- Q3 REVENUES OF £152.1 MILLION

- Q3 ADJUSTED EBITDA OF £41.2

MILLION

- Q3 OPERATING PROFIT OF £14.2

MILLION

Manchester United (NYSE: MANU; the “Company” and the “Group”) –

one of the most popular and successful sports teams in the world -

today announced financial results for the 2019 fiscal third quarter

ended 31 March 2019.

Highlights

- Ole Gunnar Solskjær appointed as

permanent manager on a three year contract

- Manchester United Women promoted to

Women’s Super League, winning the FA Women’s Championship

title

- Announced global partnership with

Marriott

- Announced global partnership and

licensing agreement with Maui Jim eyewear

Commentary

Ed Woodward, Executive Vice Chairman, commented, "After a

turbulent season, everyone at Manchester United is focussed on

building towards the success that this great club expects and our

fans deserve. Preparations for the new season are underway and the

underlying strength of our business will allow us to support the

Manager and his team as we look to the future."

Outlook

For fiscal 2019, Manchester United continues to expect:

- Revenue to be £615m to £630m.

- Adjusted EBITDA to be £175m to

£190m.

Key Financials

(unaudited)

£ million (except earnings/(loss) per share)

Three months ended

31 March

Nine months ended

31 March

2019

Restated(1)

2018

Change

2019

Restated(1)

2018

Change

Commercial revenue

66.6

66.6 0.0%

208.4 212.4 (1.9%)

Broadcasting revenue

53.8

49.4 8.9%

200.3 165.4 21.1%

Matchday revenue

31.7

31.1 1.9%

87.0 90.4 (3.8%)

Total revenue

152.1

147.1 3.4%

495.7 468.2 5.9%

Adjusted EBITDA(2)

41.2

45.7 (9.9%)

174.9 166.2 5.2%

Operating profit

14.2

7.3 94.5%

72.1 67.4 7.0%

Profit/(loss) for the period (i.e. net income/(loss))(3)

7.7 6.9

11.6%

41.1

(3.2) - Basic earnings/(loss) per share

(pence)

4.65 4.20

11.0%

24.96

(1.97) - Adjusted profit for the

period (i.e. adjusted net income)(2)

7.8 1.5 420.0%

61.1 36.7

66.5% Adjusted basic earnings per share (pence)(2)

4.72 0.91

418.7%

37.12

22.38 65.9% Net

debt(2)/(4)

301.7

301.3 0.1%

301.7

301.3 0.1%

(1)

Comparative amounts have been restated following the

implementation of IFRS 15 – see supplemental note 5 for further

details.

(2)

Adjusted EBITDA, adjusted profit for the period, adjusted basic

earnings per share and net debt are non-IFRS measures. See

“Non-IFRS Measures: Definitions and Use” on page 5 and the

accompanying Supplemental Notes for the definitions and

reconciliations for these non-IFRS measures and the reasons we

believe these measures provide useful information to investors

regarding the Group’s financial condition and results of

operations.

(3)

The US federal corporate income tax rate reduced from 35% to 21%

following the enactment of US tax reform on 22 December 2017. This

necessitated a re-measurement of the then existing US deferred tax

position in the period to 31 December 2017. As a result the loss

for the nine months ended 31 March 2018 included a non-cash tax

accounting write off of £49.0 million.

(4)

The gross USD debt principal remains unchanged.

Revenue

Analysis

Commercial

Commercial revenue for the quarter was £66.6 million, unchanged

from the prior year quarter.

- Sponsorship revenue for the quarter was

£41.6 million, unchanged from the prior year quarter;

- Retail, Merchandising, Apparel &

Product Licensing revenue for the quarter was £25.0 million,

unchanged from the prior year quarter.

Broadcasting

Broadcasting revenue for the quarter was £53.8 million, an

increase of £4.4 million, or 8.9%, over the prior year quarter,

primarily due to the new UEFA Champions League broadcasting rights

agreement and playing one additional PL game.

Matchday

Matchday revenue for the quarter was £31.7 million, an increase

of £0.6 million, or 1.9%, over the prior year quarter.

Other Financial

Information

Operating expenses

Total operating expenses for the quarter were £144.2 million, an

increase of £7.8 million, or 5.7%, over the prior year quarter.

Employee benefit expenses

Employee benefit expenses for the quarter were £84.8 million, an

increase of £9.7 million, or 12.9%, over the prior year quarter,

primarily due to investment in the first team playing squad.

