Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

VITALIBIS, INC.

(Exact name of Registrant as specified

in its charter)

|

Nevada

|

|

0001636509

|

|

30-0828224

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

3960 Howard Hughes Parkway, Suite 500

Las

Vegas, NV 89169

702-944-9620

(Address, including zip code, and telephone

number,

including area code, of Registrant’s

principal executive offices)

Steven Raack

3960 Howard Hughes Parkway, Suite 500

Las

Vegas, NV 89169

702-944-9620

(Name, address, including zip code, and

telephone number,

including area code, of agent for service)

Copies to:

Michael J. Morrison, Esq.

Michael J. Morrison, Chtd.

1495 Ridgeview Dr., Ste. 220

Reno, NV 89519

(775) 827-6300

As soon as practicable after the effective

date of this Registration Statement.

(Approximate date of commencement of

proposed sale to the public)

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the

following box: [ ]

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the

Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration

statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration

statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act.

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

|

(Do not check if a smaller reporting company)

|

|

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided to Section 7(a)(2)(B) of the Securities Act. [X]

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

|

|

Amount

to be

Registered

|

|

Proposed

Maximum

Offering Price

Per Unit (1)(2)

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration Fee

|

|

Primary Offering:

|

|

|

|

|

|

|

|

|

|

|

|

Common stock, par value $0.001 per share (3)

|

|

5,000,000

|

|

$1.00

|

|

$5,000,000

|

|

|

$ 606.00(5)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secondary Offering:

(8)

|

|

|

|

|

|

|

|

|

|

|

|

Warrants (4)

|

|

3,500,000

|

|

1.00

|

|

$3,500,000

|

|

|

$424.20

|

|

|

Common Stock, par value $0.001 per share, underlying common stock purchase warrants

|

|

3,500,000

|

|

$1.00

|

|

$3,500,000

|

|

|

$424.20

|

|

|

Common stock, par value $0.001 per share (3)

|

|

4,161,371

|

|

$1.00

|

|

$4,161,371

|

|

|

$504.36

|

|

|

Common stock, par value $0.001 per share (7)

|

|

5,321,400

|

|

$1.00

|

|

$5,321,400

|

|

|

$644.95

|

|

|

Total secondary offering

|

|

|

|

|

|

|

|

|

|

|

|

Total

(primary and secondary offerings)

|

|

21,482,771

|

|

$1.00

|

|

$21,482,771

|

(8)

|

|

$2,603.71

|

(9)

|

(1) To be determined.

(2) The registrant, or the selling stockholders,

as applicable, will determine the proposed maximum offering price per share from time to time in connection with, and at the time

of, the issuance of the securities registered hereby. Securities registered hereby may be offered for U.S. dollars or foreign currencies

or currency units and may be sold separately or together in units with other securities registered hereby.

(3) Also includes such indeterminate principal

amount, liquidation amount or number of securities as may be issued upon conversion or exchange of any securities that provide

for conversion or exchange into other securities. Separate consideration may or may not be received by the registrant for securities

that are issuable on exercise, conversion or exchange of other securities.

(4) The warrants registered hereby may

be warrants to purchase common stock, preferred stock or debt securities.

(5) Estimated solely for purposes of calculating

the registration fee pursuant to Rule 457(o) under the Securities Act. The aggregate maximum offering price of all securities offered

and sold by the registrant pursuant to this registration statement shall not have a maximum aggregate offering price that exceeds

$5,000,000 in U.S. dollars or the equivalent at the time of offering in any other currency.

(6) Calculated in accordance with Rule

457(o) under the Securities Act.

(7) Up to 3,571,400 shares of common stock may from time to time be sold pursuant to this registration

statement by the selling stockholders named herein. Includes shares of common stock issued to the selling stockholders and an additional

1,750,000 shares of common stock that may be earned by certain of the selling stockholders.

(8) Estimated solely for purposes of calculating

the registration fee pursuant to Rule 457(c) under the Securities Act based on the average of the high and low prices per share

of the registrant’s common stock on May 10 2019, as reported by the OTC Markets Group’s OTCQB.

(9) Calculated in accordance with Rule

457(c) under the Securities Act.

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment

which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act, or until the registration statement shall become effective on such date as the Commission, acting pursuant

to said Section 8(a), may determine.

The information in this prospectus is not complete

and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission

is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted.

Subject to Completion, dated

May 16, 2019

PROSPECTUS

Vitalibis,

Inc.

5,000,000

SHARES

OF COMMON STOCK

(Offered by the Company)

5,321,400

SHARES OF COMMON STOCK

(Offered by the Selling Stockholders)

3,500,000

COMMON

STOCK PURCHASE WARRANTS

(Offered by the Selling Warrant Holder)

3,500,000

SHARES OF

Common Stock underlying common stock

purchase warrants

The specific terms of any securities to

be offered by us or the selling stockholders or the selling Warrant Holder, and the specific manner in which they may be offered,

will be described in a supplement to this prospectus. You should read this prospectus and each applicable prospectus supplement

carefully before you invest. This prospectus may not be used to sell securities unless accompanied by a prospectus supplement.

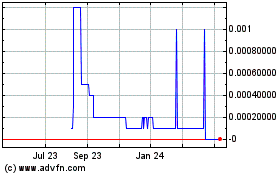

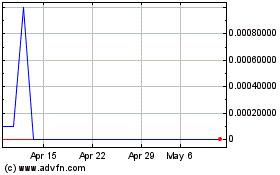

Our common stock is quoted by the OTC Markets

Group’s OTCQB under the symbol “VCBD.” We have not yet determined whether any of the other securities that may

be offered by this prospectus and a prospectus supplement will be listed on any exchange, inter-dealer quotation system or over-the-counter

market. Our principal executive offices are located at 3960 Howard Hughes Parkway, Suite 500,

Las

Vegas, NV 89169,

and our telephone number is

702-944-9620.

Investing in our securities involves

risks. You should carefully read and consider the risk factors included in our periodic reports and other information that

we file with the Securities and Exchange Commission and that are incorporated by reference into this prospectus or any prospectus

supplement before you invest in our securities. See “Risk Factors” on page 4 of this prospectus and any risk factors

contained in any applicable prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2019.

ABOUT THIS PROSPECTUS

Unless otherwise indicated or the context

otherwise requires, all references in this prospectus to “we,” “us,” the “Company” and “VCBD”

mean Vitalibis, Inc. and, where appropriate, our consolidated subsidiaries.

