Current Report Filing (8-k)

May 20 2019 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d)

of the Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported): May 15, 2019

SenesTech, Inc.

(Exact name of registrant

as specified in its charter)

|

Delaware

|

001-37941

|

20-2079805

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File No.)

|

Identification No.)

|

3140 N. Caden Court,

Suite 1

Flagstaff, AZ 86004

(Address of principal executive

offices) (Zip Code)

(928) 779-4143

(Registrant’s telephone

number, including area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant

to Section 12(b) of the Act

|

|

|

Name

of each exchange on which

|

|

Title of each class

|

Trading Symbol(s)

|

registered

|

|

Common Stock, $0.001

par value

|

SNES

|

The NASDAQ Stock

Market LLC

|

|

|

|

(NASDAQ Capital Market)

|

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2

of the Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☒

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On May 15,

2019, SenesTech, Inc. (“SenesTech” or the “Company”) announced the appointment of Kenneth Siegel as

the Company’s Chief Executive Officer, effective May 16, 2019, succeeding the Company’s co-founder, Dr. Loretta

Mayer, who will remain Chair of the board of directors of the Company and Chief Scientific Officer. Mr. Siegel has been a

SenesTech director since February 2019.

Mr. Siegel, 63,

has over 25 years of experience as an executive and senior leader of major corporations. Since September 2018, Mr. Siegel has

served as a Director on the board of directors of Babcock & Wilcox Enterprises, Inc. From December 2016 to November 2018,

Mr. Siegel served in key leadership roles at Diamond Resorts International Inc., a global vacation ownership company, most recently

as President since March 2017. Prior to Diamond Resorts, he served as Chief Administrative Officer and General Counsel of Starwood

Hotels & Resorts, a branded lifestyle hospitality company. An instrumental member of the Starwood leadership team, Mr. Siegel

was intimately involved in Starwood’s emergence as an industry leader before its acquisition by Marriott International in

2016. Mr. Siegel played a pivotal role in Starwood’s transition to an asset-light business and was the architect of transactions

that drove both top- and bottom-line benefits through industry leading initiatives. Prior to joining Starwood in 2000, Mr. Siegel

spent four years as the Senior Vice President and General Counsel of Cognizant Corporation and its successor companies.

Under the terms

of an employment letter agreement between Mr. Seigel and the Company dated May 16, 2019, Mr. Seigel will receive an annual

base salary of $275,000 and will receive a one-time signing bonus of stock options representing 700,000 shares of common stock

(the “Option”), which will vest on a quarterly basis over a three-year period, and will be subject to the terms and

conditions of the Company’s 2018 Equity Incentive Plan (the “Plan”) and standard form of option agreement. Mr.

Seigel will be eligible to receive annual Incentive bonus with a target value equal to 50% of his annual base salary, payable

in cash, subject to his achievement of performance objectives to be determined by the Company’s compensation committee or

board of directors. In addition, after each full year of employment with the Company, subject to Board approval, Mr. Sigel will

receive an annual option grant (each, an “Additional Option”) valued at 35% of his then base salary, subject to such

vesting terms as determined by the Board in its discretion. The Option and Additional Options that are granted to Mr. Siegel will

remain exercisable for five (5) years following the end of his continuous service with the Company. Mr. Seigel will also be eligible

to participate in the standard benefits, vacation and expense reimbursement plans offered to similarly situated employees, and

will enter into the Company’s standard form of indemnification agreement applicable to its directors and officers.

In the event

Mr. Siegel’s termination by the Company without Cause or Mr. Siegel resigns for Good Reason (as such terms are defined

in his employment letter agreement), Mr. Siegel will be entitled to severance benefits equal to twelve (12) months

continuation of his then base salary. In addition, the Company will reimburse Mr. Siegel for COBRA premiums in effect on the

date of termination for coverage in effect for him and, if applicable, his spouse and dependent children on such date under

the Company’s group health plan(s), Finally, the vesting of Mr. Siegel’s Option and Additional Options shall be

accelerated such that he will be deemed vested in those shares subject to the Options that would have vested in the twelve

(12) month period following his separation date had his employment not ended.

A copy of

the employment letter agreement between the Company and Mr. Siegel is filed with this report as Exhibit 10.1 and is

incorporated herein by reference.

A copy of the Company’s

press release dated May 15, 2019 announcing Mr. Siegel’s appointment was previously filed with the Securities and Exchange

Commission and is incorporated herein by reference.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

The following exhibits are being furnished herewith:

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

Date: May 17, 2019

|

|

|

|

|

|

|

SENESTECH, INC.

|

|

|

|

|

|

|

By:

|

/s/ Thomas C. Chesterman

|

|

|

|

Thomas C. Chesterman

|

|

|

|

Chief Financial Officer

|

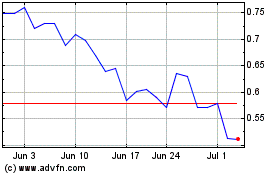

SenesTech (NASDAQ:SNES)

Historical Stock Chart

From Mar 2024 to Apr 2024

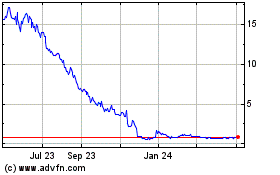

SenesTech (NASDAQ:SNES)

Historical Stock Chart

From Apr 2023 to Apr 2024