Other operating expenses

Other operating expenses for the quarter were £26.1 million, a

decrease of £0.2 million, or 0.8%, over the prior year quarter.

Depreciation & amortization

Depreciation for the quarter was £2.8 million, an increase of

£0.2 million, or 7.7%, over the prior year quarter. Amortization

for the quarter was £30.5 million, a decrease of £1.9 million, or

5.9%, over the prior year quarter. The unamortized balance of

registrations at 31 March 2019 was £288.0 million.

Profit/(loss) on disposal of intangible assets

Profit on disposal of intangible assets for the quarter was £6.3

million compared to a loss of £3.4 million in the prior year

quarter.

Net finance (costs)/income

Net finance costs for the quarter were £3.1 million, compared to

net finance income of £1.0 million in the prior year quarter, due

to a reduction in unrealized, non-cash foreign exchange gains on

unhedged USD borrowings compared to the prior year quarter.

Tax

The tax expense for the quarter was £3.4 million, compared to

£1.4 million in the prior year quarter.

Cash flows

Net cash generated from operating activities for the quarter was

£22.2 million, an increase of £1.0 million over the prior year

quarter.

Net capital expenditure on property, plant and equipment for the

quarter was £1.6 million, an increase of £0.6 million over the

prior year quarter.

Net capital expenditure on intangible assets for the quarter was

£2.0 million, an increase of £3.3 million over the prior year

quarter.

Overall cash and cash equivalents (including the effects of

exchange rate changes) increased by £3.5 million in the quarter

compared to an increase of £6.4 million in the prior year

quarter.

Net debt

Net debt as of 31 March 2019 was £301.7 million, an increase of

£0.4 million over the year. The gross USD debt principal remains

unchanged.

Dividend

A semi-annual dividend of $0.09 per share was paid during the

quarter. A further semi-annual dividend of $0.09 per share will be

paid on 5 June 2019, to shareholders of record on 26 April 2019.

The stock began trading ex-dividend on 25 April 2019.

Conference Call

Information

The Company’s conference call to review third quarter fiscal

2019 results will be broadcast live over the internet today, 16 May

2019 at 8:00 a.m. Eastern Time and will be available on Manchester

United’s investor relations website at http://ir.manutd.com.

Thereafter, a replay of the webcast will be available for thirty

days.

About Manchester

United

Manchester United is one of the most popular and successful

sports teams in the world, playing one of the most popular

spectator sports on Earth.

Through our 141-year heritage we have won 66 trophies, enabling

us to develop what we believe is one of the world’s leading sports

brands and a global community of 659 million followers. Our

large, passionate community provides Manchester United with a

worldwide platform to generate significant revenue from multiple

sources, including sponsorship, merchandising, product licensing,

broadcasting and matchday.

Cautionary

Statement

This press release contains forward-looking statements. You

should not place undue reliance on such statements because they are

subject to numerous risks and uncertainties relating to the

Company’s operations and business environment, all of which are

difficult to predict and many are beyond the Company’s control.

Forward-looking statements include information concerning the

Company’s possible or assumed future results of operations,

including descriptions of its business strategy. These statements

often include words such as “may,” “might,” “will,” “could,”

“would,” “should,” “expect,” “plan,” “anticipate,” “intend,”

“seek,” “believe,” “estimate,” “predict,” “potential,” “continue,”

“contemplate,” “possible” or similar expressions. The

forward-looking statements contained in this press release are

based on our current expectations and estimates of future events

and trends, which affect or may affect our businesses and

operations. You should understand that these statements are not

guarantees of performance or results. They involve known and

unknown risks, uncertainties and assumptions. Although the Company

believes that these forward-looking statements are based on

reasonable assumptions, you should be aware that many factors could

affect its actual financial results or results of operations and

could cause actual results to differ materially from those in these

forward-looking statements. These factors are more fully discussed

in the “Risk Factors” section and elsewhere in the Company’s

Registration Statement on Form F-1, as amended (File No.

333-182535) and the Company’s Annual Report on Form 20-F (File No.

001-35627).

Non-IFRS Measures:

Definitions and Use

1. Adjusted EBITDA

Adjusted EBITDA is defined as profit/(loss) for the period

before depreciation, amortization, profit/(loss) on disposal of

intangible assets, exceptional items, net finance (costs)/income,

and tax.