This prospectus is part of a registration

statement that we filed with the Securities and Exchange Commission (the “SEC”).

We, and the selling stockholders and selling

warrant holder may offer and sell these securities to or through one or more underwriters, dealers and agents, or directly to purchasers,

on a continuous or delayed basis.

This prospectus describes some of the

general terms that may apply to the securities offered by us or the selling stockholders or the selling warrant holder, and the

general manner in which they may be offered.

This Form S-1 and prospectus relating thereto includes:

|

|

(a)

|

the sale of up to 5,000,000 shares of the Company's common stock by the Company (the "Company’s Securities"),

|

|

|

(b)

|

the resale of

5,321,400 shares held by certain stockholders of the Company named in the registration statement (“Selling

Stockholders”), previously purchased by the Selling Stockholders in a Private Placement at $1.00 per share,

|

|

|

(c)

|

the resale of 1,500,000 common stock purchase warrants held by one stockholder of the Company named in the registration statement (“Selling Warrant Holder”), previously acquired in conjunction with an agreement with the Company,

|

|

|

(d)

|

3,500,000 shares of our common stock issuable upon exercise of common stock purchase warrants held by the selling

warrant holder, with 1,500,000 exercisable at $1.01 per share and 2,000,000 exercisable at $1.50.

|

|

|

(e)

|

4,161,371 shares of our common stock issuable upon conversion or exchange of any securities that provide for conversion or exchange into other securities.

|

The registration statement, while effective, allows the Selling

Warrant older named in the registration statement to publicly sell the Warrants. The Company will not receive any proceeds from

the sale of the Warrants by the selling warrant holder.

Upon the cash exercise of the warrants,

the Company will receive the exercise price of the warrants. There can be no assurance any warrants will be exercised.

There are no underwriting commissions involved

in this offering. We have agreed to pay all the costs and expenses of this offering. Selling shareholders will pay no offering

expenses. As of the date of this prospectus, there is a limited trading market in our common stock. Our common stock is currently

listed on OTCQB. There is no guarantee that our securities will ever trade on the NASDAQ or other exchange.

This offering is highly

speculative and these securities involve a high degree of risk and should be considered only by persons who can afford the loss

of their entire investment. Additionally, auditors have expressed substantial doubt as to our Company’s ability to continue

as a going concern.

See

“Risk Factors” beginning on page ___,

infra

.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the

accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus provides you with a general

description of the securities we or the selling stockholders may offer. Each time we or the selling stockholders sell securities,

we will provide a prospectus supplement that will contain specific information about the terms and manner of that offering. The

accompanying prospectus supplement or information incorporated by reference into this prospectus after the date of this prospectus

may also add, update or change information contained in this prospectus. Any such information that is inconsistent with this prospectus

will supersede the information in this prospectus. You should read both this prospectus and the accompanying prospectus supplement

together with the additional information described under the heading “Where You Can Find More Information.”

You should rely only on the information

we have provided or incorporated by reference into this prospectus, any applicable prospectus supplement and any related free writing

prospectus. Neither we nor the selling stockholders have authorized anyone to provide you with different information. No dealer,

salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any

applicable prospectus supplement or any related free writing prospectus.

Neither the delivery of this prospectus

nor any sale made under it implies that the information in this prospectus is correct as of any date after the date of this prospectus.

You should assume that the information in this prospectus, any applicable prospectus supplement or any related free writing prospectus

is accurate only as of the date thereof and that any information incorporated by reference in this prospectus, any applicable prospectus

supplement or any related free writing prospectus is accurate only as of the date of the document incorporated by reference, regardless

of the time of delivery of this prospectus, any applicable prospectus supplement or any related free writing prospectus, or any

sale of a security.

This prospectus contains summaries of certain

provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information.

All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein

have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus

is a part, and you may obtain copies of those documents as described below under “Incorporation by Reference.”

TABLE OF CONTENTS

You should rely only on the information

contained in this prospectus and any free writing prospectus prepared by us or on our behalf. We have not authorized anyone to

provide you with different or additional information. If anyone provides you with different or additional information, you should

not rely on it. The information in this prospectus is accurate only as of the date on the front of this prospectus. Our business,

financial condition, results of operations and prospects may have changed since the date of this prospectus. This prospectus is

not an offer or solicitation relating to the securities in any jurisdiction in which such an offer or solicitation relating to

the securities is not authorized. You should not consider this prospectus to be an offer or solicitation relating to the securities

if the person making the offer or solicitation is not qualified to do so, or if it is unlawful for you to receive such an offer

or solicitation.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly

and current reports, proxy statements, and other information with the SEC. Such reports, proxy statements, and other information

concerning us can be read and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 or

on the Internet at http://www.sec.gov. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room.

The

SEC also maintains a web site at http://www.sec.gov that contains reports, proxy statements and other information about issuers,

such as us, who file electronically with the SEC.

This prospectus is

part of a registration statement on Form S-1 under the Securities Act of 1933, as amended (the “Securities Act”) with

respect to the securities covered by this prospectus. This prospectus, which is a part of the registration statement, does not

contain all of the information set forth in the registration statement or the exhibits and schedules filed therewith. For further

information with respect to us and the securities covered by this prospectus, please see the registration statement and the exhibits

filed with the registration statement. A copy of the registration statement and the exhibits filed with the registration

statement may be inspected without charge from the SEC as indicated above, or from us as indicated under “Incorporation by

Reference.”

INCORPORATION BY REFERENCE

The SEC allows us

to “incorporate by reference” into this prospectus the information that we file with the SEC. This permits us to disclose

important information to you by referring to these filed documents. Any information referred to in this way is considered part

of this prospectus, and any information filed with the SEC by us after the date of this prospectus will automatically be deemed

to update and supersede this information. We incorporate by reference the following documents that have been filed with the SEC

(other than, in each case, documents or information deemed furnished and not filed in accordance with SEC rules, including pursuant

to Item 2.02 or Item 7.01 or any related exhibit furnished under Item 9.01(d) of Form 8-K, and no such information shall be deemed

specifically incorporated by reference hereby):

|

|

·

|

Annual Reports on Form 10-K for the fiscal years ended December 31, 2017 and December 31, 2018;

|

|

|

·

|

Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2018, June 30, 2018, September 30, 2018 and

March 31, 2019;

|

|

|

·

|

Current Report on Form 8-K filed with the SEC on November 15, 2018; and

|

|

|

·

|

The description of our common stock contained in our Registration Statement on Form S-1, filed with the SEC on March 25, 2015

(File No. 333-202970), and any amendment or reports filed for the purpose of updating such description.

|

We also incorporate

by reference any future filings (other than information in such documents that is not deemed to be filed) made with the SEC pursuant

to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) until

we file a post-effective amendment which indicates the termination of the offering of the securities made by this prospectus.

