31% Increase in Cloud Revenue

Record Operating Cash Flow of $182 Million,

Increase of 33%

Company Increases Guidance for Full-Year

2019 Earnings Per Share

NICE (NASDAQ: NICE) today announced results for the first

quarter ended March 31, 2019.

First Quarter 2019 Financial Highlights

GAAP Non-GAAP Revenue of $377 million, growth

of 12% year-over-year Revenue of $378 million, growth of 12%

year-over-year Cloud revenue of $136 million, growth of 31%

year-over-year Cloud revenue of $137 million, growth of 30%

year-over-year Gross margin of 65.2% compared to 64.7% last year

Gross margin of 70.5% compared to 70.4% last year Operating

income of $52 million compared to $34 million last year, an

increase of 52% Operating income of $97 million compared to

$79 million last year, an increase of 23% Operating margin of 13.8%

compared to 10.2% last year Operating margin of 25.7%

compared to 23.4% last year Diluted EPS of $0.58 versus $0.37 last

year, 57% growth year-over-year Diluted EPS of $1.18 versus

$0.97 last year, 22% growth year-over-year Record cash flow from

operations of $182 million, 33% growth year-over-year

“The first quarter marked a very strong start to the year as we

reported accelerated growth with double-digit increases in all key

metrics, including total revenues, cloud revenues, operating income

and earnings per share. Moreover, we continued to benefit from the

leverage in our operating model as reflected in the significant

expansion in our operating margin,” said Barak Eilam, CEO,

NICE.

Mr. Eilam continued, “The strong start to the year was driven by

the more than 30% increase in cloud revenue with our CXone platform

as the underpinning of that growth. We are now taking the next step

in the evolution of CXone by ushering in a new era in CX with the

introduction of smart digital conversations. This builds on our

CXone platform strategy with an additional market leading

innovation that enables our customers to accelerate their

transition in managing digital experiences. This innovation is

augmented by the acquisition of Brand Embassy, announced earlier

today.”

GAAP Financial Highlights for the First Quarter and Full Year

Ended March 31:

Revenues: First quarter 2019 total revenues increased

12.4% to $377.0 million compared to $335.4 million for the first

quarter of 2018.

Gross Profit: First quarter 2019 gross profit and gross

margin increased to $246.0 million and 65.2%, respectively, from

$216.9 million and 64.7%, respectively, for the first quarter of

2018.

Operating Income: First quarter 2019 operating income and

operating margin increased to $51.9 million and 13.8%,

respectively, compared to $34.2 million and 10.2%, respectively,

for the first quarter of 2018.

Net Income: First quarter 2019 net income and net income

margin were $37.1 million and 9.8%, respectively, compared to $23.5

million and 7.0%, respectively, for the first quarter of 2018.

Fully Diluted Earnings Per Share: Fully diluted earnings

per share for the first quarter of 2019 increased 56.8% to $0.58,

compared to $0.37 in the first quarter of 2018.

Operating Cash Flow and Cash Balance: First quarter 2019

operating cash flow was $182.4 million. In the first quarter $10.1

million was used for share repurchases. As of March 31, 2019, total

cash and cash equivalents, short term investments and marketable

securities were $890.9 million, and total debt was $458.2

million.

Non-GAAP Financial Highlights for the First Quarter and Full

Year Ended March 31:

Revenues: First quarter 2019 non-GAAP total revenues

increased to $377.9 million, up 11.9% from $337.6 million for the

first quarter of 2018.

Gross Profit: First quarter 2019 non-GAAP gross profit

and non-GAAP gross margin increased to $266.5 million and 70.5%,

respectively, from $237.7 million and 70.4%, respectively, for the

first quarter of 2018.

Operating Income: First quarter 2019 non-GAAP operating

income and non-GAAP operating margin increased to $97.0 million and

25.7%, respectively, from $78.9 million and 23.4%, respectively,

for the first quarter of 2018.

Net Income: First quarter 2019 non-GAAP net income and

non-GAAP net income margin increased to $75.5 million and 20.0%,

respectively, from $60.7 million and 18.0%, respectively, for the

first quarter of 2018.

Fully Diluted Earnings Per Share: First quarter 2019

non-GAAP fully diluted earnings per share increased 21.6% to $1.18,

compared to $0.97 for the first quarter of 2018.

Second Quarter and Full Year 2019 Guidance:

Second Quarter 2019: Second quarter 2019 non-GAAP total

revenues are expected to be in a range of $373 million to $383

million (2018 non-GAAP: $343.7 million). Second quarter 2019

non-GAAP fully diluted earnings per share are expected to be in a

range of $1.16 to $1.26 (2018 non-GAAP: $1.10).