Adjusted EBITDA is useful as a measure of comparative operating

performance from period to period and among companies as it is

reflective of changes in pricing decisions, cost controls and other

factors that affect operating performance, and it removes the

effect of our asset base (primarily depreciation and amortization),

material volatile items (primarily profit on disposal of intangible

assets and exceptional items), capital structure (primarily finance

costs), and items outside the control of our management (primarily

taxes). Adjusted EBITDA has limitations as an analytical tool, and

you should not consider it in isolation, or as a substitute for an

analysis of our results as reported under IFRS as issued by the

IASB. A reconciliation of profit for the period to Adjusted EBITDA

is presented in supplemental note 2.

2. Adjusted profit for the period (i.e.

adjusted net income)

Adjusted profit for the period is calculated, where appropriate,

by adjusting for charges/credits related to exceptional items,

foreign exchange gains/losses on unhedged US dollar denominated

borrowings, and fair value movements on embedded foreign exchange

derivatives, adding/subtracting the actual tax expense/credit for

the period, and subtracting/adding the adjusted tax expense/credit

for the period (based on a normalized tax rate of 21%; 2018: 28%).

The normalized tax rate of 21% is the current US federal corporate

income tax rate.

In assessing the comparative performance of the business, in

order to get a clearer view of the underlying financial performance

of the business, it is useful to strip out the distorting effects

of the items referred to above and then to apply a ‘normalized’ tax

rate (for both the current and prior periods) of the weighted

average US federal corporate income tax rate of 21% (2018: 28%)

applicable during the financial year. A reconciliation of

profit/(loss) for the period to adjusted profit for the period is

presented in supplemental note 3.

3. Adjusted basic and diluted earnings per

share

Adjusted basic and diluted earnings per share are calculated by

dividing the adjusted profit for the period by the weighted average

number of ordinary shares in issue during the period. Adjusted

diluted earnings per share is calculated by adjusting the weighted

average number of ordinary shares in issue during the period to

assume conversion of all dilutive potential ordinary shares. There

is one category of dilutive potential ordinary shares: share awards

pursuant to the 2012 Equity Incentive Plan (the “Equity Plan”).

Share awards pursuant to the Equity Plan are assumed to have been

converted into ordinary shares at the beginning of the financial

year. Adjusted basic and diluted earnings per share are presented

in supplemental note 3.

4. Net debt

Net debt is calculated as non-current and current borrowings

minus cash and cash equivalents.

Key Performance

Indicators

Three months ended Nine months

ended 31 March 31 March

2019

Restated(1)

2018

2019

Restated(1)

2018

Commercial % of total revenue

43.8%

45.3%

42.0% 45.4%

Broadcasting % of

total revenue

35.4% 33.6%

40.4%

35.3%

Matchday % of total revenue

20.8%

21.1%

17.6% 19.3% Home Matches Played

PL

5 5

15 16 UEFA competitions

1 1

4 4 Domestic Cups

1 2

2 3 Away Matches

Played PL

6 5

16 15 UEFA

competitions

1 1

4 5(2)

Domestic Cups

3 2

3 4

Other

Employees at period end

950 930

950 930 Employee benefit expenses % of revenue

55.8% 51.1%

48.4% 45.9%

(1)Comparative amounts have been restated

– see supplemental note 5 for further details.

(2) Includes UEFA Super Cup final

following UEFA Europa League win in 2016/17

Phasing of Premier League games Quarter 1

Quarter 2 Quarter 3 Quarter 4

Total 2018/19 season 7 13 11 7

38 2017/18 season 7 14 10 7 38

CONSOLIDATED STATEMENT OF

PROFIT OR LOSS

(unaudited; in £ thousands, except per

share and shares outstanding data)

Three months ended

31 March

Nine months ended

31 March

2019 Restated(1)

2018

2019 Restated(1)

2018

Revenue 152,068 147,059

495,706

468,139 Operating expenses

(144,181) (136,411)

(448,030) (415,699) Profit/(loss) on disposal of intangible

assets

6,378 (3,446)

24,457

14,846

Operating profit 14,265

7,202

72,133 67,286 Finance costs

(5,361) (5,935)

(16,877) (18,293) Finance income

2,213 7,027

2,257 14,239

Net finance (costs)/income

(3,148) 1,092

(14,620) (4,054)