We

will provide without charge upon written or oral request a copy of any or all of the documents that are incorporated by reference

into this prospectus, other than exhibits which are specifically incorporated by reference into such documents. Requests should

be directed to our Corporate Secretary at Vitalibis, Inc., 3960 Howard Hughes Parkway, Suite 500,

Las

Vegas, NV 89169

, telephone number is

702-944-9620.

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus and

the documents incorporated by reference herein contain forward-looking statements within the meaning of Section 27A of the Securities

Act and Section 21E of the Exchange Act. Some of these statements can be identified by use of forward-looking words such as “believes,”

“expects,” “anticipates,” “may,” “will,” “should,” “seeks,”

“approximately,” “intends,” “plans” or “estimates,” or the negative of these words,

or other comparable terminology. The discussion of financial trends, strategy, plans or intentions may also include forward-looking

statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from

those projected, anticipated, or implied. Although it is not possible to predict or identify all such risks and uncertainties,

they may include, but are not limited to, the factors discussed under “Risk Factors” in our most recent Annual Report

on Form 10-K, in our Quarterly Reports on Form 10-Q, in any prospectus supplement related hereto, and in other information contained

in our publicly available SEC filings and press releases.

You should not consider

this list to be a complete statement of all risks and uncertainties. You are cautioned not to place undue reliance on any such

forward-looking statements, which speak only as of the date such statements were first made. Except to the extent required by federal

securities laws, we undertake no obligation to publicly release the result of any revisions to these forward-looking statements

to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

RISK FACTORS

As

a “smaller reporting company”, we are not required to provide the information required by this Item.

However,

investing in our securities involves significant risks. You should carefully consider the risks factors set forth in the documents

and reports filed by us with the SEC and incorporated by reference into this prospectus, as well as any risks described or incorporated

by reference in any applicable prospectus supplement before deciding whether to buy our securities. Additional risks and uncertainties

not presently known to us or that we believe are immaterial may also significantly impair our business operations. If any of these

risks actually occur, our business, financial condition and results of operations could be materially affected, and you could lose

all or part of your investment in offered securities.

You should carefully

consider the risks discussed under “Risk Factors” in our most recent Annual Report on Form 10-K, in our Quarterly

Reports on Form 10-Q, in any prospectus supplement related hereto, and in other information contained in our publicly available

SEC filings and press releases. See “Where You Can Find Additional Information.”

You should rely only on the

information contained in this prospectus and any free writing prospectus prepared by us or on our behalf. We have not authorized

anyone to provide you with different or additional information. If anyone provides you with different or additional information,

you should not rely on it. The information in this prospectus is accurate only as of the date on the front of this prospectus.

Our business, financial condition, results of operations and prospects may have changed since the date of this prospectus. This

prospectus is not an offer or solicitation relating to the securities in any jurisdiction in which such an offer or solicitation

relating to the securities is not authorized. You should not consider this prospectus to be an offer or solicitation relating

to the securities if the person making the offer or solicitation is not qualified to do so, or if it is unlawful for you to receive

such an offer or solicitation.

PROSPECTUS SUMMARY

This summary highlights certain information

appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider

prior to investing. After you read this summary, you should read and consider carefully the more detailed information and financial

statements and related notes that we include in this prospectus, especially the sections entitled “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations.” If you invest in our

securities, you are assuming a high degree of risk.

Unless we have indicated otherwise or

the context otherwise requires, references in the prospectus to “Greater Cannabis Company” the “Company,”

“we,” “us” and “our” or similar terms are to Vitalibis, Inc.

Going Concern

The

Company intends to overcome the circumstances that impact its ability to remain a going concern through a combination of the expansion

of revenues, with interim cash flow deficiencies being addressed through additional equity and debt financing. The Company anticipates

raising additional funds through public or private financing, strategic relationships or other arrangements in the near future

to support its business operations; however, the Company may not have commitments from third parties for a sufficient amount of

additional capital. The Company cannot be certain that any such financing will be available on acceptable terms, or at all, and

its failure to raise capital when needed could limit its ability to continue its operations. The Company’s ability to obtain

additional funding will determine its ability to continue as a going concern. Failure to secure additional financing in a timely

manner and on favorable terms would have a material adverse effect on the Company’s financial performance, results of operations

and stock price and require it to curtail or cease operations, sell off its assets, seek protection from its creditors through

bankruptcy proceedings, or otherwise. Furthermore, additional equity financing may be dilutive to the holders of the Company’s

common stock, and debt financing, if available, may involve restrictive covenants, and strategic relationships, if necessary,

to raise additional funds, and may require that the Company relinquish valuable rights. Please see

NOTE 1- ORGANIZATION AND

GOING CONCERN

for further information.

There can be no assurance that sufficient

funds required during the next year or thereafter will be generated from operations or that funds will be available from external

sources such as debt or equity financings or other potential sources. The lack of additional capital resulting from the inability

to generate cash flow from operations or to raise capital from external sources would force the Company to substantially curtail

or cease operations and would, therefore, have a material adverse effect on its business. Furthermore, there can be no assurance

that any such required funds, if available, will be available on attractive terms or that they will not have a significant dilutive

effect on the Company’s existing stockholders.

Company

We

market and sell consumer products containing

full Spectrum

phytocannabinoid rich hemp oil with naturally occurring CBD

under our

Vitalibis™

brand in a

range of market sectors including wellness, and beauty care. We currently distribute 3 products and we expect to continue to

add new products to our

Vitalibis™

portfolio to enhance our line of

full

spectrum phyto-cannabinoid rich hemp products with naturally occurring cannabidiol (CBD)

and hemp-related consumer

products. We also expect to develop and launch new brands under the

Vitalibis™

product development umbrella to

more effectively market and sell certain products. We also sell

full spectrum

phyto-cannabinoid rich hemp powder with naturally occurring cannabidiol (CBD)

acquired through our supply

relationships in the United States to various customers that produce products for resale into the market. We also began

offering of our technology back-end which is being offered as a Software as a Service (SaaS) platform.

We seek to take

advantage of an emerging worldwide trend to re-energize the production of industrial hemp and to foster its many uses for consumers.

