applied equally across all Class A and Class B shares, so no stockholder’s holdings or voting power is diluted relative to any other existing stockholders (subject to the treatment of fractional shares).

·

This action does not independently impact a company’s overall market value, meaning the total value of the shares and equity awards you hold immediately before and immediately after the reverse stock split will not change upon implementation of the reverse stock split (subject to the treatment of fractional shares).

For example, assume Company A has 10,000 shares that are trading at $1.00 per share. If Company A implements a 1-for-10 reverse stock split, following the transaction Company A’s shares outstanding will be reduced to 1,000 shares, but the shares will be trading at $10.00 per share. As explained, this transaction does not independently affect the overall market value of the company or the total value of shares and equity awards held by any shareholder:

·

Immediately after the reverse stock split, Company A will still have a market capitalization of $10,000 (10,000 x $1.00 = 1,000 x $10.00).

·

Similarly, a shareholder who held 100 shares at $1.00 per share ($100 total value) will instead hold 10 shares valued at $10.00 per share (still $100 total value) immediately after the reverse stock split.

Why are we seeking to implement a reverse stock split?

·

The primary purpose of effecting a reverse stock split is to increase the per share price of our Class A shares trading on NYSE.

·

In the near term, this is important for curing the NYSE’s minimum threshold for our average share price.

·

In the longer term, we believe that the increased per share stock price could improve the marketability of our stock and encourage investor interest and trading. For example:

·

Many institutional investors are prohibited from purchasing stocks that trade below certain minimum price levels, meaning they cannot currently invest in Blue Apron stock even if they want to.

·

Additionally, certain other investors prefer to invest in stocks that trade at a per share price range that is more typical of companies listed on the NYSE.

Are we being delisted by the NYSE?

·

No, our stock is not currently being delisted from the NYSE. The NYSE rules provide a six-month period for a company to cure any non-compliance by raising its share price above the minimum share price requirement.

4

·

Assuming we receive shareholder approval for the reverse stock split at the Annual Meeting and promptly implement the split after such approval, we are confident we will bring our stock price back above the minimum share price requirement by July 1

st

, well within the six-month cure period.

What ratio is the reverse split?

·

The definitive split ratio will be determined by our Board, but it will be between the range of 1-for-5 and 1-for-15.

How does this affect my RSUs and/or options?

·

The total value of the equity awards you hold before and after the reverse stock split will not change upon implementation of the reverse stock split (subject to the treatment of fractional shares).

·

For RSU awards

, the total number of shares issuable upon vesting of an outstanding award will be divided and reduced by the split ratio.

·

For example, if the company implements a 1-for-10 reverse stock split and you have an outstanding RSU award for 1,000 shares, your RSU award will automatically be reduced to 100 shares. Because the trading price of each underlying share should also increase by 10x immediately after the split, the market value of your shares underlying the RSU awards will not be affected upon implementation of the split.

·

For option awards

, the total number of shares issuable upon exercise of an outstanding award will be divided and reduced by the split ratio, and the exercise price for the options will be increased by the split ratio.

·

For example, if the company implements a 1-for-10 reverse stock split and you have an outstanding option award for 1,000 shares at an exercise price of $1.00 per share, your option award will automatically be reduced to 100 shares and your exercise price will increase to $10.00 per share. Because the trading price of each underlying share should also increase by 10x immediately after the split, neither the total cost to exercise all of your options nor the market value of your exercised shares will be affected upon implementation of the split.

How can I learn more about the reverse stock split proposal?

·

We encourage you to read our proxy statement filed with the Securities and Exchange Commission on April 29

th

, which describes the proposed reverse stock split in more detail, a copy of which can be found on our

Investor Relations website

.

·

If you have further questions, you can also reach out to Tim Bensley or Christina Halliday directly.

5

Blue Apron (NYSE:APRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

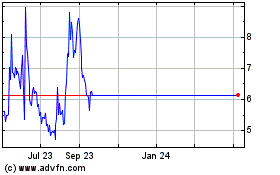

Blue Apron (NYSE:APRN)

Historical Stock Chart

From Apr 2023 to Apr 2024