Profit before tax

11,117 8,294

57,513

63,232 Tax expense (2)

(3,464) (1,401)

(16,444) (66,466)

Profit/(loss) for the period

7,653 6,893

41,069

(3,234)

Basic earnings/(loss) per share: Basic

earnings/(loss) per share (pence)

4.65 4.20

24.96

(1.97) Weighted average number of ordinary shares outstanding

(thousands)

164,526 164,195

164,526 164,195

Diluted earnings/(loss) per share: Diluted earnings/(loss)

per share (pence)(3)

4.65 4.19

24.94 (1.97) Weighted

average number of ordinary shares outstanding (thousands)

164,664 164,591

164,664 164,591

(1) Comparative amounts have been restated – see

supplemental note 5 for further details. (2) The US federal

corporate income tax rate reduced from 35% to 21% following the

enactment of US tax reform on 22 December 2017. This necessitated a

re-measurement of the then existing US deferred tax position in the

period to 31 December 2017. As a result the tax expense for the

nine months ended 31 March 2018 included a non-cash tax accounting

write off of £49.0 million. (3) For the nine months ended 31 March

2018 potential ordinary shares are anti-dilutive, as their

inclusion in the diluted loss per share calculation would reduce

the loss per share, and hence have been excluded.

CONSOLIDATED

BALANCE SHEET

(unaudited; in £ thousands)

31 March

2019

Restated(1)

30 June

2018

Restated(1)

31 March

2018

ASSETS Non-current assets

Property, plant and equipment

246,396 245,401 245,186

Investment property

13,739 13,836 13,869 Intangible assets

718,551 799,640 752,016 Derivative financial instruments

777 4,807 3,404 Trade and other receivables

9,964

4,724 5,618 Tax receivable

547 547 1,033 Deferred tax asset

57,057 63,332 77,064

1,047,031 1,132,287 1,098,190

Current

assets Inventories

2,083 1,416 1,398 Derivative

financial instruments

511 1,159 2,799 Trade and other

receivables

185,499 168,060 117,497 Tax receivable

598 800 258 Cash and cash equivalents

193,855

242,022 161,717

382,546

413,457 283,669

Total assets 1,429,577

1,545,744 1,381,859

(1) Comparative amounts have been restated

– see supplemental note 5 for further details.

CONSOLIDATED BALANCE SHEET (continued)

(unaudited; in £ thousands)

31 March

2019

Restated(1)

30 June

2018

Restated(1)

31 March

2018

EQUITY AND LIABILITIES Equity

Share capital

53 53 53 Share premium

68,822 68,822

68,822 Merger reserve

249,030 249,030 249,030 Hedging

reserve

(30,848) (27,558) (12,511) Retained earnings

166,751 136,757 181,110

453,808 427,104 486,504

Non-current

liabilities Derivative financial instruments

21 - -

Trade and other payables

45,559 104,271 74,998 Borrowings

493,336 486,694 457,011 Deferred revenue

51,079

37,085 32,208 Deferred tax liabilities

33,678

29,134 39,684

623,673 657,184

603,901

Current liabilities Derivative financial

instruments

130 - - Tax liabilities

7,898 3,874 2,166

Trade and other payables

185,733 267,996 208,840 Borrowings

2,197 9,074 5,960 Deferred revenue

156,138

180,512 74,488

352,096

461,456 291,454

Total equity and liabilities

1,429,577 1,545,744 1,381,859 (1) Comparative

amounts have been restated – see supplemental note 5 for further

details.

CONSOLIDATED STATEMENT OF CASH FLOWS

(unaudited; in £ thousands) Three months ended

31 March

Nine months ended

31 March

2019 2018

2019 2018

Cash flows from operating

activities Cash generated from operations (see

supplemental note 4)

29,803 28,743

112,140 17,254

Interest paid

(7,679 ) (7,210 )

(17,186

) (16,849 ) Interest received

697 266

2,052

654 Tax paid

(578 ) (620 )

(2,388 ) (6,388 )

Net cash generated

from/(used in) operating activities 22,243

21,179

94,618 (5,329 )

Cash flows from investing activities Payments for property,

plant and equipment

(1,559 ) (998 )

(8,877

) (9,585 ) Proceeds from sale of property, plant and

equipment

- -

- 75 Payments for intangible assets

(14,809 ) (6,812 )