Historically cultivated for industrial and practical purposes, hemp is used today for textiles, paper, auto parts, biofuel, cosmetics,

animal feed, nutritional supplements, and much more. The market for hemp-derived products is expected to increase substantially

over the next five years, and we believe Vitalibis™ is well positioned to be a significant player in the hemp industry.

Hemp-derived

CBD is one of at least 80 cannabinoids found in hemp, and is non-psychoactive. Our U.S. based supplier oversees our raw material

supply chain and raw material processing. Our internal team manages product development and manufacturing, and sales and marketing.

We will continue to scale-up our processing capability to accommodate new products in our pipeline.

Government

Regulation

We are not yet aware of any direct government

regulations relating to the marketing of CBD-related products containing less than 0.03 parts THC, which are the only products

we currently sell and intend to sell.

Emerging Growth Company

We are an “emerging growth company,”

as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable

to other public companies.

Section 107(b) of the JOBS Act provides

that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B)

of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company”

can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We could remain an “emerging growth

company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross

revenues are $1 billion, as adjusted, or more, (ii) the date that we become a “large accelerated filer” as defined

in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which would occur if the

market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently

completed second fiscal quarter, and (iii) the date on which we have issued more than $1 billion in non-convertible debt during

the preceding three-year period.

THE OFFERING

|

Securities offered

|

|

Up to 5,000,000 shares of our Common Stock by the Company

|

|

|

|

|

|

|

|

Up to 5,321,400 shares of our Common Stock

by the Selling Shareholders

Up to 3,500,000 Common Stock Purchase Warrants

by the Selling Warrant Holders

Up to 3,500,000 shares of common stock

underlying the Common Stock Purchase Warrants by the Selling Warrant Holders

4,161,371 shares of common stock issuable

upon conversion or exchange of any securities that provide for conversion or exchange into other securities

|

|

|

|

|

|

Offering Amount

|

|

$ 21,482,771

|

|

|

|

|

|

Offering price

|

|

$ 1.00 per share of Common Stock offered

by the Company

Determined at the time of sale by the selling

security holders

|

|

|

|

|

|

Common Stock Issued and Outstanding Before This Offering

|

|

30,781,400 (as of May 10, 2019)

|

|

|

|

|

|

Common Stock Issued and Outstanding After This Offering

|

|

30,781,4700 (1)(2)

|

|

|

|

|

|

Risk Factors

|

|

See

“Risk Factors” beginning on page ____ and the other information set forth in this prospectus for a discussion of factors you should consider before deciding to invest in our securities.

|

|

|

|

|

|

Market for Common Stock

|

|

VCBD - OTCQB

|

|

|

|

|

|

Dividends

|

|

We have not declared or paid any dividends on our common stock since our inception, and we do not anticipate paying any such dividends for the foreseeable future.

|

(1) BLB was issued a warrant to purchase 1,500,000 shares of

the Company’s common stock, and an additional 2,000,000 warrants were issued to a contractor. The shares to be issued under

these warrants were not included in the offering nor in the calculation of the shares outstanding as of May10, 2019. In the event

that BLB and the contractor were to fully exercise their warrants, the total number of shares outstanding would increase to 34,281,400.

Please see

NOTE 6- STOCKHOLDERS’ DEFICIT

for further information. We will however, receive proceeds from the issuance

of 3,500,000 shares of our common stock underlying the warrant issued to BLB pursuant to the Securities Purchase Agreement dated

December 31, 2018 and the independent contact agreement dated March 29, 2019. The BLB warrants have an exercise price of $1.01

and are exercisable for a period of two (2) years. The contractor warrants have an exercise price of $1.50 per share and are excersiable

for a period of three (3) years, with an additional one year term at the holders option.

(2) On January 10, 2019, the Company entered into a Securities

Purchase Agreement with Power Up Lending, LLC (“PUL”). As per the terms of the Agreement, the Company is required to

reserve One Million One Hundred Sixty Three Thousand and Seventy Six shares (1,163,076) of the Company’s common stock. Simultaneous

with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to PUL in the amount of One Hundred

Twenty Six Thousand NO/100 Dollars ($126,000.00). The shares reserved in the PUL transaction will not be issued until the Company

receives a Notice of Conversion, and are not included in the shares calculated in the common stock issued and outstanding before

this offering within “The Offering” table. Please see NOTE 5- CONVERTIBLE NOTES PAYABLE for further information.

On February 7, 2019, the Company entered into a Securities Purchase

Agreement with Power Up Lending, LLC (“PUL”). As per the terms of the Agreement, the Company is required to reserve

Seven Hundred Sixty Six Thousand One Hundred and Fifty Three shares (766,153) of the Company’s common stock. Simultaneous

with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to PUL in the amount of Eighty Three

Thousand NO/100 Dollars ($83,000.00). The shares reserved in the PUL transaction will not be issued until the Company receives

a Notice of Conversion, and are not included in the shares calculated in the common stock issued and outstanding before this offering

within “The Offering” table. Please see

NOTE 5- CONVERTIBLE NOTES PAYABLE

for further information.

On March 29, 2019, the Company entered into a Securities Purchase

Agreement with Triton Funds LP (“Triton”). As per the terms of the Agreement, the Company is required to reserve Two

Million Two Hundred and Thirty Two Thousand One Hundred and Forty Two shares (2,232,142) of the Company’s common stock. Simultaneous

with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to PUL in the amount of Two Hundred

and Fifty Thousand NO/100 Dollars ($250,000.00). The shares reserved in the PUL transaction will not be issued until the Company

receives a Notice of Conversion, and are not included in the shares calculated in the common stock issued and outstanding before

this offering within “The Offering” table. Please see NOTE 9- SUBSEQUENT EVENTS for further information.

SUMMARY FINANCIAL DATA

The following summary of our financial

data should be read in conjunction with, and is qualified in its entirety by reference to, “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements, appearing elsewhere

in this prospectus.

