AM Best Assigns Issue Credit Rating to Markel Corporation’s New Senior Unsecured Notes

May 16 2019 - 9:30AM

Business Wire

AM Best has assigned the Long-Term Issue Credit Rating of

“bbb+” to the $600 million 5.0% 30-year senior unsecured notes due

May 2049 issued by Markel Corporation (Markel) (Glen Allen, VA)

[NYSE: MKL]. The outlook assigned to this Credit Rating (rating) is

stable. The existing ratings of Markel and its subsidiaries are

unchanged.

AM Best expects Markel to use the proceeds from this offering to

retire upcoming debt obligations due in 2019, in addition to

general corporate purposes. Following this issuance, AM Best

expects Markel’s debt-to-total capital ratio to increase modestly

but remain within the guidelines for the assigned ratings. However,

its debt-to-tangible capital ratio will be elevated by an increase

in goodwill plus intangible assets associated with recent

acquisitions, including the exclusive agreement to acquire Nephila

Capital Ltd., which closed in November 2018. However, concerns

regarding the increase in goodwill plus intangibles as a percentage

of both total equity and capital are offset by the solid cash flows

associated with the businesses acquired, Markel’s strong overall

liquidity evidenced by significant parent-only cash and marketable

securities and its long-term success in executing and integrating

acquired insurance and non-insurance entities.

Although overall earnings and the interest coverage ratio was

impacted negatively by the increase in the frequency and severity

of catastrophe losses in 2017, Markel historically has generated

solid interest coverage ratios, which improved in 2018 and so far

year-to-date in 2019.

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Understanding Best’s Credit Ratings. For

information on the proper media use of Best’s Credit Ratings and AM

Best press releases, please view Guide for Media - Proper

Use of Best’s Credit Ratings and AM Best Rating Action Press

Releases.

AM Best is a global rating agency and information provider

with a unique focus on the insurance industry. Visit

www.ambest.com for more information.

Copyright © 2019 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190516005650/en/

Lewis DeLosaFinancial Analyst+1 908 439 2200,

ext. 5529lewis.delosa@ambest.com

Jennifer MarshallDirector+1 908 439 2200, ext.

5810jennifer.marshall@ambest.com

Christopher SharkeyManager, Public Relations+1

908 439 2200, ext. 5159christopher.sharkey@ambest.com

Jim PeavyDirector, Public Relations+1 908 439

2200, ext. 5644james.peavy@ambest.com

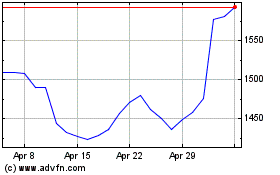

Markel (NYSE:MKL)

Historical Stock Chart

From Mar 2024 to Apr 2024

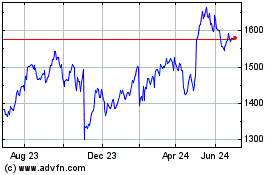

Markel (NYSE:MKL)

Historical Stock Chart

From Apr 2023 to Apr 2024