Full Year 2019: Full year 2019 non-GAAP total revenues

are expected to be in a range of $1,558 million to $1,582 million

(2018 non-GAAP: $1,453.4 million). The Company increased full year

2019 non-GAAP fully diluted earnings per share to be in an expected

range of $5.11 to $5.31 (2018 non-GAAP: $4.75).

Quarterly Results Conference Call

NICE management will host its earnings conference call today,

May 16th, 2019 at 8:30 AM ET, 13:30 GMT, 15:30 Israel, to discuss

the results and the company's outlook. To participate in the call,

please dial in to the following numbers: United States

1-866-804-8688 or +1-718-354-1175, International

+44(0)1296-480-100, United Kingdom 0-800-783-0906, Israel

1-809-344-364. The Passcode is 635 296 09. Additional access

numbers can be found at

http://www.btconferencing.com/globalaccess/?bid=54_attended. The

call will be webcast live on the Company’s website at

http://www.nice.com/news-and-events/ir-events. An online replay

will also be available approximately two hours following the call.

A telephone replay of the call will be available for 7 days after

the live broadcast and may be accessed by dialing: United States

1-877-482-6144, International +44(0)20-7136-9233, United Kingdom

0-800-032-9687. The Passcode for the replay is 667 515 36.

Non-GAAP financial measures consist of GAAP financial measures

adjusted to exclude: amortization of acquired intangible assets,

share-based compensation, certain business combination accounting

entries, amortization of discount on long term debt, tax adjustment

re non-GAAP adjustments and tax reform. The purpose of such

adjustments is to give an indication of our performance exclusive

of non-cash charges and other items that are considered by

management to be outside of our core operating results. Our

non-GAAP financial measures are not meant to be considered in

isolation or as a substitute for comparable GAAP measures and

should be read only in conjunction with our consolidated financial

statements prepared in accordance with GAAP. Our management

regularly uses our supplemental non-GAAP financial measures

internally to understand, manage and evaluate our business and make

operating decisions. These non-GAAP measures are among the primary

factors management uses in planning for and forecasting future

periods. Business combination accounting rules requires us to

recognize a legal performance obligation related to a revenue

arrangement of an acquired entity. The amount assigned to that

liability should be based on its fair value at the date of

acquisition. The non-GAAP adjustment is intended to reflect the

full amount of such revenue. We believe this adjustment is useful

to investors as a measure of the ongoing performance of our

business. We believe these non-GAAP financial measures provide

consistent and comparable measures to help investors understand our

current and future operating cash flow performance. These non-GAAP

financial measures may differ materially from the non-GAAP

financial measures used by other companies. Reconciliation between

results on a GAAP and non-GAAP basis is provided in a table

immediately following the Consolidated Statements of Income.

About NICENICE (Nasdaq: NICE) is the worldwide leading

provider of both cloud and on-premises enterprise software

solutions that empower organizations to make smarter decisions

based on advanced analytics of structured and unstructured data.

NICE helps organizations of all sizes deliver better customer

service, ensure compliance, combat fraud and safeguard citizens.

Over 25,000 organizations in more than 150 countries, including

over 85 of the Fortune 100 companies, are using NICE solutions.

www.nice.com.

Trademark Note: NICE and the NICE logo are trademarks or

registered trademarks of NICE. All other marks are trademarks

of their respective owners. For a full list of NICE' marks, please

see: http://www.nice.com/nice-trademarks.

Forward-Looking StatementsThis press release contains

forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. In some cases,

forward-looking statements may be identified by words such as

“believe,” “expect,” “seek,” “may,” “will,” “intend,” “should,”

“project,” “anticipate,” “plan,” and similar expressions.

Forward-looking statements are based on the current beliefs,

expectations and assumptions of the Company’s management regarding

the future of the Company’s business, future plans and strategies,

projections, anticipated events and trends, the economy and other

future conditions. Examples of forward-looking statements include

guidance regarding the Company’s revenue and earnings and the

growth of our cloud, analytics and artificial intelligence

business.

Forward looking statements are inherently subject to significant

economic, competitive and other uncertainties and contingencies,

many of which are beyond the control of management. The Company

cautions that these statements are not guarantees of future

performance, and investors should not place undue reliance on them.

There are or will be important known and unknown factors and

uncertainties that could cause actual results to differ materially

from those expressed or implied in the forward-looking statements.

These factors, include, but are not limited to, risks associated

with competition, success and growth of the Company’s cloud

Software-as-a-Service business, cyber security attacks or other

security breaches against the Company, privacy concerns and

legislation impacting the Company’s business, the Company’s

dependency on first-party cloud computing platform providers,

hosting facilities and service partners, changes in general

economic and business conditions, rapidly changing technology,

changes in currency exchange rates and interest rates, difficulties

in making additional acquisitions or effectively integrating

acquired operations, products, technologies and personnel,

successful execution of the Company’s growth strategy, the effects

of tax reforms and of newly enacted or modified laws, regulation or

standards on the Company and its products, and other factors and

uncertainties discussed in our filings with the U.S. Securities and

Exchange Commission (the “SEC”). You are encouraged to carefully

review the section entitled “Risk Factors” in our latest Annual

Report on Form 20-F and our other filings with the SEC for

additional information regarding these and other factors and

uncertainties that could affect our future performance. The

forward-looking statements contained in this presentation speak

only as of the date hereof, and the Company undertakes no

obligation to update or revise them, whether as a result of new

information, future developments or otherwise, except as required

by law.