Statements of Operations Data

|

|

|

For the

Three months Ended March 31, 2019

|

|

|

For the

year-ended

December 31, 2018

|

|

|

For the

year-ended

December 31, 2017

|

|

|

Revenue

|

|

$

|

139,585

|

|

|

$

|

51,331

|

|

|

$

|

–

|

|

|

Loss from operations

|

|

$

|

(2,445,159

|

)

|

|

$

|

(2,227,920

|

)

|

|

$

|

(102,865

|

)

|

|

Net loss

|

|

$

|

(2,448,499

|

)

|

|

$

|

(2,228,620

|

)

|

|

$

|

(102,904

|

)

|

Balance Sheets Data

|

|

|

As of

March 31, 2019

|

|

|

As of

December 31, 2018

|

|

|

As of

December 31, 2017

|

|

|

Cash

|

|

$

|

60,679

|

|

|

$

|

171,979

|

|

|

$

|

–

|

|

|

Total assets

|

|

$

|

408,682

|

|

|

$

|

570,407

|

|

|

$

|

–

|

|

|

Total liabilities

|

|

$

|

235,772

|

|

|

$

|

180,389

|

|

|

$

|

6,169

|

|

|

Total stockholders’ equity (deficit)

|

|

$

|

172,910

|

|

|

$

|

390,018

|

|

|

$

|

(6,169

|

)

|

RISK FACTORS

NOTE ABOUT FORWARD-LOOKING STATEMENTS

Statements under “Prospectus Summary,”

“Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,”

“Description of Business” and elsewhere in this prospectus may be “forward-looking statements.” Forward-looking

statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions

or any other statements relating to our future activities or other future events or conditions. These statements include, among

other things, statements regarding:

|

|

·

|

the growth of our business and revenues and our expectations about the factors that influence our success;

|

|

|

·

|

our plans to continue to invest in systems, facilities, and infrastructure, increase our hiring and grow our business;

|

|

|

·

|

our plans for the build out and expansion of our online store and portal, GCC Superstore, and the strategy and timing of any

plans to monetize our network;

|

|

|

·

|

our user growth expectations;

|

|

|

·

|

our ability to attain funding and the sufficiency of our sources of funding;

|

|

|

·

|

our expectation that our cost of revenues, development expenses, sales and marketing expenses, and general and administrative

expenses will increase;

|

|

|

·

|

fluctuations in our capital expenditures; and

|

|

|

·

|

our plans for potential business partners and any acquisition plans;

|

as well as other statements regarding our

future operations, financial condition and prospects, and business strategies. These statements are based on current expectations,

estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees

of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes

and results may, and are likely to, differ materially from what is expressed or forecasted in the forward-looking statements due

to numerous factors, including those described above and those risks discussed from time to time in this registration statement,

of which this prospectus is a part, including the risks described under “Risk Factors.” Any forward-looking statements

speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement

to reflect events or circumstances that occur in the future.

If one or more of these or other risks

or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what

we may have projected. Any forward-looking statements you read in this prospectus reflect our current views with respect to future

events and are subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations,

financial condition, growth strategy and liquidity. You should specifically consider the factors identified in this prospectus

that could cause actual results to differ before making an investment decision. In addition, as discussed in “Risk Factors,”

our shares may be considered a “penny stock” and, as a result, the safe harbors provided for forward-looking statements

made by a public company that files reports under the federal securities laws may not be available to us.

TAX CONSIDERATIONS

We are not providing any tax advice as

to the acquisition, holding or disposition of the securities offered herein. In making an investment decision, investors are strongly

encouraged to consult their own tax advisor to determine the U.S. Federal, state and any applicable foreign tax consequences relating

to their investment in our securities.

USE OF PROCEEDS

This prospectus relates to the sale of

5 million shares of our common stock by the company. The proceeds of our offering will be used for general working capital, including

marketing, product development and corporate compliance expenses.

This prospectus also relates to shares

of our common stock and warrants that may be offered and sold from time to time by the selling stockholders/warrant holders. We

will not receive any proceeds from the sale of shares of common stock or warrants in this offering.

DETERMINATION OF OFFERING PRICE

The pricing of the Shares has been arbitrarily

determined and established by the Company. No independent accountant or appraiser has been retained to protect the interest of

the investors. No assurance can be made that the offering price is in fact reflective of the underlying value of the Shares. Each

prospective investor is urged to consult with his or her counsel and/or accountant as to offering price and the terms and conditions

of the Shares. Factors to be considered in determining the price include the amount of capital expected to be required, the market

for securities of entities in a new business venture, projected rates of return expected by prospective investors of speculative

investments, the Company’s prospects for success and prices of similar entities.

DILUTION

The Company does not have adequate revenue

to fund all of its operational needs and may require additional financing to continue its operations if it is unable to generate

substantial revenue growth. There can be no assurance that such financing will be available at all or on favorable terms. Failure

to generate substantial revenue growth could result in delay or indefinite postponement of the Company’s deployment of its

products, and may result in the Company looking to obtain such additional financing, resulting in possible dilution. Any such financing

will dilute the ownership interest of the Company’s shareholders at the time of the financing, and may dilute the value of

their shareholdings.

PLAN OF DISTRIBUTION

The selling stockholders and any of their

respective pledgees, donees, assignees and other successors-in-interest may, from time to time, sell any or all of their shares

of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These

sales may be at fixed or negotiated prices. The selling stockholders may use any one or more of the following methods when selling

shares:

|

|

·

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits the purchaser;

|

|

|

·

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the

block as principal

|

|

|

·

|

facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

·

|

privately-negotiated transactions;

|

|

|

·

|

broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per

share;

|

|

|

·

|

through the writing of options on the shares;

|

|

|

·

|

a combination of any such methods of sale; and

|

|

|

·

|

any other method permitted pursuant to applicable law.

|

The selling stockholders may also sell

shares under Rule 144 of the Securities Act, if available, rather than under this prospectus. The selling stockholders shall have

the sole and absolute discretion not to accept any purchase offer or make any sale of shares if it deems the purchase price to

be unsatisfactory at any particular time.

The selling stockholders or their respective

pledgees, donees, transferees or other successors in interest, may also sell the shares directly to market makers acting as principals

and/or broker-dealers acting as agents for themselves or their customers. Such broker-dealers may receive compensation in the form

of discounts, concessions or commissions from the selling stockholders and/or the purchasers of shares for whom such broker-dealers

may act as agents or to whom they sell as principal or both, which compensation as to a particular broker-dealer might be in excess

of customary commissions. Market makers and block purchasers purchasing the shares will do so for their own account and at their

own risk. It is possible that a selling stockholder will attempt to sell shares of common stock in block transactions to market

makers or other purchasers at a price per share which may be below the then existing market price. We cannot assure that all or

any of the shares offered in this prospectus will be issued to, or sold by, the selling stockholders. The selling stockholders

and any brokers, dealers or agents, upon effecting the sale of any of the shares offered in this prospectus, may be deemed to be

“underwriters” as that term is defined under the Securities Exchange Act of 1933, as amended, the Securities Exchange

Act of 1934, as amended, and the rules and regulations of such acts. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act.