(159,865 ) (135,933

) Proceeds from sale of intangible assets

12,709

8,203

37,892

40,645

Net cash (used in)/generated from investing

activities (3,659 ) 393

(130,850 ) (104,798 )

Cash flows

from financing activities Repayment of borrowings

- (106

)

(3,750 ) (312 ) Dividends paid

(11,610 ) (10,929 )

(11,610

) (10,929 )

Net cash used in financing

activities (11,610 ) (11,035 )

(15,360 ) (11,241 )

Net

increase/(decrease) in cash and cash equivalents 6,974

10,537

(51,592 ) (121,368 ) Cash and cash equivalents

at beginning of period

190,395 155,312

242,022

290,267 Effects of exchange rate changes on cash and cash

equivalents

(3,514 ) (4,132 )

3,425 (7,182 )

Cash and cash equivalents at

end of period 193,855 161,717

193,855 161,717

SUPPLEMENTAL NOTES

1 General information

Manchester United plc (the “Company”) and its subsidiaries

(together the “Group”) is a professional football club together

with related and ancillary activities. The Company incorporated

under the Companies Law (2011 Revision) of the Cayman Islands, as

amended and restated from time to time.

2 Reconciliation of profit/(loss) for the period to

Adjusted EBITDA

Three months ended

31 March

Nine months ended

31 March

2019

£’000

Restated(1)

2018

£’000

2019

£’000

Restated(1)

2018

£’000

Profit/(loss) for the period 7,653

6,893

41,069 (3,234 ) Adjustments: Tax expense

3,464 1,401

16,444 66,466 Net finance costs/(income)

3,148 (1,092 )

14,620 4,054 (Profit)/loss on disposal

of intangible assets

(6,378 ) 3,446

(24,457

) (14,846 ) Exceptional items

- -

19,599 -

Amortization

30,434 32,400

99,005 105,789

Depreciation

2,852 2,622

8,631 7,951

Adjusted

EBITDA 41,173 45,670

174,911 166,180

(1) Comparative amounts have been restated – see supplemental

note 5 for further details.

3 Reconciliation of profit/(loss) for the period to

adjusted profit for the period and adjusted basic and diluted

earnings per share

Three months ended

31 March

Nine months ended

31 March

2019

£’000

Restated(1)

2018

£’000

2019

£’000

Restated(1)

2018

£’000

Profit/(loss) for the period 7,653

6,893

41,069 (3,234 ) Exceptional items

- -

19,599 - Foreign exchange (gains)/losses on unhedged US

dollar borrowings

(1,430 ) (6,761 )

105

(13,585 ) Fair value movement on embedded foreign exchange

derivatives

138 539

82 1,384 Tax expense

3,464 1,401

16,444

66,466 Adjusted profit before tax

9,825 2,072

77,299 51,031

Adjusted tax expense (using a normalized

tax rate of 21% (2018: 28%))

(2,063 ) (580 )

(16,233

) (14,289 )

Adjusted profit for the period (i.e.

adjusted net income) 7,762 1,492

61,066 36,742

Adjusted basic earnings per share: Adjusted basic earnings

per share (pence)

4.72 0.91

37.12 22.38 Weighted

average number of ordinary shares outstanding (thousands)

164,526 164,195

164,526 164,195

Adjusted diluted

earnings per share: Adjusted diluted earnings per share

(pence)1

4.71 0.91

37.09 22.32 Weighted average

number of ordinary shares outstanding (thousands)

164,664 164,591

164,664

164,591

(1) Comparative amounts have been restated – see supplemental

note 5 for further details.

4 Cash generated from operations

Three months ended

31 March

Nine months ended

31 March

2019

£’000

Restated(1)

2018

£’000

2019

£’000

Restated(1)

2018

£’000

Profit/(loss) for the period

7,653 6,893

41,069 (3,234 ) Tax expense

3,464

1,401

16,444

66,466 Profit before tax

11,117 8,294

57,513

63,232 Depreciation

2,852 2,622

8,631 7,951

Amortization

30,434 32,400

99,005 105,789

(Profit)/loss on disposal of intangible assets

(6,378

) 3,446

(24,457 ) (14,846 ) Net finance

costs/(income)

3,148 (1,092 )

14,620 4,054 Profit on

disposal of property, plant and equipment

- -

- (75 )

Equity-settled share-based payments

164 617

535 1,820

Foreign exchange (gains)/losses on operating activities

(94

) 200

88 1,200 Reclassified from hedging reserve

1,167 3,652

4,011 11,119 Changes in working capital:

Inventories

527 520

(667 ) 239 Trade and other

receivables

(66,386 ) 5,775

(27,093 )

(19,662 ) Trade and other payables and deferred revenue

53,252 (27,691 )

(20,046

) (143,567 )

Cash generated from operations

29,803 28,743

112,140 17,254

(1) Comparative amounts have been restated – see supplemental

note 5 for further details.