###

NICE LTD. AND SUBSIDIARIES CONSOLIDATED STATEMENTS

OF INCOME U.S. dollars in thousands (except per share amounts)

Quarter ended

March 31,

2019 2018 Unaudited Unaudited Revenue: Product

$ 70,031 $ 61,370 Services 170,918 170,217 Cloud 136,078

103,855 Total revenue 377,027 335,442

Cost of revenue: Product 5,881 8,137 Services 55,123 58,385 Cloud

70,046 51,993 Total cost of revenue 131,050

118,515 Gross profit 245,977 216,927 Operating

expenses: Research and development, net 46,566 45,867 Selling and

marketing 102,067 89,926 General and administrative 34,714 36,372

Amortization of acquired intangible assets 10,701

10,585 Total operating expenses 194,048 182,750

Operating income 51,929 34,177 Finance and other

expense, net 3,418 3,968 Income before tax

48,511 30,209 Taxes on income 11,447 6,683 Net income

$ 37,064 $ 23,526 Earnings per share: Basic $ 0.60 $ 0.39

Diluted $ 0.58 $ 0.37

Weighted average shares outstanding: Basic 61,842 61,054 Diluted

63,759 62,776

NICE LTD. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP RESULTS U.S. dollars in

thousands (except per share amounts)

Quarter

ended March 31, 2019

2018 GAAP revenues $ 377,027 $ 335,442 Valuation

adjustment on acquired deferred product revenue 15 15 Valuation

adjustment on acquired deferred services revenue 2 306 Valuation

adjustment on acquired deferred cloud revenue 872

1,886 Non-GAAP revenues $ 377,916 $ 337,649

GAAP cost of revenue $ 131,050 $ 118,515

Amortization of acquired intangible assets on cost of product (870

) (2,589 ) Amortization of acquired intangible assets on cost of

services (1,535 ) (823 ) Amortization of acquired intangible assets

on cost of cloud (14,805 ) (12,755 ) Valuation adjustment on

acquired deferred cost of cloud 686 336 Cost of product revenue

adjustment (1) (105 ) (188 ) Cost of services revenue adjustment

(1) (2,144 ) (1,753 ) Cost of cloud revenue adjustment (1)

(907 ) (769 ) Non-GAAP cost of revenue $ 111,370 $

99,974 GAAP gross profit $ 245,977 $ 216,927

Gross profit adjustments 20,569 20,748

Non-GAAP gross profit $ 266,546 $ 237,675

GAAP operating expenses $ 194,048 $ 182,750 Research and

development (1) (1,562 ) (2,344 ) Sales and marketing (1) (5,676 )

(6,303 ) General and administrative (1) (6,610 ) (4,782 )

Amortization of acquired intangible assets (10,702 ) (10,585 )

Valuation adjustment on acquired deferred commission 93

- Non-GAAP operating expenses $ 169,591

$ 158,736 GAAP finance & other expense

(income), net $ 3,418 $ 3,968 Amortization of discount on long-term

debt (2,308 ) (2,163 ) Non-GAAP finance & other

expense (income), net $ 1,110 $ 1,805

GAAP taxes on income (tax benefits) $ 11,447 $ 6,683 Tax

adjustments re non-GAAP adjustments 8,882

9,775 Non-GAAP taxes on income $ 20,329 $ 16,458

GAAP net income $ 37,064 $ 23,526 Valuation

adjustment on acquired deferred revenue 889 2,207 Valuation

adjustment on acquired deferred cost of cloud revenue (686 ) (336 )

Amortization of acquired intangible assets 27,912 26,752 Valuation

adjustment on acquired deferred commission (93 ) - Share-based

compensation (1) 17,004 16,139 Amortization of discount on long

term debt 2,308 2,163 Tax adjustments re non-GAAP adjustments and

tax reform (8,882 ) (9,775 ) Non-GAAP net income $

75,516 $ 60,676 GAAP diluted earnings

per share $ 0.58 $ 0.37 Non-GAAP diluted

earnings per share $ 1.18 $ 0.97 Shares used

in computing GAAP diluted earnings per share 63,759 62,776

Shares used in computing non-GAAP diluted earnings per share 63,759

62,776

NICE LTD. AND SUBSIDIARIES RECONCILIATION

OF GAAP TO NON-GAAP RESULTS (continued) U.S. dollars in

thousands

(1)