We are required to pay all fees and expenses

incident to the registration of the shares, including fees and disbursements of counsel to the selling stockholders, but excluding

brokerage commissions or underwriter discounts.

The selling stockholders, alternatively,

may sell all or any part of the shares offered in this prospectus through an underwriter. The selling stockholders have not entered

into any agreement with a prospective underwriter and there is no assurance that any such agreement will be entered into.

The selling stockholders may pledge their

shares to their brokers under the margin provisions of customer agreements. If a selling stockholder defaults on a margin loan,

the broker may, from time to time, offer and sell the pledged shares. The selling stockholders and any other persons participating

in the sale or distribution of the shares will be subject to applicable provisions of the Securities Exchange Act of 1934, as amended,

and the rules and regulations under such Act, including, without limitation, Regulation M. These provisions may restrict certain

activities of, and limit the timing of purchases and sales of any of the shares by, the selling stockholders or any other such

person. In the event that any of the selling stockholders are deemed an affiliated purchaser or distribution participant within

the meaning of Regulation M, then the selling stockholders will not be permitted to engage in short sales of common stock. Furthermore,

under Regulation M, persons engaged in a distribution of securities are prohibited from simultaneously engaging in market making

and certain other activities with respect to such securities for a specified period of time prior to the commencement of such distributions,

subject to specified exceptions or exemptions. In addition, if a short sale is deemed to be a stabilizing activity, then the selling

stockholders will not be permitted to engage in a short sale of our common stock. All of these limitations may affect the marketability

of the shares.

If a selling stockholder notifies us that

it has a material arrangement with a broker-dealer for the resale of the common stock, then we would be required to amend the registration

statement of which this prospectus is a part, and file a prospectus supplement to describe the agreements between the selling stockholder

and the broker-dealer.

DESCRIPTION OF SECURITIES

Common Stock

Our authorized capital consists of

112,500,000 shares of common stock, par value $.001 per share (the “Common Stock”) and 5,000,000 shares of preferred

stock, par value $.001 per share (the “Preferred Stock”). As of December 31, 2018, the Company had 29,638,900 shares

of Common Stock issued and outstanding and no shares of Preferred stock issued and outstanding. As of May 10, 2019, the Company

had 30,781,400 shares of Common Stock issued and outstanding and no shares of Preferred stock issued and outstanding.

Holders of the Company’s common stock

are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of common stock do not have cumulative

voting rights. Therefore, holders of a majority of the shares of common stock voting for the election of directors can elect all

of the directors. Holders of the Company’s common stock representing a majority of the voting power of the Company’s

capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum

at any meeting of stockholders. A vote by the holders of a majority of the Company’s outstanding shares is required to effectuate

certain fundamental corporate changes such as liquidation, merger or an amendment to the Company’s articles of incorporation.

Holders of the Company’s common

stock are entitled to share in all dividends that the board of directors, in its discretion, declares from legally available funds.

In the event of a liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in

all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over

the common stock. The Company’s common stock has no pre-emptive rights, no conversion rights and there are no redemption

provisions applicable to the Company’s common stock.

Preferred Stock

Our Articles of Incorporation authorizes

the issuance of up to 5,000,000 shares of preferred stock with designations, rights and preferences determined from time to time

by its Board of Directors. Accordingly, our Board of Directors is empowered, without stockholder approval, to issue preferred stock

with dividend, liquidation, conversion, voting, or other rights which could adversely affect the voting power or other rights of

the holders of the common stock. In the event of issuance, the preferred stock could be utilized, under certain circumstances,

as a method of discouraging, delaying or preventing a change in control of the Company. Although we have no present intention to

issue any shares of its authorized preferred stock, there can be no assurance that the Company will not do so in the future.

Options and Warrants

On January 16, 2019, the Company

issued a warrant to Bruce Lee Beverage, LLC (“BLB”) granting BLB the right to purchase 1,500,000 shares of the

Company’s common stock at an exercise price of $1.01 per share. The warrant has a term of 2 years and expires on

January 16, 2021. Please see

NOTE 5- STOCKHOLDERS’ DEFICIT

for further information.

In March 2019, the Company entered into

an agreement with a contractor for services. This contractor may earn a total of 1,000,000 shares of common stock and 2,000,000

warrants to purchase common stock. The contractor can elect to extend the term for an additional year with 90 days’ notice.

Of the total awards, 250,000 shares and 334,000 warrants were earned upon execution of the agreement, with the 250,000 shares

being issued in April 2019. The warrants were issued March 29, 2019 and have an exercise price of $1.50 per share, and an initial

term of 3 years from the date of issuance. The remaining shares and warrants vest upon completion of certain performance-related

milestones. Please see

NOTE 6- STOCKHOLDERS’ DEFICIT

for further information.

Convertible Notes

On January 10, 2019, the Company entered

into a Securities Purchase Agreement with Power Up Lending, LLC (“PUL”). As per the terms of the Agreement, the Company

is required to reserve One Million One Hundred Sixty Three Thousand and Seventy Six shares (1,163,076) of the Company’s

common stock. Simultaneous with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to PUL

in the amount of One Hundred Twenty Six Thousand NO/100 Dollars ($126,000.00). The shares reserved in the PUL transaction will

not be issued until the Company receives a Notice of Conversion, and are not included in the shares calculated in the common stock

issued and outstanding before this offering within “The Offering” table. Please see

NOTE 5- CONVERTIBLE NOTES PAYABLE

for further information.

On February 7, 2019, the Company entered

into a Securities Purchase Agreement with Power Up Lending, LLC (“PUL”). As per the terms of the Agreement, the Company

is required to reserve Seven Hundred Sixty Six Thousand One Hundred and Fifty Three shares (766,153) of the Company’s common

stock. Simultaneous with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to PUL in the

amount of Eighty Three Thousand NO/100 Dollars ($83,000.00). The shares reserved in the PUL transaction will not be issued until

the Company receives a Notice of Conversion, and are not included in the shares calculated in the common stock issued and outstanding

before this offering within “The Offering” table. Please see

NOTE 5- CONVERTIBLE NOTES PAYABLE

for further information.

On March 29, 2019, the Company entered

into a Securities Purchase Agreement with Triton Funds LP (“Triton”). As per the terms of the Agreement, the Company

is required to reserve Two Million Two Hundred and Thirty Two Thousand One Hundred and Forty Two shares (2,232,142) of the Company’s

common stock. Simultaneous with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to PUL

in the amount of Two Hundred and Fifty Thousand NO/100 Dollars ($250,000.00). The shares reserved in the PUL transaction will

not be issued until the Company receives a Notice of Conversion, and are not included in the shares calculated in the common stock

issued and outstanding before this offering within “The Offering” table. Please see

NOTE 9- SUBSEQUENT EVENTS

for further information.