5 Restatement of prior periods following

implementation of IFRS 15

The Group adopted IFRS 15 ‘Revenue from contracts with

customers’ with effect from 1 July 2018. The implementation of IFRS

15 had an impact on the Group’s financial statements as at 1 July

2018 and consequently prior year amounts have been restated. The

table below shows the retrospective impact on revenue for the four

quarters ended 30 June 2018. Note 34 to the interim consolidated

financial statements for the three and nine months ended 31 March

2019 contains tables and notes which explain how the restatement

affected the consolidated statement of profit or loss, consolidated

statement of comprehensive income, consolidated balance sheet, and

consolidated statement of cash flows.

Commercial revenue

IFRS 15 focuses on the identification and satisfaction of

performance obligations and includes specific guidance on the

methods for measuring progress towards complete satisfaction of a

performance obligation therefore revenue on certain commercial

contracts is recognized earlier under IFRS 15. The effect of the

retrospective application is an increase in cumulative revenue

recognized over the financial years up to and including the year

ended 30 June 2018 including a reduction to the amount of revenue

recognized during the financial year ended 30 June 2018 only.

Broadcasting revenue

Following adoption of IFRS 15, certain performance obligations

are satisfied over time as each Premier League match (home and

away) is played – accordingly revenue is recognized evenly as each

Premier League match (home and away) is played. Broadcasting merit

awards were previously recognized one share in the first quarter

with the remainder being recognized when they were known at the end

of each football season. Merit awards represent variable

consideration and therefore, following adoption of IFRS 15, are

estimated using the most likely amount method based on management’s

estimate of where the Club’s finishing position will be at the end

of each season. Broadcasting equal share payments were previously

recognized evenly as each Premier League home match was played.

Note, these changes only affect the amount of broadcasting revenue

recognized in each quarter, they do not affect the amount of

broadcasting revenue recognized for the financial year as a

whole.

Matchday revenue

Adoption of IFRS 15 has no impact on the recognition of matchday

revenue.

£’000 Three months ended

30 September

2017

Three months ended

31 December

2017

Three months ended

31 March

2018

Three months ended

30 June

2018

Twelve months ended

30 June

2018

Commercial revenue Reported 80,544 65,366 66,673 63,516

276,099 Adjustment (66 ) (66 ) (66 )

(66 ) (264 ) Restated 80,478 65,300

66,607 63,450 275,835

Broadcasting revenue Reported 38,082 61,628 39,674

64,753 204,137 Adjustment 2,751 13,519

9,656 (25,926 ) - Restated

40,833 75,147 49,330

38,827 204,137

Matchday revenue

Reported 22,354 36,968 31,122 19,342 109,786 Adjustment - -

- - - Restated 22,354

36,968 31,122 19,342

109,786

Total revenue Reported 140,980

163,962 137,469 147,611 590,022 Adjustment 2,685

13,453 9,590 (25,992 )

(264 ) Restated 143,665 177,415

147,059 121,619 589,758

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190516005344/en/

Manchester United plcInvestor Relations:Cliff BatyChief

Financial Officer+44 161 868 8650ir@manutd.co.ukManchester United

plcMedia:Charlie BrooksDirector of Communications+44 161 868

8148charlie.brooks@manutd.co.ukSard Verbinnen & CoJim Barron /

Devin Broda+ 1 212 687

8080JBarron@SARDVERB.comdbroda@SARDVERB.com

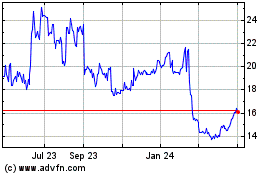

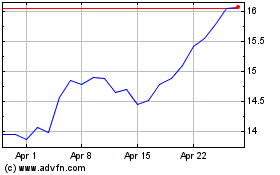

Manchester United (NYSE:MANU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Manchester United (NYSE:MANU)

Historical Stock Chart

From Apr 2023 to Apr 2024