Share-based

Compensation

Quarter ended March 31, 2019

2018 Cost of product revenue $ (105 ) $

(188 ) Cost of services revenue (2,144 ) (1,753 ) Cost of cloud

revenue (907 ) (769 ) Research and development (1,562 ) (2,344 )

Sales and marketing (5,676 ) (6,303 ) General and administrative

(6,610 ) (4,782 ) $ (17,004 ) $ (16,139 )

NICE LTD. AND SUBSIDIARIES CONSOLIDATED

CASH FLOW STATEMENTS U.S. dollars in thousands

Quarter ended March 31, 2019 2018 Unaudited Unaudited

Operating

Activities

Net income $ 37,064 $ 23,526 Depreciation and amortization

41,808 37,937 Stock based compensation 17,004 16,139 Amortization

of premium and discount and accrued interest on marketable

securities (341) (298) Deferred taxes, net (7,858) (9,667) Changes

in operating assets and liabilities: Trade Receivables 30,723

(16,154) Prepaid expenses and other assets (20,582) (12,419) Trade

payables (825) (5,501) Accrued expenses and other current

liabilities 32,438 (4,420)

Operating lease right-of-use assets,

net

4,117 - Deferred revenue 53,407 106,117 Long term liabilities 123

(383)

Operating lease liabilities

(5,505) - Amortization of discount on long term debt 2,307 2,163

Other (1,468) (183) Net cash provided by operating

activities 182,412 136,857

Investing

Activities

Purchase of property and equipment (8,416) (5,316) Purchase

of Investments (191,308) (135,645) Proceeds from Investments 76,950

19,017 Capitalization of software development costs (8,494)

(7,804) Net cash used in investing activities

(131,268) (129,748)

Financing

Activities

Proceeds from issuance of shares upon exercise of share

options 1,617 3,244 Purchase of treasury shares (10,100) (4,252)

Capital Lease payments (253) - Net cash used in

financing activities (8,736) (1,008) Effect of

exchange rates on cash and cash equivalents 189 58

Net change in cash and cash equivalents

42,597 6,159 Cash and cash equivalents, beginning of period $

242,099 $ 328,302 Cash and cash equivalents, end of period $

284,696 $ 334,461

NICE LTD. AND

SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS U.S.

dollars in thousands

March 31, December 31,

2019 2018 Unaudited Audited

ASSETS

CURRENT ASSETS: Cash and cash equivalents $ 284,696 $

242,099 Short-term investments 286,205 243,729 Trade receivables

258,888 287,963 Prepaid expenses and other current assets

102,157 87,450 Total current assets 931,946

861,241

LONG-TERM ASSETS: Long-term

investments 319,988 244,998 Property and equipment, net 139,701

140,338 Deferred tax assets 10,511 12,309 Other intangible assets,

net 480,286 508,232 Operating lease right-of-use assets 116,656 -

Goodwill 1,368,733 1,366,206 Other long-term assets 81,090

74,042 Total long-term assets 2,516,965

2,346,125

TOTAL ASSETS $ 3,448,911 $ 3,207,366

LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT

LIABILITIES: Trade payables $ 25,901 $ 29,617 Deferred revenues

and advances from customers 273,572 221,387 Current maturities of

operating leases 17,078 - Accrued expenses and other liabilities

396,009 373,908 Total current liabilities

712,560 624,912

LONG-TERM LIABILITIES:

Deferred revenues and advances from customers 38,012 35,112

Operating leases 116,737 - Deferred tax liabilities 34,759 44,140

Long-term debt 458,211 455,985 Other long-term liabilities

16,114 30,604 Total long-term liabilities

663,833 565,841

SHAREHOLDERS' EQUITY

2,072,518 2,016,613

TOTAL LIABILITIES AND

SHAREHOLDERS' EQUITY $ 3,448,911 $ 3,207,366

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190516005358/en/

NiceInvestorsMarty Cohen, +1 551 256 5354,

ETir@nice.com

Yisca Erez, +972 9 775-3798, CETir@nice.com

Media ContactChris Irwin-Dudek, +1 (551)

256-5140Chris.Irwin-Dudek@nice.com

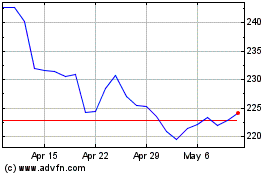

NICE (NASDAQ:NICE)

Historical Stock Chart

From Mar 2024 to Apr 2024

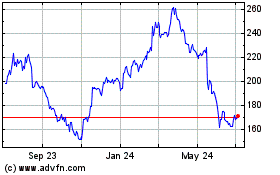

NICE (NASDAQ:NICE)

Historical Stock Chart

From Apr 2023 to Apr 2024