INTERESTS OF NAMED EXPERTS AND COUNSEL

The validity of the shares of common stock

offered by the Company hereby will be passed upon for the Registrant by Michael J. Morrison, Chtd., Reno, NV.

DIVIDEND POLICY

We have never paid any cash dividends on

our common stock and anticipate that, for the foreseeable future, no cash dividends will be paid on our common stock.

DESCRIPTION OF BUSINESS

Organization

Vitalibis, Inc. (the “Company”)

was formed on April 11, 2014 as a Nevada corporation, under the name of Crowd 4 Seeds, Inc. On January 9, 2017, the Company filed

a certificate of amendment to its Certificate of Incorporation with the Secretary of State of the State of Nevada in order to change

its name to "Sheng Ying Entertainment Corp." On December 16, 2017, new management took over control of the Company and,

on February 5, 2018, the Company filed a certificate of amendment to its Certificate of Incorporation with the Secretary of State

of the State of Nevada in order to change its name to “Vitalibis, Inc”.

Emerging Growth Company

We are an “emerging growth company,”

as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable

to other public companies.

Section 107(b) of the JOBS Act provides

that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B)

of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company”

can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have

irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section

107(b) of the JOBS Act.

We could remain an “emerging growth

company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross

revenues are $1 billion, as adjusted, or more, (ii) the date that we become a “large accelerated filer” as defined

in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates

exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, and (iii) the date on which

we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

VITALIBIS, INC.

Our principal executive offices are at

3960 Howard Hughes Parkway, Suite 500, Las Vegas, NV 89169,

telephone number is

702-944-9620.

Our website is http://ir.vitalibis.com.

Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and

you should not consider information on our website to be part of this prospectus.

Vitalibis is a

socially conscious brand focused on people, profit, products and the planet. We are a multi-channel marketer and seller of

premium, full spectrum phyto-cannabinoid rich (PCR) hemp products, along with personal care and certified organic nutritional products.

We leverage our proprietary technology platform to maximize our innovative micro-influencer sales model. In addition to selling

high-quality products and building long-term customer relationships, Vitalibis supports non-profits with environmental, health

/ wellness and neuro-emotional missions.

The Company was

incorporated in Nevada on April 11, 2014, as Crowd 4 Seeds Inc. Most of our activity through March 31, 2018, involved incorporation

efforts, registration to become a reporting company, planning our business and developing our website.

After change in

ownership October 2017, the Company had a new management team on board and the Company’s business plan was changed substantially

by the new management team to focus on the marketing of hemp-based products.

We commenced business

operations with respect to our hemp-based products in May 2018, and such operations are continuing. We are now marketing and selling

two (2) of our proprietary products, Signature 300 Hemp Oil and Daily Wellness Super-food Blend, through our website and Pro-Program.

For additional

information visit: https://www.vitalibis.com/

Fundraising and Previous Offerings

BLB was issued a warrant to purchase 1,500,000 shares of the

Company’s common stock, and an additional 2,000,000 warrants were issued to a contractor. The shares to be issued under these

warrants were not included in the offering nor in the calculation of the shares outstanding as of May10, 2019. In the event that

BLB and the contractor were to fully exercise their warrants, the total number of shares outstanding would increase to 34,281,400.

Please see

NOTE 6- STOCKHOLDERS’ DEFICIT

for further information. We will however, receive proceeds from the issuance

of 3,500,000 shares of our common stock underlying the warrant issued to BLB pursuant to the Securities Purchase Agreement dated

December 31, 2018 and the independent contact agreement dated March 29, 2019. The BLB warrants have an exercise price of $1.01

and are exercisable for a period of two (2) years. The contractor warrants have an exercise price of $1.50 per share and are excersiable

for a period of three (3) years, with an additional one year term at the holders option.

On January 10, 2019, the Company entered into a Securities Purchase

Agreement with Power Up Lending, LLC (“PUL”). As per the terms of the Agreement, the Company is required to reserve

One Million One Hundred Sixty Three Thousand and Seventy Six shares (1,163,076) of the Company’s common stock. Simultaneous

with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to PUL in the amount of One Hundred

Twenty Six Thousand NO/100 Dollars ($126,000.00). The shares reserved in the PUL transaction will not be issued until the Company

receives a Notice of Conversion, and are not included in the shares calculated in the common stock issued and outstanding before

this offering within “The Offering” table. Please see NOTE 5- CONVERTIBLE NOTES PAYABLE for further information.

On February 7, 2019, the Company entered into a Securities Purchase

Agreement with Power Up Lending, LLC (“PUL”). As per the terms of the Agreement, the Company is required to reserve

Seven Hundred Sixty Six Thousand One Hundred and Fifty Three shares (766,153) of the Company’s common stock. Simultaneous

with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to PUL in the amount of Eighty Three

Thousand NO/100 Dollars ($83,000.00). The shares reserved in the PUL transaction will not be issued until the Company receives

a Notice of Conversion, and are not included in the shares calculated in the common stock issued and outstanding before this offering

within “The Offering” table. Please see

NOTE 5- CONVERTIBLE NOTES PAYABLE

for further information.

On March 29, 2019, the Company entered into a Securities Purchase

Agreement with Triton Funds LP (“Triton”). As per the terms of the Agreement, the Company is required to reserve Two

Million Two Hundred and Thirty Two Thousand One Hundred and Forty Two shares (2,232,142) of the Company’s common stock.

Simultaneous with the entry into the Securities Purchase Agreement, the Company issued a Convertible Note to PUL in the amount

of Two Hundred and Fifty Thousand NO/100 Dollars ($250,000.00). The shares reserved in the PUL transaction will not be issued

until the Company receives a Notice of Conversion, and are not included in the shares calculated in the common stock issued and

outstanding before this offering within “The Offering” table. Please see NOTE 9- SUBSEQUENT EVENTS for further information.

Employees and Consultants

We have two full-time employees: Steven

Raack and Thomas Raack. We utilize consultants on an as-needed basis.

Insurance

The company has insurance for errors

in missions by its officers and directors in the amount of $2 million. The company also maintains a general umbrella policy for

the company in the amount of $5 million.

Cole Memo

On August 29, 2013, United States Deputy

Attorney General James Cole issued the Cole Memo to United States Attorneys guiding them to prioritize enforcement of Federal law

away from the cannabis industry operating as permitted under certain state laws, so long as:

|

|

·

|

cannabis is not being distributed to minors and dispensaries are not located around schools and public buildings;

|

|

|

·

|

the proceeds from sales are not going to gangs, cartels or criminal enterprises;

|

|

|

·

|

cannabis grown in states where it is legal is not being diverted to other states;

|

|

|

·

|

cannabis-related businesses are not being used as a cover for sales of other illegal drugs or illegal activity;

|

|

|

·

|

there is not any violence or use of fire-arms in the cultivation and sale of marijuana;

|

|

|

·

|

there is strict enforcement of drugged-driving laws and adequate prevention of adverse health consequences; and

|

|

|

·

|

cannabis is not grown, used, or possessed on Federal properties.

|

Trademarks

The success of our business depends on

our continued ability to use our existing trade name in order to increase our brand awareness. In that regard, we believe that

our trade name is valuable asset that is critical to our success. As of the date of this prospectus, we have submitted a trademark

application for “Vitalibis”. There is no guarantee that the U.S. Patent and Trademark Office will grant us a trademark.

The unauthorized use or other misappropriation of our trade name could diminish the value of our business concept and may cause

a decline in our revenue.

Competitors, Methods of Completion,

Competitive Business Conditions

We believe that we face significant direct

competition in the retail sector for CBD products. There are several direct competitors and some sell directly to consumers. The

Company believes the density of CBD consumers and the wide product selection we seek to offer are what we believe will make our

products attractive to CBD consumers and may help to serve as a competitive advantage.

Legal Proceedings

From time to time we may be a defendant

and plaintiff in various legal proceedings arising in the normal course of our business. We are currently not a party to any material

pending legal proceedings or government actions, including any bankruptcy, receivership, or similar proceedings. In addition, management

is not aware of any known litigation or liabilities involving the operators of our properties that could affect our operations.

Should any liabilities be incurred in the future, they will be accrued based on management’s best estimate of the potential

loss. As such, there is no adverse effect on our consolidated financial position, results of operations or cash flow at this time.

Furthermore, Management of the Company does not believe that there are any proceedings to which any director, officer, or affiliate

of the Company, any owner of record of the beneficially or more than five percent of the common stock of the Company, or any associate

of any such director, officer, affiliate of the Company, or security holder is a party adverse to the Company or has a material

interest adverse to the Company.

Sources and Availability of Raw Materials

We utilize various different sources

of raw materials in an effort to help ensure the availability of such materials. However, there is no assurance that the raw materials

be available when we require such materials, or that the price of such materials will be within our budget for such materials.

Seasonal Aspect of our Business

None of our products are affected by seasonal

factors.

Reports to Security Holders

We are required to file reports and other

information with the SEC. You may read and copy any document that we file at the SEC’s public reference facilities at 100

F. Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-732-0330 for more information about its public reference

facilities. Our SEC filings are available to you free of charge at the SEC’s web site at www.sec.gov. We are an electronic

filer with the SEC and, as such, our information is available through the Internet site maintained by the SEC that contains reports,

proxy and information statements and other information regarding issuers that file electronically with the SEC. This information

may be found at www.sec.gov and posted on our website for investors at http://greatercannabiscompany.com/sec-filings/.

PROPERTIES

Since our inception, we have shared space

with our founders/management, but have now established our business offices in shared leased office space at 3960 Howard Hughes

Parkway, Suite 500,

Las Vegas, NV 89169.

We do not own any real property.

We believe that our facilities are adequate

for our current needs and that, if required, we will be able to expand our current space or locate suitable new office space and

obtain a suitable replacement for our executive and administrative headquarters.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION

AND RESULTS OF OPERATION

Please read the following discussion

of our financial condition and results of operations in conjunction with financial statements and notes thereto, as well as the

“Risk Factors” and “Description of Business” sections included elsewhere in this prospectus. The following

discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially

from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those

discussed below and elsewhere in this prospectus, particularly in “Risk Factors”.

Overview

We market and sell consumer products containing

full Spectrum phytocannabinoid rich hemp oil with naturally occurring CBD

under our

Vitalibis™

brand in a range of market sectors including wellness, and beauty care. We currently

distribute 3 products and we expect to continue to add new products to our

Vitalibis™

portfolio to enhance

our line of

full spectrum phyto-cannabinoid rich hemp products with naturally occurring cannabidiol

(CBD)

and hemp-related consumer products. We also expect to develop and launch new brands under the

Vitalibis™

product development umbrella to more effectively market and sell certain products. We also sell

full

spectrum phyto-cannabinoid rich hemp powder with naturally occurring cannabidiol (CBD)

acquired through our supply relationships

in the United States to various customers that produce products for resale into the market. We also began offering of our technology

back-end which is being offered as a Software as a Service (SaaS) platform.

We seek to take

advantage of an emerging worldwide trend to re-energize the production of industrial hemp and to foster its many uses for consumers.

Historically cultivated for industrial and practical purposes, hemp is used today for textiles, paper, auto parts, biofuel, cosmetics,

animal feed, nutritional supplements, and much more. The market for hemp-derived products is expected to increase substantially

over the next five years, and we believe Vitalibis™ is well positioned to be a significant player in the hemp industry.

Hemp-derived

CBD is one of at least 80 cannabinoids found in hemp, and is non-psychoactive. Our U.S. based supplier oversees our raw material

supply chain and raw material processing. Our internal team manages product development and manufacturing, and sales and marketing.

We will continue to scale-up our processing capability to accommodate new products in our pipeline.

We expect to realize

revenue to fund our working capital needs through the sale of finished products and raw materials to third parties. However, in

order to fund our product development efforts, we will need to raise additional capital either through the issuance of equity and/or

the issuance of debt. In the event we are unable to raise sufficient additional capital to fund our product development efforts,

we may need to curtail or delay such activity.

Critical Accounting

Policies

The preparation

of these financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the dates of the financial statements,

and the reported amounts of revenues and expenses during the reporting periods. On an ongoing basis management evaluates its critical

accounting policies and estimates.

A “critical

accounting policy” is one which is both important to the understanding of the financial condition and results of operations

of the Company and requires management’s most difficult, subjective, or complex judgments, and often requires management

to make estimates about the effect of matters that are inherently uncertain. Management believes the following accounting policies

fit this definition:

Revenue

Recognition

-

The Company recognizes revenue in accordance with ASC Topic 606, Revenue From Contracts With Customers, which